DE 40 forecast: the index may break through

The DE 40 stock index may switch to an upward trend if the resistance level is broken. The DE 40 forecast for today is positive.

DE 40 forecast: key takeaways

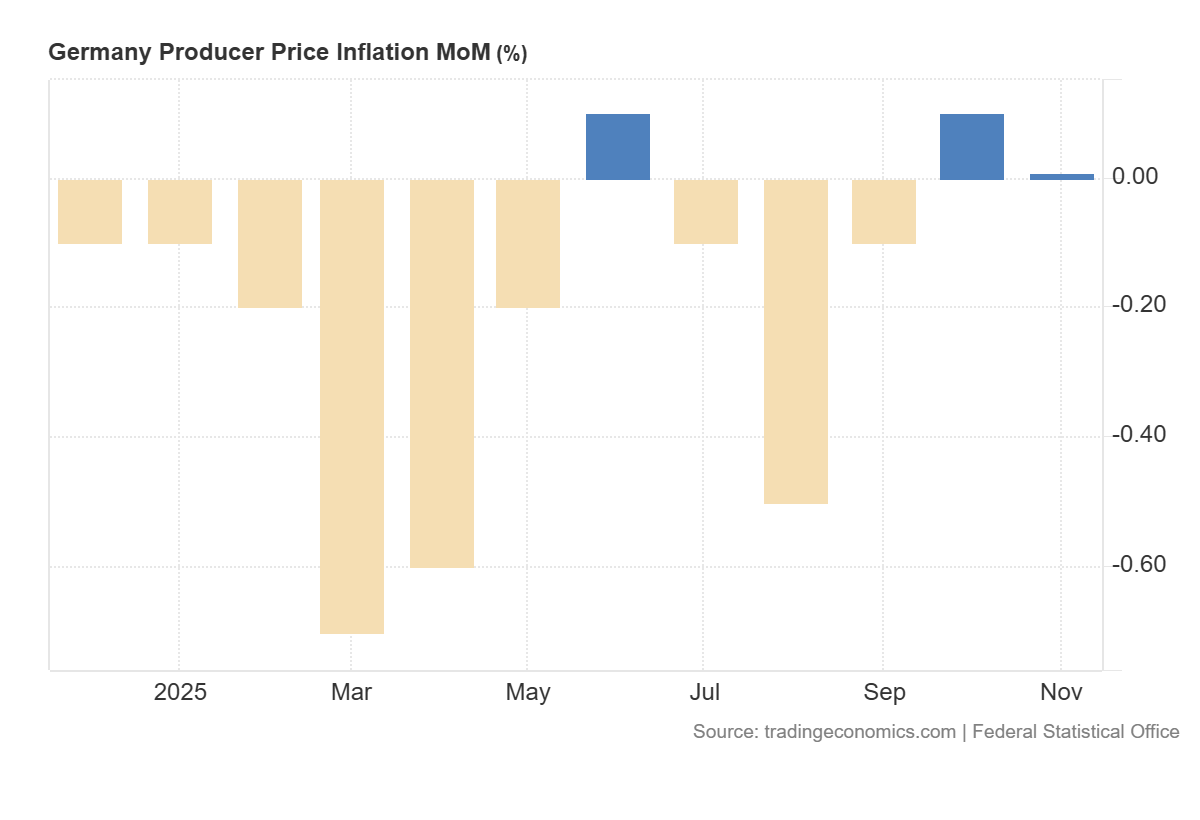

- Recent data: Germany’s PPI for November came in at 0.0%

- Market impact: the data creates a positive background for the German equity market

DE 40 fundamental analysis

The Producer Price Index (PPI) shows how prices change at the producer level — in other words, at the “input” stage for businesses. This is an important indicator of inflationary pressure: when PPI accelerates, companies face higher costs, which can later pass through to consumer prices. When PPI slows or remains flat, it signals a calmer cost environment.

In the current release, PPI (MoM) stood at 0.0%, compared with a forecast of 0.1% and a previous reading of 0.1%. For the German equity market, this usually acts as a moderately positive signal: weaker producer price growth reduces the risk of accelerating inflation and lowers the probability of aggressive action by the central bank, which supports equity valuations.

For the DE 40 index, the effect is most often moderately positive but depends on the structure of its constituents. The index includes many exporters and international corporations, so the reaction may remain restrained. From a business perspective, zero PPI growth implies more predictable costs and less pressure on margins in industries with a high share of raw materials and energy in their cost base.

Germany Producer Price Inflation MoM: https://tradingeconomics.com/germany/producer-price-inflation-momDE 40 technical analysis

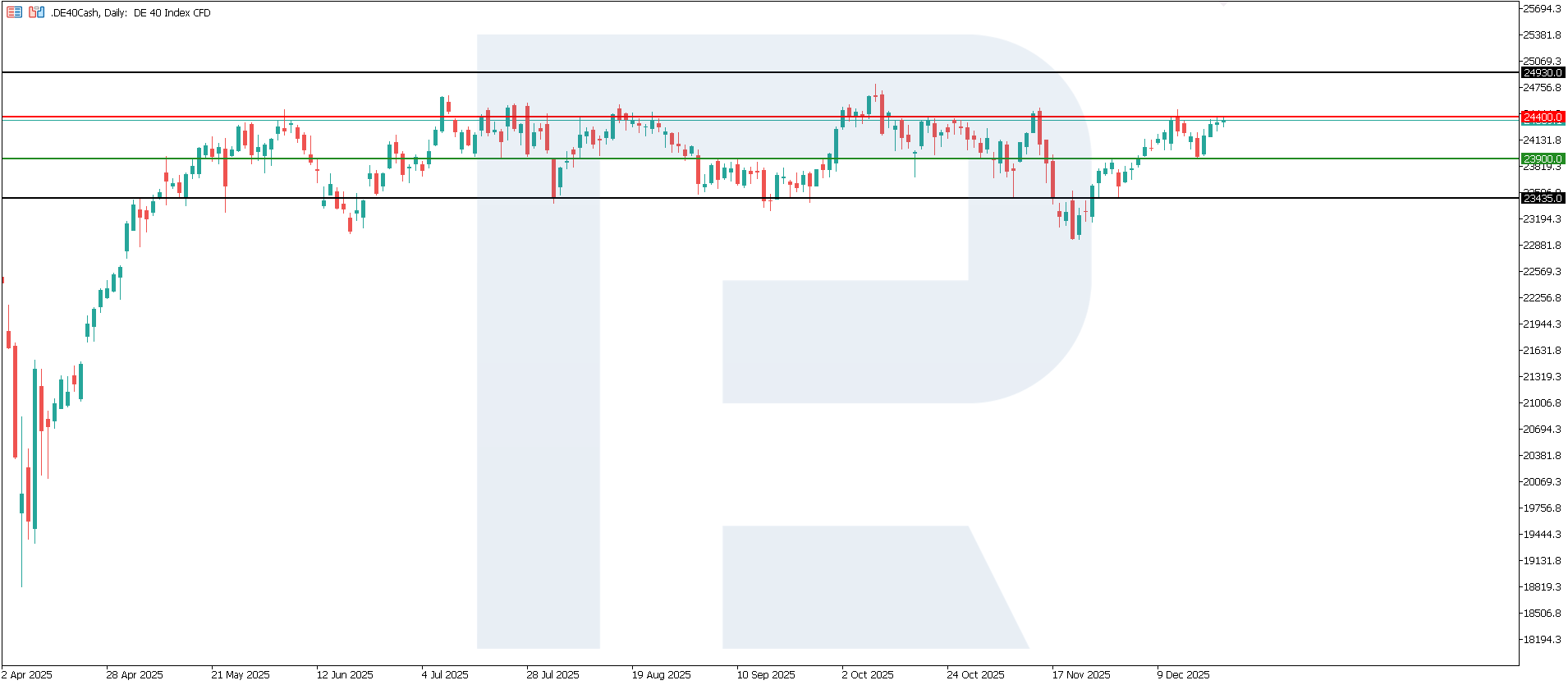

For the DE 40 index, key resistance has formed around 24,400.0, while a new support zone lies near 23,900.0. At present, downwards movement dominates the market, although elevated volatility makes it difficult to assess how long it may last. The nearest indicative downside target stands at 23,435.0.

DE 40 price forecast scenarios:

- Bearish scenario: if support at 23,900.0 is broken, prices may fall to 23,435.0

- Bullish scenario: if resistance at 24,400.0 is broken, prices may rise to 24,930.0

Summary

Overall, Germany’s PPI data point to easing inflationary pressure at the business level. The absence of price growth relative to expectations reduces the risk of further monetary tightening and creates a more stable environment for the corporate sector. For the equity market, this is a moderately positive signal: companies benefit from more predictable costs, while investors gain additional grounds to expect the continuation of favourable financial conditions.

Editors’ picks

EURUSD 2026-2027 forecast: key market trends and future predictions

EURUSD 2026-2027 forecast: key market trends and future predictionsThis article provides the EURUSD forecast for 2026 and 2027 and highlights the main factors determining the direction of the pair’s movements. We will apply technical analysis, take into account the opinions of leading experts, large banks, and financial institutions, and study AI-based forecasts. This comprehensive insight into EURUSD predictions should help investors and traders make informed decisions.

Gold (XAUUSD) forecast 2026 and beyond: expert insights, price predictions, and analysis

Gold (XAUUSD) forecast 2026 and beyond: expert insights, price predictions, and analysisDive deep into the Gold (XAUUSD) price outlook for 2026 and beyond, combining technical analysis, expert forecasts, and key macroeconomic factors. It explains the drivers behind gold’s recent surge, explores potential scenarios including a move toward 4,500 to 5,000 USD per ounce, and highlights why the metal remains a strong hedge during global uncertainty.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.