World indices overview: news from US 30, US 500, US Tech, JP 225, and DE 40 for 20 March 2025

The German DE 40 stock index hit a new all-time high, while other global indices are still in a downtrend. Find out more in our analysis and forecast for global indices for 20 March 2025.

US indices forecast: US 30, US 500, US Tech

- Recent data: the US Federal Reserve interest rate remained steady at 4.5%

- Market impact: this decision may dampen investor anxiety and bolster short-term optimism

Fundamental analysis

Keeping the interest rate at 4.5% in line with expectations allows the Federal Reserve to maintain a tight but stable monetary policy without additional abrupts moves. The slowdown in QT since 1 April signals a more flexible approach to liquidity reduction: the Federal Reserve does not want to take money out of the market too quickly given the increased economic uncertainty.

Additional rate forecasts suggest a further 0.5% cut this year. In this case, this will be a sign to the market that the Fed sees the need to stimulate the economy amid the risks of recession. Overall, the US stock market may react with volatility, with some investors playing on dovish signals (the possibility of a rate cut) and others being concerned about growth rates and levels of inflation.

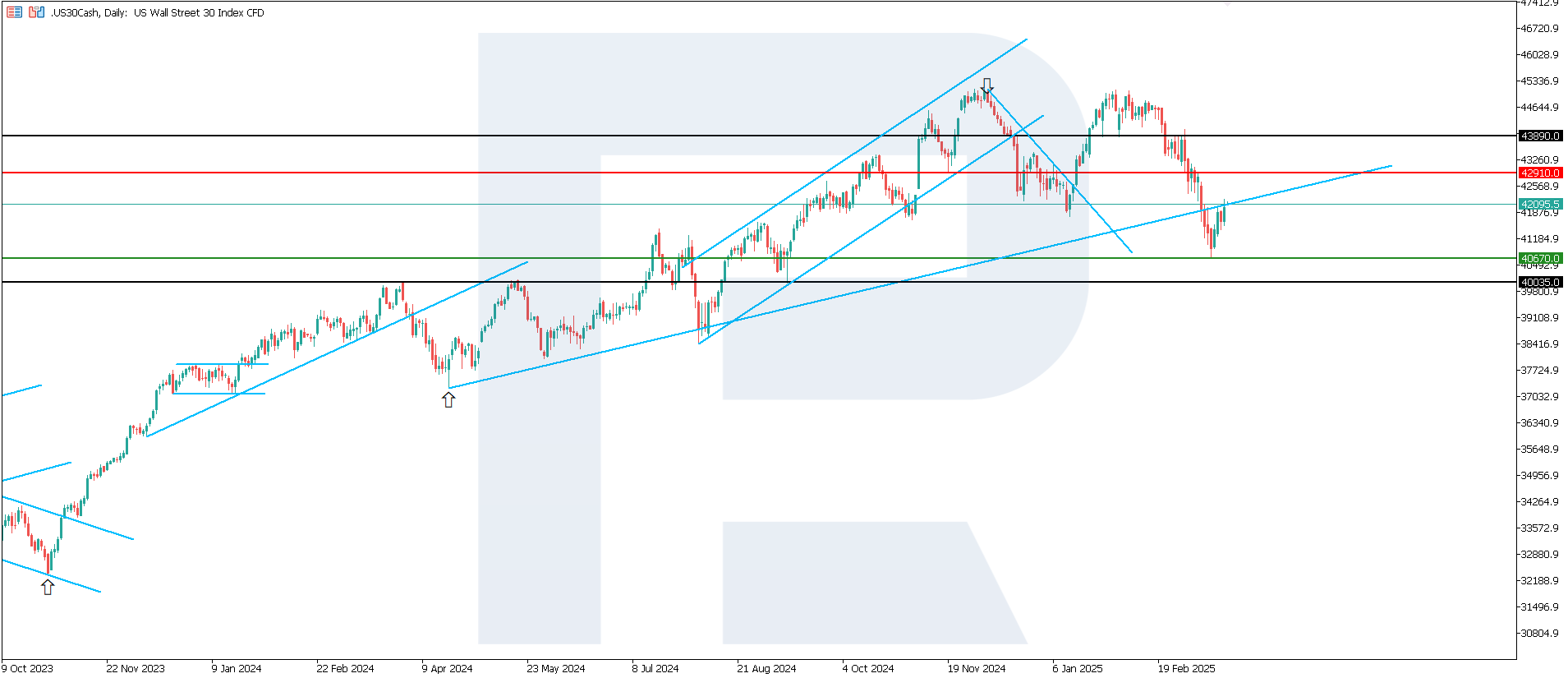

US 30 technical analysis

The global trend in the US 30 is still downward, but the stock index continues to correct. Following the correction, the price will highly likely break below the 42,370.0 support level. A trend reversal is only possible if quotes consolidate above 42,385.0.

The following scenarios are considered for the US 30 price forecast:

- Pessimistic US 30 forecast: after the price consolidates below the previously breached support level at 42,370.0, the index could tumble to 40,035.0

- Optimistic US 30 forecast: a breakout above the 42,910.0 resistance level could drive the index to 43,890.0

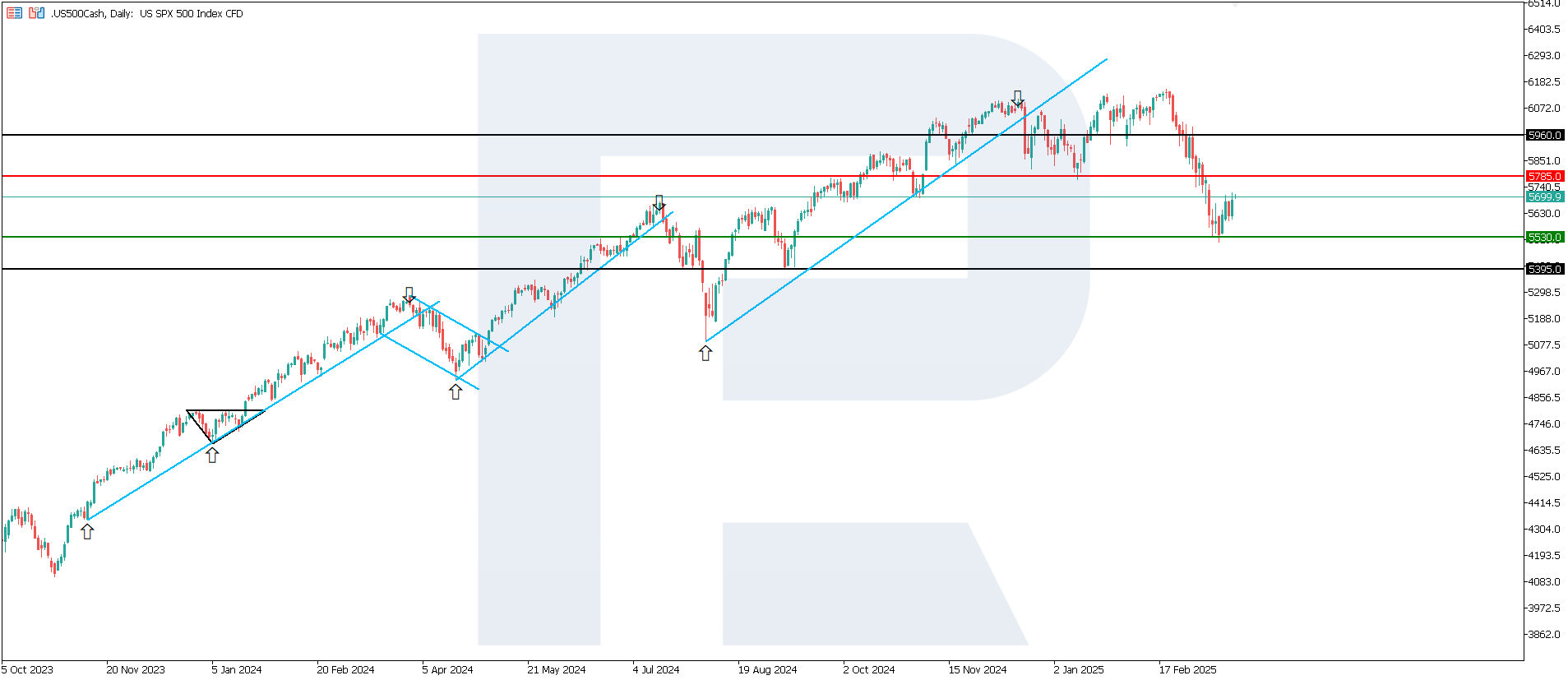

US 500 technical analysis

Although the US 500 stock index rose by 3.45%, the overall trend remains negative. Only a confident breakout and consolidation above the 5,785.0 resistance level will confirm the beginning of an uptrend. Otherwise, the quotes could fall to 5,395.0.

The following scenarios are considered for the US 500 price forecast:

- Pessimistic US 500 forecast: a breakout below the 5,530.0 support level could push the index down to 5,395.0

- Optimistic US 500 forecast: a breakout above the 5,785.0 resistance level could propel the index to 5,960.0

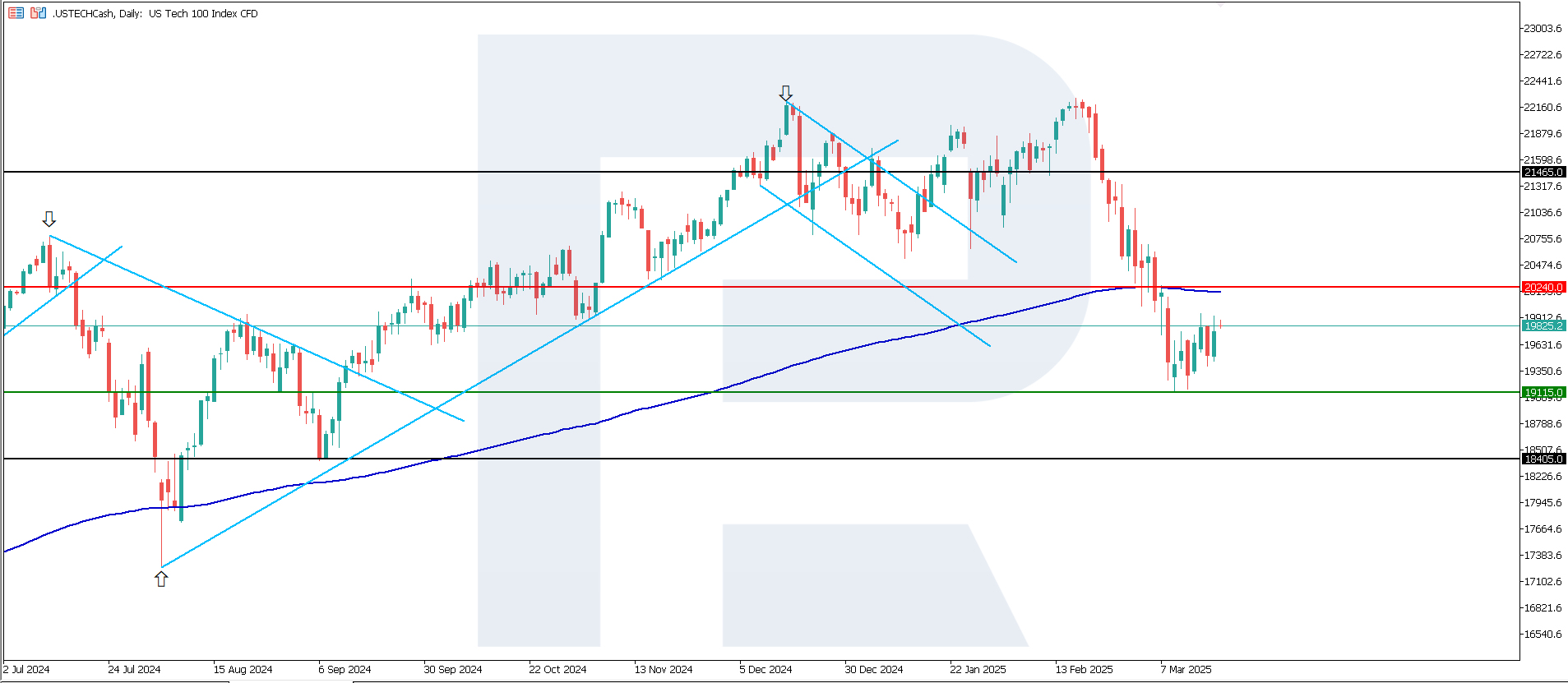

US Tech technical analysis

The US Tech index edged higher by over 4% but is still trading below the 200-day Moving Average. The downtrend is medium-term and could end only after a breakout above the 20,240.0 resistance level.

The following scenarios are considered for the US Tech price forecast:

- Pessimistic US Tech forecast: a breakout below the 19,115.0 support level could send the index down to 18,405.0

- Optimistic US Tech forecast: a breakout above the 20,240.0 resistance level could boost the index to 21,465.0

Asian index forecast: JP 225

- Recent data: the Bank of Japan held the interest rate steady at 0.5%, as expected

- Market impact: the stable rate is generally neutral or even moderately positive for the stock market

Fundamental analysis

The Bank of Japan keeping the rate unchanged at 0.5% in line with expectations suggests that the regulator does not want to create additional turmoil amid the current economic uncertainty. Citing new US tariffs points to external risks for the Japanese economy, in particular for its export-oriented industries.

The Bank of Japan emphasises the sensitivity of Japanese companies to fluctuations in the yen rate, which may increase volatility in goods prices and, hence, affect inflation. As a result, the Japanese stock market will remain active in an effort to balance the positive effects of low rates with potential risks from external factors.

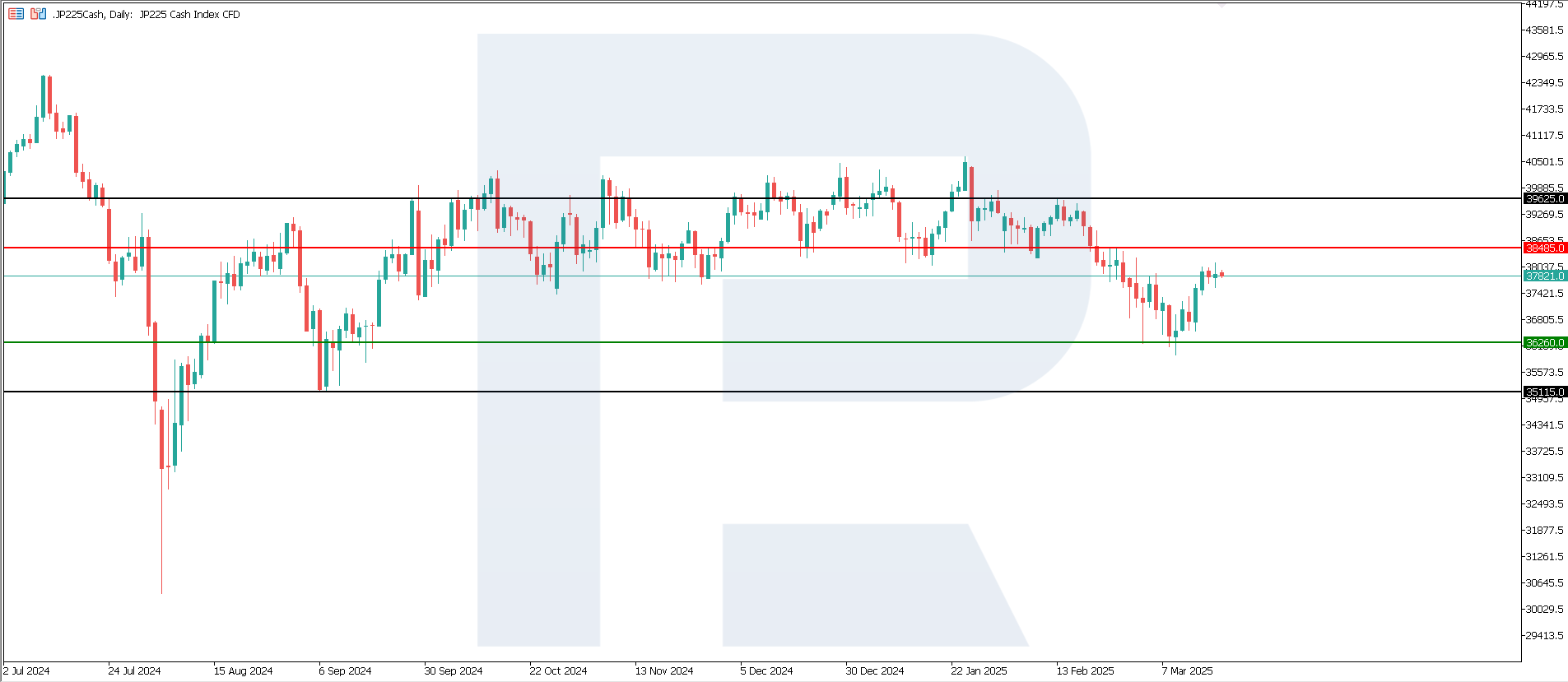

JP 225 technical analysis

The stock index added over 5% to the previously reached six-month low, with quotes currently approaching the 38,485.0 resistance level. If the price fails to break above this level, a sideways movement is likely. However, with a breakout below the 36,260.0 support level, the downtrend could become prevailing.

The following scenarios are considered for the JP 225 price forecast:

- Pessimistic JP 225 forecast: a breakout below the 36,260.0 support level could push the index down to 35,115.0

- Optimistic JP 225 forecast: a breakout above the 38,485.0 resistance level could propel the index to 39,625.0

European index forecast: DE 40

- Recent data: the ZEW Economic Sentiment Index was 51.6 points in March

- Market impact: improving expectations typically support positive investor sentiment, which may drive demand for stocks

Fundamental analysis

The ZEW Economic Sentiment Index of 51.6 points significantly exceeded the forecast of 48.1 and the previous reading of 36.0. This means that experts are generally much more positive about the German economy than expected. Positive expectations for the economy typically push up companies’ stock prices, especially in cyclical sectors.

With favourable prospects, foreign investors may increase their investments in German assets. As a result, a high ZEW Economic Sentiment Index tends to strengthen the German stock market as it shows improved expectations for economic growth and corporate earnings.

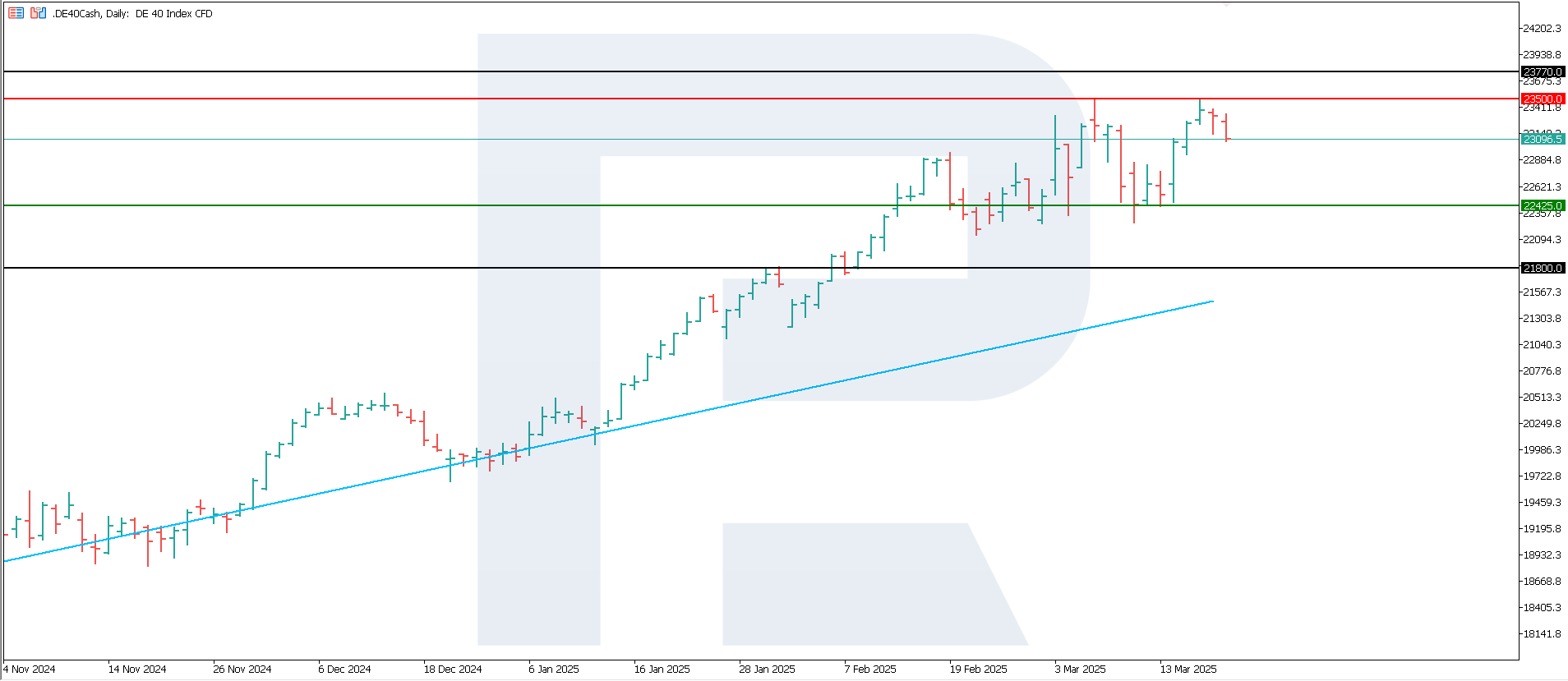

DE 40 technical analysis

The DE 40 stock index reached a new all-time high and began to correct. The trend remains upward, with no signs of its reversal yet. The resistance level has shifted to the 23,500.0 level, which will highly likely be breached, with the next target at 23,770.0.

The following scenarios are considered for the DE 40 price forecast:

- Pessimistic DE 40 forecast: a breakout below the 22,425.0 support level could send the index down to 21,800.0

- Optimistic DE 40 forecast: a breakout above the 23,500.0 resistance level could drive the index to 23,770.0

Summary

Following the US Federal Reserve meeting, the interest rate remained unchanged at 4.5%. Investors received mixed signals from the regulator. On the upside, the QT program will be cut since 1 April 2025. The Bank of Japan also held the key rate steady at 0.5%. Despite the correction, the stock market remains in a downtrend. The only exception is the German DE 40 index, which even managed to hit a new all-time high.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.