USDCAD rose to the 1.3900 area

The USDCAD rate is on the rise, climbing into the area around 1.3900 amid an increase in unemployment in Canada. Discover more in our analysis for 12 January 2026.

USDCAD forecast: key takeaways

- Market focus: Canada’s unemployment rate rose from 6.5% to 6.8% in December

- Current trend: moving upwards

- USDCAD forecast for 12 January 2026: 1.3800 and 1.4000

Fundamental analysis

The Canadian dollar weakened to 1.3900 per US dollar, reaching a monthly low. Pressure on the Canadian currency was driven by a clear deterioration in labour market conditions, which weakened arguments in favour of potential tightening of the Bank of Canada’s policy.

December data showed that the unemployment rate increased from 6.5% to 6.8%, significantly above expectations. A slowdown in wage growth to 3.7% year-on-year from 4.0% indicates easing domestic inflationary pressure.

USDCAD technical analysis

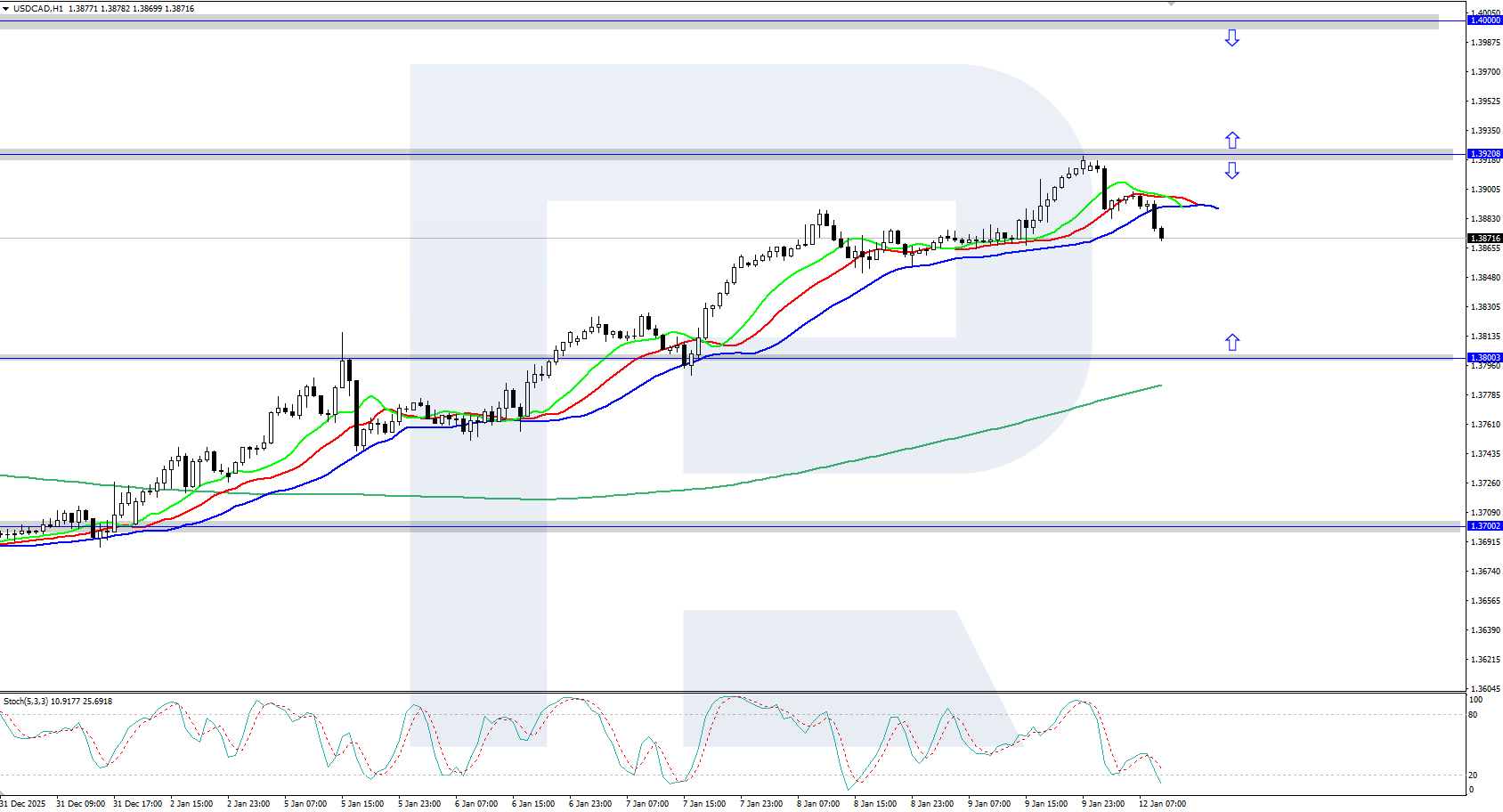

On the H1 chart, USDCAD quotes are showing upward momentum, reaching the 1.3900 area. The Alligator indicator is also pointing higher, confirming the current bullish dynamics. After a brief correction, the upward movement may continue.

The short-term USDCAD forecast suggests a correction towards the 1.3800 support level if bears hold quotes below the 1.3920 level. Conversely, if bulls push the price above 1.3920, growth may continue towards the 1.4000 area.

Summary

The USDCAD pair is showing upward dynamics, rising to the 1.3900 area, with the Canadian currency pressured by disappointing unemployment data, which recorded an increase to 6.8% in December.

Editors’ picks

EURUSD 2026-2027 forecast: key market trends and future predictions

EURUSD 2026-2027 forecast: key market trends and future predictionsThis article provides the EURUSD forecast for 2026 and 2027 and highlights the main factors determining the direction of the pair’s movements. We will apply technical analysis, take into account the opinions of leading experts, large banks, and financial institutions, and study AI-based forecasts. This comprehensive insight into EURUSD predictions should help investors and traders make informed decisions.

Gold (XAUUSD) forecast 2026 and beyond: expert insights, price predictions, and analysis

Gold (XAUUSD) forecast 2026 and beyond: expert insights, price predictions, and analysisDive deep into the Gold (XAUUSD) price outlook for 2026 and beyond, combining technical analysis, expert forecasts, and key macroeconomic factors. It explains the drivers behind gold’s recent surge, explores potential scenarios including a move toward 4,500 to 5,000 USD per ounce, and highlights why the metal remains a strong hedge during global uncertainty.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.