USDJPY declines again as the yen receives support from the Bank of Japan sentiment

The USDJPY pair is going down on Wednesday. The JPY is gaining ground ahead of BoJ decisions. Discover more in our analysis for 18 September 2024.

USDJPY forecast: key trading points

- The USDJPY pair came under pressure

- The Bank of Japan is poised to raise interest rates at the December meeting

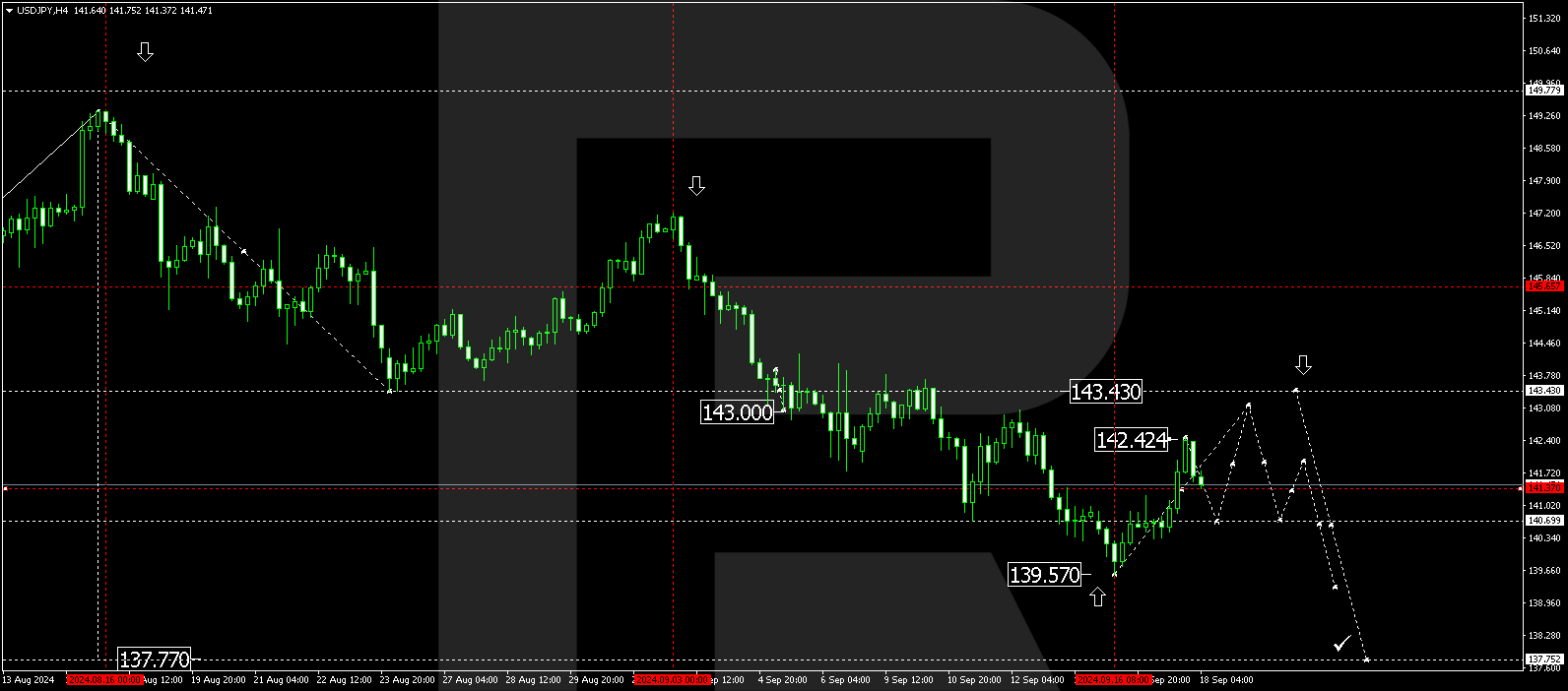

- USDJPY forecast for 18 September 2024: 143.00 and 137.77

Fundamental analysis

The USDJPY rate is down to 141.44 in the middle of the week. Although the US dollar took advantage of the environment in the form of a strong retail sales report and rose yesterday, the situation is normalising today. The market focuses on today’s Federal Reserve meeting, with the Bank of Japan meeting scheduled for Friday.

Investors are confident that the BoJ will keep the interest rate unchanged at its September and October meetings, but will give a strong signal about future steps. The interest rate will highly likely be raised at the December meeting.

Today’s statistics were not the most confident. Japan’s imports rose by 2.3% y/y in August, showing the lowest growth rate in five months. Exports expanded by 5.6% y/y, coming in half as much as expected. The JPY appreciation is likely to impact the figures markedly. The USDJPY forecast suggests a further decline.

USDJPY technical analysis

The USDJPY H4 chart shows that the market has completed a growth wave, reaching the local target of 142.42. The price has corrected towards 141.30 today, 18 September 2024, with the correction likely to continue to 140.70. Subsequently, the USDJPY rate could rise to 143.00 and potentially further to 143.43 (testing from below). Given the fundamental environment, the market may push the price to 137.77 for a short period and start developing a new growth wave, aiming for 143.43 as the first target.

Summary

The USDJPY pair is falling, with medium-term sentiment remaining in force. Technical indicators in today’s USDJPY forecast suggest that the price could rise further to 143.00 as part of the correction before declining to 137.77.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.