USDJPY in correction after a two-day rally

The USDJPY pair is undergoing a correction after a rise driven by strong US macroeconomic data and political signals from Japan, with the rate currently at 155.39. Find out more in our analysis for 3 February 2026.

USDJPY forecast: key takeaways

- The US manufacturing sector moved into expansion in January

- The ISM manufacturing PMI rose to 52.6 points from 47.9 a month earlier

- US industry has returned to expansion territory above 50 points for the first time in nearly a year

- USDJPY forecast for 3 February 2026: 152.80

Fundamental analysis

The USDJPY rate has entered a correction phase after rising for two consecutive trading sessions. Buyers met resistance near the 156.60 level, triggering short-term profit-taking.

The yen continued to weaken following comments from Japanese Prime Minister Sanae Takaichi, who over the weekend described a weak yen as a potential competitive advantage for export-oriented industries. The market interpreted these remarks as a signal of political support for a softer currency, increasing pressure on the JPY.

Fundamental support for the USD came from US data. The manufacturing sector unexpectedly entered a growth phase in January, showing the strongest expansion pace since 2022. The PMI rose to 52.6 points from 47.9 a month earlier. The figure not only comfortably exceeded the forecast of 48.5 points but also returned to expansion territory above 50 points for the first time in nearly a year. Growth in new orders and increased output confirmed a recovery in the industrial cycle and the resilience of the US corporate sector.

Technical outlook

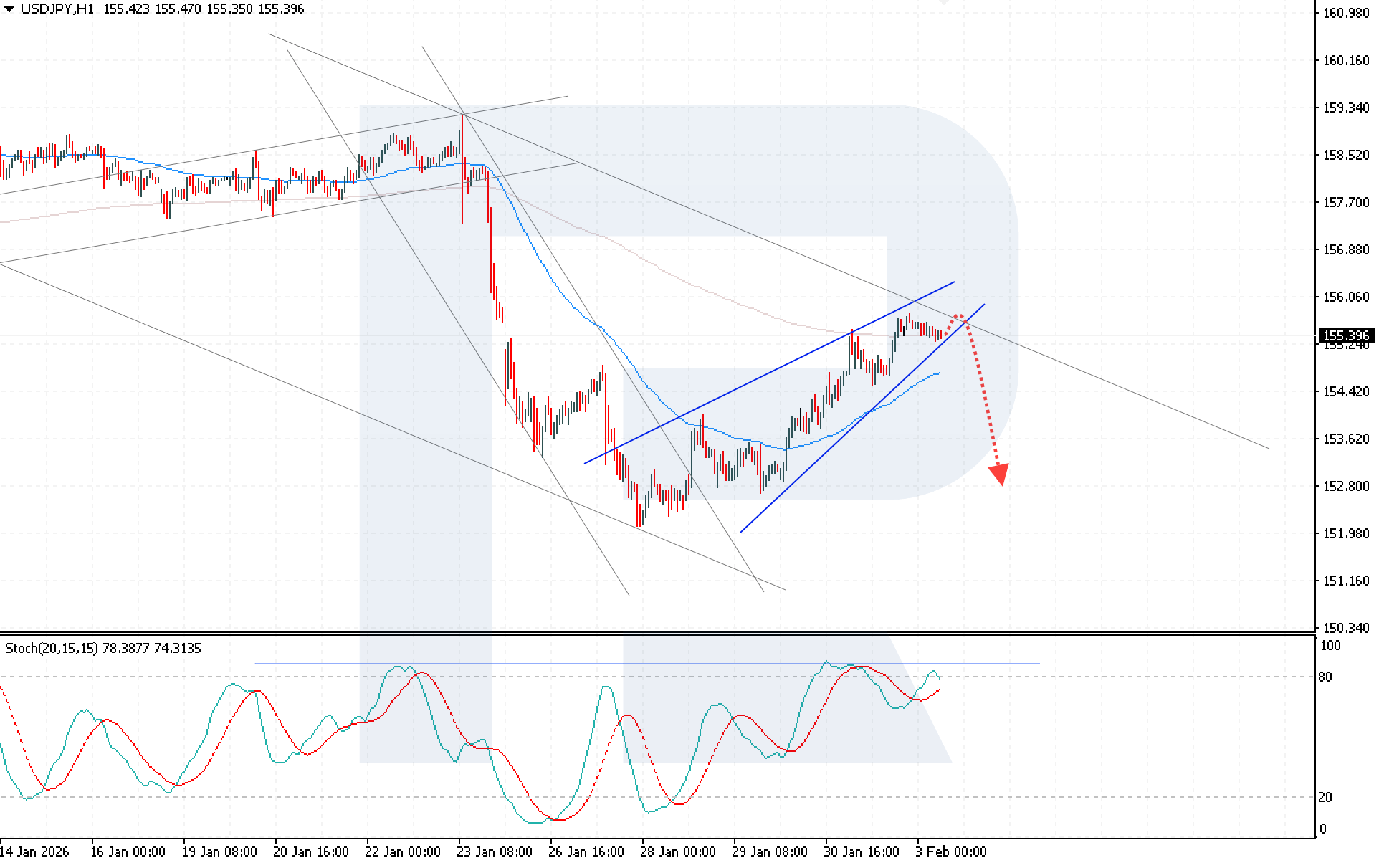

The USDJPY pair continues to rise as part of a Wedge reversal pattern. However, despite holding above moving averages, sellers remain active. The price structure indicates weakening bullish momentum and increases the risk of a downside correction.

The USDJPY forecast for today suggests a decline towards the 152.80 level. The Stochastic Oscillator further confirms the bearish scenario. Its signal lines are testing overbought territory and preparing to form a new bearish crossover, which would increase selling pressure.

The key technical condition for this scenario is a consolidation below 155.15. This signal would confirm a breakout below the lower boundary of the Wedge pattern and significantly increase the probability of reaching the 152.80 target.

USDJPY overview

- Asset: USDJPY

- Timeframe: H1 (Intraday)

- Trend: bearish

- Key resistance levels: 156.60 and 157.70

- Key support levels: 154.45 and 153.60

USDJPY trading scenarios for today

Main scenario (Sell Stop)

If prices stay below 155.15, it will mean the lower boundary of the Wedge reversal pattern has been broken, and the pattern will start to play out, with the first target at 152.80. The risk-to-reward ratio is 1:7. Potential profit upon reaching the take-profit level is 235 pips, while possible losses are capped at 30 pips.

- Take Profit: 152.80

- Stop Loss: 155.45

Alternative scenario (Buy Stop)

The bearish scenario will be invalidated if prices break and consolidate above the upper boundary of the Wedge pattern. In this case, selling pressure will weaken significantly.

- Take Profit: 157.70

- Stop Loss: 155.25

Risk factors

Strong US macroeconomic data, including the rise in the ISM manufacturing PMI index to 52.6 points and the return of the industrial sector to expansion territory, provide fundamental support for the USDJPY pair and may invalidate the bearish scenario.

Summary

A combination of political signals from Japan favouring a weaker yen and strong US macroeconomic data provides medium-term fundamental support for USDJPY, while the 156.60 area remains a key technical resistance. A consolidation below 155.15 will confirm a breakout below the lower boundary of the reversal pattern and form a signal for the USDJPY pair to decline towards 152.80.

Editors’ picks

EURUSD 2026-2027 forecast: key market trends and future predictions

EURUSD 2026-2027 forecast: key market trends and future predictionsThis article provides the EURUSD forecast for 2026 and 2027 and highlights the main factors determining the direction of the pair’s movements. We will apply technical analysis, take into account the opinions of leading experts, large banks, and financial institutions, and study AI-based forecasts. This comprehensive insight into EURUSD predictions should help investors and traders make informed decisions.

Gold (XAUUSD) forecast 2026 and beyond: expert insights, price predictions, and analysis

Gold (XAUUSD) forecast 2026 and beyond: expert insights, price predictions, and analysisDive deep into the Gold (XAUUSD) price outlook for 2026 and beyond, combining technical analysis, expert forecasts, and key macroeconomic factors. It explains the drivers behind gold’s recent surge, explores potential scenarios including a move toward 4,500 to 5,000 USD per ounce, and highlights why the metal remains a strong hedge during global uncertainty.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.