USDJPY: the yen continues its attempts to strengthen against the US dollar

The decrease in Japan’s core CPI had a mixed effect on the USDJPY rate, with the pair continuing its correction. More details in our analysis for 26 November 2024.

USDJPY forecast: key trading points

- Japan’s core CPI: previously at 1.7%, currently at 1.5%

- CB (Conference Board) US Consumer Confidence Index: previously at 108.7, projected at 111.8

- US new home sales: previously at 738,000, projected at 725,000

- USDJPY forecast for 26 November 2024: 152.88

Fundamental analysis

The core CPI reflects the price dynamics of goods and services from a consumer perspective. It is a key tool for evaluating consumer preferences and changes in the inflation rate. The CPI is calculated excluding energy and food prices due to seasonal fluctuations in these categories.

The CPI can have various impacts on currency rates. CPI growth typically prompts interest rate hikes and strengthens the national currency. However, CPI growth can aggravate conditions during an economic crisis, potentially weakening the national currency. Analysis for 25 November 2024 considers a decrease from the previous reading of 1.7% to 1.5%. This could have weakened the yen, but in this situation, it helped strengthen it against the US dollar.

The CB US Consumer Confidence Index reflects consumer confidence in the current economic environment. It is a leading indicator that predicts consumer spending, a significant part of economic activity. A high index reading indicates optimism among consumers. The forecast for 26 November 2024 suggests that the index could rise to 111.8 points, reflecting positive consumer sentiment.

US new home sales measure the number of residential buildings sold during the previous reporting period. The indicator is projected to be 725,000, below the last figure of 738,000. These results suggest a decline in citizens’ purchasing power, with purchases of new homes further constrained by rising food and energy prices. If the reading falls below the forecast, the USDJPY rate may continue to move within a corrective wave.

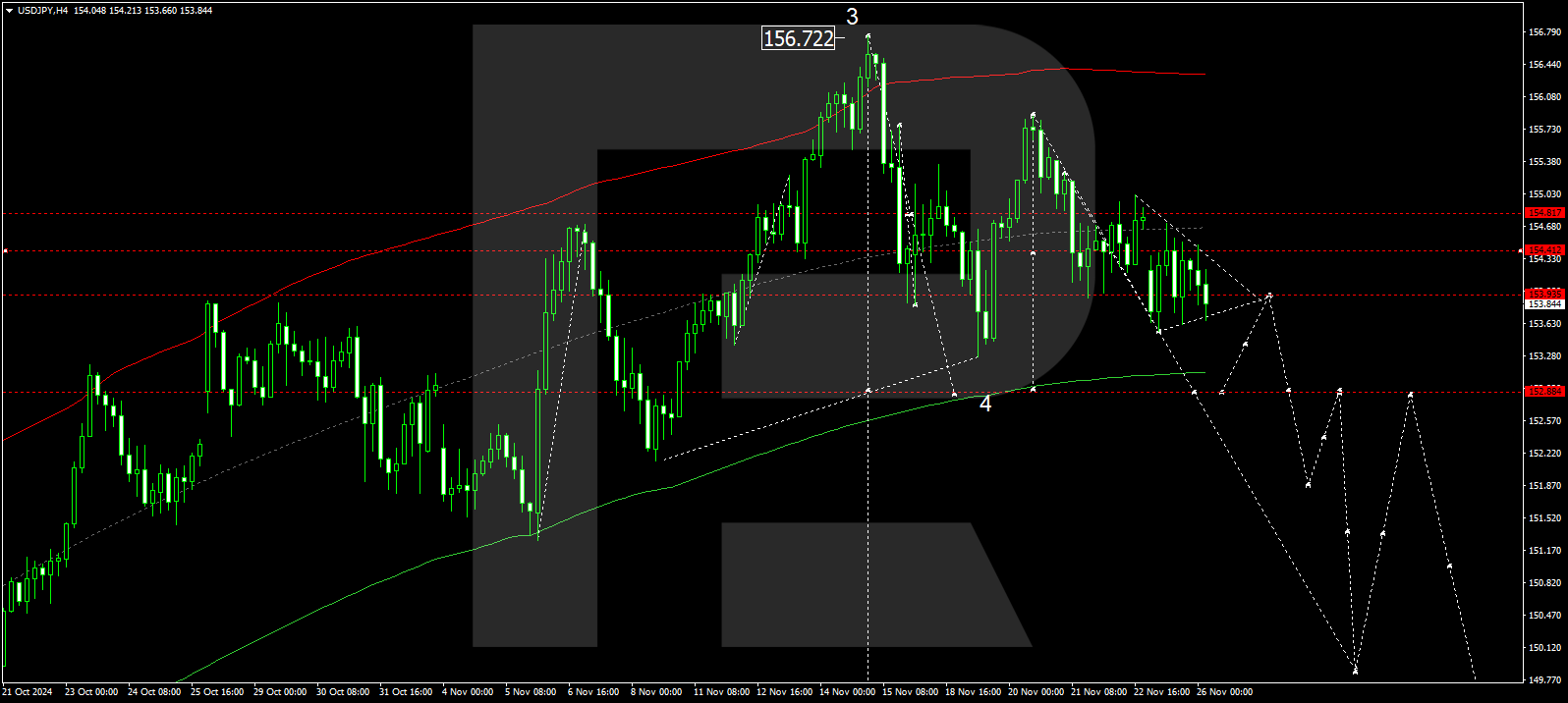

USDJPY technical analysis

The USDJPY H4 chart indicates that the market has formed a narrow consolidation range above the 153.80 level. The price is expected to break below the range today, 26 November 2024, and extend the downward wave towards 152.88. After reaching this level, the price might rise to 153.95. Subsequently, it could decline to 151.88, with the trend potentially continuing towards the local target of 150.00.

The Elliott Wave structure and downward wave matrix, with a pivot at 152.88, technically support this scenario for the USDJPY rate. The market is forming a downward wave towards the lower boundary of a price envelope at 152.88. Once this level is reached, a consolidation range is expected to be created, and the price might rise to the envelope’s central line. Subsequently, another downward wave is expected to develop, targeting the lower boundary at 150.00.

Summary

The projected decline in new home sales offsets the potential increase in the CB US Consumer Confidence Index. Coupled with technical analysis for today’s USDJPY forecast, a correction could continue towards the 152.88 level.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.