USDJPY rises to a three-week high: trend gaining momentum

The USDJPY continues to exhibit upward momentum, climbing to a three-week high as the US dollar garners favour among investors. Read more in our analysis for 26 September 2024.

USDJPY forecast: key trading points

- USDJPY growth: the pair has shown steady growth as the Japanese yen continues to retreat amidst the strengthening US dollar

- Investor sentiment: market sentiment favours the US dollar due to uncertainties surrounding the Federal Reserve’s next steps

- USDJPY forecast for 26 September 2024: range between 145.77 and 146.66

Fundamental analysis

As of 26 September 2024, USDJPY has surged to 144.93, marking its highest point in the last three weeks.

The Japanese yen was forced to retreat as the US Dollar strengthened. Due to continued uncertainty over the US Federal Reserve’s future actions and the potential for a rate cut, the market remains bullish on the dollar, pushing the yen further down.

Minutes from the latest Bank of Japan meeting showed that Monetary Committee members called for greater vigilance to mitigate rising inflation risks and warned against setting too high expectations for future monetary policy tightening.

Bank of Japan Governor Kazuo Ueda mentioned this week that the regulator has no need to rush and has sufficient time to assess market and economic developments. This suggests that the BoJ is not in a hurry to raise rates.

The USDJPY forecast does not rule out the continuation of the current dynamics.

USDJPY technical analysis

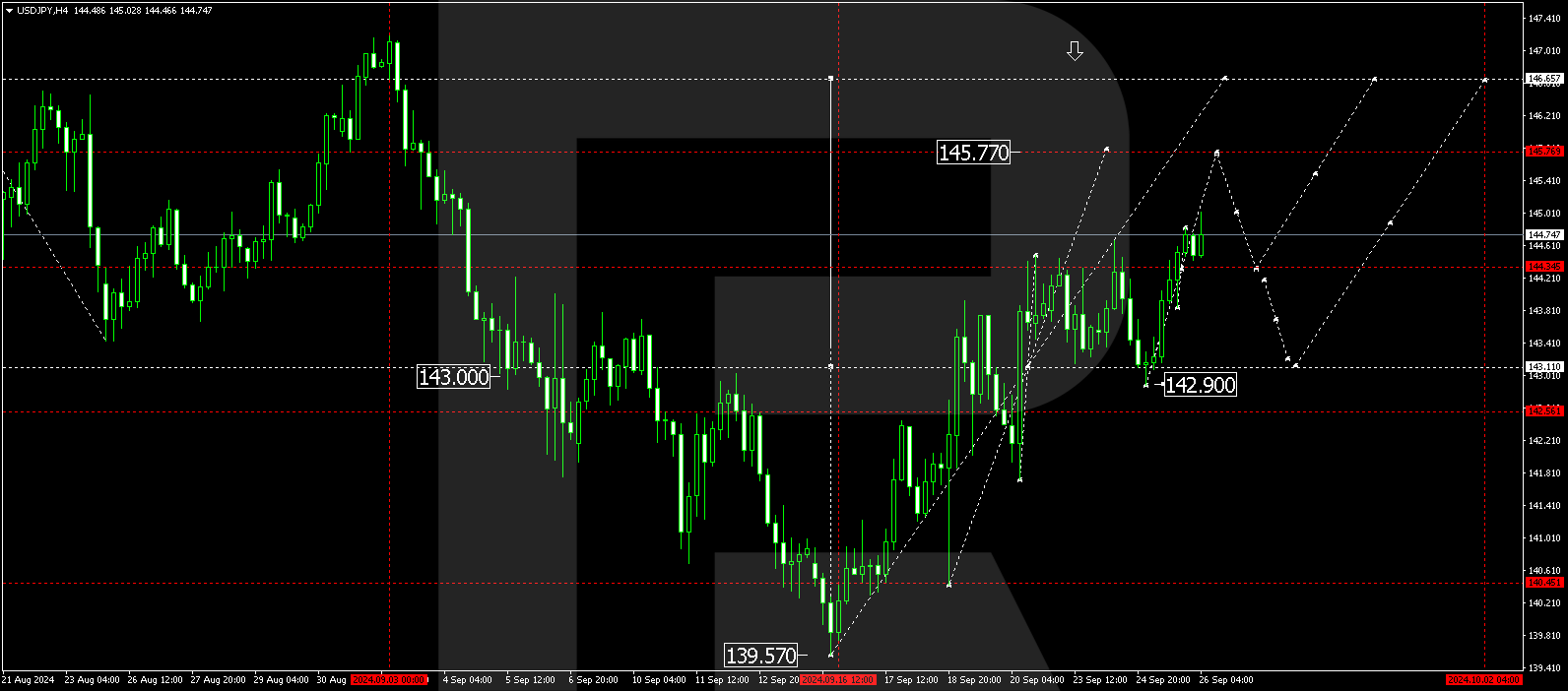

On the H4 USDJPY chart, the market found support at 142.90 and continued to develop the growth wave. Today, on 26 September 2024, the market broke through the 144.34 level upwards. We can effectively state that the consolidation range has been breached upwards. The breakout of the 144.34 level can be considered a signal for further growth towards 145.77. The target is local.

Once this level is reached, there could be a brief correction in the USDJPY rate to 143.43. In the future, we expect another growth wave to the 146.66 level. Technically, the pair’s movement is viewed as part of a corrective structure to the previous downtrend.

Summary

The USDJPY pair is near a three-week peak due to an improved market sentiment towards the US dollar. Technical indicators for today’s USDJPY forecast suggest that the potential for continued growth towards 145.77 and 146.66 should be considered.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.