World indices overview: news from US 30, US 500, US Tech, JP 225, and DE 40 for 13 February 2025

Global indices responded negatively to rising US inflation, with the German DE 40 index as the only exception. Find out more in our analysis and forecast for global indices for 13 February 2025.

US indices forecast: US 30, US 500, US Tech

- Recent data: the US CPI was 3.0% year-on-year

- Market impact: rising inflation may prompt the Federal Reserve to tighten its monetary policy, which will negatively affect the stock market

Fundamental analysis

All inflation indicators (both headline and core) exceeded market expectations. Guided by the Federal Reserve’s tough comments and high price growth rates, investors may revise their key rate forecasts upwards or in favour of keeping the rates unchanged for an extended period. It will depend on how decisively the regulator acts and how rapidly inflation will fall without serious damage to the economy.

If interest rates remain unchanged, the US stock market risks facing pressure on quotes, especially in the short term. The market may respond with increased volatility as any statements by Federal Reserve officials about policy tightening or actions will directly impact borrowing costs for businesses and households.

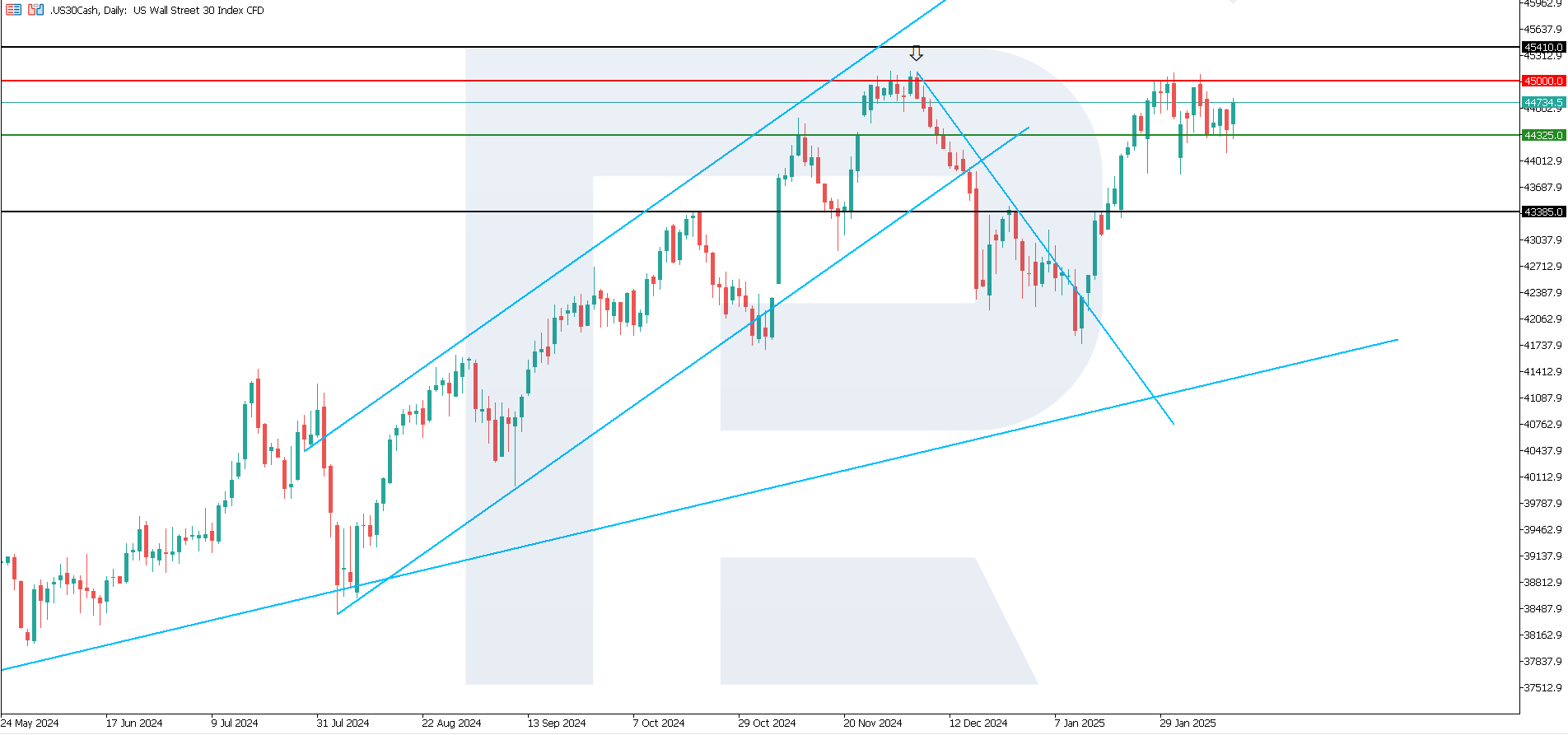

US 30 technical analysis

The US 30 stock index is trading near the 44,325.0 support level. According to the US 30 technical analysis, a breakout below this level will open the way for a downtrend. This scenario is considered the most likely in the short term.

The following scenarios are considered for the US 30 price forecast:

- Pessimistic US 30 forecast: a breakout below the 44,325.0 support level could push the index down to 43,385.0

- Optimistic US 30 forecast: a breakout above the 45,000.0 resistance level could drive the index to 45,410.0

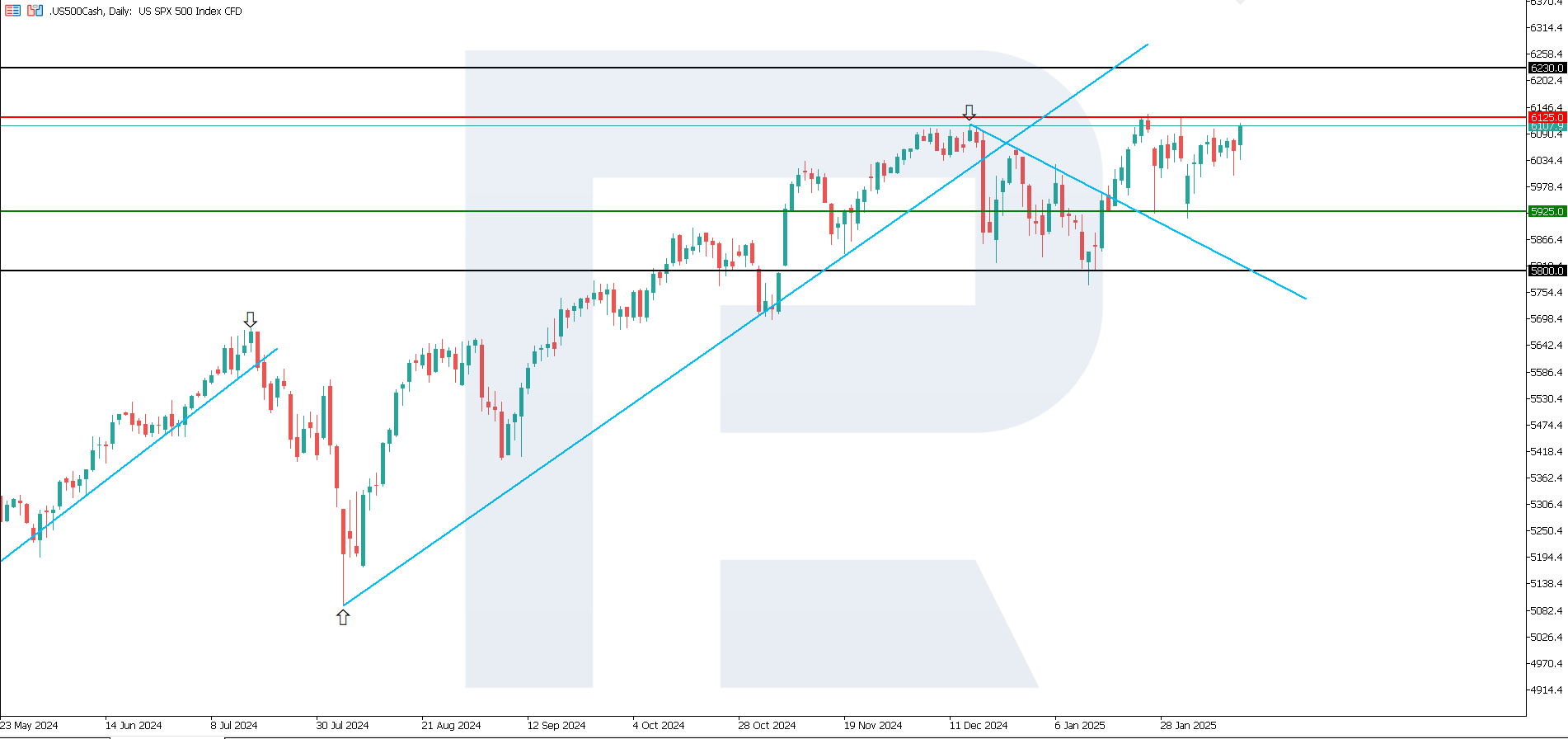

US 500 technical analysis

The US 500 stock index has been trading in a sideways channel for nearly a month. There are no prerequisites for a trend to form. According to the US 500 technical analysis, the price will most likely break below the lower boundary of the channel at 5,925.0.

The following scenarios are considered for the US 500 price forecast:

- Pessimistic US 500 forecast: a breakout below the 5,925.0 support level could send the index down to 5,800.0

- Optimistic US 500 forecast: a breakout above the 6,125.0 resistance level could propel the index to 6,230.0

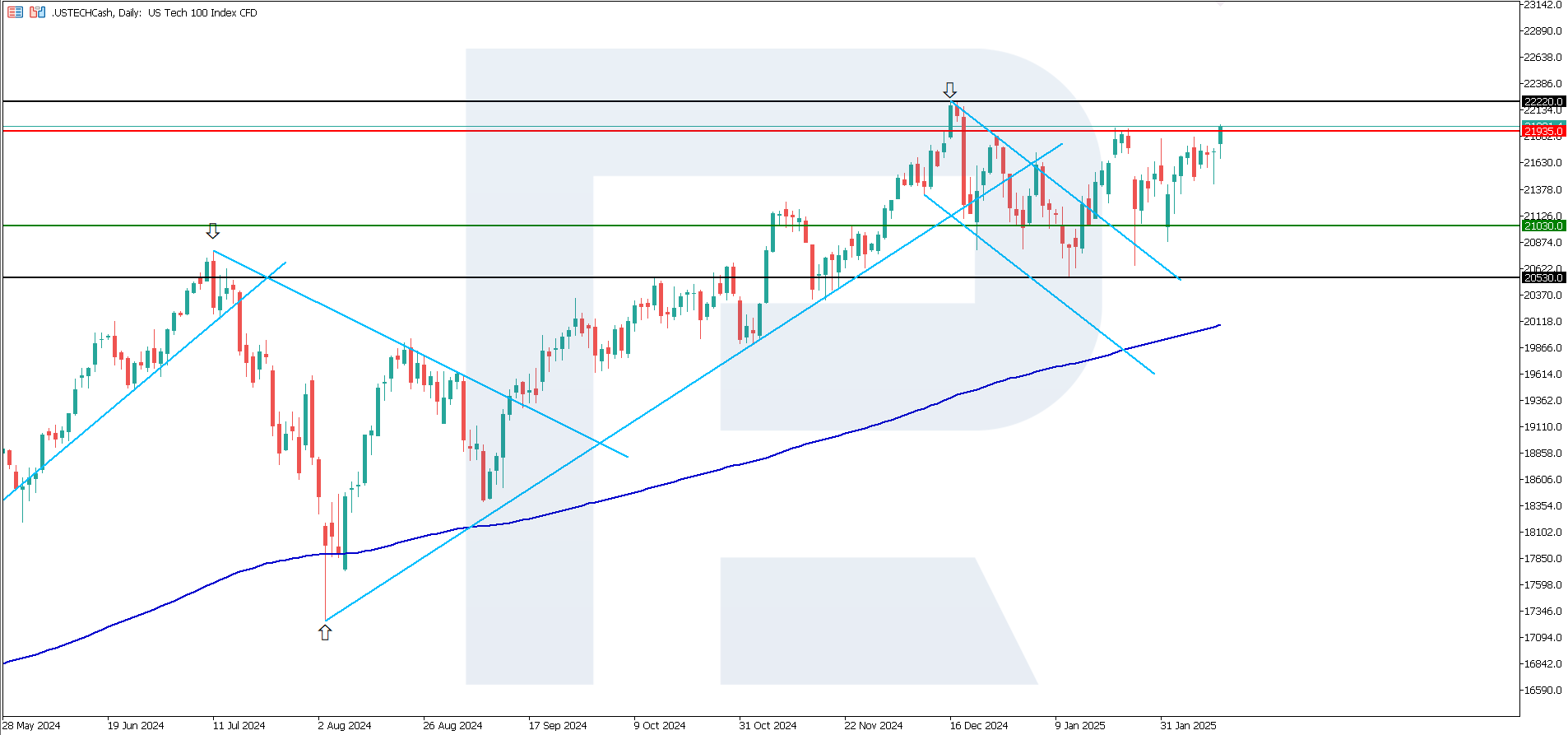

US Tech technical analysis

Having broken out of the descending channel, the US Tech index is trading in a sideways channel. The uptrend will persist in the medium term. However, according to the US Tech technical analysis, the price will unlikely breach the range boundaries in the short term.

The following scenarios are considered for the US Tech price forecast:

- Pessimistic US Tech forecast: a breakout below the 21,030.0 support level could send the index down to 20,530.0

- Optimistic US Tech forecast: a breakout above the 21,935.0 resistance level could push the index up to 22,220.0

Asian index forecast: JP 225

- Recent data: Japan’s wholesale prices rose by 4.2% year-on-year in January

- Market impact: this could lead to further tightening of monetary policy by the Bank of Japan and pressure on the stock market

Fundamental analysis

Japan’s annual wholesale price growth accelerated to 4.2% in January, the highest level in seven months, indicating persistent price pressures and reinforcing market expectations for another interest rate hike this year.

The data was released shortly after Bank of Japan Governor Kazuo Ueda warned on Wednesday that continued food price growth could weigh on people’s inflation expectations, highlighting the central bank’s focus on rising inflation risks. News of higher wholesale inflation is typically perceived as a bearish signal for the stock market due to the risk of more rapid rate hikes and increased costs for companies.

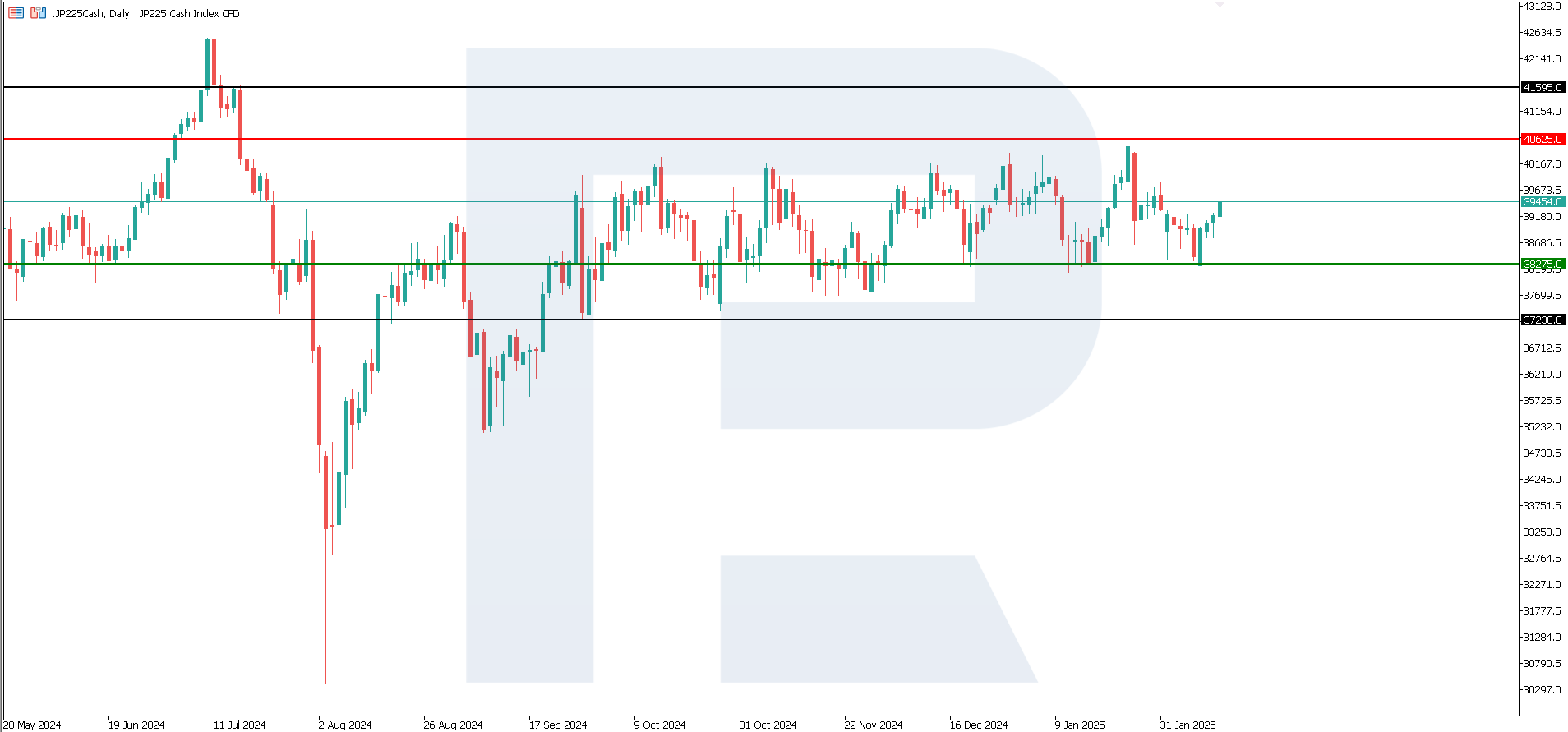

JP 225 technical analysis

The JP 225 stock index has rebounded from the lower boundary of the sideways channel at 38,275.0 and is rising to the 40,625.0 resistance level. As the JP 225 technical analysis shows, the price will unlikely break above this level in the short term. The sideways trend is medium-lived.

The following scenarios are considered for the JP 225 price forecast:

- Pessimistic JP 225 forecast: a breakout below the 38,275.0 support level could push the index down to 37,230.0

- Optimistic JP 225 forecast: a breakout above the 40,625.0 resistance level could propel the index to 41,595.0

European index forecast: DE 40

- Recent data: Germany’s CPI declined from 2.6% to 2.3% year-on-year

- Market impact: this is rather positive news for the German stock market as easing inflation reduces the likelihood of aggressive ECB rate hikes and may support domestic demand

Fundamental analysis

The CPI decreased slightly year-on-year (from 2.6% to 2.3%), indicating a potential slowdown in price growth. Investors often view lower inflation as a positive factor as it reduces the risk of monetary policy tightening (interest rate hikes) by the ECB.

Since the data aligned with expectations and showed a moderate fall in annual inflation, the reaction may be neutral to positive. There could be a slight increase in investor confidence that the economy will not face excessively tight financing conditions.

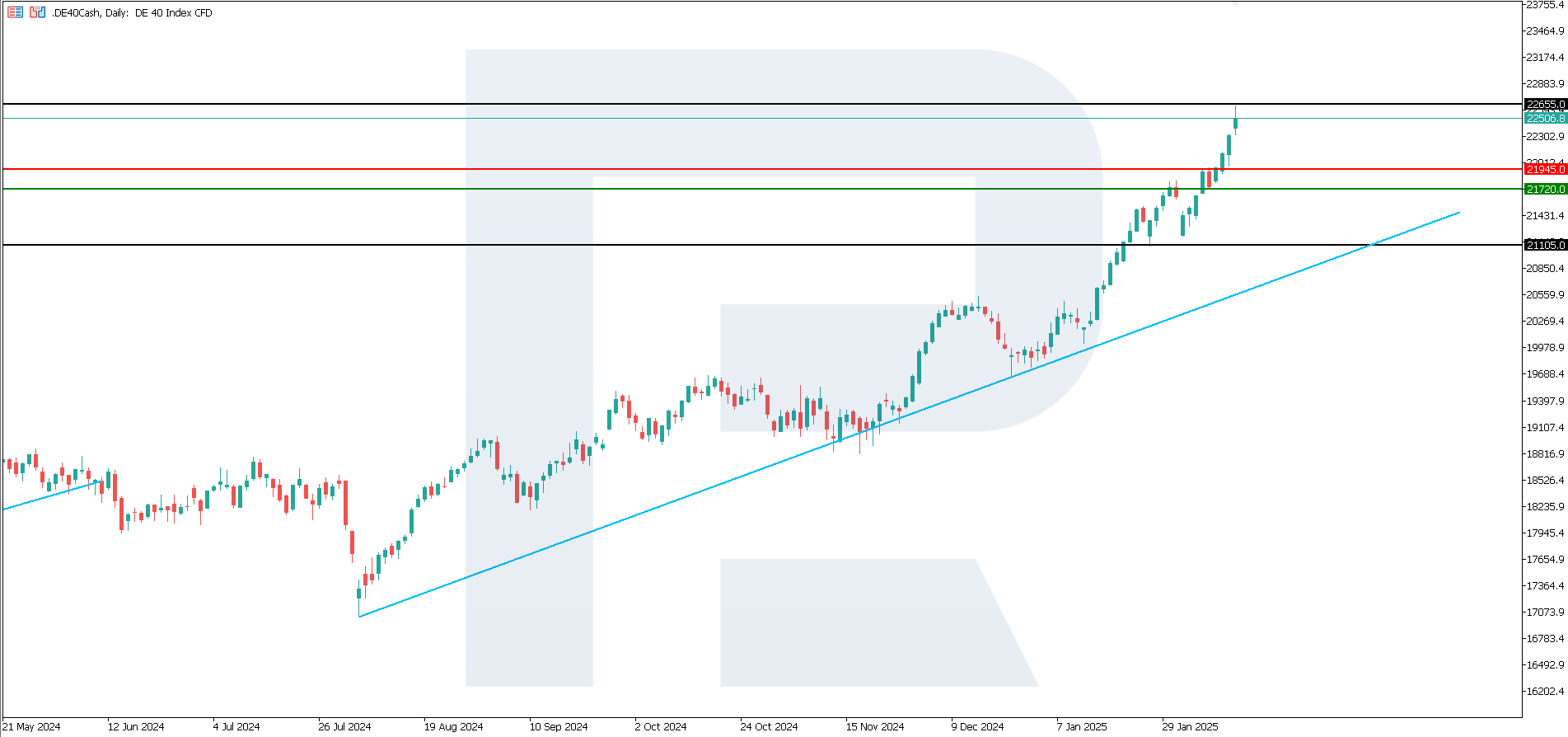

DE 40 technical analysis

The DE 40 stock index is in an uptrend and has firmly consolidated above the previously breached resistance level at 21,945.0. According to the DE 40 technical analysis, a correction could follow in the short term, with the uptrend highly likely to continue once the correction is complete.

The following scenarios are considered for the DE 40 price forecast:

- Pessimistic DE 40 forecast: a breakout below the 21,195.0 support level could send the index down to 20,540.0

- Optimistic DE 40 forecast: if the price consolidates above the previously breached resistance level at 21,945.0, it could climb to 22,655.0

Summary

US stock indices are trading in sideways channels, as is Japan’s JP 225 index, with only the German DE 40 index in an uptrend. New US industrial inflation data and comments from Fed officials could lead to a trend reversal. New tariff initiatives by the White House cannot be ruled out either.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.