DE 40 forecast: the index continues to correct after reaching a new all-time high

Despite the ongoing correction, the overall trend of the DE 40 index remains upward. The DE 40 forecast for today is positive.

DE 40 forecast: key takeaways

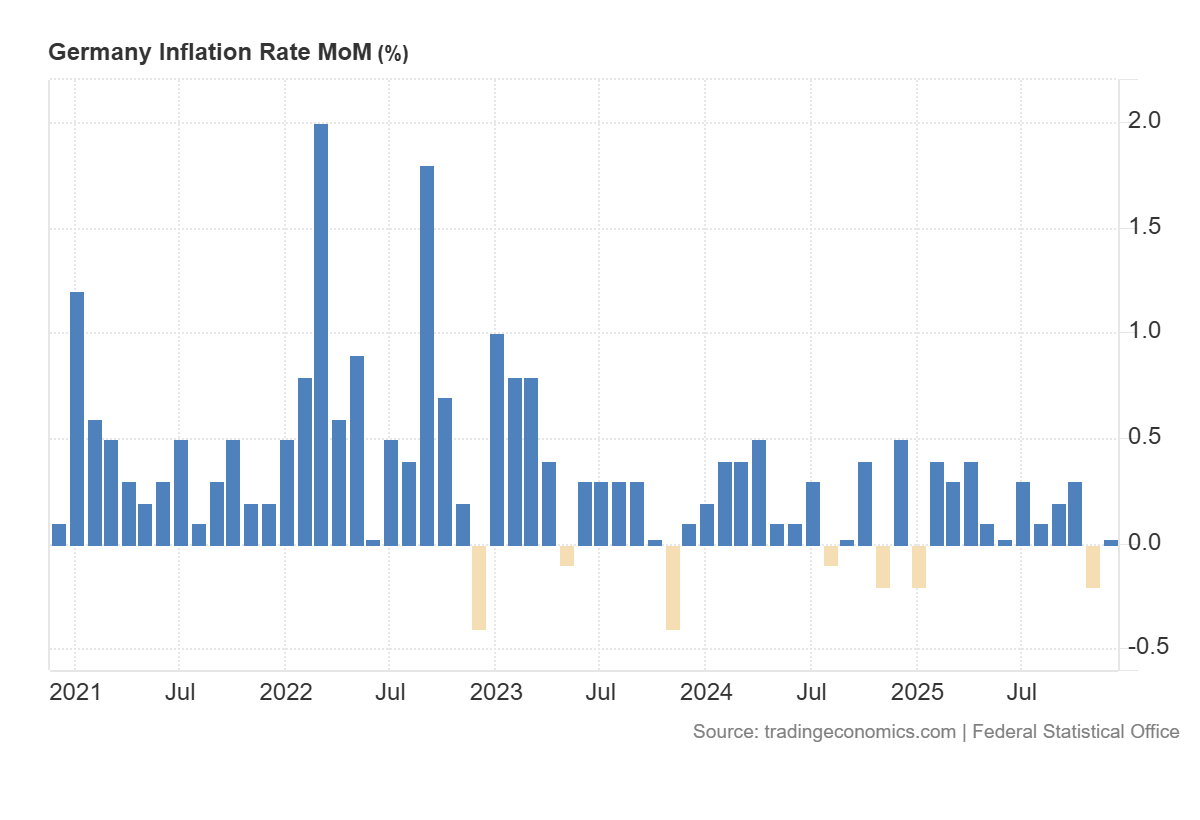

- Recent data: Germany’s CPI for December remained unchanged at 0.0%

- Market impact: the data creates a positive backdrop for the German equity market

DE 40 fundamental analysis

Germany’s consumer inflation came in at 0.0% month-on-month, in line with expectations, following −0.2% in the previous month. For the equity market, this typically signals that price pressure remains weak and that the disinflationary environment in the economy is still favourable. Since the figure fully matched forecasts, it did not come as a surprise and therefore is unlikely to trigger sharp price movements.

For the DE 40 index, the impact is usually more closely linked to the currency, as the index has a strong export-oriented component. If markets interpret zero inflation as an argument in favour of a more accommodative ECB policy, this may weaken the euro. A weaker euro typically improves exporters’ competitiveness and supports their reported revenues when foreign-currency earnings are converted back into euros. At the same time, the lack of price growth could fuel discussions about weak domestic dynamics in Germany.

Germany’s inflation rate m/m: https://tradingeconomics.com/germany/inflation-rate-momDE 40 technical analysis

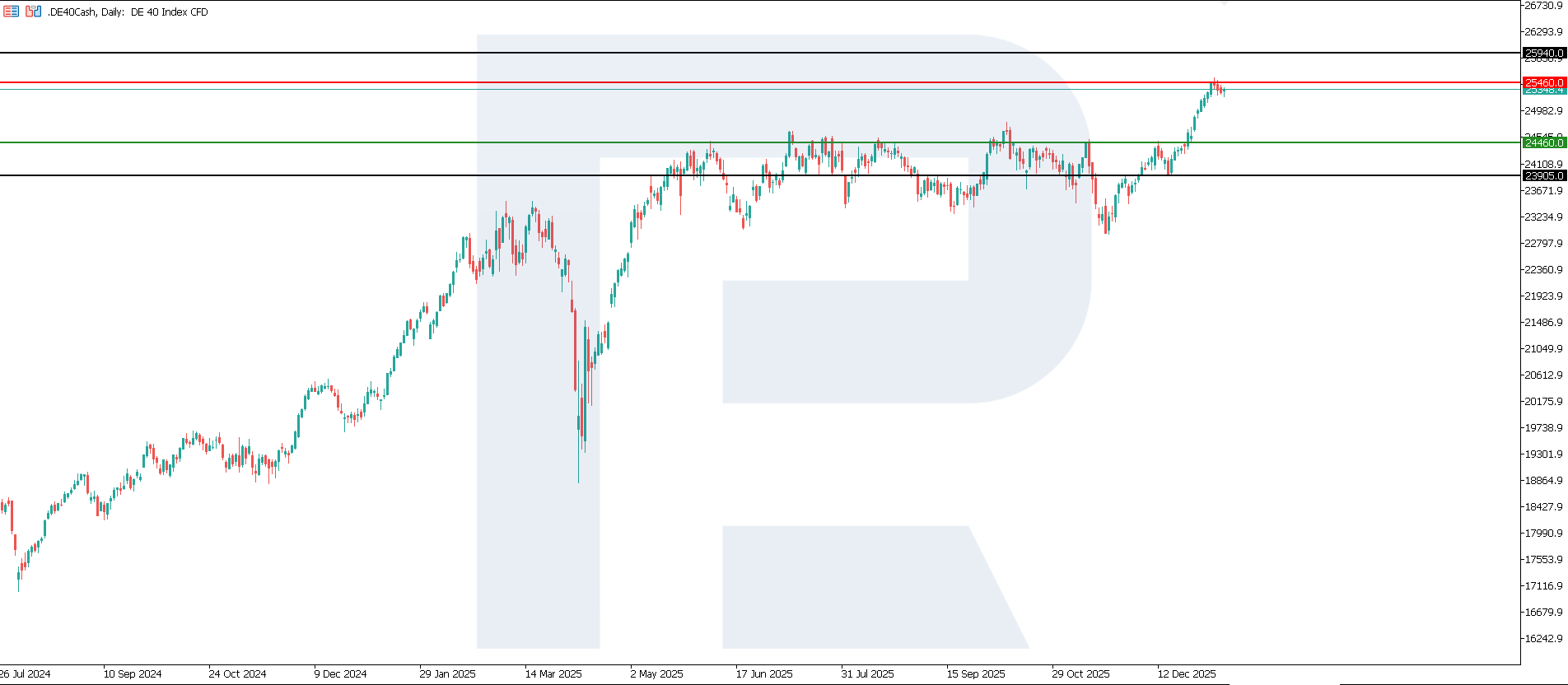

For the DE 40 index, the key resistance level is formed at 25,460.0, while the support level is located around 24,460.0. A strong uptrend currently prevails, with prices continuing to reach new all-time highs. The nearest upside target could be 25,940.0.

The DE 40 price forecast considers the following scenarios:

- Pessimistic DE 40 scenario: a breakout below the 24,460.0 support level could push the index lower towards 23,905.0

- Optimistic DE 40 scenario: a breakout above the 25,460.0 resistance level could drive the index up to 25,940.0

Summary

Germany’s CPI at 0.0% m/m, in line with expectations, is broadly neutral for the stock market in the immediate term but slightly supportive in direction, as it confirms weak inflationary pressure and thus underpins expectations of more accommodative financial conditions. For the DE 40, the effect is most likely to manifest itself through changes in the EUR rate and may remain moderately positive if the euro weakens, while staying limited due to the lack of surprise in the data. The nearest upside target remains 25,940.0.

Editors’ picks

EURUSD 2026-2027 forecast: key market trends and future predictions

EURUSD 2026-2027 forecast: key market trends and future predictionsThis article provides the EURUSD forecast for 2026 and 2027 and highlights the main factors determining the direction of the pair’s movements. We will apply technical analysis, take into account the opinions of leading experts, large banks, and financial institutions, and study AI-based forecasts. This comprehensive insight into EURUSD predictions should help investors and traders make informed decisions.

Gold (XAUUSD) forecast 2026 and beyond: expert insights, price predictions, and analysis

Gold (XAUUSD) forecast 2026 and beyond: expert insights, price predictions, and analysisDive deep into the Gold (XAUUSD) price outlook for 2026 and beyond, combining technical analysis, expert forecasts, and key macroeconomic factors. It explains the drivers behind gold’s recent surge, explores potential scenarios including a move toward 4,500 to 5,000 USD per ounce, and highlights why the metal remains a strong hedge during global uncertainty.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.