Weakening Japanese economy adds to upward pressure on USDJPY

The USDJPY pair is undergoing a correction amid weak Japanese data and moderately positive US statistics, with the rate currently at 156.72. Discover more in our analysis for 10 December 2025.

USDJPY forecast: key trading points

- Japan’s economy contracted more sharply in Q3 than preliminary estimates indicated

- The Reuters Tankan index for manufacturers declined to +10 in December 2025

- Concerns about fiscal policy and slowing growth worsened business sentiment in Japan

- USDJPY forecast for 10 December 2025: 157.80

Fundamental analysis

The USDJPY rate is declining after three consecutive days of growth. The Japanese yen is once again under pressure because revised data showed a deeper contraction in the Japanese economy in Q3 than originally expected. The Reuters Tankan index for Japanese manufacturers fell to +10 in December 2025 from November’s nearly four-year high of +17, as concerns over fiscal policy and slowing growth weighed on business sentiment.

Markets are forming expectations of a possible BoJ rate hike next week and are closely watching Governor Ueda’s comments after the meeting, as they will define the policy trajectory for 2026.

Meanwhile, the US Bureau of Labor Statistics reported with a delay that job openings in the US increased by 12 thousand to 7.670 million in October 2025, up from 7.658 million in September.

USDJPY technical analysis

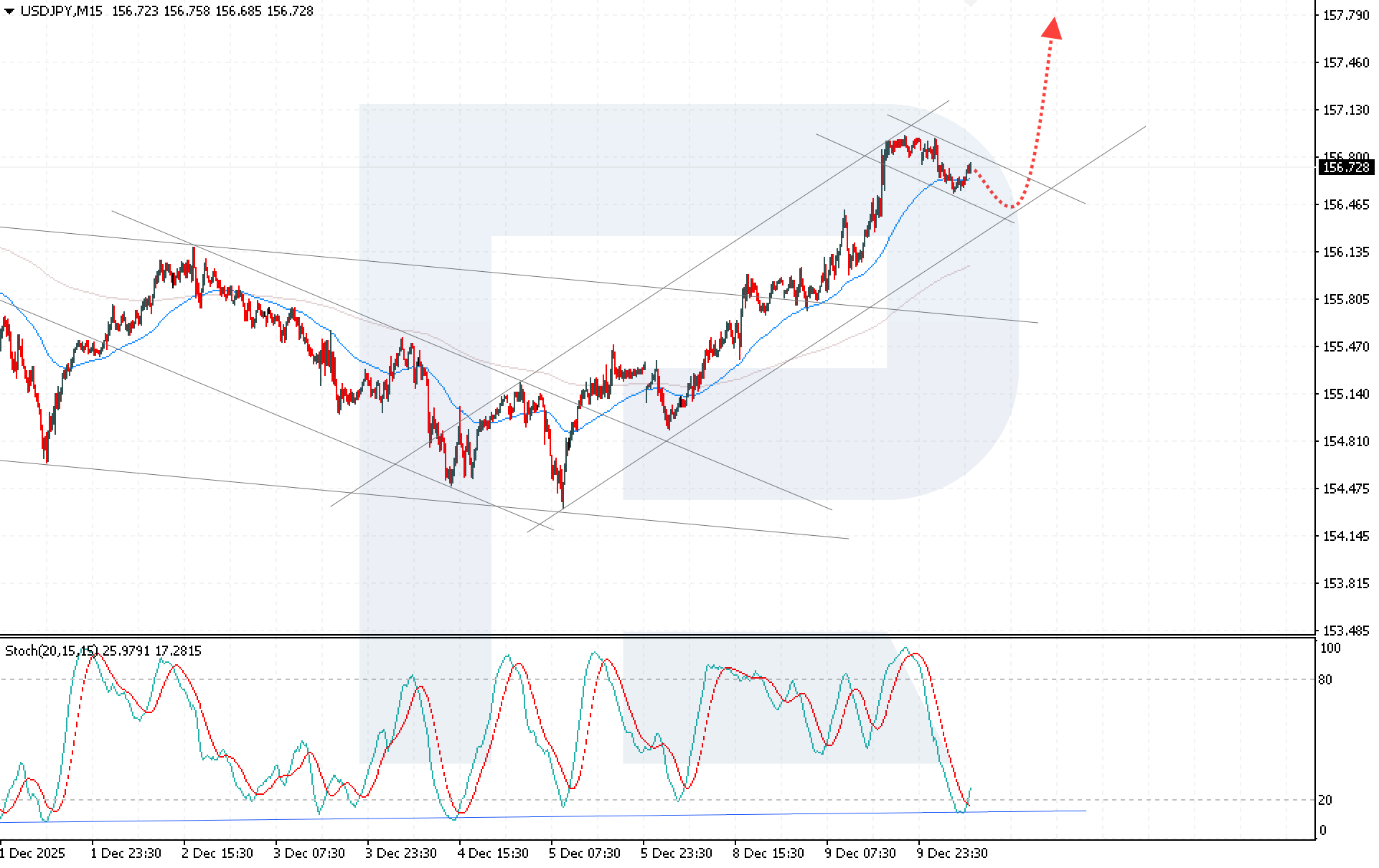

The USDJPY rate is correcting after rebounding from the 156.90 resistance level. Despite the decline, buyers are keeping the price above the EMA-65, indicating persistent upward pressure.

The USDJPY forecast for today suggests the bearish correction may end, followed by continued growth towards 157.80. The Stochastic Oscillator further supports the bullish scenario: its signal lines have reached oversold territory and turned upwards.

A consolidation above 156.90 will confirm full-fledged bullish momentum and indicate that the price is exiting the corrective channel.

Summary

The weakening of the Japanese economy, coupled with supportive US data, creates conditions for sustained bullish momentum. The USDJPY technical analysis confirms the potential for renewed growth towards 157.80 if the price breaks above 156.90.

Editors’ picks

EURUSD 2026-2027 forecast: key market trends and future predictions

EURUSD 2026-2027 forecast: key market trends and future predictionsThis article provides the EURUSD forecast for 2026 and 2027 and highlights the main factors determining the direction of the pair’s movements. We will apply technical analysis, take into account the opinions of leading experts, large banks, and financial institutions, and study AI-based forecasts. This comprehensive insight into EURUSD predictions should help investors and traders make informed decisions.

Gold (XAUUSD) forecast 2026 and beyond: expert insights, price predictions, and analysis

Gold (XAUUSD) forecast 2026 and beyond: expert insights, price predictions, and analysisDive deep into the Gold (XAUUSD) price outlook for 2026 and beyond, combining technical analysis, expert forecasts, and key macroeconomic factors. It explains the drivers behind gold’s recent surge, explores potential scenarios including a move toward 4,500 to 5,000 USD per ounce, and highlights why the metal remains a strong hedge during global uncertainty.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.