USDJPY surges, reaching a new yearly high

The USDJPY rate is showing strong upward momentum, rising to the 159.00 area amid political instability in Japan. Find out more in our analysis for 13 January 2026.

USDJPY forecast: key takeaways

- Market focus: Japan’s service sector index decreased to 48.6 in December 2025 from 48.7 a month earlier

- Current trend: trending upwards

- USDJPY forecast for 13 January 2026: 160.00 or 157.75

Fundamental analysis

The Japanese yen fell to around 159 per dollar, reaching its weakest levels since 2024 amid rising political uncertainty fuelled by speculation that Prime Minister Sanae Takaichi may dissolve parliament as early as next month.

Takaichi is expected to leverage her strong public support to push through expansionary fiscal policy. Finance Minister Satsuki Katayama stated that she and US Treasury Secretary Scott Bessent shared concerns over the ‘one-sided depreciation’ of the yen following a bilateral meeting held on the sidelines of a multilateral gathering of finance ministers earlier this week.

Markets remain divided over the timing of the Bank of Japan’s next interest rate hike. Recent economic data continues to present a mixed picture.

USDJPY technical analysis

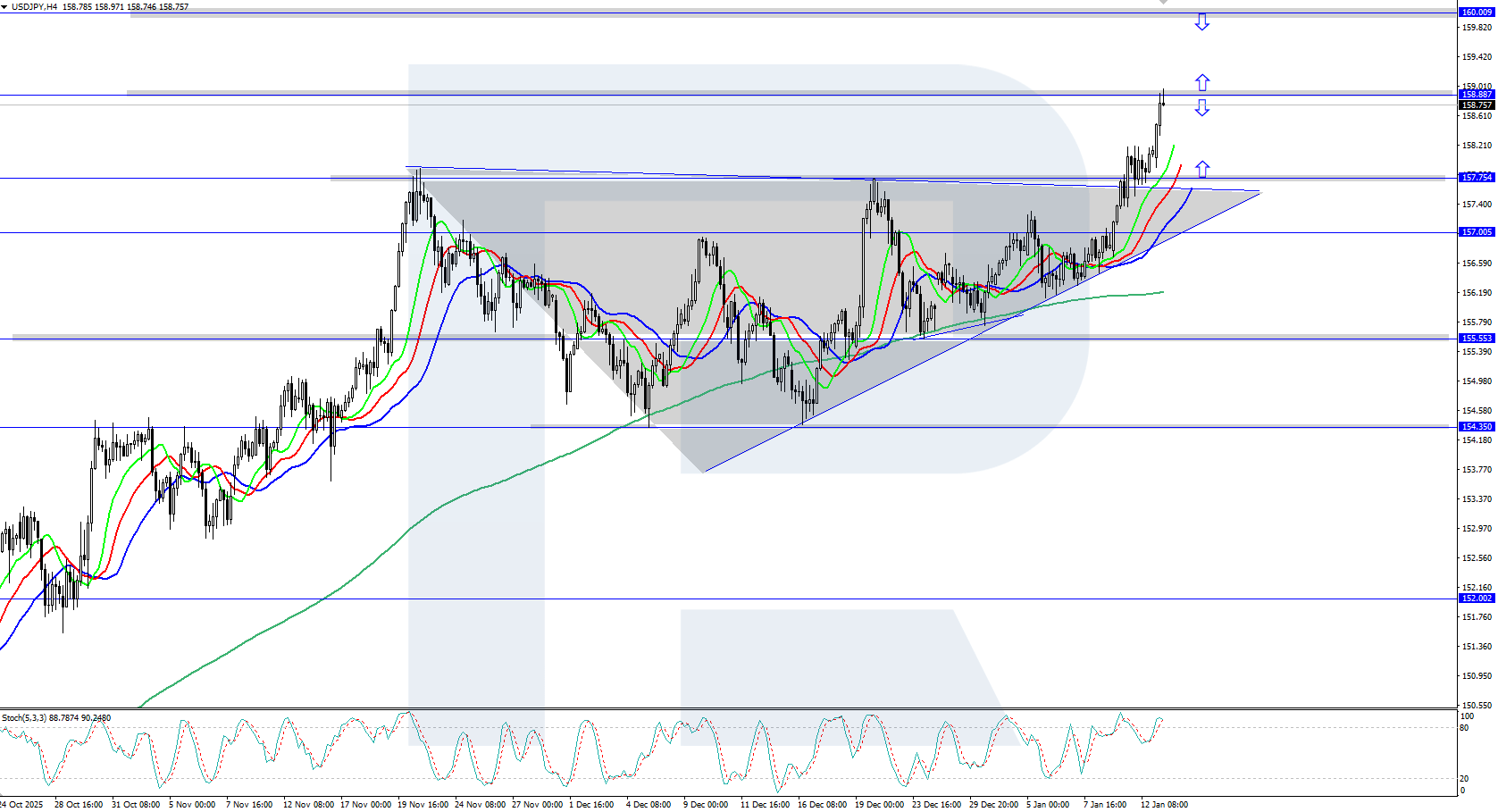

The USDJPY pair is rising sharply on the H4 chart, hitting a new 18-month high of 158.88. The Alligator indicator is moving upwards, confirming the current bullish trend. A Triangle trend continuation pattern has formed on the chart. Further upside is possible after a minor correction.

The USDJPY forecast for today suggests that the pair may continue its upward trajectory towards 160.00 if bulls hold above 158.88. A downside scenario would become relevant if bears regain control and reverse the price lower, which could lead to a correction towards the 157.75 support level.

Summary

The USDJPY pair is showing a sharp rally, rising to the 159.00 area, with the yen remaining under pressure from political instability in Japan.

Editors’ picks

EURUSD 2026-2027 forecast: key market trends and future predictions

EURUSD 2026-2027 forecast: key market trends and future predictionsThis article provides the EURUSD forecast for 2026 and 2027 and highlights the main factors determining the direction of the pair’s movements. We will apply technical analysis, take into account the opinions of leading experts, large banks, and financial institutions, and study AI-based forecasts. This comprehensive insight into EURUSD predictions should help investors and traders make informed decisions.

Gold (XAUUSD) forecast 2026 and beyond: expert insights, price predictions, and analysis

Gold (XAUUSD) forecast 2026 and beyond: expert insights, price predictions, and analysisDive deep into the Gold (XAUUSD) price outlook for 2026 and beyond, combining technical analysis, expert forecasts, and key macroeconomic factors. It explains the drivers behind gold’s recent surge, explores potential scenarios including a move toward 4,500 to 5,000 USD per ounce, and highlights why the metal remains a strong hedge during global uncertainty.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.