DE 40 forecast: the index may enter a sideways channel

The DE 40 stock index is declining, but the pace of the fall has slowed. The DE 40 forecast for today is positive.

DE 40 forecast: key takeaways

- Recent data: the ECB kept the key interest rate at 2.15% for the fourth consecutive time

- Market impact: the data creates a positive backdrop for the German equity market

DE 40 fundamental analysis

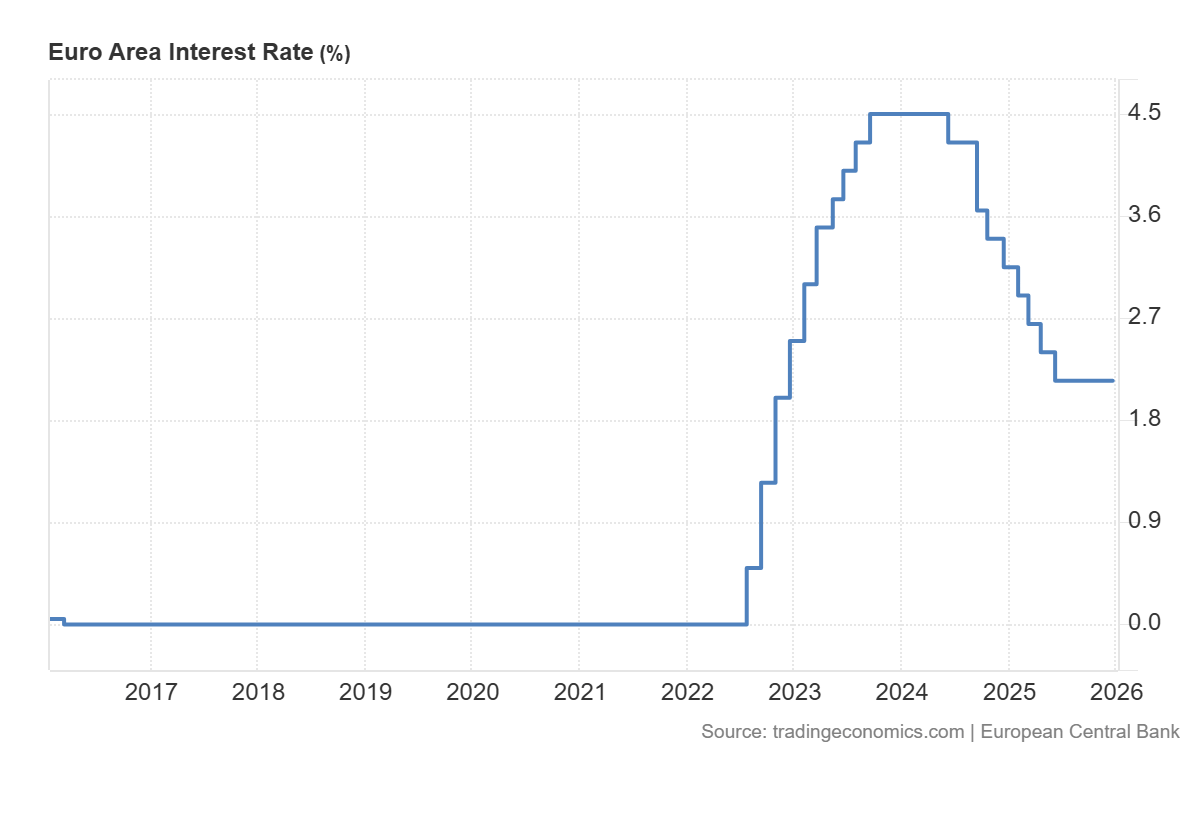

At its meeting on 18 December, the European Central Bank left all key interest rates unchanged, including the deposit rate at 2%. Inflation in the euro area remains close to the target level, standing at 2.15% in November, while the medium-term forecast was slightly revised upwards due to rising prices in the services sector. At the same time, the ECB improved its GDP growth forecasts for the euro area for 2025–2027. In such situations, the decision itself usually does not act as a strong driver for equities, as investors have already priced in this outcome.

A stable interest rate maintains predictable financing conditions for companies and does not increase borrowing costs for businesses and households. This reduces the risk of a sharp slowdown in economic activity and supports equity valuations, especially in capital-intensive sectors. The DE 40 has a high share of export-oriented companies, so the dynamics of the euro play a key role. If the euro remains weak or weakens further after the decision, this supports the index through improved price competitiveness of German exporters.

Euro Area Interest Rate: https://tradingeconomics.com/euro-area/interest-rateDE 40 technical analysis

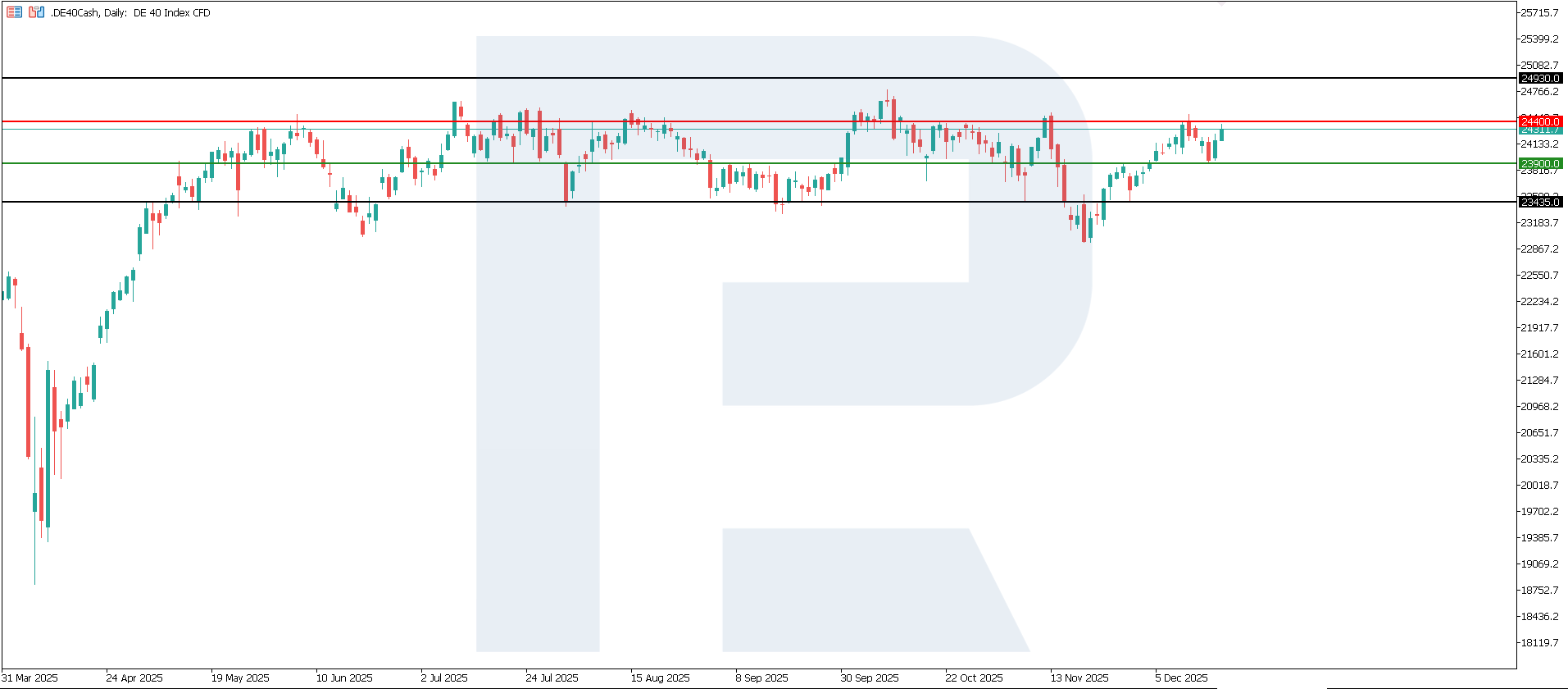

For the DE 40 index, the key resistance is located at 24,400.0, while a new support level formed at 23,900.0. Downward dynamics currently prevail, and it remains difficult to assess their duration due to high volatility. The nearest downside target appears at 23,435.0.

Forecast scenarios for the DE 40 index price:

- Bearish scenario: if prices break below the support at 23,900.0, the index may fall to 23,435.0

- Bullish scenario: if prices break above the resistance at 24,400.0, the index may rise to 24,930.0

Summary

The ECB’s decision to keep the rate at 2.15% is neutral for DE 40, as the outcome was widely expected. The positive aspect lies in the fact that financing conditions are not tightening. However, the directional move of the index will most likely depend on how the market interprets the ECB’s accompanying comments and subsequent data. If inflation continues to slow, the probability of future rate cuts will increase, which usually supports equities. The nearest downside target for the index may stand at 23,435.0.

Editors’ picks

EURUSD 2026-2027 forecast: key market trends and future predictions

EURUSD 2026-2027 forecast: key market trends and future predictionsThis article provides the EURUSD forecast for 2026 and 2027 and highlights the main factors determining the direction of the pair’s movements. We will apply technical analysis, take into account the opinions of leading experts, large banks, and financial institutions, and study AI-based forecasts. This comprehensive insight into EURUSD predictions should help investors and traders make informed decisions.

Gold (XAUUSD) forecast 2026 and beyond: expert insights, price predictions, and analysis

Gold (XAUUSD) forecast 2026 and beyond: expert insights, price predictions, and analysisDive deep into the Gold (XAUUSD) price outlook for 2026 and beyond, combining technical analysis, expert forecasts, and key macroeconomic factors. It explains the drivers behind gold’s recent surge, explores potential scenarios including a move toward 4,500 to 5,000 USD per ounce, and highlights why the metal remains a strong hedge during global uncertainty.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.