USDJPY strengthens amid widening US–Japan rate gap and fragile fiscal outlook in Japan

The USDJPY pair continues to move higher, supported by persistent weakness in the Japanese yen and market confidence that the Bank of Japan will stick to its accommodative policy stance. The pair is currently trading near 158.67.

USDJPY forecast: key takeaways

- The Bank of Japan is widely expected to keep the key interest rate unchanged at 0.75% after December’s hike

- The absence of clear signals on further tightening undermines the yen’s appeal

- Concerns over possible FX interventions by Japanese authorities limit aggressive buying

- USDJPY forecast for 23 January 2026: 160.45

Fundamental analysis

USDJPY is posting steady gains for the fourth consecutive trading session, reflecting the continued advantage of the US dollar against a weak Japanese yen. Buyers are gradually pushing the market towards a test of the key resistance level at 159.05, which serves as an important technical and psychological level for the current upward momentum.

Pressure on the yen persists due to the deterioration of Japan’s fiscal outlook. A widening budget deficit and rising debt servicing costs create additional risks for the national currency, reducing investor interest in yen-denominated assets. The start of the Bank of Japan’s monetary policy meeting, with results due on Friday, further heightens uncertainty.

The market has almost fully priced in the expectation that the BoJ will keep the interest rate unchanged at 0.75% following the December hike. The lack of signals regarding further policy tightening supports the interest rate differential between the US and Japan, continuing to favour the dollar and pressure the yen. Investors expect cautious rhetoric rather than active steps from the regulator, which reduces the likelihood of a short-term trend reversal.

Japan’s macroeconomic data remains mixed. Exports rose for the fourth consecutive month in December and reached record levels, supported by steady demand from China. However, positive external trade momentum has not yet translated into sustained yen strength, as political and diplomatic tensions in the region and weak domestic demand continue to limit the currency’s upside potential.

At the same time, market participants remain cautious. Further yen depreciation increases domestic inflation risks and raises the likelihood of verbal or actual currency interventions by Japanese authorities. This factor may act as a constraint on further USDJPY gains, especially near extreme levels.

Technical outlook

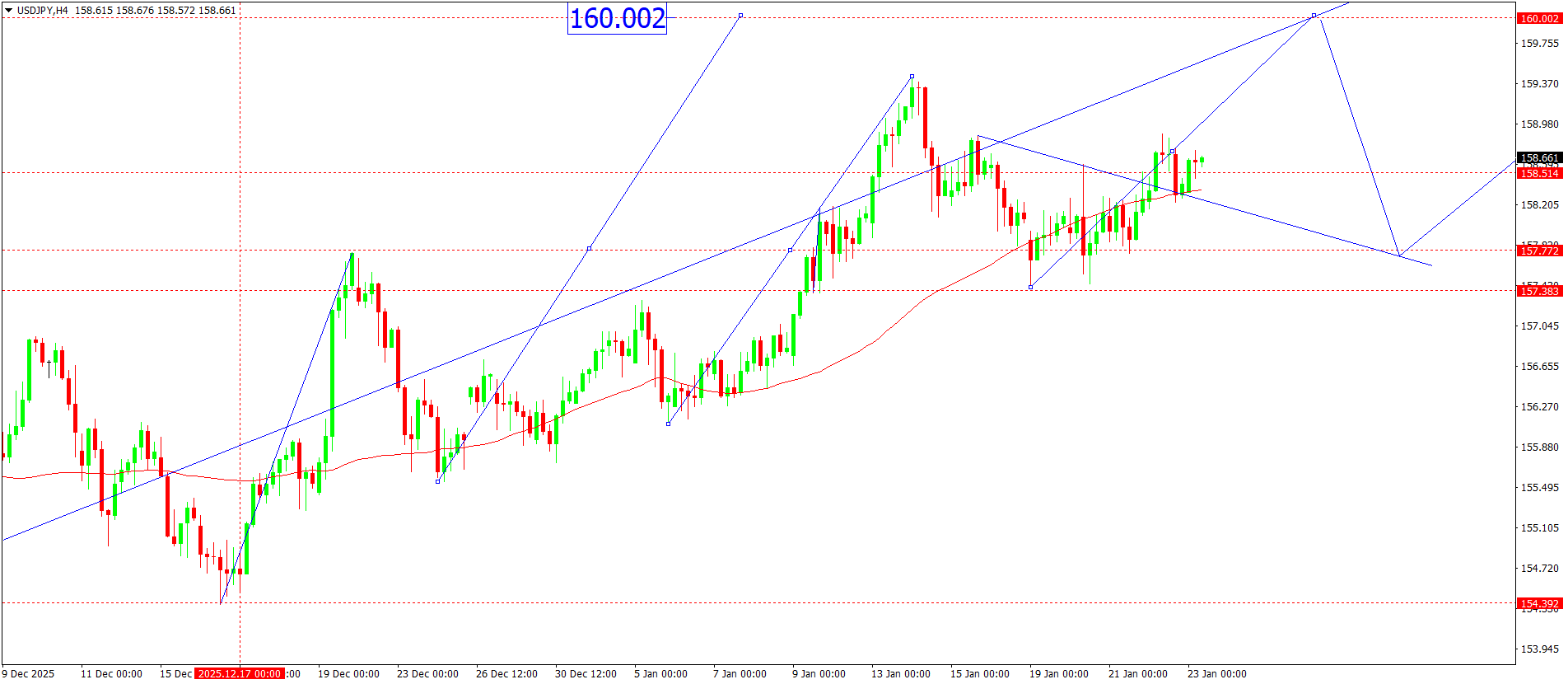

The USDJPY pair received solid support in the 158.20 area, from where the market resumed its upward movement. The baseline scenario suggests further growth towards 158.90. A confident breakout and consolidation above this resistance level would open the way for continued impulsive movement towards 160.00.

The current technical picture indicates that buyers remain in control. The price is hovering above the SMA-50, confirming the dominance of the medium-term uptrend, with no signs of a reversal. The price structure remains impulsive, increasing the probability of further growth.

The USDJPY forecast for today suggests a continued rise towards the 160.45 area. A key confirmation of the bullish scenario would be consolidation above the 158.90 level. Such a signal would point to acceleration of the bullish momentum and increase the probability of reaching the next target resistance zone.

An alternative scenario would be considered only if the price returns below 158.20, indicating a correction phase within the current wave structure.

USDJPY overview

- Asset: USDJPY

- Timeframe: H4 (Intraday)

- Trend: bullish

- Key resistance levels: 158.80 and 159.45

- Key support levels: 158.28 and 157.70

USDJPY trading scenarios for today

Main scenario (Buy Stop)

Consolidation above the 158.95 level will confirm a breakout of key resistance and create conditions for long signals as the bullish momentum accelerates. A breakout above the pattern’s upper boundary strengthens the upward structure and increases the probability of continued growth towards 160.45.

The risk-to-reward ratio is 1:3, making the scenario attractive with controlled risk. Potential profit at the take-profit level is 150 pips, while potential losses are limited to 50 pips.

- Take Profit: 160.45

- Stop Loss: 158.00

Alternative scenario (Sell Stop)

Short positions become relevant if the USDJPY pair returns below 157.65 and loses support from the SMA-50. Such a scenario would indicate weakening bullish momentum and a corrective decline after a failed attempt to consolidate above 158.95.

- Take Profit: 156.35

- Stop Loss: 158.45

Risk factors

The key risks to further USDJPY appreciation today include the possibility of currency interventions by Japanese authorities and rising inflationary pressures resulting from a weaker yen. Additionally, any shift in BoJ rhetoric towards a more restrictive policy stance could limit bullish momentum.

Summary

USDJPY maintains a bullish bias, although upward momentum may slow near the 159.05 level amid expectations surrounding the Bank of Japan’s policy decision and persistent intervention risks. Technical indicators continue to favour buyers, with a high probability of further gains towards 160.45, provided the price consolidates above the 158.95 level.

Editors’ picks

EURUSD 2026-2027 forecast: key market trends and future predictions

EURUSD 2026-2027 forecast: key market trends and future predictionsThis article provides the EURUSD forecast for 2026 and 2027 and highlights the main factors determining the direction of the pair’s movements. We will apply technical analysis, take into account the opinions of leading experts, large banks, and financial institutions, and study AI-based forecasts. This comprehensive insight into EURUSD predictions should help investors and traders make informed decisions.

Gold (XAUUSD) forecast 2026 and beyond: expert insights, price predictions, and analysis

Gold (XAUUSD) forecast 2026 and beyond: expert insights, price predictions, and analysisDive deep into the Gold (XAUUSD) price outlook for 2026 and beyond, combining technical analysis, expert forecasts, and key macroeconomic factors. It explains the drivers behind gold’s recent surge, explores potential scenarios including a move toward 4,500 to 5,000 USD per ounce, and highlights why the metal remains a strong hedge during global uncertainty.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.