Swiss franc declines: markets again favour the US dollar

The USDCHF pair shows moderate gains with accelerated growth potential. Find out more in our analysis for 26 November 2024.

USDCHF forecast: key trading points

- The USDCHF pair is poised for growth

- The SNB prioritises low inflation

- USDCHF forecast for 26 November 2024: 0.8815

Fundamental analysis

The USDCHF rate is hovering around 0.8863.

The Swiss franc recently fell to its mid-July 2024 low against the US dollar due to the rapid strengthening of the US currency. Strong expectations persist in the market that the Federal Reserve will slow the pace of interest rate cuts due to robust economic data. Additionally, market participants are overly cautious, given the significant impact of US President-elect Donald Trump’s protectionist policies.

The Swiss National Bank’s inflation target ranges between 0% and 2%. The SNB intends to prioritise maintaining low inflation as the foundation for its monetary policy.

Annual inflation in Switzerland fell for the third consecutive month in October, reaching 0.6%, marking its lowest level since June 2021.

The USDCHF forecast appears optimistic.

USDCHF technical analysis

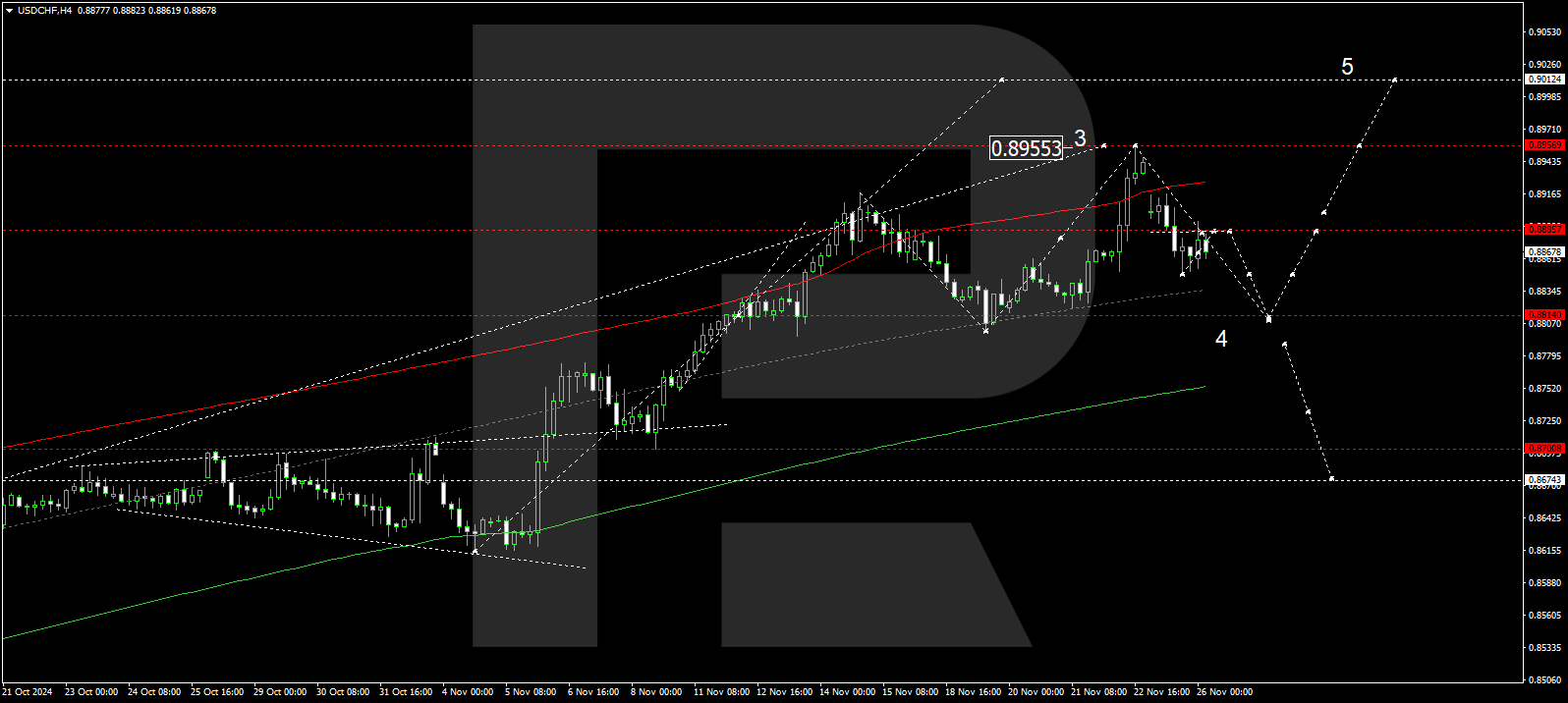

The USDCHF H4 chart shows that the market has completed a downward wave, reaching 0.8848. Today, 26 November 2024, the price technically returned to the 0.8860 level (testing from below), with the market outlining a consolidation range around this level. A downward breakout could lead to an extended correction towards 0.8815, the first target for the correction.

The Elliott Wave structure and wave matrix, with a pivot point at 0.8880, technically support this scenario. This level is considered critical for a downward wave in the USDCHF rate. The market is forming a downward structure towards the envelope’s central line at 0.8815. After the price reaches this level, a narrow consolidation range may develop around it. A breakout below this range could pave the way for a further decline towards 0.8700, with the correction potentially extending to the envelope’s lower boundary at 0.8677.

Summary

The USDCHF pair could hit summer highs, supported by the strong US dollar. Technical indicators in today’s USDCHF forecast suggest a potential correction towards the 0.8815 level.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.