The dollar strengthens: what will be the trigger for USDJPY growth

US statistics may trigger a strengthening of the USD, with USDJPY testing the 156.40 level. Discover more in our analysis for 4 February 2026.

USDJPY forecast: key takeaways

- US job openings (JOLTS): previously at 7.146 million, projected at 7.230 million

- US ISM non-manufacturing PMI: previously at 54.4, projected at 53.5

- USDJPY forecast for 4 February 2026: 157.70

Fundamental analysis

The forecast for 4 February 2026 appears optimistic for the USD. The USDJPY pair is forming an upward wave and may continue to rise. At the moment, quotes are trading around the 156.40 level.

US job openings (JOLTS) is an economic indicator that reflects the number of unfilled job positions in the country at the end of the month. The report is published by the US Bureau of Labor Statistics (BLS) and provides insight into labour demand, the level of economic activity, and the balance between employers and job seekers.

JOLTS helps assess labour market dynamics: a high number of vacancies indicates economic activity and growing demand for workers, while a low number points to business difficulties and slowing economic growth. The data is used by analysts, investors, and government authorities in decision-making.

The forecast for 4 February 2026 suggests that the number of job openings may rise to 7.230 million. A stronger-than-expected figure could positively impact the US dollar, while a reading below the forecast may push the USDJPY rate lower.

The US ISM non-manufacturing PMI is an economic indicator that reflects the state of the US service sector. It is based on surveys of purchasing managers and shows business activity outside manufacturing, including trade, healthcare, finance, IT, and other industries.

A reading above 50.0 indicates expansion, while a reading below 50.0 signals contraction. The index is published monthly by the Institute for Supply Management (ISM) and has a strong impact on financial markets, as the service sector accounts for a large share of the US economy.

Fundamental analysis for 4 February 2026 takes into account that the index may decline to 53.5 points from the previous 54.4. The decline is not critical, but an actual reading above the forecast could have a positive impact on the US dollar.

Technical outlook

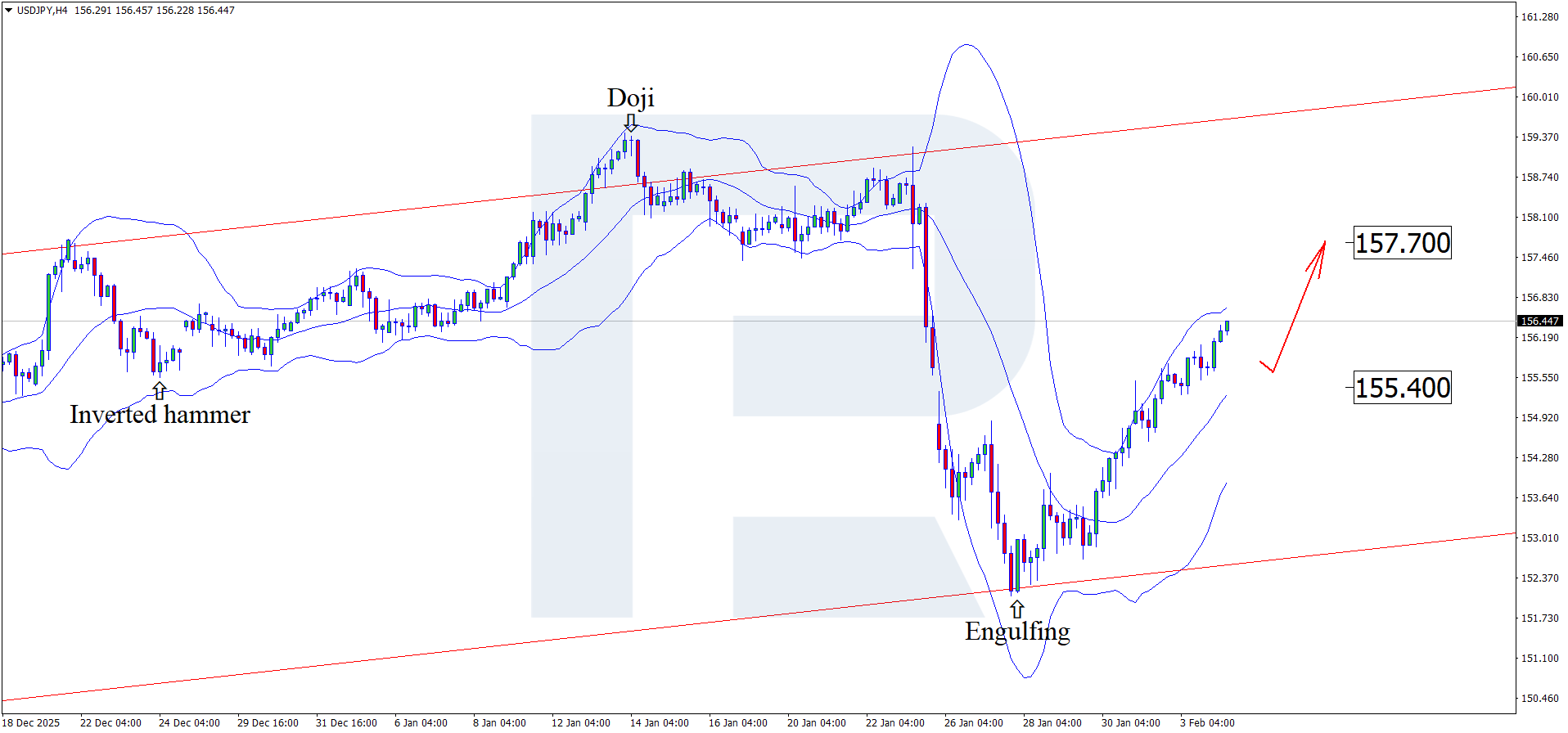

On the H4 chart, the USDJPY pair formed an Engulfing reversal pattern near the lower Bollinger Band and is trading around the 156.40 level. At this stage, the pair may continue its upward trajectory following the pattern’s signal, with the upside target at 157.70.

At the same time, the USDJPY forecast also considers an alternative scenario, with a corrective move down to the 155.40 level before further growth.

USDJPY overview

- Asset: USDJPY

- Timeframe: H4 (Intraday)

- Trend: bullish

- Key resistance levels: 157.70 and 159.30

- Key support levels: 155.40 and 152.15

USDJPY trading scenarios for today

Main scenario (Buy Stop)

A consolidation above the 157.70 level will indicate continued upward momentum, with the first target at 159.30. The risk-to-reward ratio is 1:4. Potential profit at the take-profit level is 160 pips, while possible losses are capped at 40 pips.

- Take Profit: 159.30

- Stop Loss: 157.30

Alternative scenario (Sell Stop)

The bullish scenario will be cancelled if quotes break below the support level and consolidate below 155.40. In this case, bullish pressure will weaken significantly.

- Take Profit: 152.15

- Stop Loss: 156.00

Risk factors

Weak US macroeconomic data, including a decline in job openings, may weaken the USD and trigger a downward move in the USDJPY pair.

Summary

A positive news backdrop from the US may strengthen the USD. Technical analysis of USDJPY suggests a rise towards the 157.70 level.

Editors’ picks

EURUSD 2026-2027 forecast: key market trends and future predictions

EURUSD 2026-2027 forecast: key market trends and future predictionsThis article provides the EURUSD forecast for 2026 and 2027 and highlights the main factors determining the direction of the pair’s movements. We will apply technical analysis, take into account the opinions of leading experts, large banks, and financial institutions, and study AI-based forecasts. This comprehensive insight into EURUSD predictions should help investors and traders make informed decisions.

Gold (XAUUSD) forecast 2026 and beyond: expert insights, price predictions, and analysis

Gold (XAUUSD) forecast 2026 and beyond: expert insights, price predictions, and analysisDive deep into the Gold (XAUUSD) price outlook for 2026 and beyond, combining technical analysis, expert forecasts, and key macroeconomic factors. It explains the drivers behind gold’s recent surge, explores potential scenarios including a move toward 4,500 to 5,000 USD per ounce, and highlights why the metal remains a strong hedge during global uncertainty.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.