USDJPY: the pair falls below 156.00 after the Fed decision

USDJPY is declining, sliding below 156.00 following the Fed’s rate cut. Details — in our analysis for 11 December 2025.

USDJPY forecast: key trading points

- Market focus: The Fed, as expected, cut the rate by 25 basis points

- Current trend: a downward correction is underway

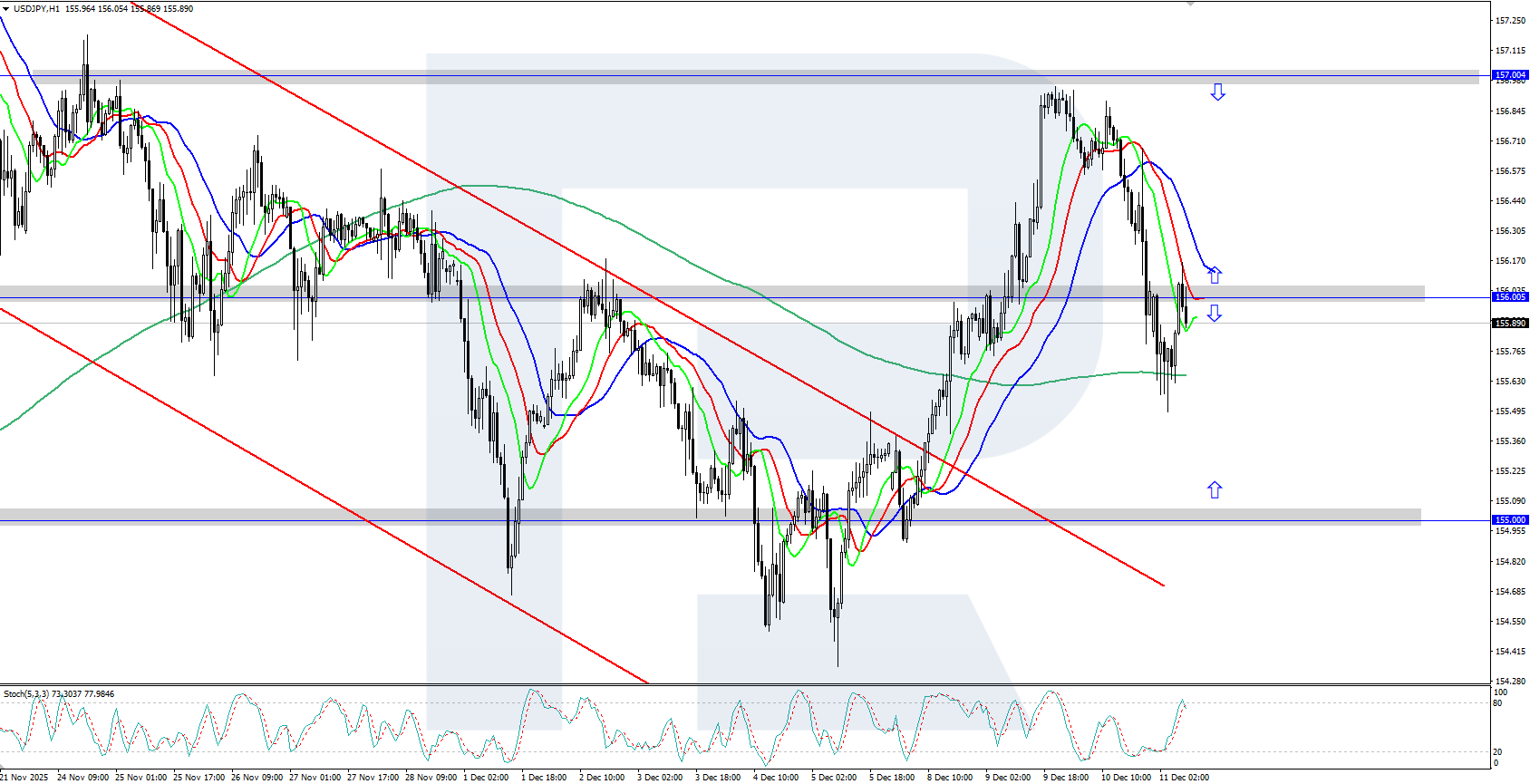

- USDJPY forecast for 11 December 2025: 155.00 or 157.00

Fundamental analysis

USDJPY is moving lower as the US dollar weakens after the Federal Reserve delivered its third rate cut of the year. Chair Jerome Powell reaffirmed confidence in the trajectory of the US economy, although the Fed projects only one rate cut next year, while markets expect two.

Investors are also awaiting next week’s Bank of Japan meeting, where markets anticipate a rate hike. BoJ Governor Kazuo Ueda recently stated that Japan is approaching its inflation target. Markets will focus on Ueda’s commentary following the meeting, which will guide expectations for 2026.

USDJPY technical analysis

USDJPY continues to decline within the current downward correction. The Alligator indicator has turned lower, confirming the prevailing bearish momentum. The immediate support level is located at 155.00.

Today’s USDJPY forecast suggests the pair may continue falling toward support at 155.00 if sellers maintain control. A move higher would require buyers to push the price back above 155.00, which could pave the way for a recovery toward 156.00.

Summary

USDJPY has dropped below 156.00 as the pair extends its corrective decline, supported by the latest Fed rate cut.

Editors’ picks

EURUSD 2026-2027 forecast: key market trends and future predictions

EURUSD 2026-2027 forecast: key market trends and future predictionsThis article provides the EURUSD forecast for 2026 and 2027 and highlights the main factors determining the direction of the pair’s movements. We will apply technical analysis, take into account the opinions of leading experts, large banks, and financial institutions, and study AI-based forecasts. This comprehensive insight into EURUSD predictions should help investors and traders make informed decisions.

Gold (XAUUSD) forecast 2026 and beyond: expert insights, price predictions, and analysis

Gold (XAUUSD) forecast 2026 and beyond: expert insights, price predictions, and analysisDive deep into the Gold (XAUUSD) price outlook for 2026 and beyond, combining technical analysis, expert forecasts, and key macroeconomic factors. It explains the drivers behind gold’s recent surge, explores potential scenarios including a move toward 4,500 to 5,000 USD per ounce, and highlights why the metal remains a strong hedge during global uncertainty.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.