USDJPY: the pair has risen above 155.00

USDJPY is showing an upward correction, rising above the 155.00 level after mixed US employment data. Details — in our analysis for 17 December 2025.

USDJPY forecast: key trading points

- Market focus: US unemployment rate rose to 4.6%, the highest level since 2021

- Current trend: an upward correction is underway

- USDJPY forecast for 17 December 2025: 156.00 or 154.35

Fundamental analysis

US labor market data for November showed that the unemployment rate increased to 4.6%, the highest level since 2021, although job growth slightly exceeded expectations. Markets currently estimate the probability that the Federal Reserve will keep interest rates unchanged at its January meeting at around 75%.

Investors are preparing for the Bank of Japan meeting scheduled for this week. The central bank is expected to raise its interest rate by 25 basis points to 0.75% on Friday. Market attention will be focused on comments from Governor Kazuo Ueda after the meeting, as they may provide guidance on the regulator’s monetary policy outlook for the coming year.

USDJPY technical analysis

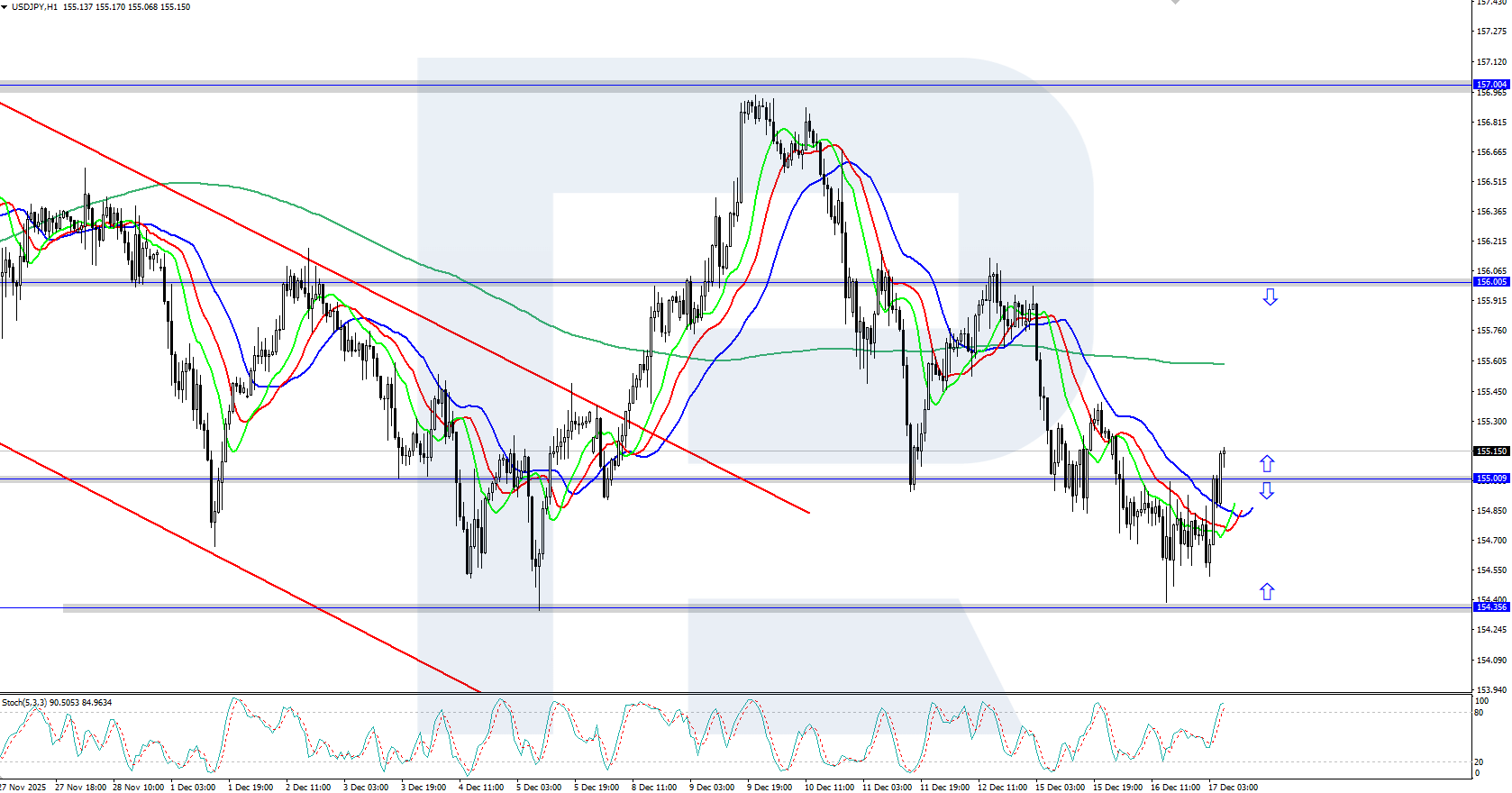

On the H1 chart, USDJPY is showing moderate growth, having consolidated above the 155.00 level. The Alligator indicator is moving upward, confirming the current upward correction. Further growth toward the local resistance level at 156.00 remains possible.

Today’s USDJPY forecast suggests that the pair may continue to rise if bulls manage to hold above the 155.00 level. A decline in quotes would become likely if bears regain control and confidently consolidate below 155.00, in which case a correction toward support at 154.35 may follow.

Summary

USDJPY prices are showing an upward correction, having consolidated above the 155.00 level. The market is now awaiting the Bank of Japan’s interest rate decision at Friday’s meeting.

Editors’ picks

EURUSD 2026-2027 forecast: key market trends and future predictions

EURUSD 2026-2027 forecast: key market trends and future predictionsThis article provides the EURUSD forecast for 2026 and 2027 and highlights the main factors determining the direction of the pair’s movements. We will apply technical analysis, take into account the opinions of leading experts, large banks, and financial institutions, and study AI-based forecasts. This comprehensive insight into EURUSD predictions should help investors and traders make informed decisions.

Gold (XAUUSD) forecast 2026 and beyond: expert insights, price predictions, and analysis

Gold (XAUUSD) forecast 2026 and beyond: expert insights, price predictions, and analysisDive deep into the Gold (XAUUSD) price outlook for 2026 and beyond, combining technical analysis, expert forecasts, and key macroeconomic factors. It explains the drivers behind gold’s recent surge, explores potential scenarios including a move toward 4,500 to 5,000 USD per ounce, and highlights why the metal remains a strong hedge during global uncertainty.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.