Strong data from Japan keeps USDJPY from rising further

The USDJPY pair is slightly declining, currently trading at 147.70. Find more details in our analysis for 8 April 2025.

USDJPY forecast: key trading points

- Donald Trump announces readiness to begin trade talks with Japan

- Japan posts a record current account surplus in February 2025

- USDJPY forecast for 8 April 2025: 146.25

Fundamental analysis

The USDJPY rate is retreating after Monday’s sharp rally, where the pair tested the key resistance level at 148.00. The Japanese yen temporarily weakened against the US dollar amid growing uncertainty around global trade — typically a driver of safe-haven demand.

On the political front, Donald Trump confirmed his readiness to start trade negotiations with Japan following a phone call with Prime Minister Shigeru Ishiba. The upcoming talks will address a wide range of issues, including tariffs, currency policy, and state subsidies.

Robust economic data keeps the yen from further weakening. In February 2025, Japan recorded a record current account surplus of 4.0607 trillion yen, driven by strong export growth amid high external demand and a decline in imports due to lower energy prices and subdued domestic consumption.

USDJPY technical analysis

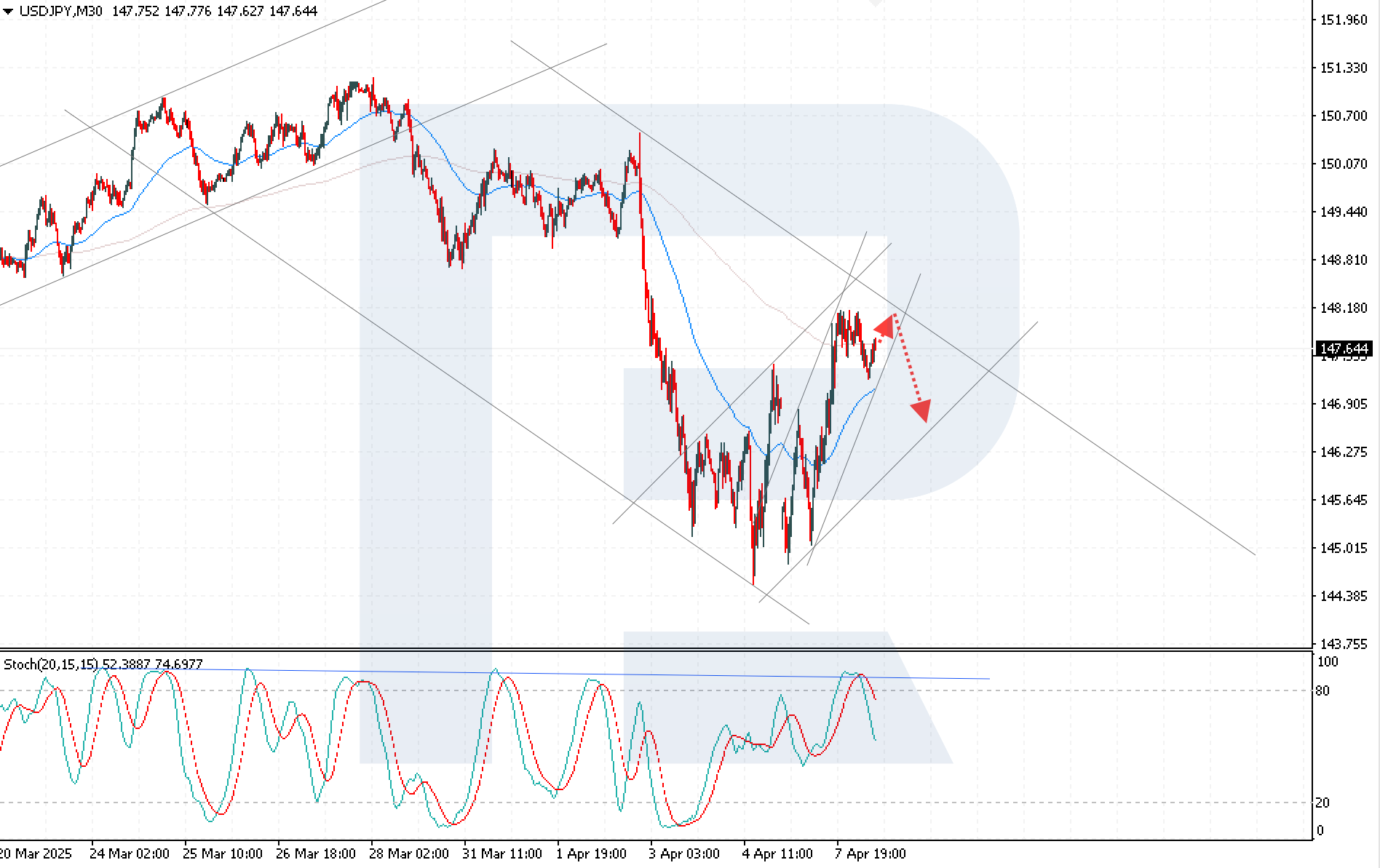

The USDJPY rate is falling after rebounding from the 148.00 resistance level, remaining within the boundaries of an ascending corrective channel. The USDJPY forecast for today suggests a potential breakout below the lower boundary of this channel and a decline to the 146.25 support level. Technical indicators support the bearish outlook, with Moving Averages indicating a downtrend and the Stochastic Oscillator turning downwards from the overbought area, signalling a fading bullish impulse and a possible price reversal.

Summary

The USDJPY rate is undergoing a short-term correction, with strong Japanese economic data limiting further yen weakness. The USDJPY technical analysis points to a potential bearish move, with the price likely to break below the lower boundary of the ascending channel and dip to 146.25.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.