DE 40 forecast: the index tested support, but the uptrend remains intact

The DE 40 stock index has completed its correction and is ready to resume growth. The DE 40 forecast for today is positive.

DE 40 forecast: key takeaways

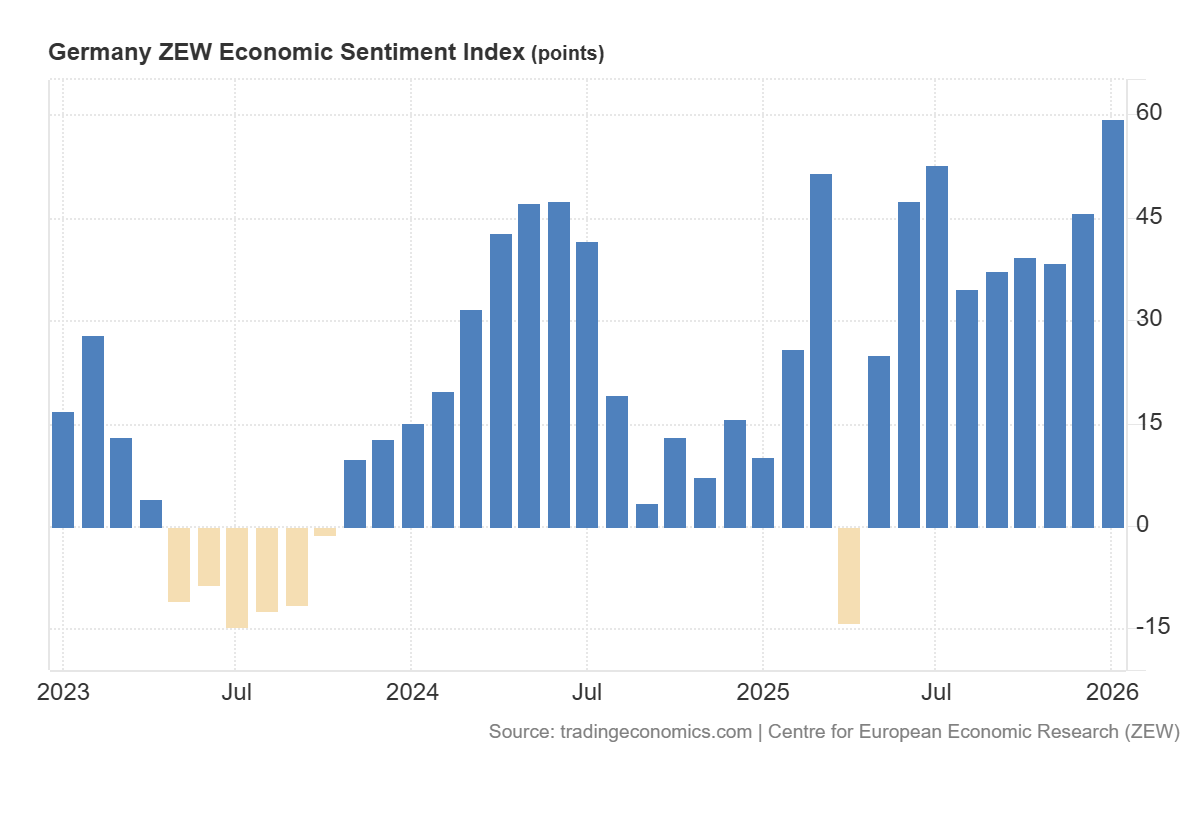

- Recent data: Germany’s ZEW Economic Sentiment Index came in at 59.6 in December

- Market impact: the data creates a positive backdrop for the German equity market

DE 40 fundamental analysis

Germany’s ZEW Economic Sentiment Index rose to 59.6 points, significantly exceeding the forecast of 50.0 and improving markedly from 45.8 previously. For equity markets, this is primarily a positive signal, as the ZEW index is a leading indicator of sentiment and reflects improving expectations among professional analysts regarding economic dynamics in the coming months. When expectations rise sharply and beat consensus estimates, investors typically interpret this as a lower recession risk and as justification for more optimistic estimates of future corporate earnings, particularly in cyclical sectors.

For the DE 40 index, the effect is typically more pronounced than for the broader market, as the index has a high weighting of global industrial and export-oriented companies whose performance is strongly linked to growth and order expectations. Improving ZEW sentiment increases the likelihood of a recovery in demand and stronger corporate results, which is generally supportive for industrials, automakers, chemicals, and capital goods producers, thereby underpinning the index as a whole.

Germany’s ZEW Economic Sentiment Index: https://tradingeconomics.com/germany/zew-economic-sentiment-indexDE 40 technical analysis

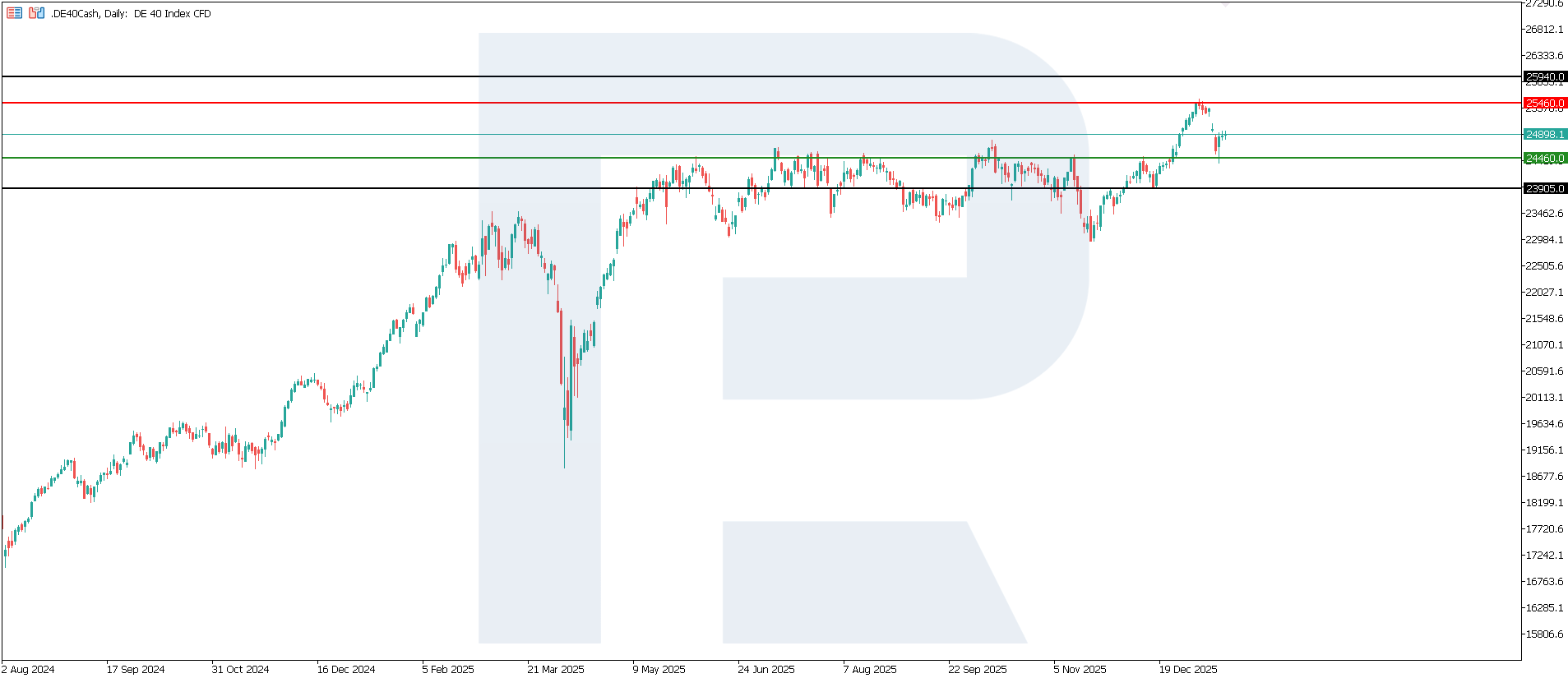

For the DE 40 index, the key resistance level is formed at 25,460.0, while the support level is located around 24,460.0. Recently, the index has undergone a correction, with prices testing the support area. The nearest upside target could be 25,940.0.

The DE 40 price forecast considers the following scenarios:

- Pessimistic DE 40 scenario: a breakout below the 24,460.0 support level could send the index down to 23,905.0

- Optimistic DE 40 scenario: a breakout above the 25,460.0 resistance level could boost the index up to 25,940.0

Summary

The strong upside surprise in the ZEW index is a positive factor for the German stock market and generally supports the DE 40 by improving growth and earnings expectations. However, the scale and durability of this effect may be limited by the reaction of the euro and bond yields, as well as by the need for confirmation from real macroeconomic data. The nearest upside target remains 25,940.0.

Editors’ picks

EURUSD 2026-2027 forecast: key market trends and future predictions

EURUSD 2026-2027 forecast: key market trends and future predictionsThis article provides the EURUSD forecast for 2026 and 2027 and highlights the main factors determining the direction of the pair’s movements. We will apply technical analysis, take into account the opinions of leading experts, large banks, and financial institutions, and study AI-based forecasts. This comprehensive insight into EURUSD predictions should help investors and traders make informed decisions.

Gold (XAUUSD) forecast 2026 and beyond: expert insights, price predictions, and analysis

Gold (XAUUSD) forecast 2026 and beyond: expert insights, price predictions, and analysisDive deep into the Gold (XAUUSD) price outlook for 2026 and beyond, combining technical analysis, expert forecasts, and key macroeconomic factors. It explains the drivers behind gold’s recent surge, explores potential scenarios including a move toward 4,500 to 5,000 USD per ounce, and highlights why the metal remains a strong hedge during global uncertainty.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.