USDCAD in neutral: statistics will determine everything

The USDCAD pair stands at 1.3616 on Monday. The focus is on fresh inflation data from Canada. Find out more in our analysis for 16 February 2026.

USDCAD forecast: key takeaways

- The USDCAD pair stabilised after last week’s volatility

- Investors are focused on Canadian inflation data due on Tuesday

- USDCAD forecast for 16 February 2026: 1.3490 or 1.3725

Fundamental analysis

The USDCAD pair starts the week at 1.3616. Previously, the Canadian dollar declined moderately but managed to retain most of its weekly gains thanks to signals of slowing inflation in the US.

The focus is on Canada’s January CPI, scheduled for release on Tuesday. Annual inflation is expected to remain at 2.4%. This could influence expectations regarding the Bank of Canada’s future policy.

Brent oil, one of the country’s key export commodities, is hovering at 67.21 USD per barrel. Prices remain stable after declining on news of a potential resumption of production growth by OPEC+.

Canadian government bond yields fell across the curve following the movement in US Treasuries. The yield on 10-year bonds dropped by 3.2 basis points to 3.259%, having previously reached its lowest level since 4 December at 3.234%.

The USDCAD outlook is neutral.

Technical outlook

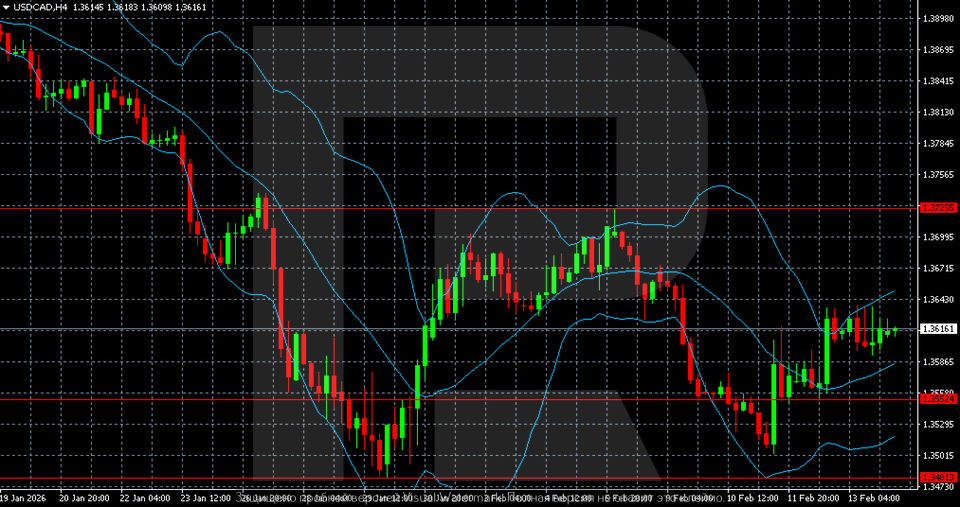

On the H4 chart, the USDCAD pair remains in a consolidation phase after January’s decline. The pair is trading in the middle of a broad range between 1.3490 and 1.3725, currently around 1.3615. There is no clear trend: Bollinger Bands have flattened, and volatility is moderate.

The latest rebound from 1.3490 quickly lost momentum, and the market shifted into sideways movement above the 1.3550 support level. As long as the price holds above this zone, a neutral-to-positive balance remains, with potential movement towards 1.3650–1.3700 and further to the upper boundary of the range at 1.3725. A breakout below the 1.3550 level would increase pressure and reopen the path towards 1.3490.

USDCAD overview

- Asset: USDCAD

- Timeframe: H4 (Intraday)

- Trend: range

- Key resistance levels: 1.3650 and 1.3725

- Key support levels: 1.3550 and 1.3490

USDCAD trading scenarios for today

Main scenario (Buy Stop)

A consolidation above 1.3650 would confirm an exit from local consolidation and create conditions for movement towards the range’s upper boundary at 1.3725. A breakout above 1.3725 would open the door for continued upward momentum. The risk-to-reward ratio is close to 1:2. The upside potential is about 70 pips, with the risk limited to 35–40 pips.

- Take Profit: 1.3725

- Stop Loss: 1.3610

Alternative scenario (Sell Stop)

A decline below 1.3550 would add to pressure on the pair and signal readiness to test the 1.3490 support level. A breakout below this level would restore the medium-term bearish momentum.

- Take Profit: 1.3490

- Stop Loss: 1.3590

Risk factors

Risk factors for the USDCAD pair include the release of Canada’s January CPI and expectations regarding the Bank of Canada’s policy. Additional influence will come from fluctuations in Brent oil prices and the overall dynamics of the US dollar amid revised expectations for Fed rate policy.

Summary

The USDCAD pair has stabilised after last week’s volatility, with the forecast for today, 16 February 2026, suggesting sideways trading within the 1.3490–1.3725 range.

Editors’ picks

EURUSD 2026-2027 forecast: key market trends and future predictions

EURUSD 2026-2027 forecast: key market trends and future predictionsThis article provides the EURUSD forecast for 2026 and 2027 and highlights the main factors determining the direction of the pair’s movements. We will apply technical analysis, take into account the opinions of leading experts, large banks, and financial institutions, and study AI-based forecasts. This comprehensive insight into EURUSD predictions should help investors and traders make informed decisions.

Gold (XAUUSD) forecast 2026 and beyond: expert insights, price predictions, and analysis

Gold (XAUUSD) forecast 2026 and beyond: expert insights, price predictions, and analysisDive deep into the Gold (XAUUSD) price outlook for 2026 and beyond, combining technical analysis, expert forecasts, and key macroeconomic factors. It explains the drivers behind gold’s recent surge, explores potential scenarios including a move toward 4,500 to 5,000 USD per ounce, and highlights why the metal remains a strong hedge during global uncertainty.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.