USDJPY factors in expectations of the BoJ keeping rates unchanged

The USDJPY rate continues its confident upward movement amid yen weakness and expectations that the Bank of Japan will maintain a dovish stance, with prices currently at 158.67. Discover more in our analysis for 22 January 2026.

USDJPY forecast: key takeaways

- The market expects the Bank of Japan to keep the interest rate at 0.75% after the December hike

- The lack of signals of further policy tightening reduces the attractiveness of the Japanese yen

- Risks of currency interventions by Japanese authorities restrain trader activity

- USDJPY forecast for 22 January 2026: 160.45

Fundamental analysis

The USDJPY rate is rising for the fourth consecutive trading session, with buyers preparing to test the key resistance level at 159.05. The Japanese yen remains under pressure due to Japan’s deteriorating fiscal outlook. Additional uncertainty comes from the start of the BoJ monetary policy meeting.

The market is almost certain that the Bank of Japan will hold the interest rate steady at 0.75% on Friday after raising it in December. The lack of new tightening steps continues to reduce the attractiveness of the yen.

Japan’s exports increased for the fourth consecutive month in December and reached a record level. Sustained demand from China supported external trade despite ongoing diplomatic tensions between the countries.

At the same time, traders remain cautious. Market participants factor in the risk of currency interventions, as further yen weakness increases domestic inflationary pressure and may trigger a response from the authorities.

Technical outlook

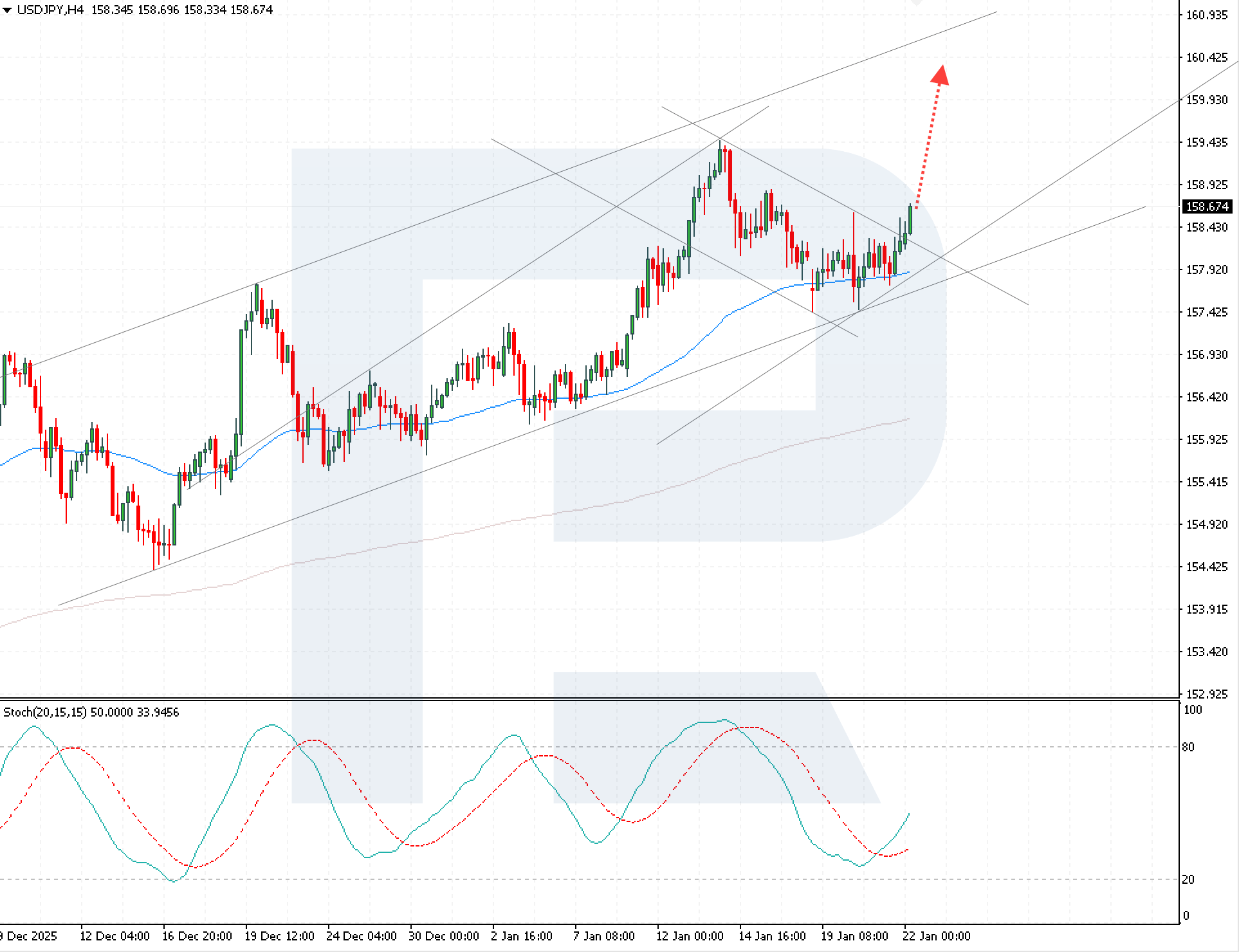

USDJPY quotes continue to rise after breaking out of the downward corrective channel. Buyers breached the upper boundary of the Double Bottom reversal pattern, strengthening the bullish momentum.

The USDJPY forecast for today suggests a continued advance towards the 160.45 level. The current technical picture indicates that buyers continue to hold the upper hand. Prices are hovering above the EMA-65, confirming the medium-term uptrend. The signal lines of the Stochastic Oscillator formed a bullish crossover, increasing the probability of further growth.

A key confirmation of the continued bullish scenario will be consolidation above the 158.95 level. Such a signal will indicate an acceleration of the bullish momentum and increase the likelihood of reaching the target resistance level.

USDJPY overview

- Asset: USDJPY

- Timeframe: H4 (Intraday)

- Trend: bullish

- Key resistance levels: 158.95 and 159.45

- Key support levels: 158.15 and 157.35

USDJPY trading scenarios for today

Main scenario (Buy Stop)

Consolidation above 158.95 will confirm a breakout of the key resistance level and form conditions for long signals as the bullish momentum accelerates. The breakout above the upper boundary of the Double Bottom reversal pattern strengthens the upward structure and increases the probability of continued growth towards 160.45.

The risk-to-reward ratio is 1:3, which makes the scenario attractive under controlled risk. Potential profit upon reaching the take-profit level amounts to 150 pips, while possible losses are capped at 50 pips.

- Take Profit: 160.45

- Stop Loss: 158.45

Alternative scenario (Sell Stop)

Selling becomes relevant if the USDJPY pair returns below the 157.65 level and loses EMA-65 support. This scenario will indicate weakening bullish momentum and a corrective decline after an unsuccessful attempt to consolidate above 158.95.

- Take Profit: 156.35

- Stop Loss: 158.45

Risk factors

The main risk factors for further USDJPY growth today remain the probability of currency interventions by Japanese authorities and rising inflationary pressure due to the weakening yen. A change in the BoJ’s rhetoric, if it signals readiness for a tighter monetary policy, could further restrain the bullish momentum.

Summary

The current USDJPY dynamics remain upward; however, growth may slow near the 159.05 level due to expectations surrounding Bank of Japan decisions and persistent risks of currency interventions. USDJPY technical analysis indicates continued bullish momentum and a high probability of further growth towards the 160.45 level, provided quotes consolidate above 158.95.

Editors’ picks

EURUSD 2026-2027 forecast: key market trends and future predictions

EURUSD 2026-2027 forecast: key market trends and future predictionsThis article provides the EURUSD forecast for 2026 and 2027 and highlights the main factors determining the direction of the pair’s movements. We will apply technical analysis, take into account the opinions of leading experts, large banks, and financial institutions, and study AI-based forecasts. This comprehensive insight into EURUSD predictions should help investors and traders make informed decisions.

Gold (XAUUSD) forecast 2026 and beyond: expert insights, price predictions, and analysis

Gold (XAUUSD) forecast 2026 and beyond: expert insights, price predictions, and analysisDive deep into the Gold (XAUUSD) price outlook for 2026 and beyond, combining technical analysis, expert forecasts, and key macroeconomic factors. It explains the drivers behind gold’s recent surge, explores potential scenarios including a move toward 4,500 to 5,000 USD per ounce, and highlights why the metal remains a strong hedge during global uncertainty.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.