USDCAD will continue to rise, but after a pause

The USDCAD pair halted at 1.3901, with the market monitoring political developments and oil price fluctuations. Find out more in our analysis for 19 January 2026.

USDCAD forecast: key takeaways

- Current mood: trade-related news and US policy weigh on the CAD, while oil prices provide support

- Market focus: the pair’s growth has slowed, but the market is not yet preparing for a reversal

- USDCAD forecast for 19 January 2026: 1.3930

Fundamental analysis

The USDCAD rate declined to 1.3901 on Monday. Previously, the CAD fell to a six-week low against the US dollar amid news of a trade agreement between Canada and China, as well as expectations surrounding the selection of the next chair of the US Federal Reserve.

Additional pressure on the Canadian dollar came from comments by US President Donald Trump, who publicly supported his economic adviser Kevin Hassett. Trump stated that he would like to keep him in his current role. The market interpreted this as a reduced probability of Hassett, considered one of the most dovish candidates, being appointed as Fed chair. This supported the US dollar.

Trade-related news also added uncertainty. Canadian Prime Minister Mark Carney announced a preliminary agreement with China that would reduce tariffs on electric vehicles and canola. In Washington, this development was met with caution. Representatives of the Trump administration stated that Canada would regret the decision to bring Chinese electric vehicles into its market and emphasised that such vehicles would not be allowed into the US market.

The Canadian currency received partial support from rising oil prices. Domestic data also proved positive, with housing starts up 11% month-on-month in December, exceeding forecasts. The yield on 10-year Canadian government bonds rose by 2.2 basis points to 3.376%, following the rise in US yields.

Technical outlook

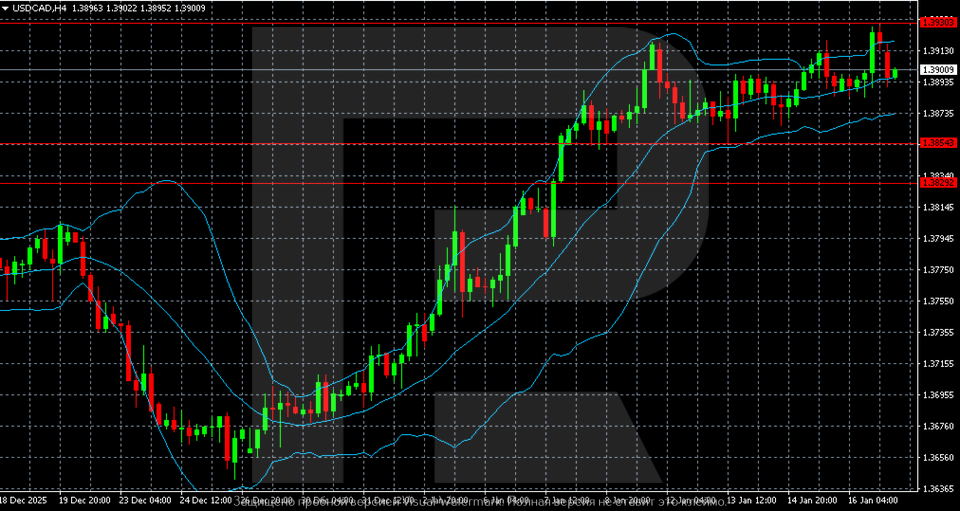

On the H4 chart, the USDCAD pair maintains an upward structure that formed after the reversal in late December. After declining towards the 1.3650–1.3680 area, the pair shifted into a stable upward move, accompanied by a series of higher lows and higher highs. The impulsive movement in early January allowed the price to quickly return above 1.3800 and then consolidate above this zone, confirming a shift in short-term sentiment in favour of buyers.

In recent sessions, growth has slowed, and quotes have moved into a consolidation phase within the 1.3890–1.3930 range. The price is hovering near the upper Bollinger Band, while the indicator’s middle line continues to rise, indicating a continued bullish bias. Attempts at corrective declines remain limited and find support in the 1.3850–1.3820 area, which acts as the nearest demand zone.

Technically, the market appears moderately overbought, but without signs of a reversal. The absence of a sharp pullback indicates buyers’ willingness to hold positions. Consolidation above 1.3930 will open the door for continued growth towards 1.4000. A move below the 1.3820–1.3800 area will become the first signal of weakening upward momentum and a possible transition to a deeper correction.

USDCAD overview

- Asset: USDCAD

- Timeframe: H4 (Intraday)

- Trend: Bullish

- Key resistance levels: 1.3930 and 1.4000

- Key support levels: 1.3850–1.3820 and 1.3800

USDCAD trading scenarios for today

Main scenario (Buy Stop)

A breakout and consolidation above 1.3930 will confirm continued upward momentum and market readiness to move higher after the consolidation phase.

Growth is supported by trade and political risks for the Canadian dollar, as well as stable demand for the US dollar. Oil prices partially restrain the pair’s advance, but do not change the overall bias at this stage.

- Take Profit: 1.4000

- Stop Loss: 1.3850

Alternative scenario (Sell Stop)

A short scenario becomes possible if the price moves below 1.3820 with consolidation beneath this level. This will serve as the first signal of weakening bullish structure and a transition to a deeper correction.

- Take Profit: 1.3720

- Stop Loss: 1.3900

Risk factors

The main risk to the bullish scenario remains a sharp strengthening of oil prices or a softening of US rhetoric on trade issues. This may support the Canadian dollar and trigger profit-taking on long positions.

Summary

The USDCAD pair has slowed its upward momentum but continues to look resilient. The USDCAD forecast for today, 19 January 2026, does not rule out continued growth towards 1.3930.

Editors’ picks

EURUSD 2026-2027 forecast: key market trends and future predictions

EURUSD 2026-2027 forecast: key market trends and future predictionsThis article provides the EURUSD forecast for 2026 and 2027 and highlights the main factors determining the direction of the pair’s movements. We will apply technical analysis, take into account the opinions of leading experts, large banks, and financial institutions, and study AI-based forecasts. This comprehensive insight into EURUSD predictions should help investors and traders make informed decisions.

Gold (XAUUSD) forecast 2026 and beyond: expert insights, price predictions, and analysis

Gold (XAUUSD) forecast 2026 and beyond: expert insights, price predictions, and analysisDive deep into the Gold (XAUUSD) price outlook for 2026 and beyond, combining technical analysis, expert forecasts, and key macroeconomic factors. It explains the drivers behind gold’s recent surge, explores potential scenarios including a move toward 4,500 to 5,000 USD per ounce, and highlights why the metal remains a strong hedge during global uncertainty.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.