EURUSD, USDJPY, GBPUSD, AUDUSD, USDCHF, NZDUSD, and USDCAD technical analysis and forecast for 18-22 November 2024

Here is a detailed weekly technical analysis and forecast for EURUSD, USDJPY, GBPUSD, AUDUSD, USDCHF, NZDUSD, and USDCAD for 18-22 November 2024.

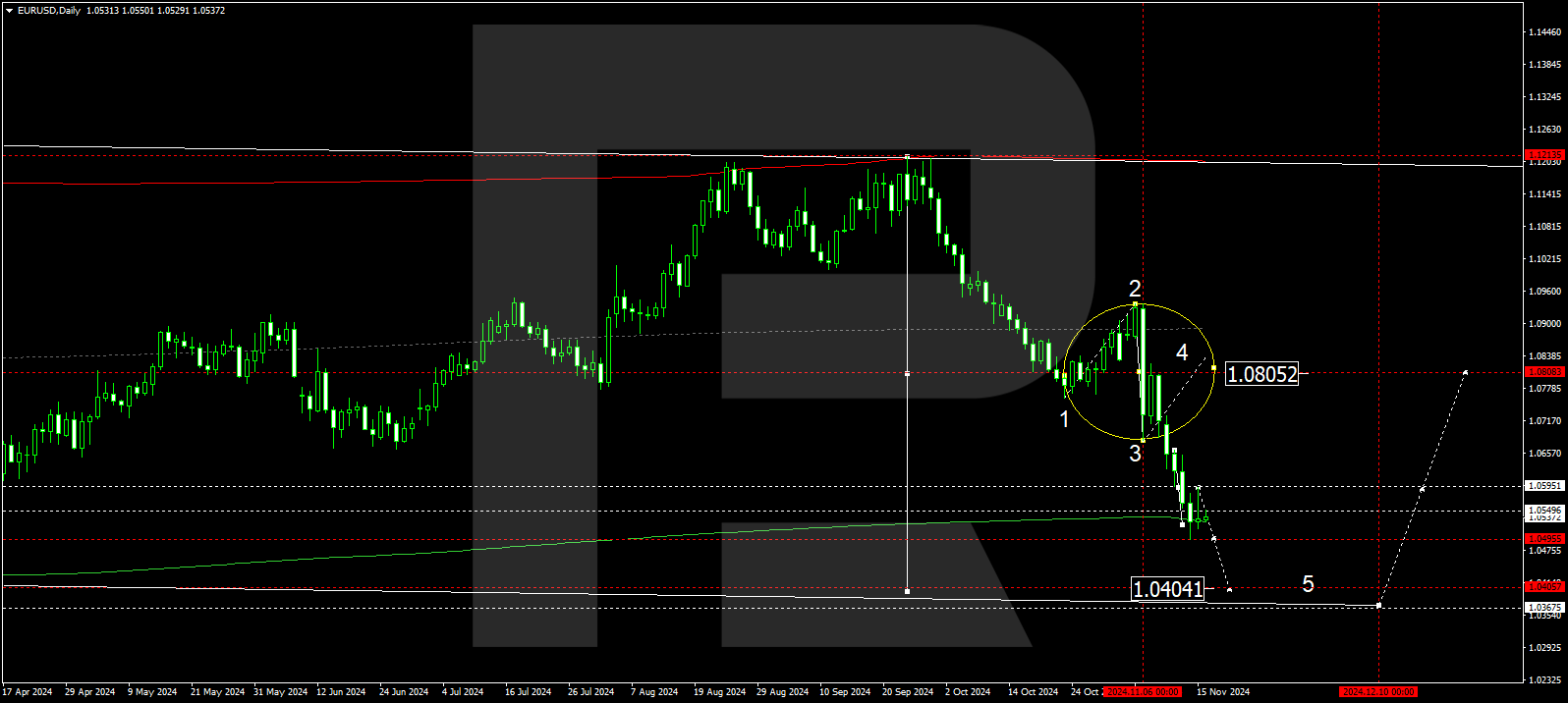

EURUSD forecast

The EURUSD pair has formed a broad consolidation range around 1.0800. Breaking below this range, it completed a move to 1.0495. The market continues to develop a downward movement towards 1.0400, potentially extending to 1.0380. A correction has occurred at 1.0592, with another corrective move towards 1.0600 possible. Subsequently, the EURUSD pair is expected to decline to the target level of 1.0400. Once the first downward wave is complete, a more substantial correction could follow, targeting 1.0800 (testing from below).

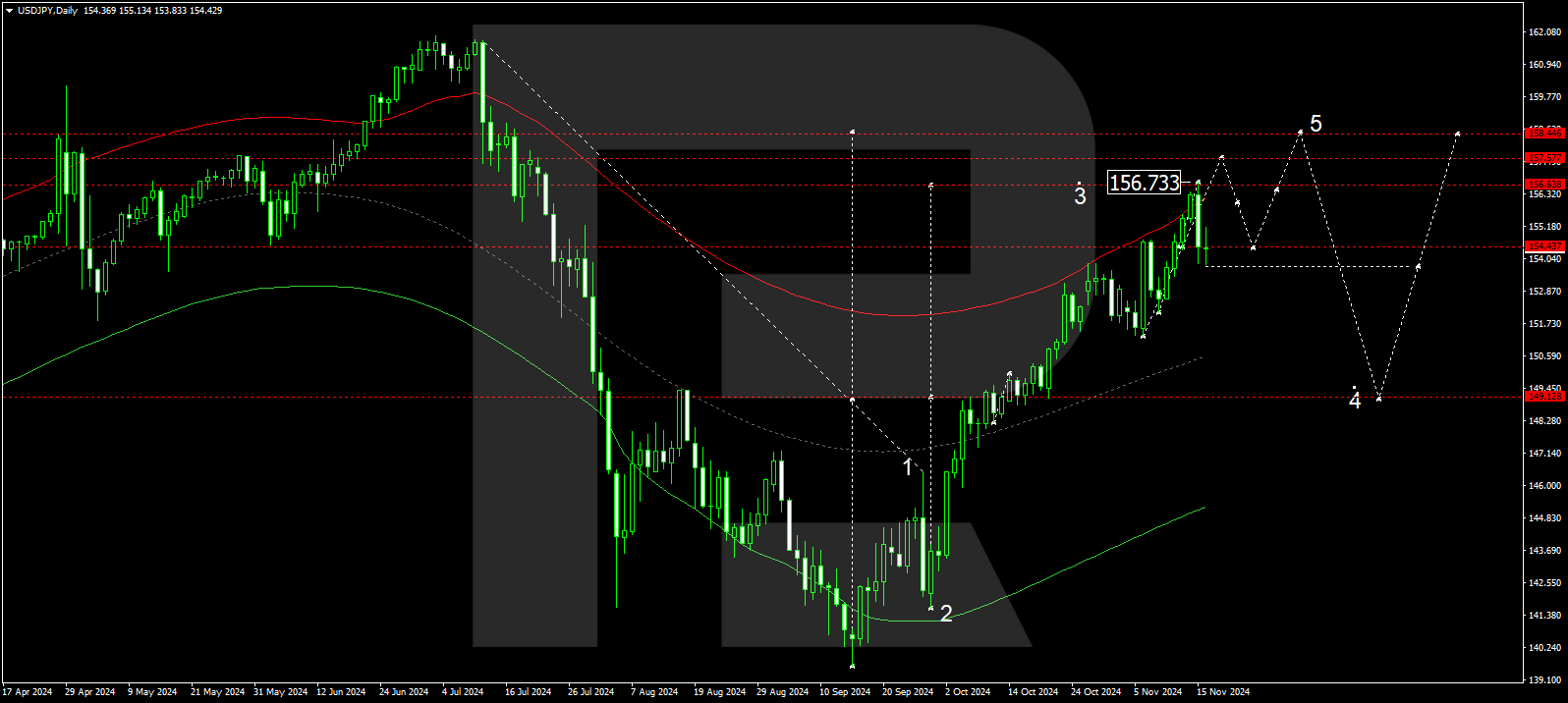

USDJPY forecast

The USDJPY pair is forming a broad consolidation range around 154.44. The range has extended upwards to 156.73, and the price has technically returned to 154.44. Another upward movement could follow, aiming for 157.57 as the local target. Subsequently, a correction might begin, targeting 154.44 (testing from above). A breakout below this level would open the potential for a deeper correction in the USDJPY pair towards 149.20. Once the correction is complete, a new upward movement could start, aiming for 158.50 as the first target.

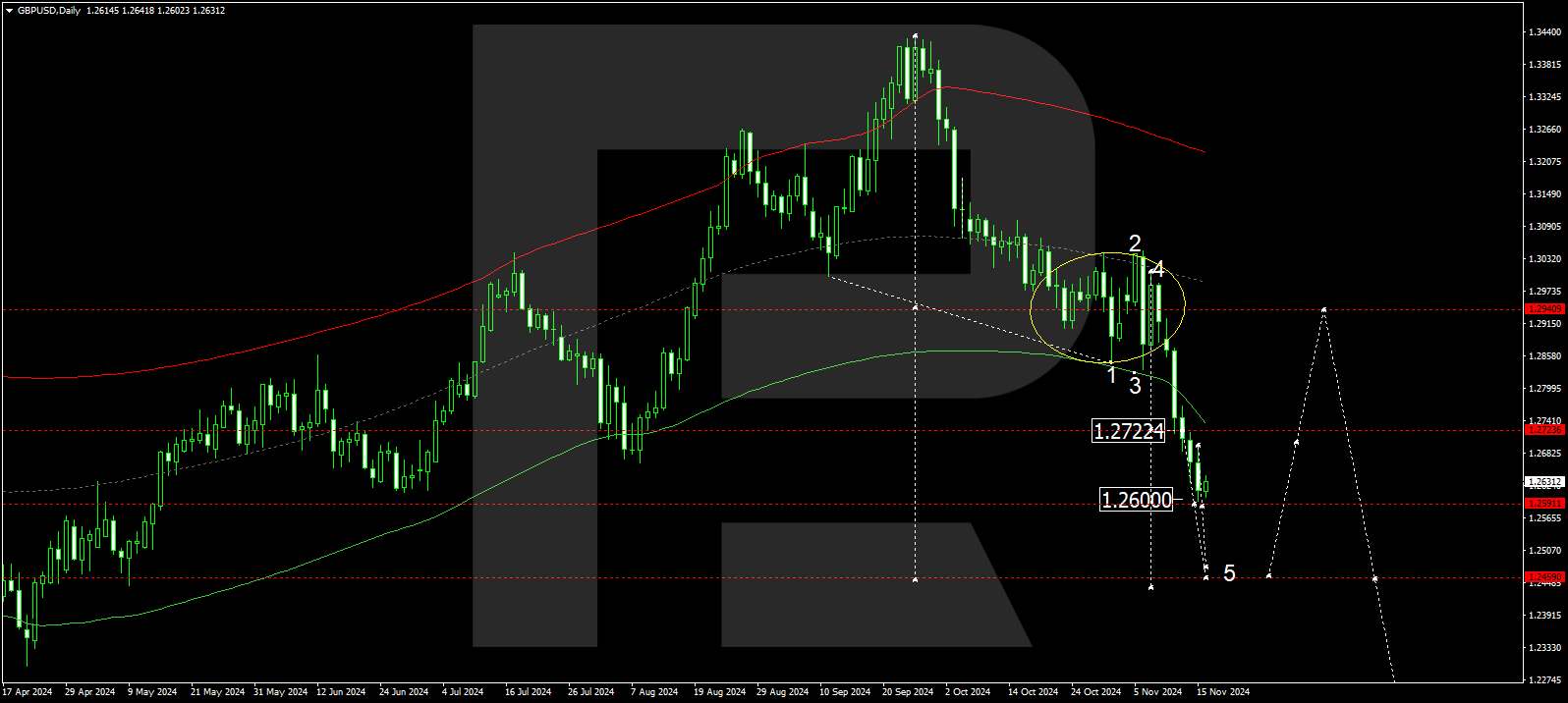

GBPUSD forecast

The GBPUSD pair has formed a broad consolidation range around 1.2940 and broken below this range. The pair has completed a downward move towards 1.2600, with a narrow consolidation range likely to develop above this level. A breakout upwards could lead to a correction towards 1.2727. A downward breakout could develop a structure in line with the trend, aiming for 1.2460 as the first target. After reaching this level, a corrective movement in the GBPUSD rate would begin, targeting 1.2940 (testing from below).

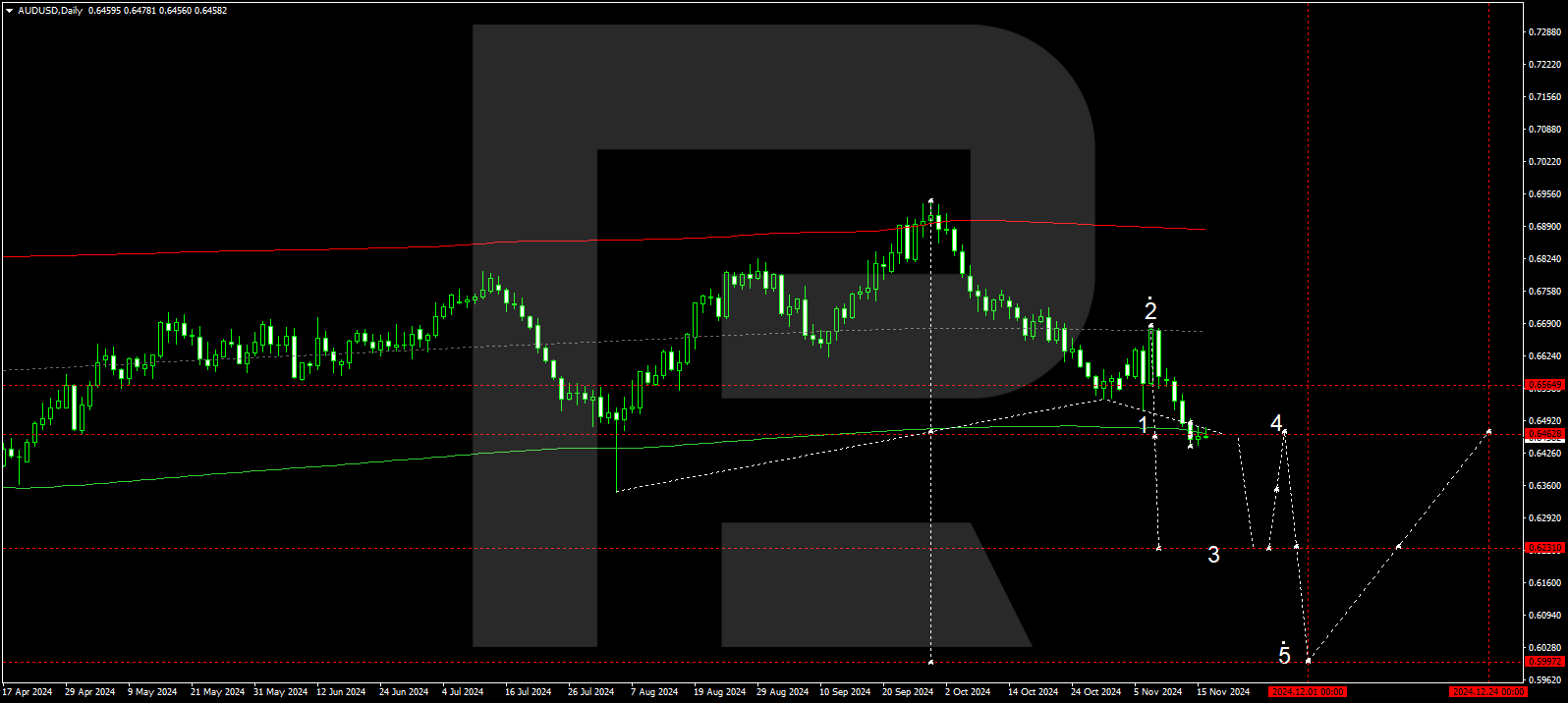

AUDUSD forecast

The AUDUSD pair has completed a downward move, reaching 0.6464, with the third downward wave likely to develop. A narrow consolidation range is expected to form around 0.6464. A breakout upwards could enable a correction towards 0.6500. A downward breakout could extend the movement towards 0.6230, the local target.

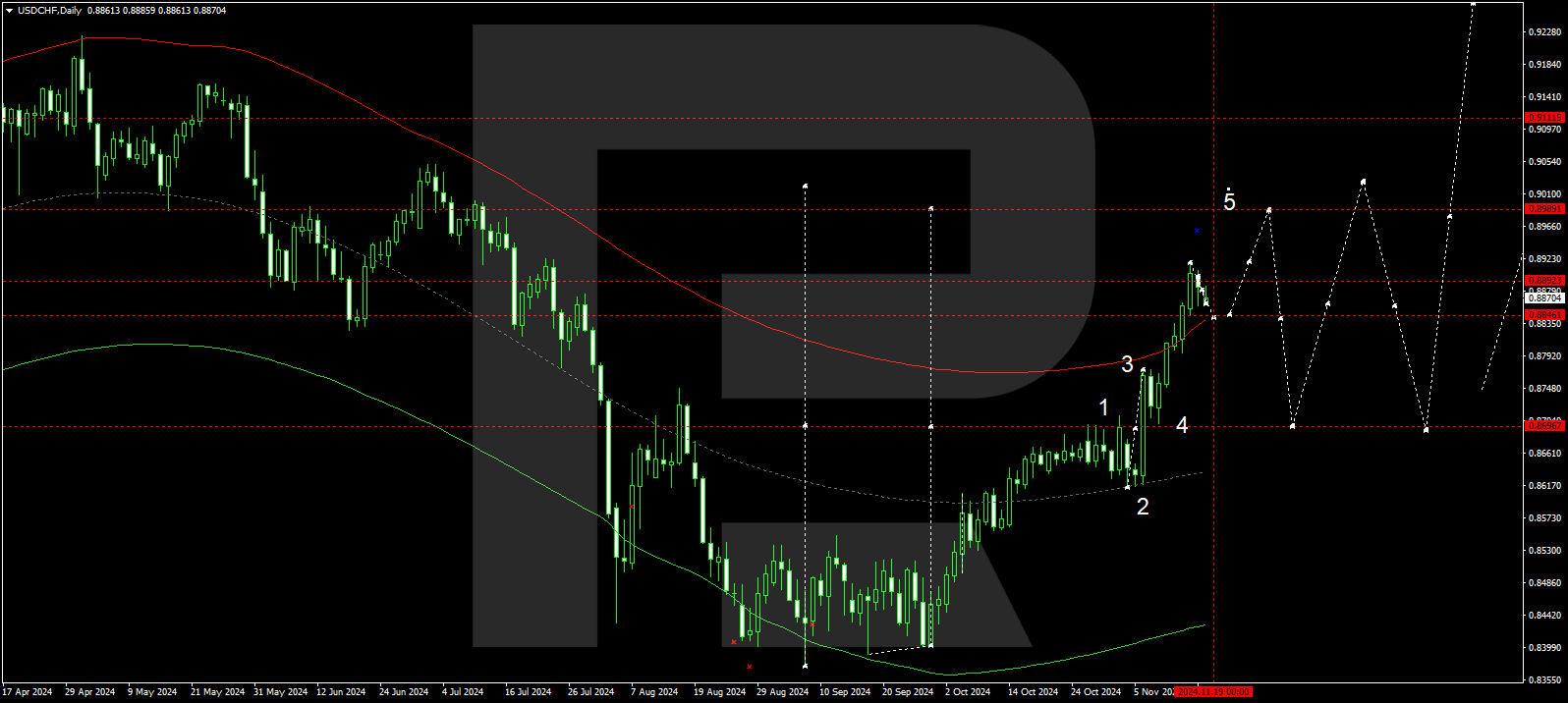

USDCHF forecast

The USDCHF pair has formed a consolidation range around 0.8700. The market has breached the upper boundary of this range and moved to 0.8917. A narrow consolidation range is expected to develop below this level. With a downward breakout, the price could correct towards 0.8840. With an upward breakout, the trend in the USDCHF pair might continue towards the local target of 0.8989.

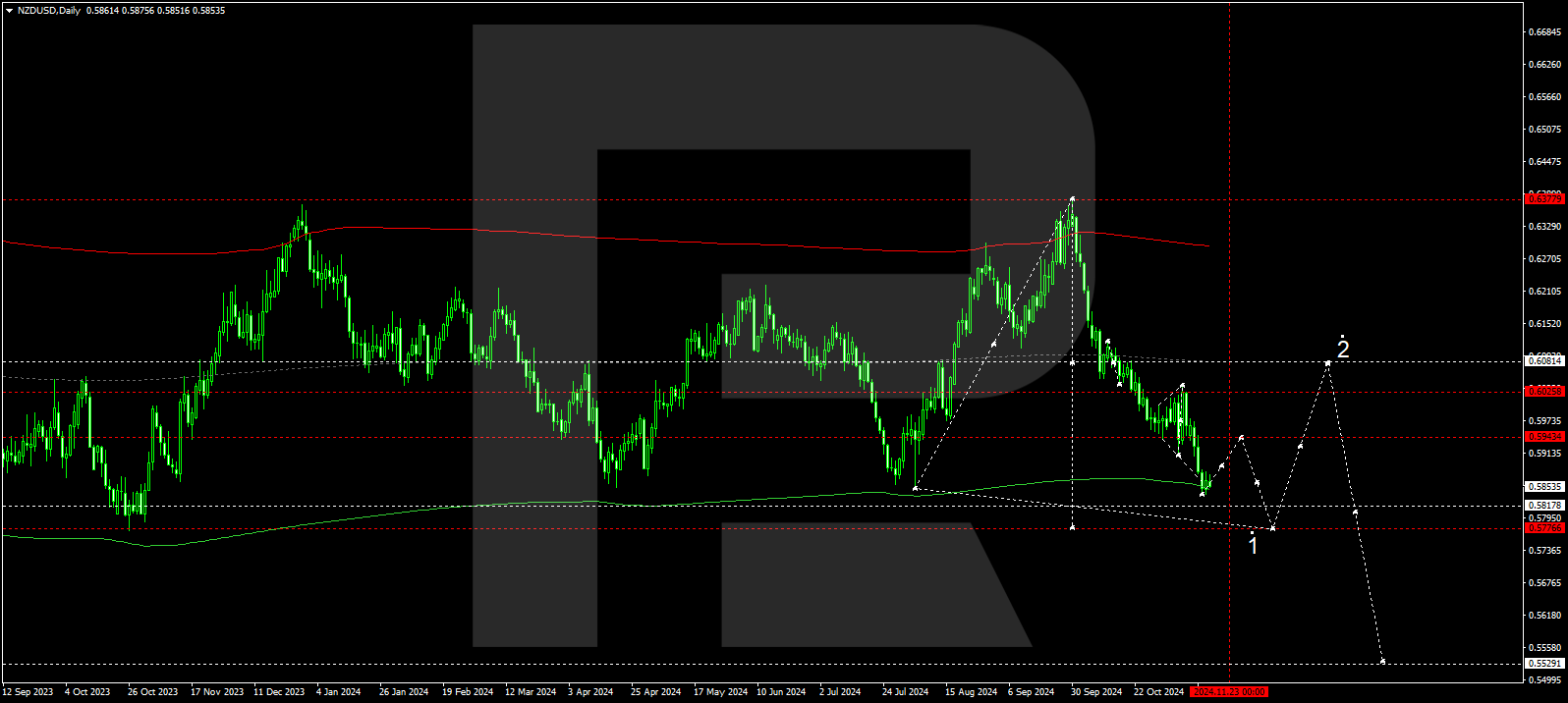

NZDUSD forecast

The NZDUSD pair has broken below the 0.5900 level and formed a downward move towards 0.5838. A narrow consolidation range is expected to form above this level. A breakout above the range could enable a correction towards 0.5944. A breakout below this level would reinforce the downward trend, potentially reaching 0.8989, the estimated target.

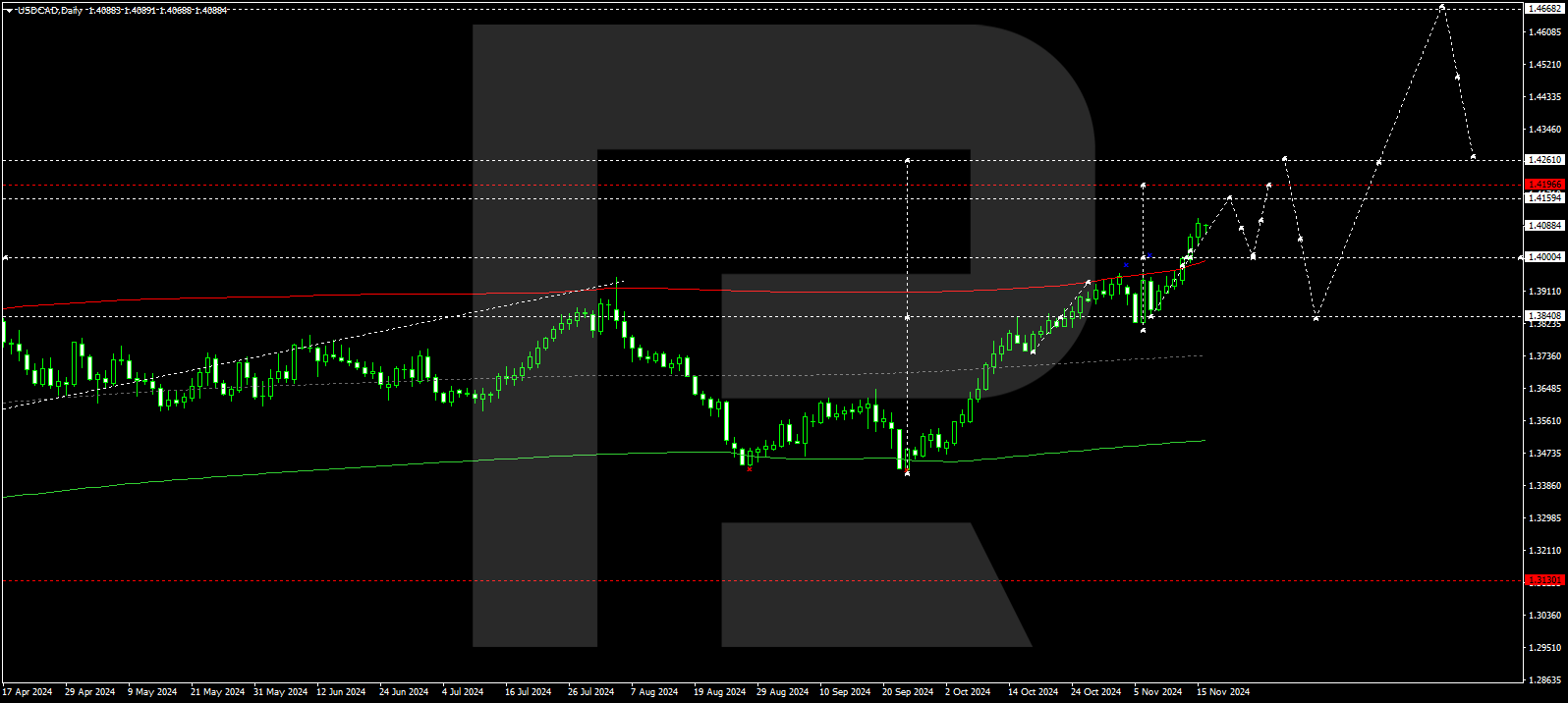

USDCAD forecast

The USDCAD pair has formed a consolidation range around 1.3840 and exited the range upwards. Breaking above 1.4000 opens the potential for a move towards 1.4160, with further upside possible towards 1.4260, the first target. After the price reaches this level, a more substantial correction in the USDCAD pair might begin, aiming for 1.3840 (testing from above).

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.