DE 40 forecast: the index reached its target level and corrected

The DE 40 stock index has corrected, but the support level has held and the trend remains upward. The DE 40 forecast for today is positive.

DE 40 forecast: key trading points

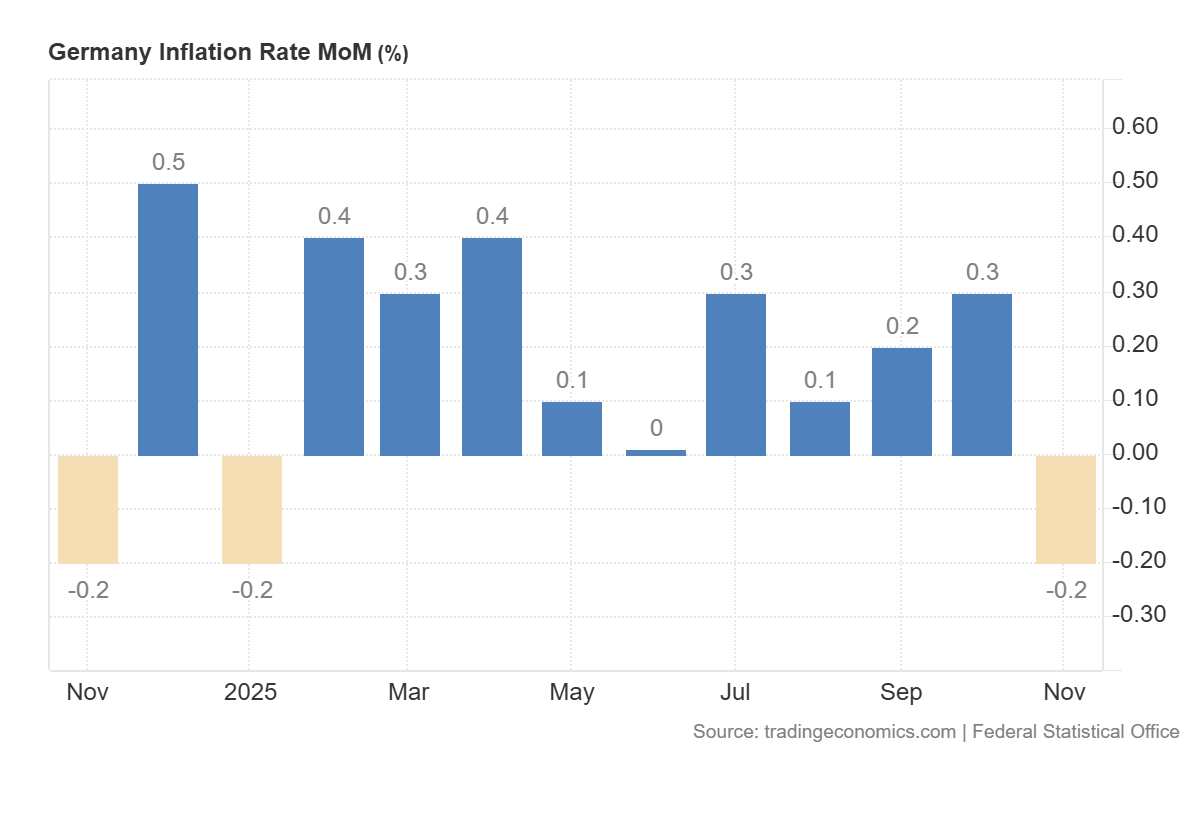

- Recent data: Germany’s CPI declined by 0.2% m/m

- Market impact: the data creates a mixed backdrop for the German equity market

DE 40 fundamental analysis

Germany reported a monthly CPI change of -0.2% m/m. The figure matched market expectations (-0.2%) but was significantly lower than the previous reading (+0.3%). In practical terms, this indicates a short-term decline in consumer prices and easing inflationary pressure compared with the previous month. For the German equity market, the key transmission channel is expectations for interest rates and bond yields. Lower inflation generally reduces the likelihood that the euro area will need to maintain high interest rates for an extended period.

When analysing DE 40, it is important to note that many index constituents generate a substantial share of their revenues outside Germany. As a result, the index often reacts not only to domestic data but also to broader European and global economic developments. When inflation eases, markets gain confidence that euro area interest rates could be lower than previously expected. In such conditions, the euro often weakens, which provides additional support for DE 40 compared with indices that are more heavily dependent on domestic consumption and internal demand.

Germany Inflation Rate MoM: https://tradingeconomics.com/germany/inflation-rate-momDE 40 technical analysis

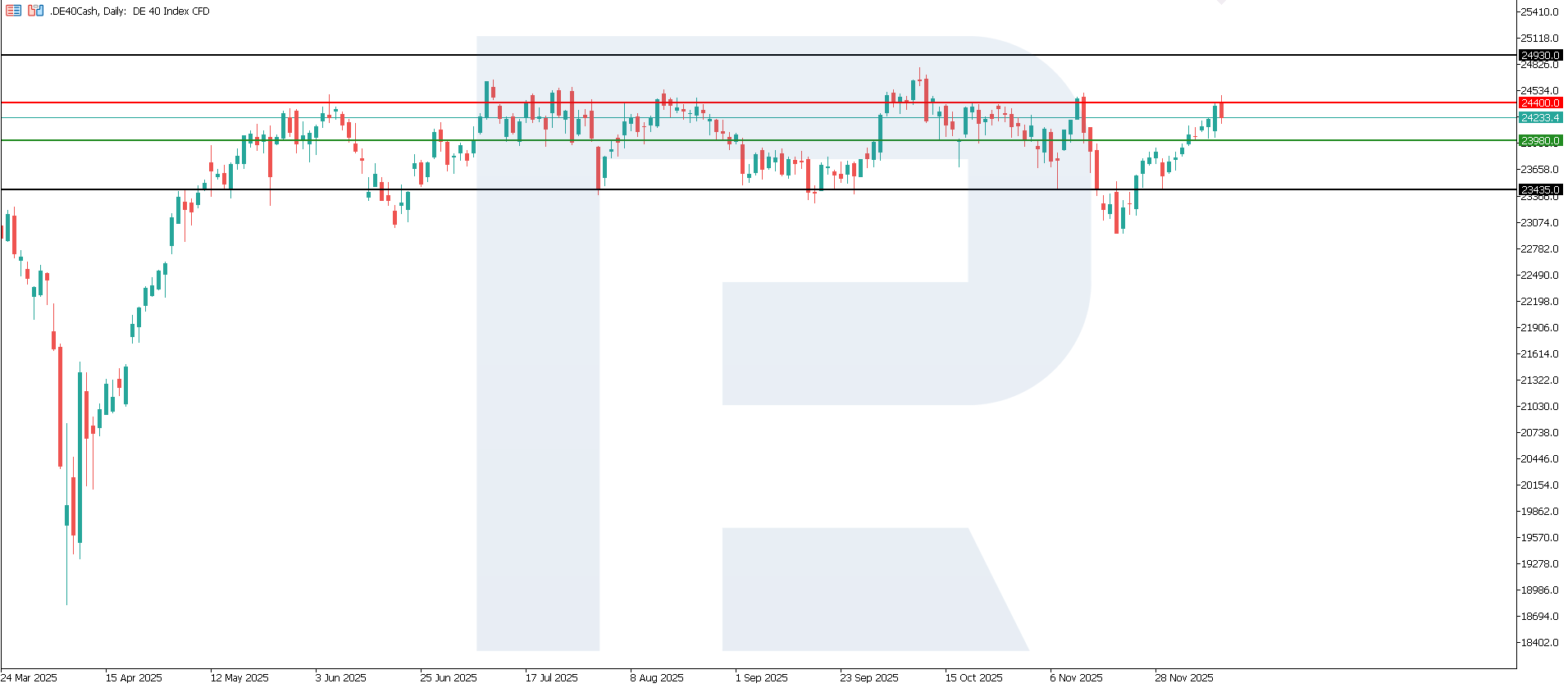

For the DE 40 index, key resistance is located at 24,400.0, while a new support level has formed at 23,980.0. Upward momentum remains dominant, although the duration of this move is still difficult to assess. The nearest upside reference target is 24,930.0.

Forecast scenarios for DE 40:

- Bearish scenario: if the index breaks below support at 23,980.0, prices may fall toward 23,435.0

- Bullish scenario: if the index breaks above resistance at 24,400.0, prices may rise to 24,930.0

Summary

Overall, the latest CPI release is moderately supportive for DE 40 in terms of inflation risks and interest-rate expectations. However, because the figure matched forecasts, it is not a standalone trigger for a sharp market move. For investors, the key question is whether the easing trend in price pressure will be confirmed in upcoming releases and whether it will be accompanied by stable data on economic activity and the labour market. The nearest upside target for the index stands at 24,980.0.

Editors’ picks

EURUSD 2026-2027 forecast: key market trends and future predictions

EURUSD 2026-2027 forecast: key market trends and future predictionsThis article provides the EURUSD forecast for 2026 and 2027 and highlights the main factors determining the direction of the pair’s movements. We will apply technical analysis, take into account the opinions of leading experts, large banks, and financial institutions, and study AI-based forecasts. This comprehensive insight into EURUSD predictions should help investors and traders make informed decisions.

Gold (XAUUSD) forecast 2026 and beyond: expert insights, price predictions, and analysis

Gold (XAUUSD) forecast 2026 and beyond: expert insights, price predictions, and analysisDive deep into the Gold (XAUUSD) price outlook for 2026 and beyond, combining technical analysis, expert forecasts, and key macroeconomic factors. It explains the drivers behind gold’s recent surge, explores potential scenarios including a move toward 4,500 to 5,000 USD per ounce, and highlights why the metal remains a strong hedge during global uncertainty.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.