USDJPY forecast 2025, 2026: expert predictions, price outlook, and analysis

Disclaimer: the information in this article is based on the analysis of reputable financial resources and analytical data from RoboForex specialists. It reflects the conclusions of thorough research, but it should be taken into account that economic changes may significantly affect market conditions, which may lead to changes in forecasts. We recommend conducting your own research and consulting with professionals before making important financial decisions.

The USDJPY pair represents the exchange rate of the US dollar against the Japanese yen. It is one of the major currency pairs on the Forex market, widely used by investors and popular among traders. Its exchange rate depends on the economic indicators of the United States and Japan, the monetary policies of the central banks of both countries, and the impact of global geopolitical factors. The Bank of Japan (BoJ) and the Federal Reserve System (Fed) play a key role in regulating the value of their currencies, adjusting monetary policy in response to factors such as inflation, unemployment, and economic growth rates.

In this article, we will examine the forecast for the USDJPY pair for 2025 and 2026, highlighting the key factors that will determine the direction of the currency pair's movement. We will utilize technical analysis, consider the opinions of leading experts, major banks, and financial institutions, and review forecasts based on artificial intelligence models.

Table of contents:

- Key takeaways: USDJPY price prediction

- How to make a Japanese yen price forecast?

- USDJPY live price chart

- USDJPY weekly technical analysis

- Long-term USDJPY forecast for 2025

- Expert USDJPY forecast 2025-2026

- USDJPY forecast from AI 2025-2026

- Conclusion

- FAQ

Key takeaways: USDJPY price prediction

Before we get into a detailed analysis and forecast for EURUSD for 2025 and 2026, let's take a look at the crucial factors that have the biggest impact on this currency pair.

Long-term trend. The USDJPY pair has been trading in a long-term upward trend since the beginning of 2021. A key support level for this trend is 130.50. If the price drops below this mark, it will signal the end of the long-term uptrend.

Central Bank policies. In January, the Bank of Japan raised the interest rate by 25 basis points to 0.5%, marking the highest short-term borrowing cost in 16 years. The central bank also revised its inflation forecasts upwards, indicating the possibility of further rate hikes. The US Federal Reserve has paused its cycle of rate cuts, leaving the rate at its current level of 4.5%. The recently published minutes of the Fed's latest meeting note the need for a cautious approach to monetary policy decisions due to the risks of a possible increase in inflation in the US.

Expert and AI forecasts. Forecasts for USDJPY show a divergence of opinions: some analysts expect the yen to strengthen, while others predict a stronger U.S. dollar. The projected USDJPY rate range varies approximately between 140.00 and 170.00.

Support and resistance levels

Support:

- Key support - 151.50

- Target in case of a key support breakout - 158.00

Resistance:

- Nearest resistance - 140.00

- Target in case of a resistance breakout - 130.50

In 2025, the dynamics of the USDJPY currency pair will be primarily influenced by the monetary policies of the Federal Reserve and the Bank of Japan. Forecasts for the pair remain varied: a "bearish" scenario suggests a break below the 140.00 support level with a target at 130.00. A "bullish" scenario envisions a rise in quotations toward the 158.00 area and beyond.

How to make a Japanese yen price forecast?

When creating a forecast for the USDJPY pair, in addition to technical analysis, it is essential to account for key fundamental factors influencing the pair's quotes:

Monetary policy of Central Banks

The Bank of Japan (BoJ) and the Federal Reserve (Fed) play a crucial role in determining USDJPY dynamics. Decisions regarding interest rates and inflation targets can drastically shift trader sentiment, leading to currency pair fluctuations. A more aggressive Fed policy generally strengthens the U.S. dollar against the yen.

Economic growth

Economic performance indicators for both Japan and the U.S. are key to shaping USDJPY prices. Strong GDP growth in Japan may support the yen, whereas a slowdown in the U.S. economy could weaken the dollar. The difference in economic growth rates between the two countries will define USDJPY’s long-term prospects and influence the overall market trend.

Inflation levels

Inflation has a significant impact on central bank decisions and, therefore, on currency exchange rates. High inflation in the U.S., coupled with Fed rate hikes, encourages investors to favor the U.S. dollar over the low-yielding Japanese yen.

Political and geopolitical events

Political stability in the U.S. and Japan greatly affects USDJPY dynamics. For example, U.S. presidential elections have historically had a notable influence on the currency pair. Additionally, energy crises and regional conflicts contribute to heightened market volatility.

Yen as a safe haven currency during crises

Another key factor influencing USDJPY is the role of the Japanese yen as a safe-haven currency during global crises. During an active phase of a crisis, stock markets tend to decline, and investors sell off risky assets to buy safe-haven currencies such as the U.S. dollar, Swiss franc, and yen. During such times, USDJPY may decline significantly due to yen strengthening.

Bank of Japan interventions

A unique characteristic of the USDJPY pair is periodic currency interventions. The Bank of Japan often takes action when the yen strengthens or weakens excessively. In such cases, the BoJ may intervene through large-scale purchases or sales of yen to stabilize the USDJPY exchange rate locally.

USDJPY live price chart

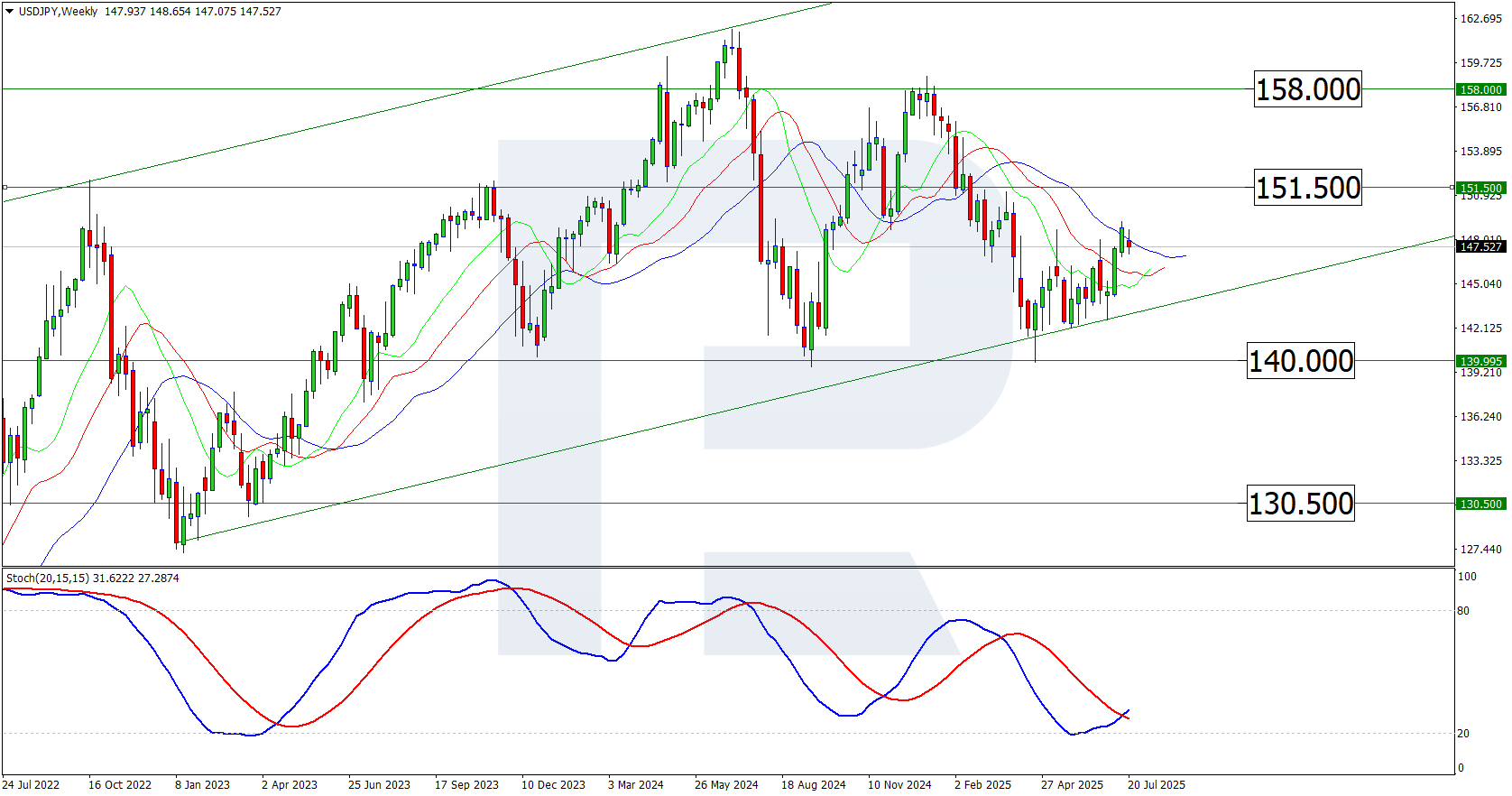

USDJPY weekly technical analysis

Let’s analyze the weekly chart of the USD/JPY pair. Within the framework of technical analysis, we will assess the positioning of the nearest support and resistance levels, review the formation of chart patterns, and examine technical indicators.

On the weekly timeframe, USD/JPY has shifted into an upward trend, crossing above the Alligator indicator, which is now aligned with the price chart and also forming a crossover. In April 2025, the pair established a local low around the 140.00 level and has since reversed to the upside, currently developing a new upward wave.

The potential continuation of the bullish trend is supported by the Stochastic indicator, which has generated a buy signal. If key resistance levels fail to hold back the bulls, further upside movement is likely. However, if these resistance levels prove resilient, a broader bearish reversal may unfold.

Key support levels:

- 142.00 – The nearest support level, aligned with the lower boundary of the ascending price channel. If this level holds, the upward trend may continue

- 140.00 – A critical support level, potentially serving as a launching point for a bullish reversal. A break below this level would signal the end of the current uptrend and the beginning of a broader bearish move

- 130.50 – A long-term support level that may serve as the target for bears if the 140.00 level is breached and a downtrend is confirmed

Key resistance levels:

- 151.50 – The local weekly high. A breakout above this level would confirm the strength of the uptrend and open the way for bulls to target the 2024 high at 162.00

- 162.00 – A major resistance level. A break above it would pave the way for further upside, with the next bullish target potentially around the 170.00 mark

Long-term USDJPY forecast for 2025

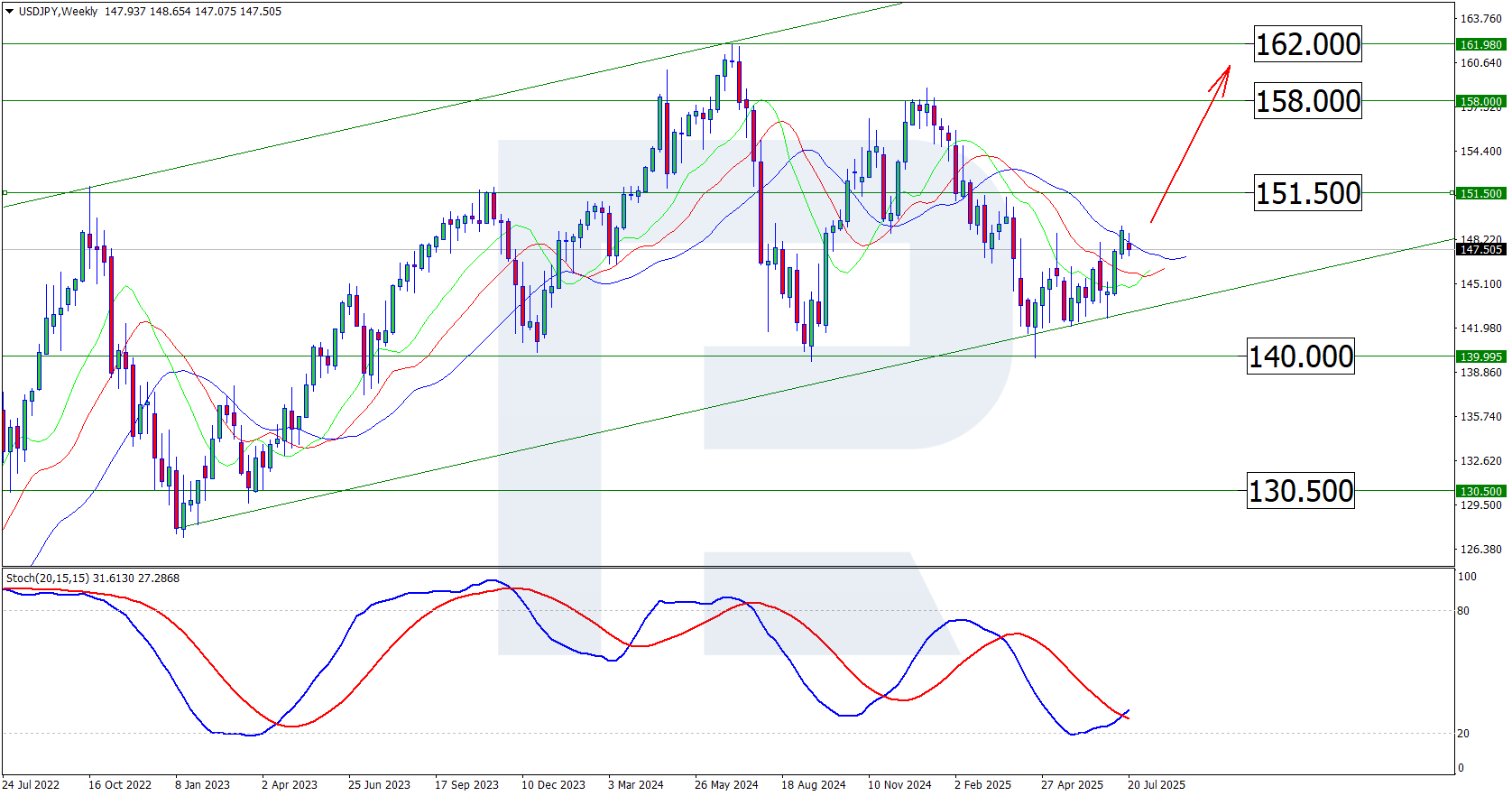

Bullish scenario:

Despite the correction, the long-term trend for the USD/JPY pair remains upward. If the price pulls back and rebounds from the lower boundary of the ascending channel or the 140.00 support level, a new bullish wave may form. A breakout above the 151.50 resistance level would confirm the continuation of the uptrend, potentially paving the way for a rally toward the 2024 high at 162.00.

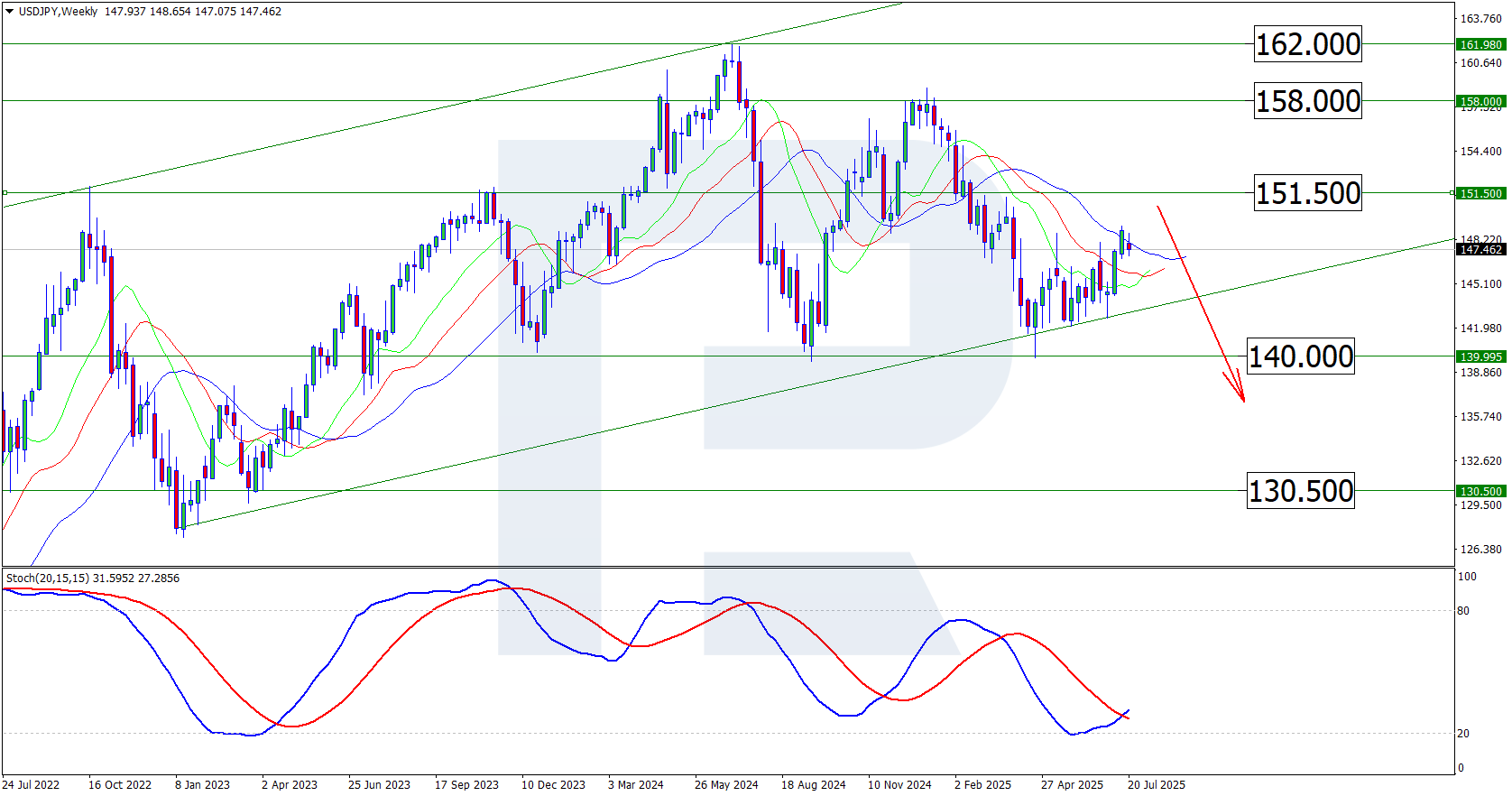

Bearish scenario:

If the resistance at 151.50 successfully halts the current upward movement, the risk of a trend reversal increases. A confirmed rejection from the 151.50 resistance level would signal the beginning of a bearish phase, opening the path for sellers to target the 2024 low at 139.40.

Sideways scenario:

There is also a possibility that the asset enters a prolonged sideways consolidation, bounded by the 140.00 support level below and the 151.50 resistance level above. This scenario could materialize if the Federal Reserve and the Bank of Japan adopt a wait-and-see approach in 2025 and refrain from significant interest rate changes. In such a case, the current "status quo" within the mentioned range may persist throughout the year.

Expert USDJPY forecast 2025-2026

J.P. Morgan

Analysts at the bank predict that excessive weakness of the yen is unacceptable for both U.S. and Japanese policymakers. If the devaluation of the yen accelerates, it will be countered by more hawkish interventions aimed at purchasing yen.

- Forecast for 2025: 151.00

- Forecast for 2026: 148.00

RBC

RBC Capital Markets experts note a trend of gradual decline in the USDJPY exchange rate, as well as risks of a potential rollback of the Federal Reserve's rate-cutting policy and the possibility of Chinese yuan devaluation.

- Forecast for 2025: 153.00

- Forecast for 2026: 150.00

Citi Research

Citi Research specialists suggest that a tighter monetary policy by the Bank of Japan, combined with a reduction in the Federal Reserve rate, should lead to a gradual strengthening of the yen against the U.S. dollar.

- Forecast for 2025: 150.00

- Forecast for 2026: 130.00

ING

Analysts at ING anticipate a moderate decline in the pair in 2025, followed by strengthening in 2026.

- Forecast for 2025: 160.00

- Forecast for 2026: 150.00

Wells Fargo

Wells Fargo experts forecast that the contrast between the Bank of Japan's rate hikes and the Federal Reserve's rate cuts could lead to a strengthening of the yen.

- Forecast for 2025: 144.00

- Forecast for 2026: 146.00

USDJPY forecast from AI 2025-2026

In addition to expert opinions, AI algorithms have been used to generate forecasts. These models rely on advanced prediction algorithms, historical data, and machine learning techniques to create more accurate projections based on past trends.

Wallet Investor

Wallet Investor expects the pair to rise over the next two years.

- USDJPY forecast for 2025: 171.00

- USDJPY forecast for 2026: 184.00

Coin Index

Coin Index also anticipates the continuation of the bullish trend.

- USDJPY forecast for 2025: 164.00

- USDJPY forecastfor 2026: 174.00

Long Forecast

Long Forecast believes that in 2025, the pair will remain near current levels.

- USDJPY forecast for 2025: 155.00

- USDJPY forecast for 2026: 173.00

Panda Forecast

Panda Forecast expects moderate growth in the pair.

- USDJPY forecast for 2025: 160.00

- USDJPY forecast for 2026: 167.00

Conclusion

The USD/JPY currency pair remains one of the most popular trading instruments in the Forex market. Thanks to its high liquidity, accessibility, and tight spreads, the pair attracts significant interest from both traders and investors.

In 2025, USD/JPY may experience substantial volatility, allowing for the possible realization of both bullish and bearish scenarios. The primary drivers of exchange rate dynamics will be the monetary policies of the Federal Reserve and the Bank of Japan, inflation expectations, and broader global economic risks.

According to long-term forecasts from leading financial institutions such as J.P. Morgan, RBC Capital Markets, and Citi Research, the pair is expected to decline moderately toward the 150.00–148.00 range over the 2025–2026 period. Conversely, AI-driven models project continued appreciation of the USD/JPY rate, potentially reaching the 160.00–170.00 levels over the next two years.

From a technical standpoint, the optimistic scenario for 2025 suggests a continued uptrend, with price targets in the 158.00–162.00 range if bullish momentum persists. The pessimistic forecast anticipates a trend reversal, with the pair potentially declining to 140.00 and even 130.50. A sideways scenario is also possible, with the pair consolidating between 140.00 and 151.50, reflecting a fundamental equilibrium between key macroeconomic factors.

FAQ

The current USDJPY price you can find in the USDJPY live price chart.

The USD/JPY forecast for 2025, based on expert opinions and AI algorithm calculations, suggests that the USD/JPY exchange rate will range between 150.00 and 171.00.

There is no definitive answer to this question. Experts lean toward a moderate strengthening of the yen, while AI algorithms predict further weakening of the Japanese currency. The determining factor will be the policies of the regulators—the U.S. Federal Reserve and the Bank of Japan.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.