USDJPY in growth zone: what could drive the dollar and the yen in the coming days

The USD continues to strengthen against the yen amid recent economic data, with the USDJPY rate currently at 155.10. Find out more in our analysis for 20 February 2026.

USDJPY forecast: key takeaways

- Japan’s nationwide core CPI: previously at 2.4%, currently at 2.0%

- Japan’s services PMI: previously at 53.7, currently at 53.8

- US services PMI: previously at 52.7, projected at 53.0

- USDJPY forecast for 20 February 2026: 156.55

Fundamental analysis

The outlook for 20 February 2026 remains optimistic for the USD. After a pullback, the USDJPY pair is forming an upward wave and may continue its growth, currently trading around 155.10.

The nationwide core Consumer Price Index in Japan reflects changes in the prices of goods and services from the consumer perspective. It is a key measure of inflation trends and consumer behaviour. The core CPI excludes food and energy prices due to their seasonal volatility.

The impact of CPI on exchange rates is not always straightforward: an increase in the index may lead to higher interest rates and support the national currency. However, during periods of economic weakness, higher CPI can worsen conditions and weigh on the currency.

Analysis as of 20 February 2026 shows that the decline in the core CPI from 2.4% to 2.0% was not critical and helped the yen to make a minor correction.

The services PMI covers industries such as transportation, communications, financial services, business and personal services, information technology, and hospitality.

The forecast for 20 February 2026 appears moderately positive, as Japan’s services PMI increased by 0.1 points to 53.8. The reading remains above the 50.0 threshold, indicating expansion and providing moderate support for the yen.

The US services PMI is also expected to rise to 53.0 from the previous 52.7. Although the projected growth is modest, the indicator may remain above 50.0, which is a positive signal for the USD.

Against the backdrop of economic data from Japan and the US, the USDJPY pair may continue its upward movement within the ascending channel.

Technical outlook

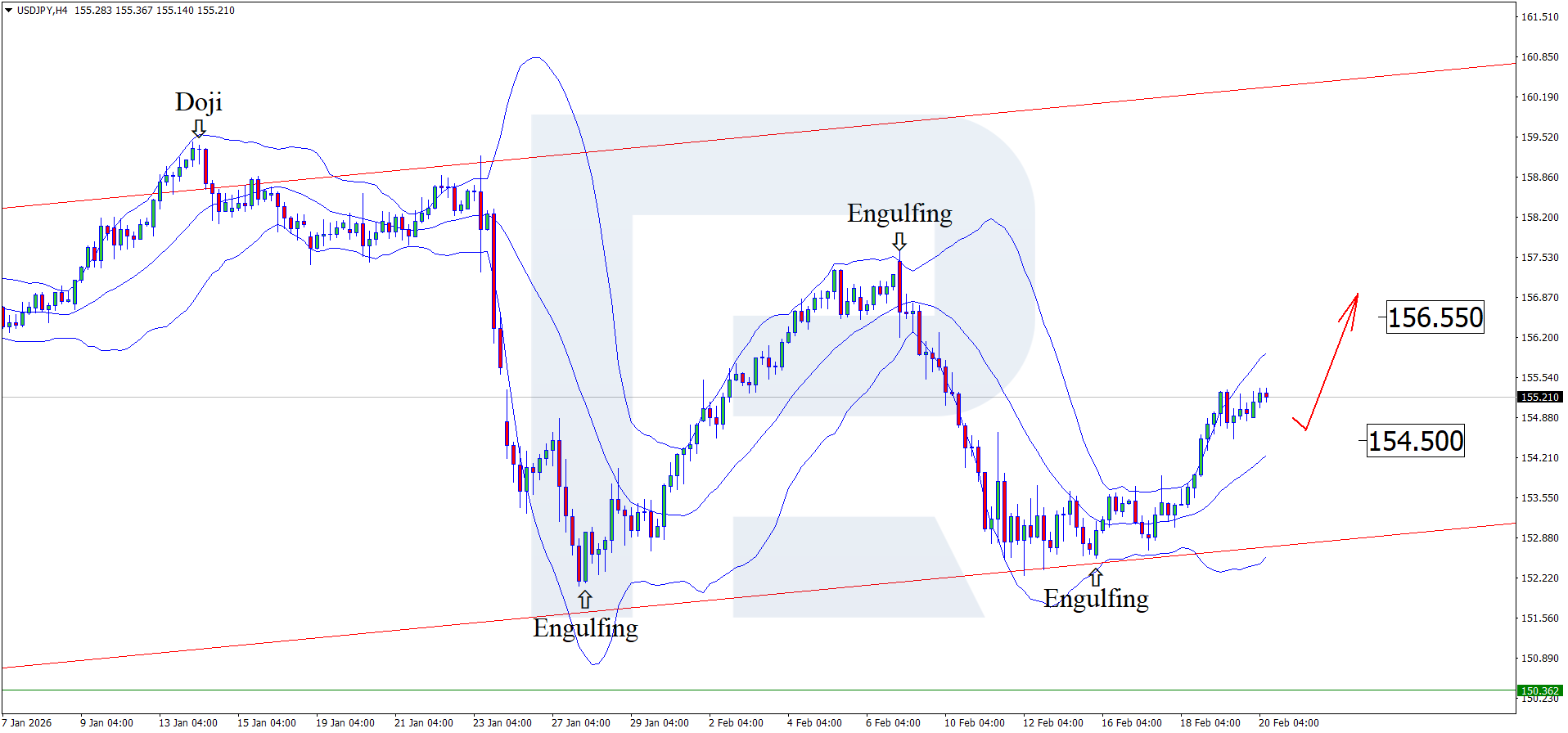

On the H4 chart, the USDJPY pair has formed an Engulfing pattern near the lower Bollinger Band and is trading around 155.10. At this stage, the pair may continue its upward momentum as the pattern plays out, with the next upside target at 156.55.

At the same time, the USDJPY forecast also considers an alternative scenario involving a correction towards 154.50 before further growth.

USDJPY overview

- Asset: USDJPY

- Timeframe: H4 (Intraday)

- Trend: bullish

- Key resistance levels: 156.55 and 157.50

- Key support levels: 154.50 and 153.50

USDJPY trading scenarios for today

Main scenario (Buy Limit)

A rebound from the 154.50 level may create conditions for opening long positions and increase pressure on the yen. The risk-to-reward ratio is 1:4. The upside potential is about 205 pips with a risk of around 50 pips.

- Take Profit: 156.55

- Stop Loss: 154.00

Alternative scenario (Sell Stop)

The bearish scenario will be activated if the price breaks and consolidates below the 154.50 support level, opening the way for further decline.

- Sell Stop: 154.30

- Take Profit: 153.50

- Stop Loss: 154.60

Risk factors

Risks to the bullish USDJPY scenario include a softer Fed tone, which could reduce demand for the dollar, pushing the pair lower. An additional invalidation signal for the bullish scenario would be a breakout below 154.50 with consolidation beneath this level, indicating continued seller dominance and a renewed downward momentum.

Summary

The yen is attempting to strengthen after positive economic data from Japan. Technical analysis suggests the USDJPY pair may rise towards 156.55 following a correction.

Editors’ picks

EURUSD 2026-2027 forecast: key market trends and future predictions

EURUSD 2026-2027 forecast: key market trends and future predictionsThis article provides the EURUSD forecast for 2026 and 2027 and highlights the main factors determining the direction of the pair’s movements. We will apply technical analysis, take into account the opinions of leading experts, large banks, and financial institutions, and study AI-based forecasts. This comprehensive insight into EURUSD predictions should help investors and traders make informed decisions.

Gold (XAUUSD) forecast 2026 and beyond: expert insights, price predictions, and analysis

Gold (XAUUSD) forecast 2026 and beyond: expert insights, price predictions, and analysisDive deep into the Gold (XAUUSD) price outlook for 2026 and beyond, combining technical analysis, expert forecasts, and key macroeconomic factors. It explains the drivers behind gold’s recent surge, explores potential scenarios including a move toward 4,500 to 5,000 USD per ounce, and highlights why the metal remains a strong hedge during global uncertainty.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.