USDCAD: the pair attempts an upside reversal

USDCAD has halted its decline and is attempting to reverse higher, having received buyer support near the 1.3730 area. Details — in our analysis for 22 December 2025.

USDCAD forecast: key takeaways

- Market focus: Retail sales in Canada rose by 1.2% in November

- Current trend: an upward correction is observed

- USDCAD forecast for 22 December 2025: 1.3730 and 1.3870

Fundamental analysis

According to data released on Friday, retail sales in Canada increased by 1.2% month-on-month in November 2025. This marked the strongest growth in five months, rebounding after a 0.2% decline in October.

Meanwhile, oil prices are attempting to recover as markets assess the risk of additional U.S. sanctions against Russia and potential supply disruptions linked to the blockade of Venezuelan oil tankers. These factors provide support for Canadian oil exporters.

USDCAD technical analysis

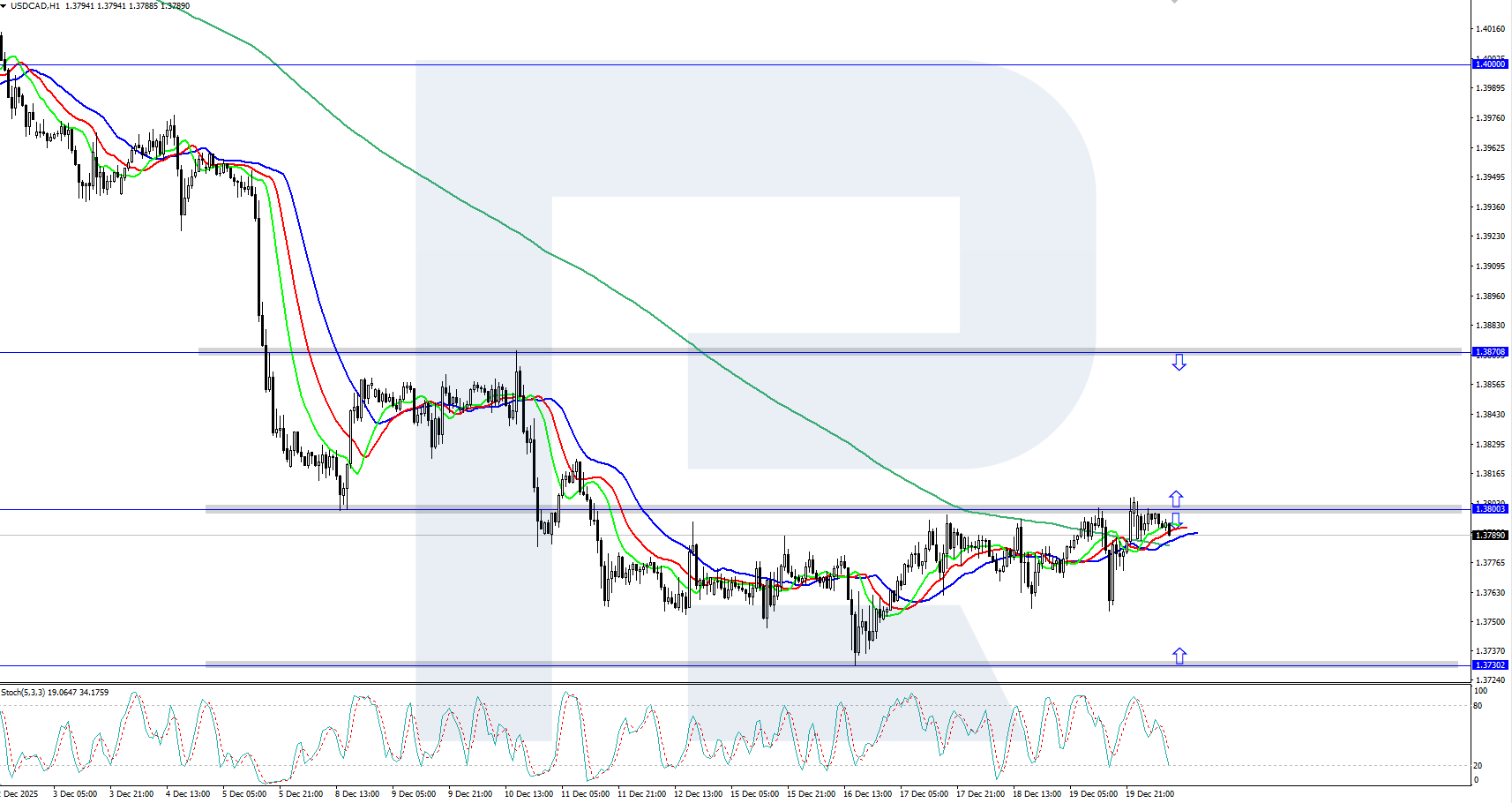

On the H4 chart, USDCAD quotes are showing an upward correction within a broader downtrend. Prices rebounded from daily support at 1.3730 and formed a local upside reversal, but have so far failed to break above resistance at 1.3800.

Within the short-term USDCAD price outlook, if sellers manage to keep prices below the 1.3800 level, the broader decline may resume. If buyers take control and push the price above 1.3800, the upward correction could extend toward the 1.3870 area.

Summary

USDCAD has turned higher and moved into the area around 1.3800 as part of an upward correction. However, the daily trend remains bearish, meaning further downside cannot yet be ruled out.

Editors’ picks

EURUSD 2026-2027 forecast: key market trends and future predictions

EURUSD 2026-2027 forecast: key market trends and future predictionsThis article provides the EURUSD forecast for 2026 and 2027 and highlights the main factors determining the direction of the pair’s movements. We will apply technical analysis, take into account the opinions of leading experts, large banks, and financial institutions, and study AI-based forecasts. This comprehensive insight into EURUSD predictions should help investors and traders make informed decisions.

Gold (XAUUSD) forecast 2026 and beyond: expert insights, price predictions, and analysis

Gold (XAUUSD) forecast 2026 and beyond: expert insights, price predictions, and analysisDive deep into the Gold (XAUUSD) price outlook for 2026 and beyond, combining technical analysis, expert forecasts, and key macroeconomic factors. It explains the drivers behind gold’s recent surge, explores potential scenarios including a move toward 4,500 to 5,000 USD per ounce, and highlights why the metal remains a strong hedge during global uncertainty.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.