USDJPY falls to monthly lows as yen finds support everywhere

The USDJPY pair dropped to 153.89, with the yen supported by expectations of interventions and US dollar weakness. Find more details in our analysis for 26 January 2026.

USDJPY forecast: key takeaways

- The USDJPY pair is falling rapidly due to the government’s stance to support the yen

- Investors do not rule out a coordinated intervention by the New York Fed and Japan

- USDJPY forecast for 26 January 2026: 153.70

Fundamental analysis

The USDJPY rate plunged to 153.89 on Monday, its lowest level in more than a month. The market is pricing in a growing risk of a coordinated currency intervention by Tokyo and Washington to support the yen.

On Sunday, Japanese Prime Minister Sanae Takaichi stated that the government is ready to take necessary measures against speculative movements, confirming the authorities’ commitment to stabilising the exchange rate. An additional impulse came from the US. The Federal Reserve Bank of New York reportedly asked dealers about USDJPY levels on Friday. The market interpreted this step as preparation for a possible coordinated intervention in the currency market.

The yen also received support amid general US dollar weakness caused by elevated geopolitical and trade risks. There are also expectations that US President Donald Trump may soon replace Fed Chair Jerome Powell with a more dovish successor. This increased pressure on the dollar.

The USDJPY forecast is moderately negative.

Technical outlook

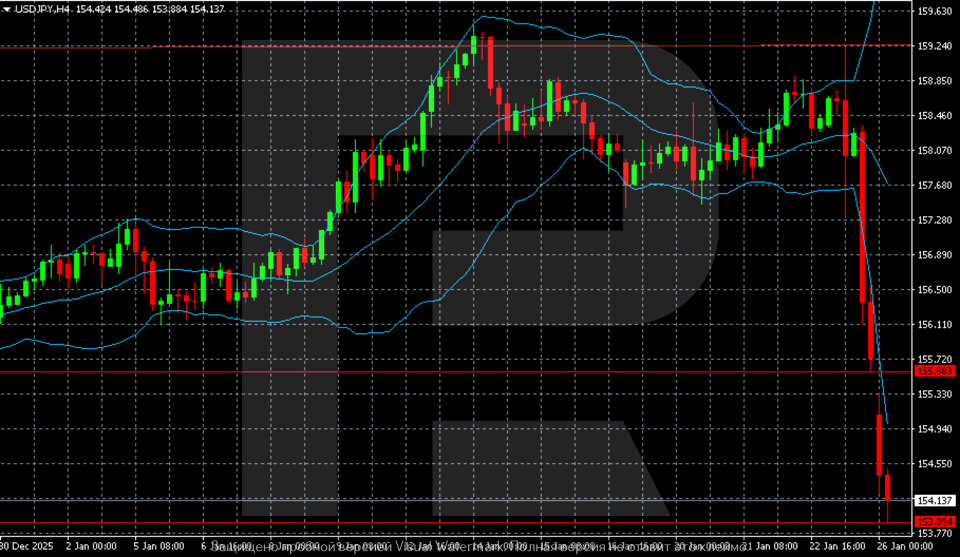

Until mid-January, the USDJPY pair moved in a stable uptrend on the H4 chart. The rise was accompanied by consistent local highs and the price remaining in the upper part of the Bollinger Bands. In the 159.20–159.60 area, growth slowed and a resistance zone formed. After that, the market shifted into sideways consolidation.

This week, a sharp structural breakdown occurred. The price reversed downwards impulsively, first breaking the middle Bollinger Band line and then the lower boundary of the range. The decline accelerated after moving below 157.50–157.30, where a key consolidation support had previously been located.

The downward move is accelerating, without pronounced corrections. Candlesticks are forming with long bodies, indicating seller dominance and forced position closures. The price moved outside the lower Bollinger Band, reflecting extreme volatility and a sell-off phase.

At present, quotes are hovering around 154.10–154.20. The nearest support zone is located in the 153.70–153.50 area, where local lows had previously formed. A break below this zone will increase the risks of further decline. Resistance has now shifted to the 155.50–155.80 range, and a return above this area will be required to stabilise the move.

USDJPY overview

- Asset: USDJPY

- Timeframe: H4 (Intraday)

- Trend: bearish

- Key resistance levels: 155.80 and 157.30

- Key support levels: 153.70 and 152.90

USDJPY trading scenarios for today

Main scenario (Sell Stop)

A breakout and consolidation below the 153.70–153.50 zone will confirm downward momentum after the breakdown of the medium-term structure. Pressure on the pair persists amid expectations of Japanese currency interventions and general US dollar weakness. A move below the support level will intensify selling and open the way for a deeper decline.

The risk-to-reward ratio is around 1:3. The potential target of the move is about 120 pips, with limited risk.

- Sell Stop: 153.60

- Take Profit: 152.40

- Stop Loss: 155.10

Alternative scenario (Buy Stop)

Stabilisation is possible if the price returns and consolidates above 155.50–155.80. This scenario would indicate profit-taking on short positions and a transition to a corrective recovery after the sharp fall.

- Buy Stop: 155.90

- Take Profit: 157.20

- Stop Loss: 154.70

Risk factors

The key risk for the short scenario remains a possible verbal or actual intervention by Japanese authorities and a sharp change in the rhetoric of US President Donald Trump regarding monetary policy. Additional volatility triggers may come from comments by Federal Reserve Chairman Jerome Powell or unexpected signals about coordination of actions between Tokyo and Washington.

Summary

The USDJPY pair is falling rapidly in response to political rhetoric and market expectations. The USDJPY forecast for today, 26 January 2026, does not rule out a return towards 153.70.

Editors’ picks

EURUSD 2026-2027 forecast: key market trends and future predictions

EURUSD 2026-2027 forecast: key market trends and future predictionsThis article provides the EURUSD forecast for 2026 and 2027 and highlights the main factors determining the direction of the pair’s movements. We will apply technical analysis, take into account the opinions of leading experts, large banks, and financial institutions, and study AI-based forecasts. This comprehensive insight into EURUSD predictions should help investors and traders make informed decisions.

Gold (XAUUSD) forecast 2026 and beyond: expert insights, price predictions, and analysis

Gold (XAUUSD) forecast 2026 and beyond: expert insights, price predictions, and analysisDive deep into the Gold (XAUUSD) price outlook for 2026 and beyond, combining technical analysis, expert forecasts, and key macroeconomic factors. It explains the drivers behind gold’s recent surge, explores potential scenarios including a move toward 4,500 to 5,000 USD per ounce, and highlights why the metal remains a strong hedge during global uncertainty.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.