USDJPY resumes growth, but the yen will not retreat easily

The USDJPY pair rose to 150.06 on Tuesday. Despite sustained pressure, the Japanese yen remains resilient. Find out more in our analysis for 3 December 2024.

USDJPY forecast: key trading points

- The USDJPY pair recorded modest gains

- Investors remain optimistic about a December Bank of Japan interest rate hike

- USDJPY forecast for 3 December 2024: 150.70

Fundamental analysis

The USDJPY exchange rate rose to 150.06.

Despite local pressure from the US dollar, the yen remains close to a seven-week high. The optimism is attributed to expectations that the Bank of Japan will raise interest rates in December.

Last weekend, BoJ Governor Kazuo Ueda stated that further rate hikes were imminent as economic data aligned with expectations.

Investors currently assess the likelihood of a 25-basis-point rate hike this month at 60%, compared to no more than 50% last week.

The USDJPY forecast is neutral.

USDJPY technical analysis

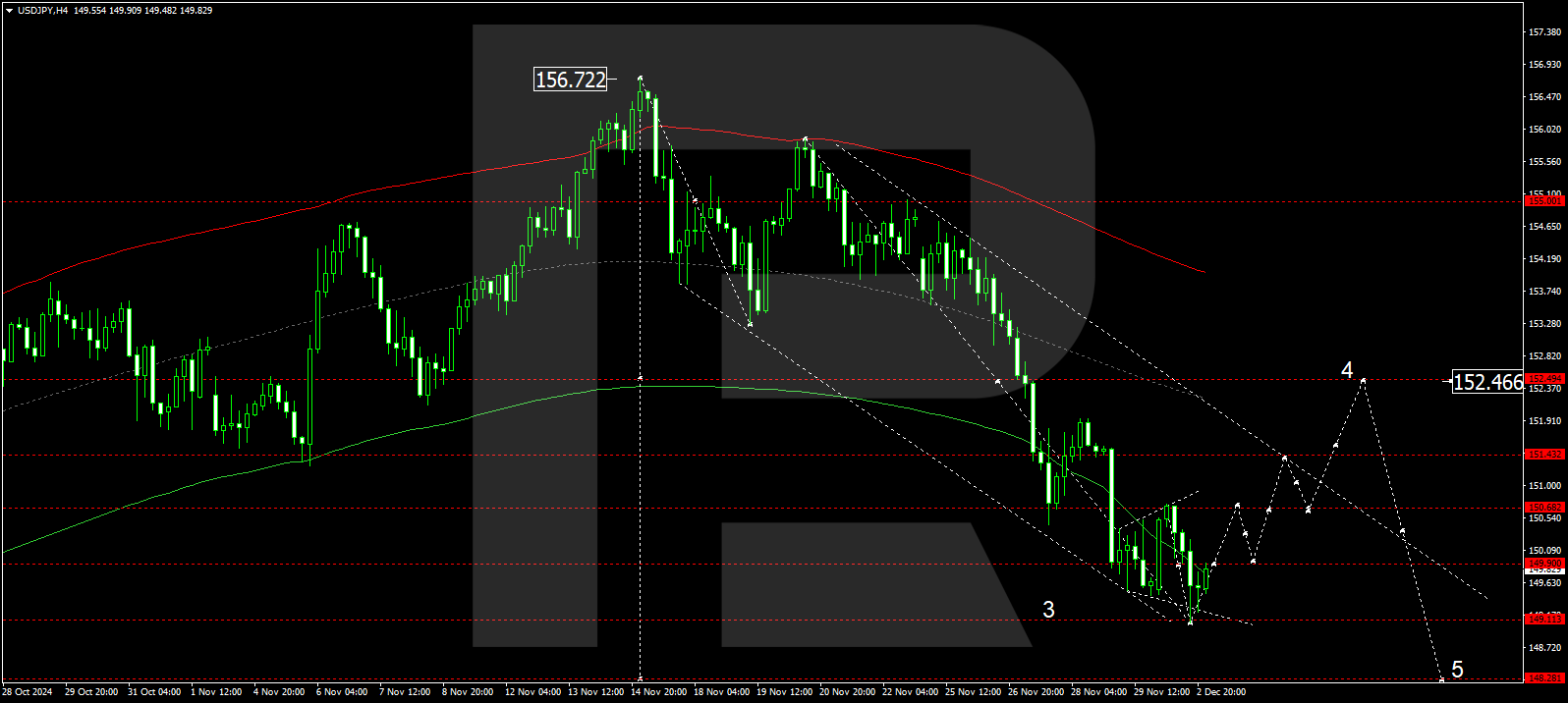

The USDJPY H4 chart indicates that the market has completed a growth wave to 150.73 before retracing to 149.10. Today, 3 December 2024, the market is expected to return to 149.90, forming a broad consolidation range around this level. An upward breakout will trigger a growth wave targeting 151.44, potentially extending further to 152.44. A breakout below the range would drive a downward movement towards 148.28.

The Elliott Wave structure and downward wave matrix, with a pivot at 152.50, technically support this forecast for the USDJPY rate. The market has reached the estimated target for the third downward wave at 149.10 and is now at the lower boundary of the price envelope, creating a consolidation range around 149.90. A breakout upwards could push the price to the envelope’s central line at 151.44. Conversely, a breakout below the range could lead to a drop to the envelope’s lower boundary at 148.28. Subsequently, the price is expected to rise to its upper boundary at 152.50 (testing from below).

Summary

Despite today’s rebound, the USDJPY pair remains close to a seven-week high. Technical indicators for today’s USDJPY forecast suggest potential growth to 150.70.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.