USDJPY gains support amid lack of clear guidance from the BoJ

The USDJPY rate is rising amid a technical breakout and increasing fundamental pressure on the Japanese yen. The current quote is 158.12. Find more details in our analysis for 12 January 2026.

USDJPY forecast: key takeaways

- The market reacted negatively to the risk of snap elections in Japan, reducing demand for the yen

- Contradictory macroeconomic data from Japan increased uncertainty regarding the BoJ’s future policy

- USDJPY forecast for 12 January 2026: 159.20

Fundamental analysis

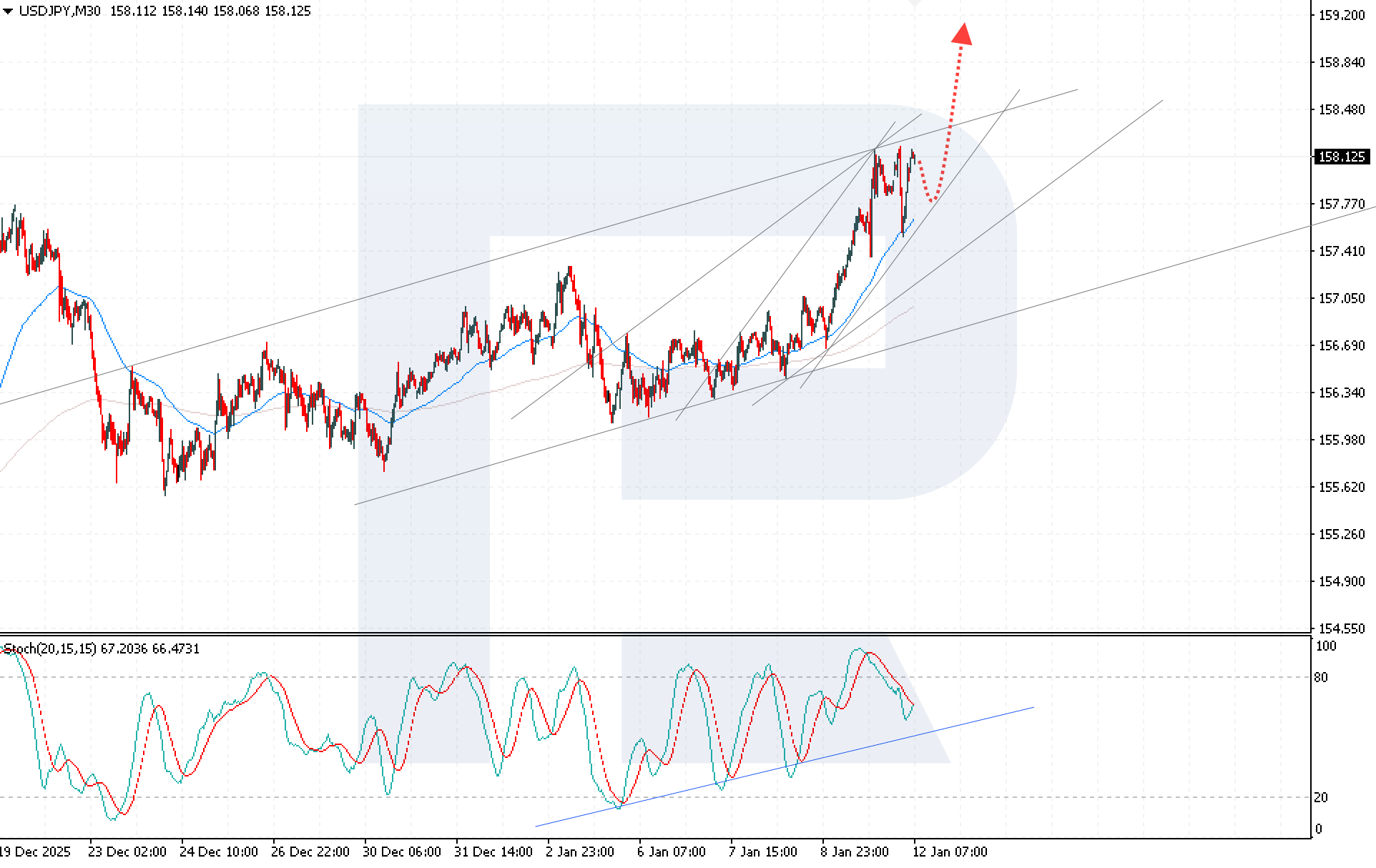

The USDJPY rate continues to move higher after breaking above the key resistance level at 157.75. Buyers are attempting for the third time to gain a foothold above this level, reinforcing the short-term bullish sentiment for the pair.

The yen remains under pressure amid rising political uncertainty. A coalition partner of Prime Minister Sanae Takaichi allowed for the possibility of snap elections as early as February, which increased nervousness in the domestic market and weakened demand for the Japanese currency.

Additional pressure on the yen comes from contradictory macroeconomic data, which directly affects expectations regarding the Bank of Japan’s monetary policy. Last week, BoJ Governor Kazuo Ueda reiterated that the regulator will continue to raise interest rates provided that economic and inflation trends align with the baseline forecast. These statements highlight the cautious yet flexible approach of the Bank of Japan, which still does not provide the market with clear signals regarding the pace of policy tightening.

USDJPY technical analysis

USDJPY quotes are testing the upper boundary of the bullish channel, which may slow upward momentum. However, buyers are keeping prices above the EMA-65, indicating sustained buying pressure. The USDJPY forecast for today suggests a continued rise towards the 159.20 level.

An additional signal in favour of further growth comes from the Stochastic Oscillator analysis: the signal lines are turning upwards after rebounding from the overbought area and are approaching the ascending support line, which often precedes a renewed increase in buying activity.

A sustained consolidation of USDJPY quotes above the 158.65 level will confirm the development of the bullish impulse.

Summary

Political uncertainty in Japan and the lack of clear signals from the BoJ regarding the pace of policy tightening continue to pressure the yen. Technical analysis of USDJPY suggests a continued bullish scenario with the potential for further growth towards the 159.20 level.

Editors’ picks

EURUSD 2026-2027 forecast: key market trends and future predictions

EURUSD 2026-2027 forecast: key market trends and future predictionsThis article provides the EURUSD forecast for 2026 and 2027 and highlights the main factors determining the direction of the pair’s movements. We will apply technical analysis, take into account the opinions of leading experts, large banks, and financial institutions, and study AI-based forecasts. This comprehensive insight into EURUSD predictions should help investors and traders make informed decisions.

Gold (XAUUSD) forecast 2026 and beyond: expert insights, price predictions, and analysis

Gold (XAUUSD) forecast 2026 and beyond: expert insights, price predictions, and analysisDive deep into the Gold (XAUUSD) price outlook for 2026 and beyond, combining technical analysis, expert forecasts, and key macroeconomic factors. It explains the drivers behind gold’s recent surge, explores potential scenarios including a move toward 4,500 to 5,000 USD per ounce, and highlights why the metal remains a strong hedge during global uncertainty.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.