USDJPY: everything is complex and dynamic

The USDJPY pair dipped to 153.20, with the market monitoring monetary policy and incoming data. Find out more in our analysis for 17 February 2026.

USDJPY forecast: key takeaways

- The USDJPY pair maintains a moderately bearish sentiment, while the yen attempts to recover losses

- Japan’s Q4 GDP data put local pressure on the JPY

- USDJPY forecast for 17 February 2026: 152.25 and 151.95

Fundamental analysis

The USDJPY rate is holding near 153.20. The yen is recovering some of the previous session’s losses amid expectations of an earlier interest rate hike by the Bank of Japan.

Former BoJ board member Saiji Adachi stated that the regulator may raise the key rate as early as April, as sufficient data will have been accumulated by then to justify such a move.

Bank of Japan Governor Kazuo Ueda also reported that no specific monetary policy demands were raised during his regular meeting with Prime Minister Sanae Takaichi. Despite concerns that the Prime Minister could slow policy normalisation, there has been no explicit resistance to a rate hike so far.

Previously, the yen weakened following the release of weak Q4 GDP data, as economic growth came in significantly below expectations due to subdued domestic demand.

The USDJPY forecast is neutral.

Technical outlook

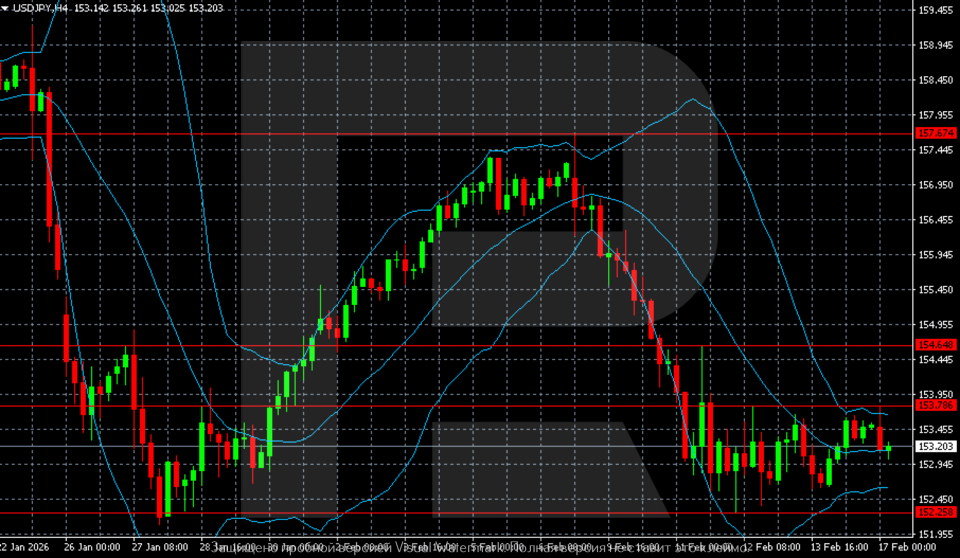

On the H4 chart, the USDJPY pair is trading around 153.20 after a sharp decline from 157.50–158.00. The chart clearly shows a shift in momentum: after a failed attempt to consolidate above 157.50, an accelerated sell-off began, with the price breaking below the middle line of Bollinger Bands.

The price is now consolidating within the 152.25–153.80 range. Bollinger Bands are narrowing, indicating declining volatility and the formation of a base after the momentum-driven drop. The middle line stands near 153.70 and acts as the nearest dynamic resistance. Key levels include resistance at 153.80, followed by 154.65, with the support levels at 152.25 and then 151.95.

As long as quotes remain below 153.80, the short-term balance remains neutral-to-bearish. A breakout above 153.80 would open the way for a correction towards 154.60–155.00. A loss of 152.25 would increase pressure and shift the focus back to February lows.

USDJPY overview

- Asset: USDJPY

- Timeframe: H4 (Intraday)

- Trend: bearish (moderate)

- Key resistance levels: 153.80 and 154.65

- Key support levels: 152.25 and 151.95

USDJPY trading scenarios for today

Main scenario (Sell Stop)

A breakout below 152.25 would confirm a downside exit from the current consolidation and intensify pressure on the pair with a target at 151.95 and lower. After the impulsive decline from 157.50–158.00, the structure remains bearish, and consolidation below the support level would create conditions for continued movement. The risk-to-reward ratio is close to 1:2. The downside potential is around 30 pips with a risk of approximately 20 pips.

- Sell Stop: 152.20

- Take Profit: 151.95

- Stop Loss: 152.45

Alternative scenario (Buy Stop)

Consolidation above 153.80 would indicate a breakout above the upper boundary of the 152.25–153.80 range and create conditions for a correction towards 154.60–155.00.

- Buy Stop: 153.85

- Take Profit: 154.65

- Stop Loss: 153.40

Risk factors

Risk factors for further USDJPY decline include the resilience of the 152.25 support level and rising expectations of an earlier Bank of Japan rate hike. Additional influence will come from US Treasury yield dynamics and revisions to Fed policy expectations, as these factors may shift the balance in favour of the US dollar.

Summary

The USDJPY pair maintains a moderately bearish sentiment. The USDJPY forecast for today, 17 February 2026, does not rule out the potential for a decline towards 152.25 and further to 151.95.

Editors’ picks

EURUSD 2026-2027 forecast: key market trends and future predictions

EURUSD 2026-2027 forecast: key market trends and future predictionsThis article provides the EURUSD forecast for 2026 and 2027 and highlights the main factors determining the direction of the pair’s movements. We will apply technical analysis, take into account the opinions of leading experts, large banks, and financial institutions, and study AI-based forecasts. This comprehensive insight into EURUSD predictions should help investors and traders make informed decisions.

Gold (XAUUSD) forecast 2026 and beyond: expert insights, price predictions, and analysis

Gold (XAUUSD) forecast 2026 and beyond: expert insights, price predictions, and analysisDive deep into the Gold (XAUUSD) price outlook for 2026 and beyond, combining technical analysis, expert forecasts, and key macroeconomic factors. It explains the drivers behind gold’s recent surge, explores potential scenarios including a move toward 4,500 to 5,000 USD per ounce, and highlights why the metal remains a strong hedge during global uncertainty.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.