USDJPY under pressure: will the pair rebound after the FOMC minutes and CPI data

The yen remains under pressure ahead of the FOMC minutes, with the USDJPY pair currently trading at 153.60. Discover more in our analysis for 18 February 2026.

USDJPY forecast: key takeaways

- US January CPI data is supporting the USD

- The market is awaiting Japan’s CPI release

- The FOMC minutes are scheduled for release

- USDJPY forecast for 18 February 2026: 154.50 and 151.25

Fundamental analysis

The forecast for 18 February 2026 appears optimistic for the USD. After a recent decline, the USDJPY pair is forming an upward wave and may extend its recovery. The pair is currently trading near 153.60.

Key drivers influencing the USDJPY rate:

- US January CPI came in below the forecast of 2.5%, with the actual figure at 2.4%, reinforcing expectations of two Federal Reserve rate cuts in 2026

- The market is pricing in a Bank of Japan rate hike in April but is awaiting Friday’s inflation data (CPI)

- The publication of the FOMC minutes may clarify several issues: the degree of consensus on January’s rate decision, the Fed’s potential response to US tariff policy, and whether a reduction of the policy rate to 3.1–3.2% was discussed

At this stage, the USDJPY pair remains caught between a strong export boom supporting the JPY and fiscal concerns weighing on the Japanese currency, as well as between bearish positioning in the USD and robust US labour market data.

Technical outlook

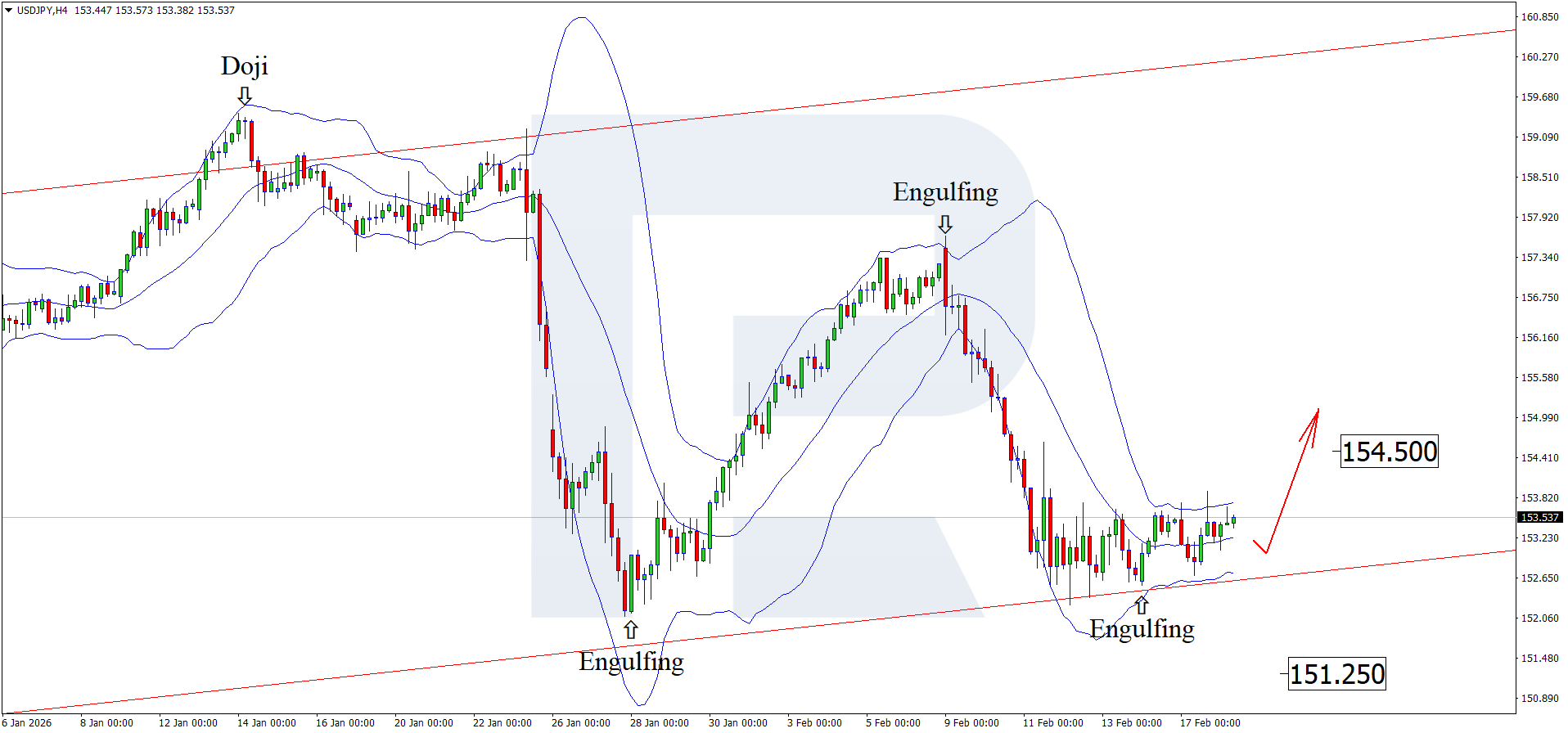

On the H4 chart, the USDJPY pair formed an Engulfing reversal pattern near the lower Bollinger Band and is trading around 153.50. At this stage, the pair may continue its upward movement in line with the pattern signal, with 154.50 acting as the immediate upside target.

However, the USDJPY forecast also considers an alternative scenario in which the price declines towards 151.25 without testing the resistance level.

USDJPY overview

- Asset: USDJPY

- Timeframe: H4 (Intraday)

- Trend: bullish (moderate)

- Key resistance levels: 154.50 and 155.60

- Key support levels: 151.25 and 150.35

USDJPY trading scenarios for today

Main scenario (Buy Stop)

A breakout above 154.50 would confirm an exit from the current consolidation and increase the probability of further gains. After the recent impulsive decline, consolidation above resistance would create conditions for continued upside movement. The risk-to-reward ratio is approximately 1:3, with upside potential of around 100 pips against a risk of about 30 pips.

- Buy Stop: 154.60

- Take Profit: 155.60

- Stop Loss: 154.30

Alternative scenario (Sell Stop)

A consolidation below 152.50 would signal a breakout below the support level and create conditions for a correction towards 151.25–150.35.

- Sell Stop: 152.40

- Take Profit: 151.25

- Stop Loss: 152.70

Risk factors

Risks to the bullish USDJPY scenario include rising expectations of an earlier Bank of Japan rate hike and potential Fed rate cuts. Additional influence will come from US Treasury yield dynamics and revisions to Fed policy expectations, as these factors may shift the balance in favour of the dollar.

Summary

The USD continues attempting to regain lost ground, with additional support coming from the anticipation of the FOMC minutes. USDJPY technical analysis suggests the pair may advance towards 154.50.

Editors’ picks

EURUSD 2026-2027 forecast: key market trends and future predictions

EURUSD 2026-2027 forecast: key market trends and future predictionsThis article provides the EURUSD forecast for 2026 and 2027 and highlights the main factors determining the direction of the pair’s movements. We will apply technical analysis, take into account the opinions of leading experts, large banks, and financial institutions, and study AI-based forecasts. This comprehensive insight into EURUSD predictions should help investors and traders make informed decisions.

Gold (XAUUSD) forecast 2026 and beyond: expert insights, price predictions, and analysis

Gold (XAUUSD) forecast 2026 and beyond: expert insights, price predictions, and analysisDive deep into the Gold (XAUUSD) price outlook for 2026 and beyond, combining technical analysis, expert forecasts, and key macroeconomic factors. It explains the drivers behind gold’s recent surge, explores potential scenarios including a move toward 4,500 to 5,000 USD per ounce, and highlights why the metal remains a strong hedge during global uncertainty.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.