USDJPY under pressure from rumours: joint intervention or a stronger dollar?

After a sharp decline, the USDJPY rate is forming a correction. Amid rumours of possible intervention, volatility is expected to remain elevated, with the price currently at 154.45. Discover more in our analysis for 27 January 2026.

USDJPY forecast: key takeaways

- Bank of Japan core CPI: projected at 2.0%, currently at 1.9%

- US CB Consumer Confidence Index: previously at 89.1, projected at 90.6

- USDJPY forecast for 27 January 2026: 153.00 and 155.40

Fundamental analysis

The forecast for 27 January 2026 appears optimistic for the USD. After a sharp drop, the USDJPY pair is trading around 154.45.

The core CPI reflects changes in the cost of goods and services from the consumer’s perspective. Today’s USDJPY outlook takes into account that Japan’s core CPI declined to 1.9%, compared with a forecast of 2.0%. A 0.1% deviation is unlikely to have a significant impact on the USDJPY rate on its own, but together with other economic data from Japan and the US, it creates room for a modest strengthening of the USD against the yen.

The US Conference Board Consumer Confidence Index reflects consumers’ confidence in current economic conditions. It is a leading indicator that helps predict consumer spending, which is a key component of economic activity. Higher readings indicate greater optimism. The forecast for 27 January 2026 suggests the index may rise to 90.6, signalling improving consumer sentiment.

The USDJPY pair remains under pressure amid speculation about a possible coordinated intervention by the US and Japan. Investors are concerned about potential actions by the BoJ and the Fed. Such intervention would be aimed at supporting the yen, while the US president has hinted at attempts to weaken the USD to improve competitiveness with Japan and China. As a result, elevated volatility in the pair is likely.

Technical outlook

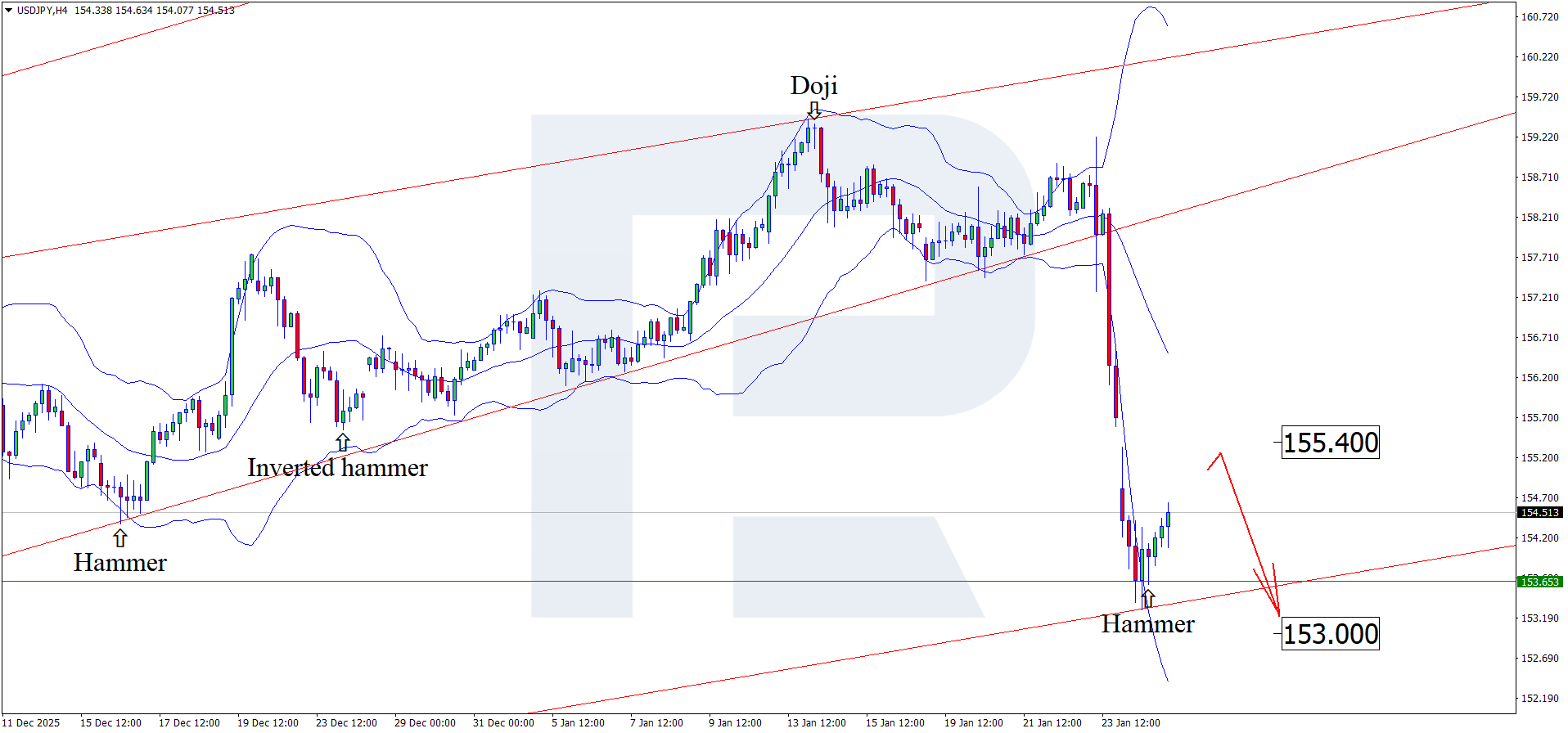

On the H4 chart, the USDJPY pair has formed a Doji reversal pattern near the lower Bollinger Band and is trading around the 153.65 area. At this stage, it may continue an upward wave as the pattern plays out, with the upside target at 155.40.

At the same time, the USDJPY outlook also considers an alternative scenario in which the price declines towards 153.00 before growth.

USDJPY overview

- Asset: USDJPY

- Timeframe: H4 (Intraday)

- Trend: bearish

- Key resistance levels: 155.80 and 157.30

- Key support levels: 153.70 and 152.90

USDJPY trading scenarios for today

Main scenario (Sell Stop)

A breakout and consolidation below the 153.70–153.50 zone will confirm continued bearish momentum after the recent rebound. Pressure on the pair persists amid expectations of Japanese currency intervention and overall weakness of the US dollar. A move below the support level would intensify selling and open the way for deeper losses.

The risk-to-reward ratio exceeds 1:2. The potential target is around 110 pips with limited risk.

- Sell Stop: 153.60

- Take Profit: 152.50

- Stop Loss: 154.00

Alternative scenario (Buy Stop)

Stabilisation is possible if the price returns and consolidates above 155.50. This scenario would indicate profit-taking on short positions and a transition to a corrective recovery after the sharp decline.

- Buy Stop: 155.60

- Take Profit: 157.20

- Stop Loss: 155.00

Risk factors

The key risk for the short scenario remains a possible verbal or actual intervention by Japanese authorities and a sharp change in the rhetoric of US President Donald Trump regarding monetary policy. Additional volatility triggers may come from comments by Federal Reserve Chairman Jerome Powell or unexpected signals about coordination of actions between Tokyo and Washington.

Summary

Amid expectations of intervention and positive US economic data, the USDJPY pair is likely to face heightened volatility. USDJPY technical analysis suggests a corrective move towards the 155.40 level before a decline.

Editors’ picks

EURUSD 2026-2027 forecast: key market trends and future predictions

EURUSD 2026-2027 forecast: key market trends and future predictionsThis article provides the EURUSD forecast for 2026 and 2027 and highlights the main factors determining the direction of the pair’s movements. We will apply technical analysis, take into account the opinions of leading experts, large banks, and financial institutions, and study AI-based forecasts. This comprehensive insight into EURUSD predictions should help investors and traders make informed decisions.

Gold (XAUUSD) forecast 2026 and beyond: expert insights, price predictions, and analysis

Gold (XAUUSD) forecast 2026 and beyond: expert insights, price predictions, and analysisDive deep into the Gold (XAUUSD) price outlook for 2026 and beyond, combining technical analysis, expert forecasts, and key macroeconomic factors. It explains the drivers behind gold’s recent surge, explores potential scenarios including a move toward 4,500 to 5,000 USD per ounce, and highlights why the metal remains a strong hedge during global uncertainty.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.