USDJPY may continue to decline amid a weakening US dollar

A combination of fundamental factors from the US and Japan continues to increase USDJPY volatility, with quotes testing the 152.90 level. Discover more in our analysis for 29 January 2026.

USDJPY forecast: key takeaways

- US Federal Reserve interest rate decision: projected at 3.75%, currently at 3.75%

- Bank of Japan monetary policy meeting minutes

- USDJPY forecast for 29 January 2026: 154.00 and 151.50

Fundamental analysis

The forecast for 29 January 2026 appears optimistic for the JPY. After a sharp decline, the USDJPY pair is completing a corrective wave and may continue to fall. Currently, quotes are trading near the 152.90 level.

The US Federal Reserve’s interest rate decision did not cause market turbulence, as the forecast was confirmed and the rate remained unchanged at 3.75%. For the USD, this became another trigger for weakening against major global currencies.

Yesterday, the Bank of Japan released its monetary policy meeting minutes.

Key takeaways from the minutes:

- If economic growth and price forecasts are maintained, BoJ representatives may proceed with an interest rate hike

- Despite pressure from US tariffs, the economy is gradually recovering

- Price pressure did not significantly affect income and employment growth

- Most BoJ representatives expected the core CPI to fall below 2.0%

- With the interest rate at 0.75%, accommodative measures will continue

Overall, economic indicators are working in favour of the yen. However, the possibility of a currency intervention in the near term should not be ruled out, as such actions are usually carried out when market participants expect them the least.

Technical outlook

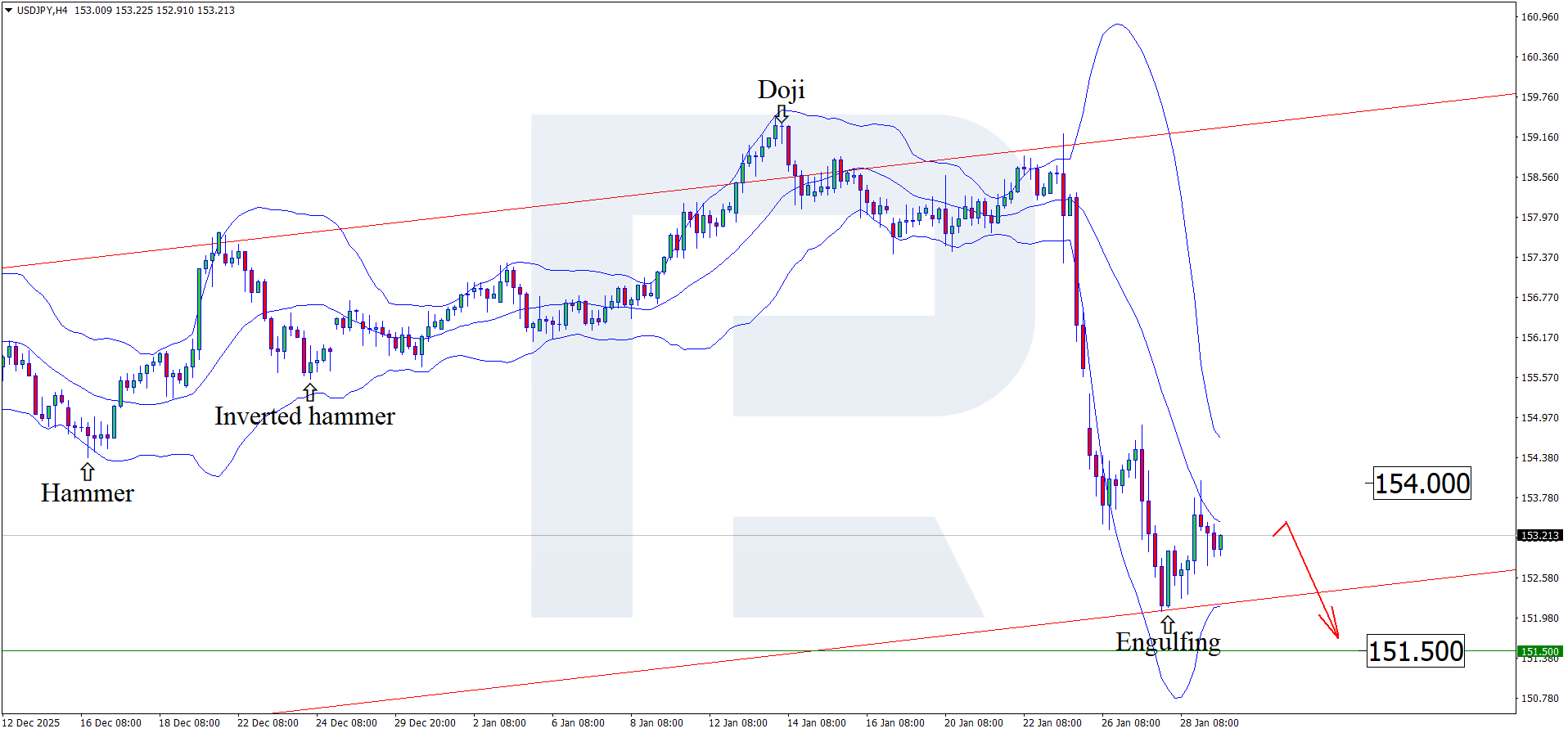

On the H4 chart, the USDJPY pair has formed an Engulfing reversal pattern near the lower Bollinger Band and is currently trading around the 153.20 level. At this stage, the price may continue an upward wave following the pattern’s signal, with the upside target at 154.00.

At the same time, the USDJPY forecast also considers an alternative scenario, with quotes falling to the 151.50 level without testing the resistance level.

USDJPY overview

- Asset: USDJPY

- Timeframe: H4 (Intraday)

- Trend: bearish

- Key resistance levels: 154.00 and 154.60

- Key support levels: 151.50 and 151.00

USDJPY trading scenarios for today

Main scenario (Sell Stop)

A consolidation below the 152.45 level will create conditions for opening short positions. This scenario would open the way towards the target level of 151.00. The risk-to-reward ratio exceeds 1:3. Potential profit upon reaching the target is 145 pips, while possible losses are limited to 45 pips.

- Take Profit: 151.00

- Stop Loss: 152.90

Alternative scenario (Buy Stop)

The bearish scenario will be cancelled if the price moves above the 154.00 resistance level and consolidates above it. This scenario would indicate a transition to a growth phase.

- Take Profit: 155.50

- Stop Loss: 153.50

Risk factors

Risks to the bearish USDJPY scenario are associated with a possible recovery of the US dollar in case expectations of a more hawkish Fed policy strengthen. An additional factor could be a reduction in intervention rhetoric and a more cautious stance by the BoJ, which would weaken support for the Japanese yen.

Summary

The yen continues to strengthen against the USD following the release of the US interest rate decision. USDJPY technical analysis suggests a correction towards the 154.00 level before a further decline.

Editors’ picks

EURUSD 2026-2027 forecast: key market trends and future predictions

EURUSD 2026-2027 forecast: key market trends and future predictionsThis article provides the EURUSD forecast for 2026 and 2027 and highlights the main factors determining the direction of the pair’s movements. We will apply technical analysis, take into account the opinions of leading experts, large banks, and financial institutions, and study AI-based forecasts. This comprehensive insight into EURUSD predictions should help investors and traders make informed decisions.

Gold (XAUUSD) forecast 2026 and beyond: expert insights, price predictions, and analysis

Gold (XAUUSD) forecast 2026 and beyond: expert insights, price predictions, and analysisDive deep into the Gold (XAUUSD) price outlook for 2026 and beyond, combining technical analysis, expert forecasts, and key macroeconomic factors. It explains the drivers behind gold’s recent surge, explores potential scenarios including a move toward 4,500 to 5,000 USD per ounce, and highlights why the metal remains a strong hedge during global uncertainty.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.