DE 40 forecast: the index is trading sideways

The DE 40 stock index failed to reverse the downtrend and entered a sideways channel. The DE 40 forecast for today is positive.

DE 40 forecast: key takeaways

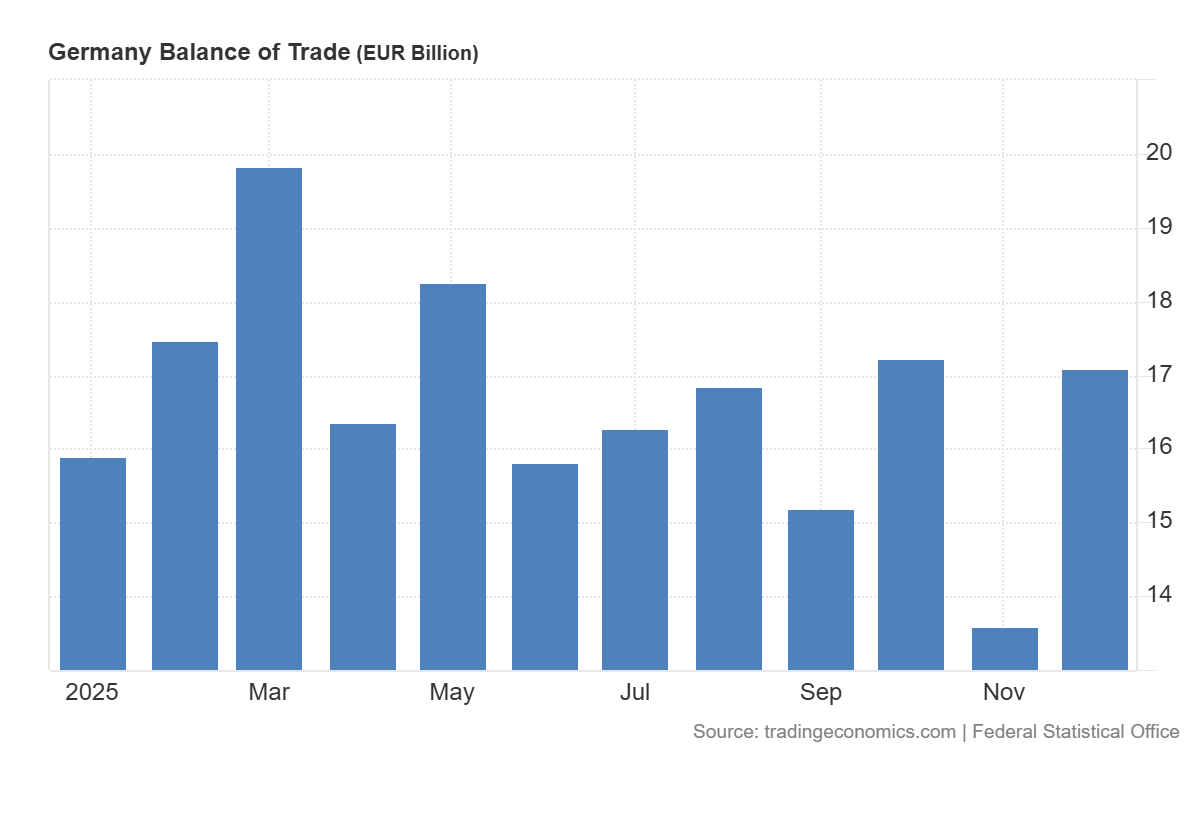

- Recent data: Germany’s trade balance for December totalled 17.1 billion EUR

- Market impact: the data creates a negative backdrop for the German equity market

DE 40 fundamental analysis

Germany’s trade balance data came in stronger than expected, with the actual figure reaching 17.1 billion EUR, above a forecast of 14.1 billion EUR and the previous reading. For the DE 40 index, this outcome typically represents a moderately favourable signal, as it points to relative resilience in external demand for German goods and the continued export potential of the eurozone’s largest economy. In practical terms, this supports revenue and cash flow expectations for companies focused on international markets, which account for a significant share of the German stock index.

In the short term, the impact on the DE 40 forms a positive expectations impulse, as the result exceeded consensus and indicates stronger-than-anticipated external dynamics. In the medium term, the significance of this release will depend on whether the trend is confirmed in subsequent publications and whether improvements in manufacturing indicators also follow. If confirmed, the German market may receive more sustainable support, particularly in cyclical export-oriented sectors. If confirmation does not materialise, the effect will remain localised and limited to a short-term reaction to the positive statistical surprise.

Germany’s balance of trade: https://tradingeconomics.com/germany/balance-of-tradeDE 40 technical analysis

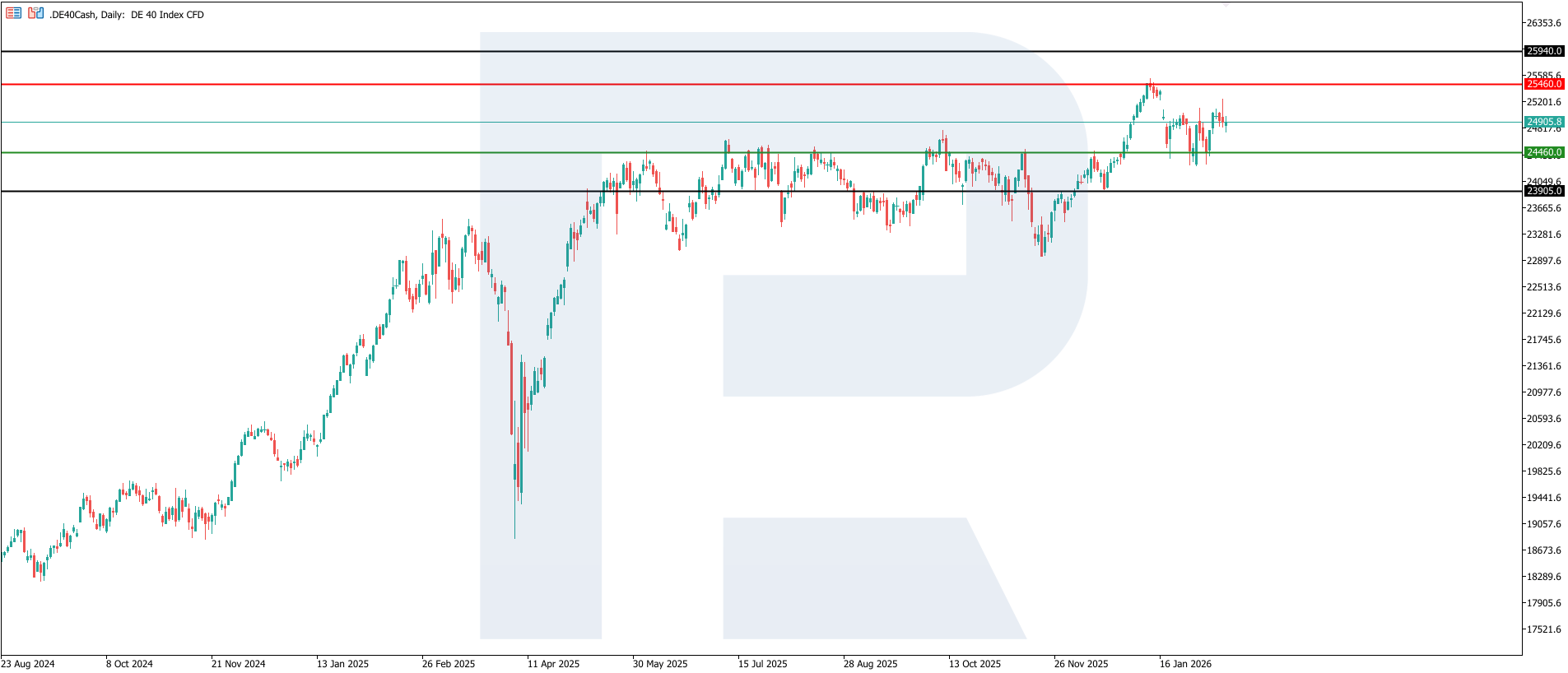

For the DE 40 index, the crucial resistance level is located at 25,460.0, with the key support level around 24,460.0. In recent trading sessions, the index has been in a correction phase and has tested the support level. If the recovery continues, the nearest upside target could be 25,940.0.

The DE 40 price forecast considers the following scenarios:

- Pessimistic DE 40 scenario: a breakout below the 24,460.0 support level could push the index down to 23,905.0

- Optimistic DE 40 scenario: a breakout above the 25,460.0 resistance level could drive the index up to 25,940.0

Summary

The baseline conclusion for the DE 40 is as follows: the current release is rather favourable for the DE 40 and for overall sentiment towards the German equity market, as it increases confidence in the resilience of Germany’s export profile. Export-oriented industrial sectors appear most sensitive to the positive surprise, while domestic and regulated segments are likely to experience a more moderate and indirect impact through the broader macroeconomic backdrop. The nearest upside target remains 25,940.0.

Editors’ picks

EURUSD 2026-2027 forecast: key market trends and future predictions

EURUSD 2026-2027 forecast: key market trends and future predictionsThis article provides the EURUSD forecast for 2026 and 2027 and highlights the main factors determining the direction of the pair’s movements. We will apply technical analysis, take into account the opinions of leading experts, large banks, and financial institutions, and study AI-based forecasts. This comprehensive insight into EURUSD predictions should help investors and traders make informed decisions.

Gold (XAUUSD) forecast 2026 and beyond: expert insights, price predictions, and analysis

Gold (XAUUSD) forecast 2026 and beyond: expert insights, price predictions, and analysisDive deep into the Gold (XAUUSD) price outlook for 2026 and beyond, combining technical analysis, expert forecasts, and key macroeconomic factors. It explains the drivers behind gold’s recent surge, explores potential scenarios including a move toward 4,500 to 5,000 USD per ounce, and highlights why the metal remains a strong hedge during global uncertainty.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.