USDJPY declines: the Bank of Japan maintains a hawkish stance

The USDJPY pair dipped to 155.08. The Japanese yen reached a three-week high amid a wave of expectations. Discover more in our analysis for 8 December 2025.

USDJPY forecast: key trading points

- Market focus: the USDJPY pair moves lower on expectations of future Bank of Japan policy decisions

- Current trend: externally, the market is focused on the Federal Reserve

- USDJPY forecast for 8 December 2025: 154.33

Fundamental analysis

The USDJPY rate fell to 155.08 at the start of the week. The Japanese yen strengthened to a three-week high amid expectations that the Bank of Japan may raise interest rates as early as next week, driven by hawkish signals from several BoJ officials.

Additional support for the yen comes from expectations that Prime Minister Sanae Takaichi’s cabinet may support a stronger national currency to reduce inflationary pressure caused by high import prices.

At the same time, Japan’s economic backdrop remains mixed. Real wages fell for the tenth consecutive month in October, while GDP contraction in Q3 was revised downwards. This complicates the monetary policy outlook.

An external driver for yen strength is the weakening US dollar. The market is nearly certain that the Federal Reserve will cut rates by 25 basis points as early as this week.

The USDJPY forecast is moderate.

USDJPY technical analysis

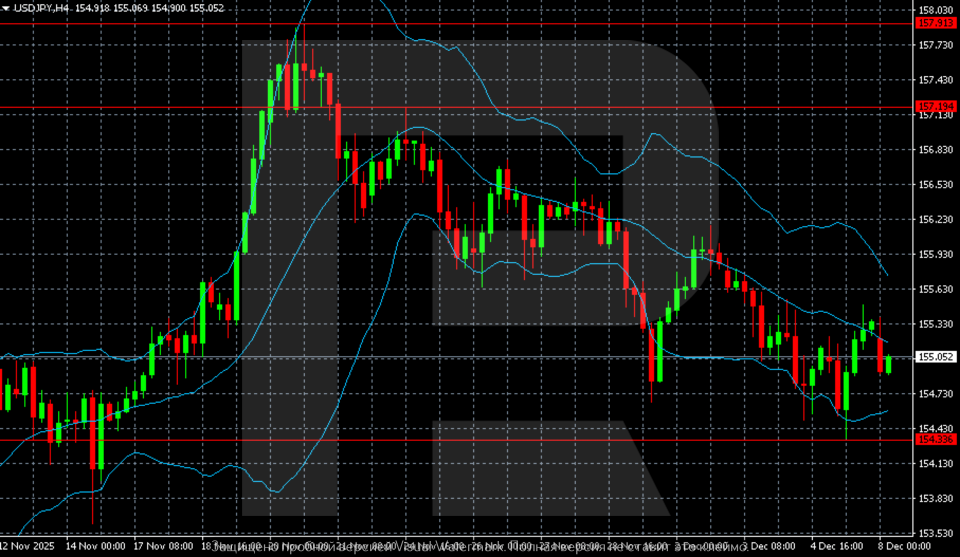

The USDJPY H4 chart shows continued downward movement following a reversal from the key resistance level at 157.19. The price remains firmly below the middle Bollinger Band, confirming seller dominance. The upper band is pointing downwards, reflecting declining volatility within the descending channel.

Buyers attempted a local pullback, but the 155.60–155.70 zone acted as strong resistance. This area coincides with the middle Bollinger Band, which continues to cap upward attempts. Bearish pressure has intensified after repeated failures to break above this area.

The nearest support level lies at 154.33, the low of the last downward wave. A breakout and firm consolidation below this level would open the way towards the next target around 153.80.

For an upward reversal, buyers must push the price back above 155.70. Only then would the first signs of weakening bearish momentum appear, allowing for a potential recovery towards 156.30–156.50.

Summary

The overall structure in USDJPY remains bearish. Momentum points downwards, price action is under pressure, and indicators confirm seller dominance. The USDJPY forecast for today, 8 December 2025, suggests a move towards 154.33.

Editors’ picks

EURUSD 2026-2027 forecast: key market trends and future predictions

EURUSD 2026-2027 forecast: key market trends and future predictionsThis article provides the EURUSD forecast for 2026 and 2027 and highlights the main factors determining the direction of the pair’s movements. We will apply technical analysis, take into account the opinions of leading experts, large banks, and financial institutions, and study AI-based forecasts. This comprehensive insight into EURUSD predictions should help investors and traders make informed decisions.

Gold (XAUUSD) forecast 2026 and beyond: expert insights, price predictions, and analysis

Gold (XAUUSD) forecast 2026 and beyond: expert insights, price predictions, and analysisDive deep into the Gold (XAUUSD) price outlook for 2026 and beyond, combining technical analysis, expert forecasts, and key macroeconomic factors. It explains the drivers behind gold’s recent surge, explores potential scenarios including a move toward 4,500 to 5,000 USD per ounce, and highlights why the metal remains a strong hedge during global uncertainty.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.