Oil, BoC, and US tariffs: a perfect storm for a USDCAD decline

The Canadian dollar continues to strengthen, with the USDCAD rate testing the 1.3690 level. Discover more in our analysis for 26 January 2026.

USDCAD forecast: key takeaways

- The Canadian dollar is awaiting the interest rate decision on 28 January

- Donald Trump stated that he may impose 100% tariffs on goods from Canada

- USDCAD forecast for 26 January 2026: 1.3645

Fundamental analysis

Today’s USDCAD forecast is optimistic for the CAD. The pair continues to decline, trading near the 1.3690 level.

The Canadian dollar is awaiting the interest rate decision on 28 January. The Bank of Canada is expected to keep the rate at 2.25%, which in turn would support the CAD and trigger a further decline in the USDCAD rate.

Recent data showed stagnation in employment levels and a rise in unemployment in Canada, but this failed to exert significant pressure on the Canadian dollar.

The rise in Brent prices provided additional support for the CAD, while unpredictable US foreign and domestic policies are adding to pressure on the USD. According to some reports, the US president is pursuing a weaker USD to improve competitiveness with China and Japan.

On Saturday, 25 January, Trump stated that he may impose 100% tariffs on goods from Canada if it enters into trade relations with China. The US remains concerned about mutually beneficial trade relations between other countries and China, leading to constant threats of sanctions, tariffs, and duties. There are few positive aspects to this, and the USD continues to lose ground against other currencies.

Technical outlook

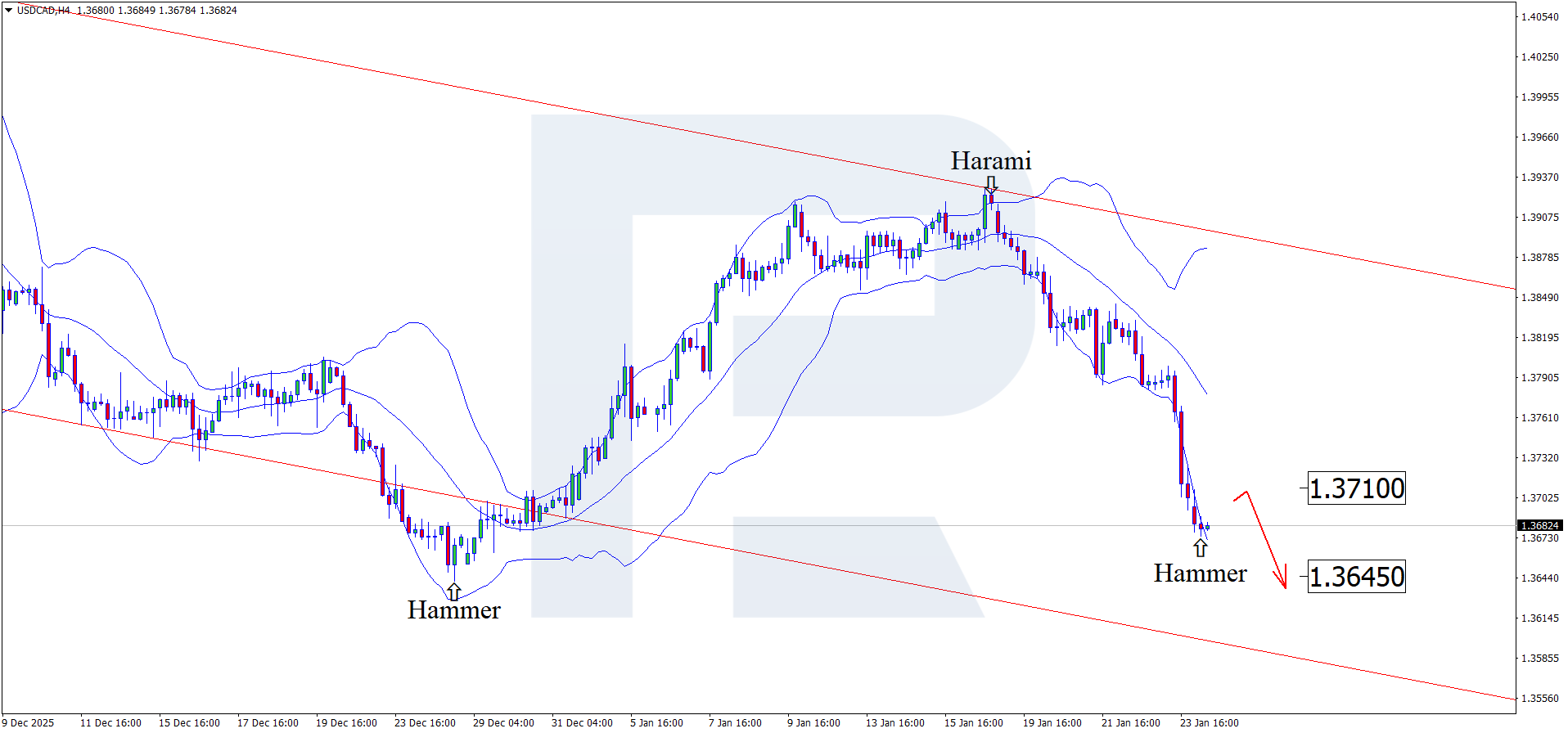

On the H4 chart, the USDCAD pair formed a Hammer reversal pattern near the lower Bollinger Band. At this stage, it may develop a corrective wave following the signal. Since prices remain within a descending channel, a pullback towards the nearest resistance at 1.3710 can be expected. A rebound from this level would open the way for continued downward momentum.

At the same time, the forecast for 26 January 2026 also includes a scenario in which the price falls to the 1.3645 level without a corrective move toward resistance.

USDCAD overview

- Asset: USDCAD

- Timeframe: H4 (Intraday)

- Trend: bearish

- Key resistance levels: 1.3925 and 1.4000

- Key support levels: 1.3650 and 1.3580

USDCAD trading scenarios for today

Main scenario (Sell Stop)

A breakout and consolidation below 1.3650 will confirm continued bearish momentum and the market’s readiness to resume the move after a consolidation phase.

The decline is supported by trade and political risks for the US dollar. Oil prices are partially supporting the Canadian dollar.

- Sell Stop: 1.3645

- Take Profit: 1.3550

- Stop Loss: 1.3675

Alternative scenario (Buy Stop)

A long scenario is possible if the price moves and consolidates above 1.3745. This would be the first signal of weakening bearish structure and a transition to a deeper correction.

- Take Profit: 1.3825

- Stop Loss: 1.3715

Risk factors

The main risk for the bearish scenario remains a sharp drop in oil prices or tougher rhetoric from the US on trade issues. This could support the USD, pushing the USDCAD rate higher.

Summary

The Canadian dollar continues to strengthen amid expectations of the BoC interest rate decision. Technical analysis suggests a further decline towards the 1.3645 level.

Editors’ picks

EURUSD 2026-2027 forecast: key market trends and future predictions

EURUSD 2026-2027 forecast: key market trends and future predictionsThis article provides the EURUSD forecast for 2026 and 2027 and highlights the main factors determining the direction of the pair’s movements. We will apply technical analysis, take into account the opinions of leading experts, large banks, and financial institutions, and study AI-based forecasts. This comprehensive insight into EURUSD predictions should help investors and traders make informed decisions.

Gold (XAUUSD) forecast 2026 and beyond: expert insights, price predictions, and analysis

Gold (XAUUSD) forecast 2026 and beyond: expert insights, price predictions, and analysisDive deep into the Gold (XAUUSD) price outlook for 2026 and beyond, combining technical analysis, expert forecasts, and key macroeconomic factors. It explains the drivers behind gold’s recent surge, explores potential scenarios including a move toward 4,500 to 5,000 USD per ounce, and highlights why the metal remains a strong hedge during global uncertainty.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.