USDJPY remains in rally mode: next target is the July 2024 highs

The USDJPY pair climbed to 159.12. The market is uncertain about the potential outcome of snap elections. Find out more in our analysis for 14 January 2026.

USDJPY forecast: key takeaways

- Expectations of early elections in Japan weigh on the yen

- The Bank of Japan has limited room to raise interest rates

- USDJPY forecast for 14 January 2026: 160.00

Fundamental analysis

The USDJPY rate surged to 159.12 on Wednesday, reaching its highest level since July 2024 and moving closer to the psychologically important 160.00 mark. Previously, this level had already triggered currency interventions by the authorities.

The weakening of the yen is linked to expectations of possible snap elections. Prime Minister Sanae Takaichi may announce an early vote in February to strengthen the government’s position and advance an expansionary fiscal policy. In particular, elections to the lower house of parliament may take place on 8 February.

From a macroeconomic perspective, mixed signals are adding to pressure. A private survey indicated a slowdown in industrial production amid trade tensions, while the service sector is facing disruptions related to tourist demand. This limits the Bank of Japan’s ability to raise interest rates further.

Earlier this week, Japan’s Finance Minister Satsuki Katayama said that she and US Treasury Secretary Scott Bessent are concerned about the one-sided weakening of the yen. The market did not react to the comments, but they nevertheless added to overall tension.

The USDJPY forecast is favourable.

USDJPY technical analysis

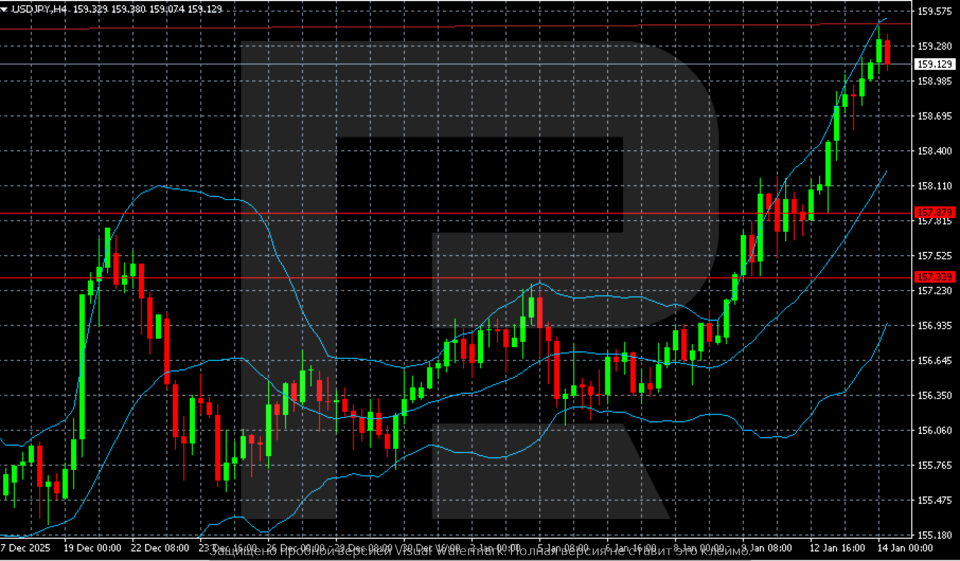

On the H4 chart, the USDJPY pair maintains a pronounced uptrend. After accelerating and consolidating above the 158.00–158.20 zone, the pair continued to rise towards the 159.00–159.50 area, reaching new highs last seen in the summer of 2024.

The move is impulsive. Recent candlesticks are forming with long bodies and minimal pullbacks, indicating buyer dominance.

The rally developed after a prolonged consolidation within the 156.00–157.50 range, from which the price broke upwards in early January. Bollinger Bands are expanding, confirming increased volatility. At the same time, the price is moving along the upper boundary of the channel – a typical sign of a strong trending phase. The middle line of the indicator remains well below current quotes, indicating that the bullish structure is intact.

At the same time, approaching the psychologically significant 160.00 area increases the risk of a short-term correction or a slowdown in growth. The nearest support level is located in the 158.00–157.80 area, with a lower zone at 157.30–157.50, from where the previous impulse originated.

As long as the price remains above these levels, the upward scenario remains a priority. However, further upward movement may be accompanied by increased volatility.

Summary

The USDJPY pair continues its surge, while correction risks are also increasing. The USDJPY forecast for today, 14 January 2026, does not rule out a move towards 160.00.

Editors’ picks

EURUSD 2026-2027 forecast: key market trends and future predictions

EURUSD 2026-2027 forecast: key market trends and future predictionsThis article provides the EURUSD forecast for 2026 and 2027 and highlights the main factors determining the direction of the pair’s movements. We will apply technical analysis, take into account the opinions of leading experts, large banks, and financial institutions, and study AI-based forecasts. This comprehensive insight into EURUSD predictions should help investors and traders make informed decisions.

Gold (XAUUSD) forecast 2026 and beyond: expert insights, price predictions, and analysis

Gold (XAUUSD) forecast 2026 and beyond: expert insights, price predictions, and analysisDive deep into the Gold (XAUUSD) price outlook for 2026 and beyond, combining technical analysis, expert forecasts, and key macroeconomic factors. It explains the drivers behind gold’s recent surge, explores potential scenarios including a move toward 4,500 to 5,000 USD per ounce, and highlights why the metal remains a strong hedge during global uncertainty.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.