World indices overview: news from US 30, US 500, US Tech, JP 225, and DE 40 for 19 March 2025

Global stock indices are rising after a protracted decline, with the German DE 40 being the only one to maintain its upward momentum. Find out more in our analysis and forecast for global indices for 19 March 2025.

US indices forecast: US 30, US 500, US Tech

- Recent data: US retail sales rose by 0.2% in February

- Market impact: retail sales reports are particularly significant for companies involved in the consumer sector

Fundamental analysis

Retail sales data is one of the key gauges of consumer spending, which accounts for a significant part of US GDP. A lower-than-expected reading (as in this case, growth of 0.2% below the expected 0.6%) may raise concerns about a decline in consumer activity and slowing GDP growth.

The Federal Reserve takes into account retail sales data when making interest rate decisions. If demand falls, the regulator has more grounds to ease monetary policy. This week, the Fed will decide on the key rate, which will affect the medium-term trend in the US stock market.

US 30 technical analysis

The US 30 stock index rose by over 3% from six-month lows. However, the trend remains downward, with the current growth likely to be considered only a correction. The decline will continue to the 40,035.0 target in the short term.

The following scenarios are considered for the US 30 price forecast:

- Pessimistic US 30 forecast: if the price consolidates below the previously breached support level at 42,370.0, the index could plunge to 40,035.0

- Optimistic US 30 forecast: a breakout above the 42,910.0 resistance level could drive the index to 43,890.0

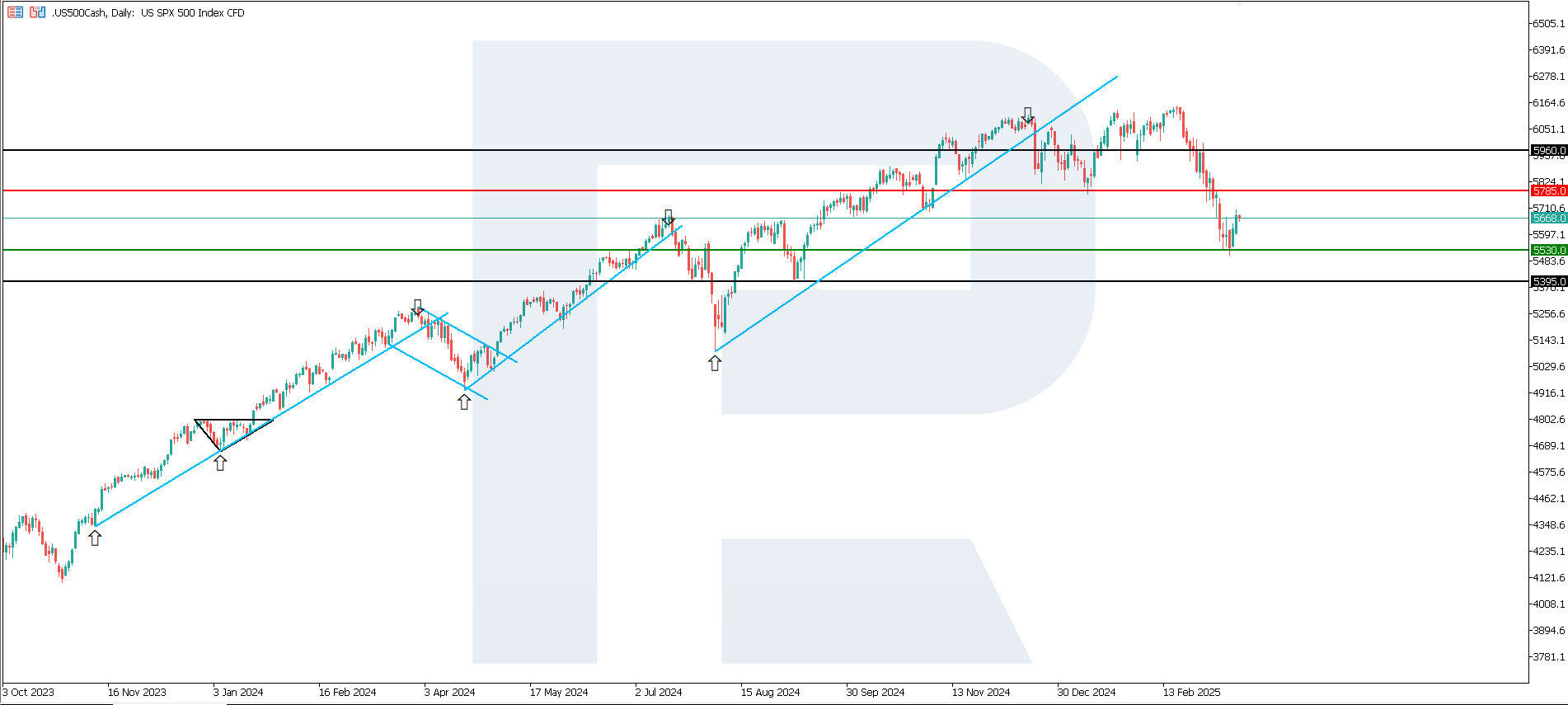

US 500 technical analysis

The US 500 stock index reached its highest level in the last week as part of a downtrend correction. The trend is unlikely to reverse in the short term, with bears dominating the market.

The following scenarios are considered for the US 500 price forecast:

- Pessimistic US 500 forecast: a breakout below the 5,530.0 support level could push the index down to 5,395.0

- Optimistic US 500 forecast: a breakout above the 5,785.0 resistance level could propel the index to 5,960.0

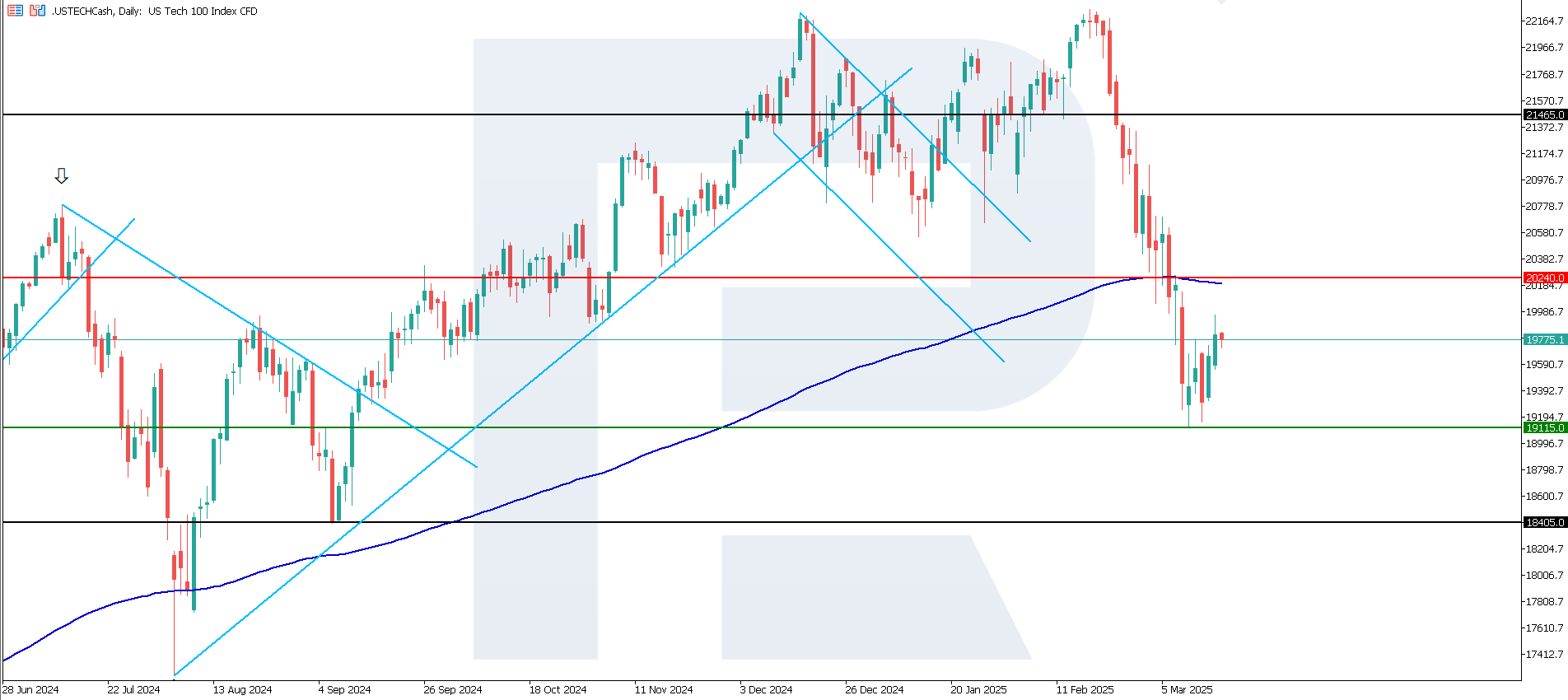

US Tech technical analysis

The US Tech index is trading below the 200-day Moving Average. Despite the growth in recent trading sessions, the trend is unlikely to reverse yet, with the next downside target at 18,405.0.

The following scenarios are considered for the US Tech price forecast:

- Pessimistic US Tech forecast: a breakout below the 19,115.0 support level could send the index down to 18,405.0

- Optimistic US Tech forecast: a breakout above the 20,240.0 resistance level could boost the index to 21,465.0

Asian index forecast: JP 225

- Recent data: analysts polled by Reuters expect the Bank of Japan to raise the interest rate to 0.75% in Q3 2025

- Market impact: higher interest rates can make Japanese government bonds more attractive to some market participants, which could lead to a capital flow from stocks to bonds

Fundamental analysis

Elevated rates typically make borrowings more expensive for companies, which may somewhat dampen investment and corporate earnings growth. Investors may reassess stocks, especially companies with high debt loads or those focused on domestic demand.

Overall, the stock market reaction depends on whether a rate hike is accompanied by positive economic factors. If the economy continues to strengthen, the stock market could react moderately or even positively, especially in the long term.

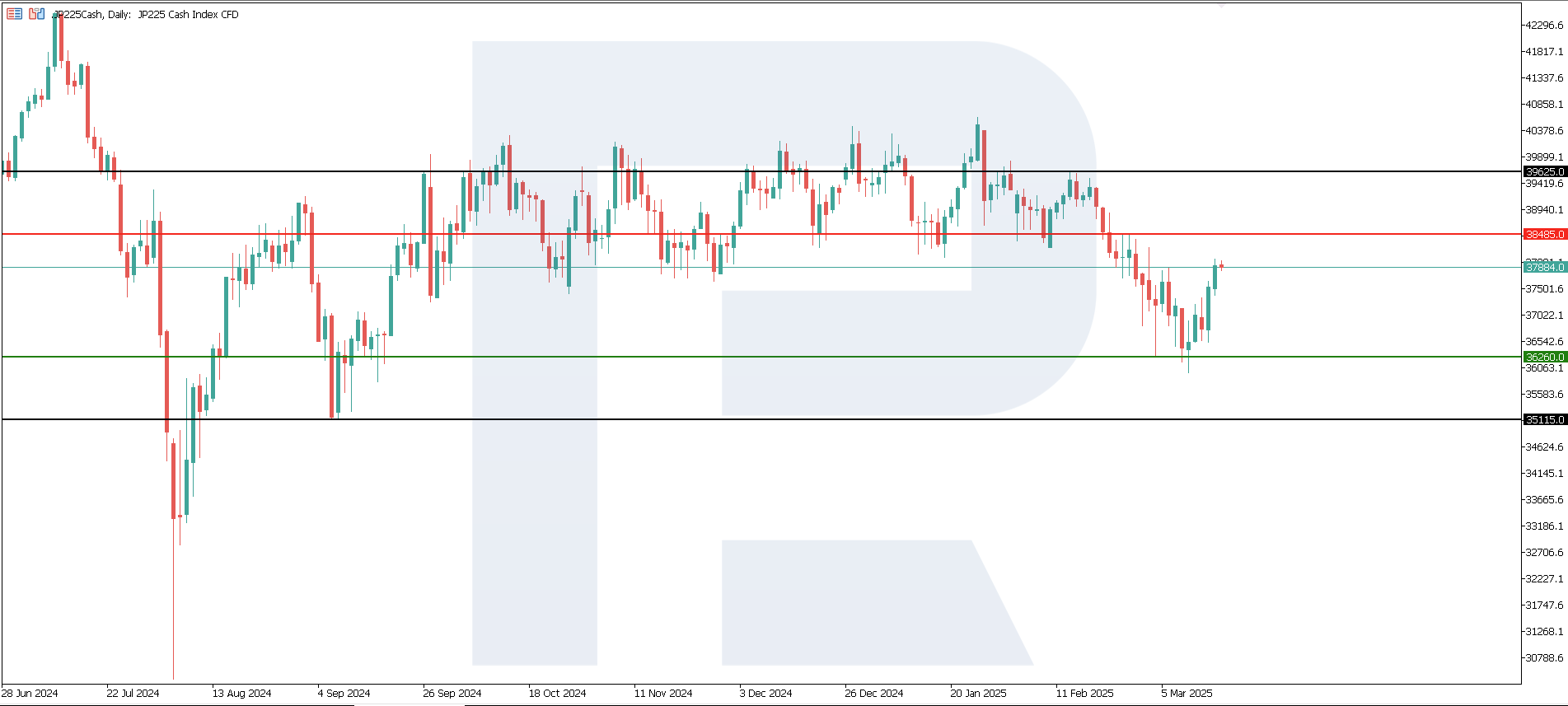

JP 225 technical analysis

The stock index climbed by over 4% from six-month lows, with the price approaching the 38,485.0 resistance level. If this level does not break, a sideways channel will highly likely form. In case of a breakout below the 36,260.0 support level, the downtrend could become long-term.

The following scenarios are considered for the JP 225 price forecast:

- Pessimistic JP 225 forecast: a breakout below the 36,260.0 support level could push the index down to 35,115.0

- Optimistic JP 225 forecast: a breakout above the 38,485.0 resistance level could propel the index to 39,625.0

European index forecast: DE 40

- Recent data: Germany’s CPI was 2.3% year-on-year in February

- Market impact: if inflation remains stable, equity investments become less risky

Fundamental analysis

With inflation aligning with expectations and showing no sharp increase, investors expect the European Central Bank to maintain the current monetary policy. The lack of surprises in inflation data typically reassures markets. Moderate inflation may indicate steady consumer demand, which potentially supports revenues of companies in the consumer goods and services sector.

If inflation rises significantly, investors may reconsider their positions in favour of more conservative assets such as bonds, which may put pressure on stock prices. Overall, Germany’s stable inflation data gives the market some confidence as the likelihood of strong ECB actions decreases, and companies can plan spending and prices based on a rather predictable dynamics.

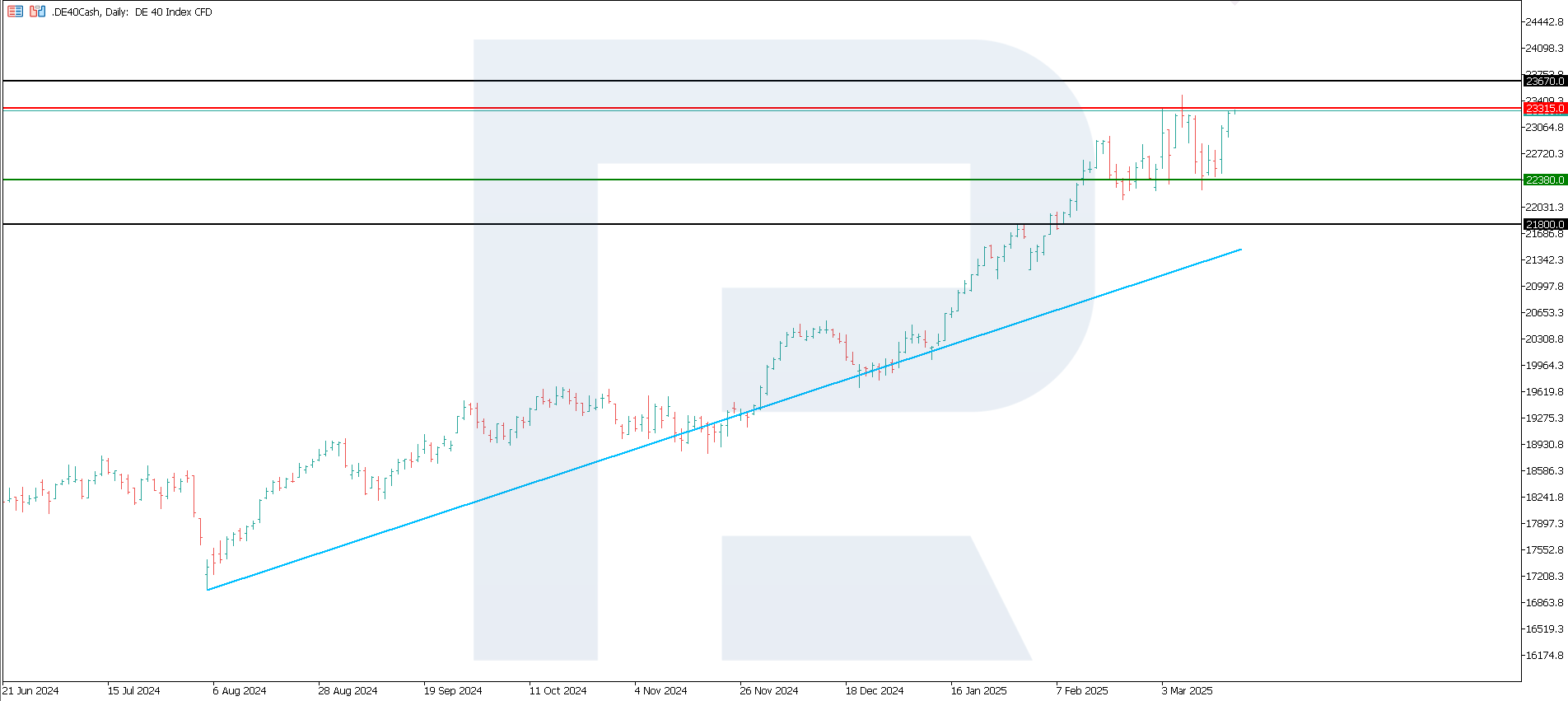

DE 40 technical analysis

The DE 40 stock index is one of a few to maintain its upward momentum. Following a correction of over 5%, the price will highly likely break above the 23,315.0 resistance level and rise to new all-time highs, with the first target at 23,670.0.

The following scenarios are considered for the DE 40 price forecast:

- Pessimistic DE 40 forecast: a breakout below the 22,380.0 support level could send the index down to 21,800.0

- Optimistic DE 40 forecast: a breakout above the 23,315.0 resistance level could drive the index to 23,670.0

Summary

All global stock indices are showing positive dynamics. However, the German DE 40 is the only one in an uptrend. The Japanese JP 225 could form a sideways channel again. The US indices are correcting after a protracted decline, but their trend remains downward. The US Federal Reserve decision on the key interest rate and the regulator’s subsequent comments on future monetary policy may change investor sentiment. One of the significant issues is the impact of new US tariffs on inflation trends.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.