Short-term USDCAD dynamics remain bearish

The USDCAD pair continues to decline amid positive macroeconomic data from Canada. The current quote stands at 1.3763. Details — in our analysis for 15 December 2025.

USDCAD forecast: key trading points

- In October 2025, Canada’s wholesale trade volume increased by 0.1% month-over-month

- Growth in building permits in Canada in October 2025 was the fastest since June 2024

- Positive signals from individual sectors of the Canadian economy increase pressure on USDCAD

- USDCAD forecast for 15 December 2025: 1.3690

Fundamental analysis

The USDCAD pair is correcting but remains under selling pressure. Investors’ attention is still focused on the geopolitical environment, which continues to generate heightened volatility in commodity and currency markets.

Macroeconomic data from Canada present a mixed picture. In October 2025, wholesale trade volumes rose by 0.1% month-over-month to CAD 86.0 billion, while the market had expected a decline of 0.1%. Additional support for domestic demand came from the construction sector. In October 2025, the value of building permits issued surged by 14.9% compared to the previous month, reaching CAD 13.8 billion — the fastest pace of growth since June 2024.

Positive signals from individual sectors of the Canadian economy are increasing pressure on USDCAD, strengthening the Canadian dollar and keeping the short-term outlook for USDCAD bearish.

USDCAD technical analysis

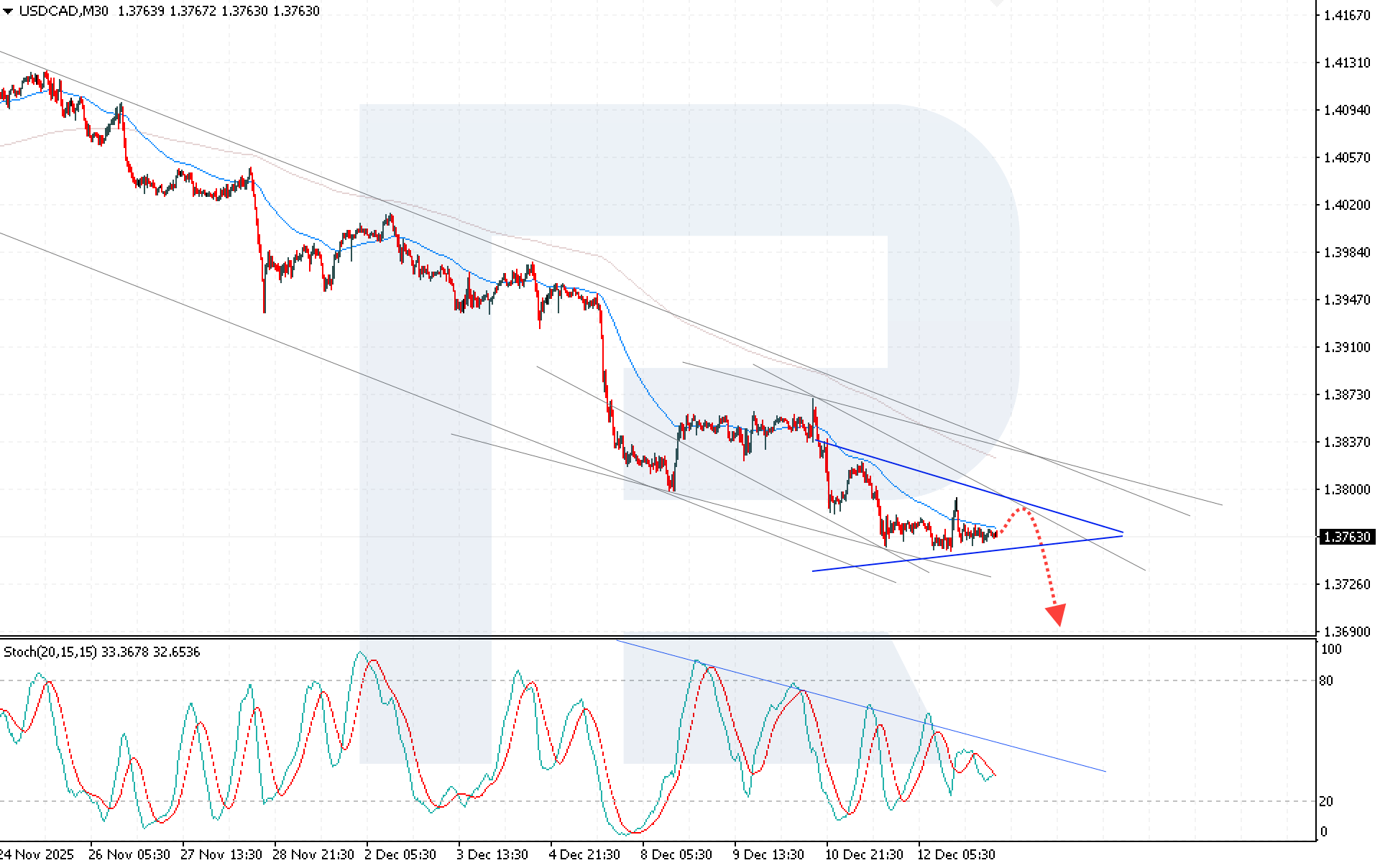

The USDCAD pair is consolidating below the EMA-65, confirming persistent bearish pressure. The price structure points to the formation of a Triangle pattern with a projected target near 1.3680. The USDCAD outlook for today suggests a continuation of the decline, with the nearest target at 1.3690.

An additional signal in favor of the bearish scenario is provided by the Stochastic Oscillator: the signal lines are bouncing off the descending trend line, indicating that bearish momentum remains intact.

A firm consolidation below the 1.3745 level will confirm the downside scenario and signal a breakout below the lower boundary of the Triangle pattern.

Summary

Short-term USDCAD dynamics remain under pressure. Technical analysis of USDCAD points to a continuation of the bearish move with a target at 1.3680, provided that the price holds below the 1.3745 level.

Editors’ picks

EURUSD 2026-2027 forecast: key market trends and future predictions

EURUSD 2026-2027 forecast: key market trends and future predictionsThis article provides the EURUSD forecast for 2026 and 2027 and highlights the main factors determining the direction of the pair’s movements. We will apply technical analysis, take into account the opinions of leading experts, large banks, and financial institutions, and study AI-based forecasts. This comprehensive insight into EURUSD predictions should help investors and traders make informed decisions.

Gold (XAUUSD) forecast 2026 and beyond: expert insights, price predictions, and analysis

Gold (XAUUSD) forecast 2026 and beyond: expert insights, price predictions, and analysisDive deep into the Gold (XAUUSD) price outlook for 2026 and beyond, combining technical analysis, expert forecasts, and key macroeconomic factors. It explains the drivers behind gold’s recent surge, explores potential scenarios including a move toward 4,500 to 5,000 USD per ounce, and highlights why the metal remains a strong hedge during global uncertainty.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.