World indices overview: news from US 30, US 500, US Tech, JP 225, and DE 40 for 22 April 2025

Uncertainty surrounding further US trade policy results in a lack of trend in global stock indices. Find out more in our analysis and forecast for global indices for 22 April 2025.

US indices forecast: US 30, US 500, US Tech

- Recent data: US initial jobless claims came in at 215 thousand last week

- Market impact: low jobless claims may support demand for stocks of companies focused on the domestic market

Fundamental analysis

The actual reading was below the forecast and the previous level, indicating that fewer people are applying for benefits and the labour market remains strong. A strong labour market reduces the need for monetary easing. If investors believe the Federal Reserve will keep interest rates elevated for an extended period, the technology sector and other rate-sensitive industries may face moderate pressure.

The conflict between Federal Reserve Chairman Jerome Powell and President Donald Trump over future monetary policy is escalating. Trump urges immediate key rate cuts, while the Fed chair is not ready for such drastic changes amid rising inflation risks.

US 30 technical analysis

The US 30 stock index sees the support level formed at 37,060.0. Despite the current optimism, the global trend remains downward. If the support level does not break, a sideways movement could follow.

The following scenarios are considered for the US 30 price forecast:

- Pessimistic US 30 forecast: a breakout below the 37,060.0 support level could send the index down to 35,060.0

- Optimistic US 30 forecast: a breakout above the 42,535.0 resistance level could drive the index to 43,890.0

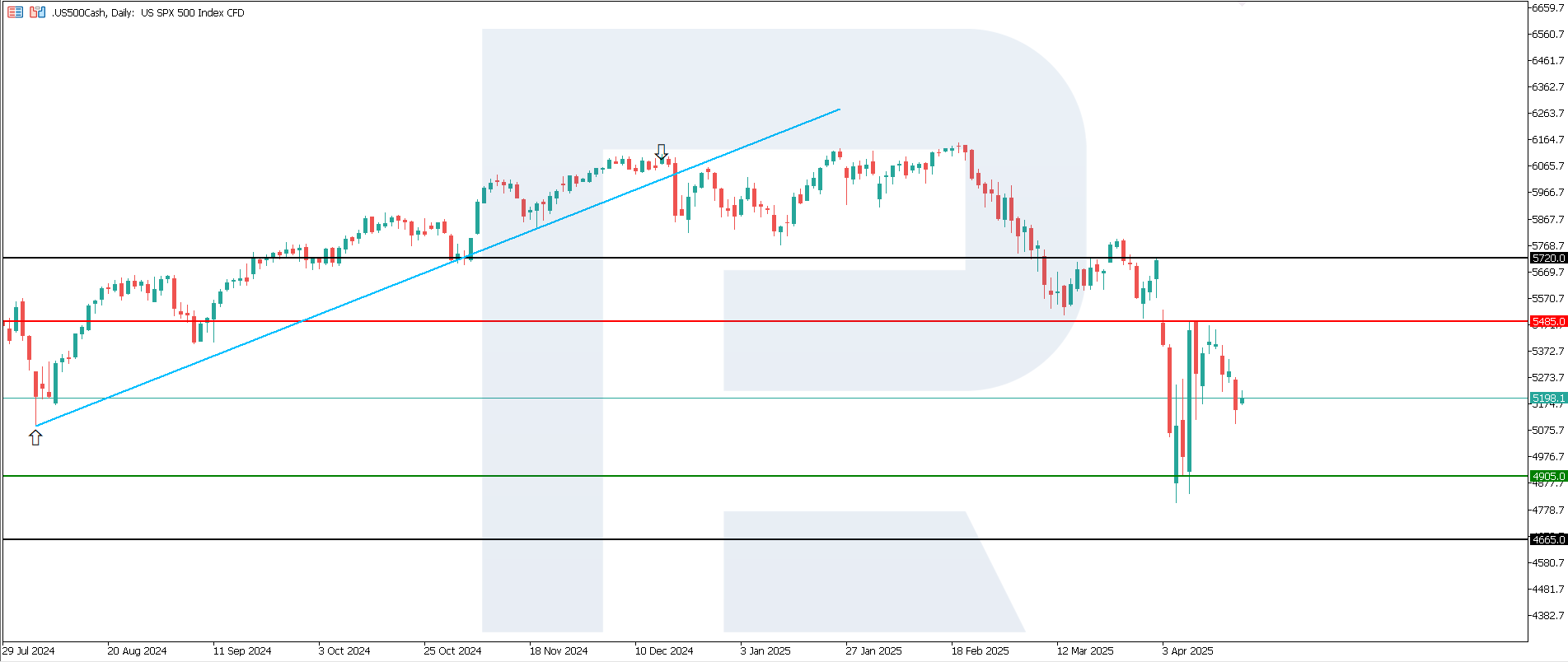

US 500 technical analysis

The US 500 stock index is declining again, offsetting the previous corrective growth. The support level shifted to 4,905.0, with resistance at 5,245.0. The latter was breached when the price corrected upwards, indicating the beginning of an uptrend.

The following scenarios are considered for the US 500 price forecast:

- Pessimistic US 500 forecast: a breakout below the 4,905.0 support level could send the index down to 4,665.0

- Optimistic US 500 forecast: if the price consolidates above the previously breached resistance level at 5,245.0, the index could climb to 5,720.0

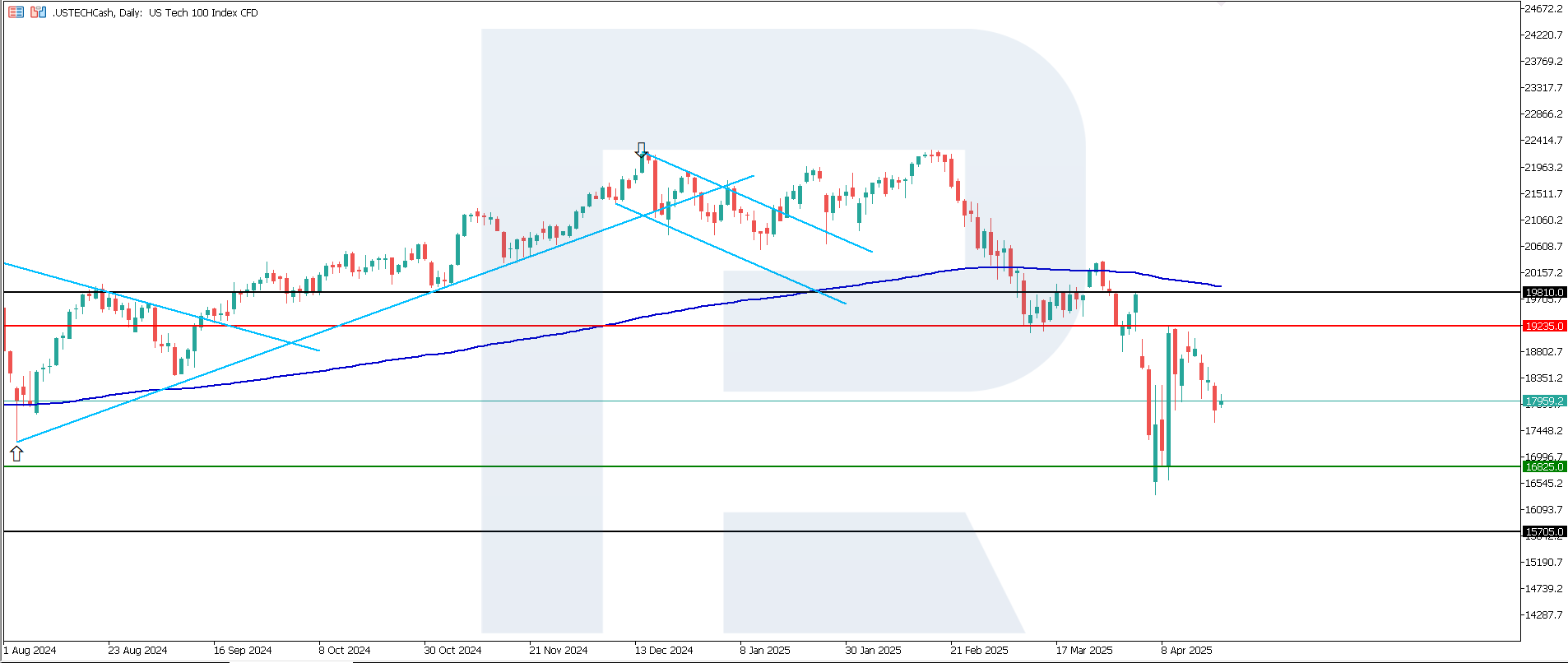

US Tech technical analysis

The US Tech index formed a resistance level at 19,235.0, with support at 16,825.0. The current uptrend is rather weak as the price remains below the 200-day Moving Average.

The following scenarios are considered for the US Tech price forecast:

- Pessimistic US Tech forecast: a breakout below the 16,825.0 support level could push the index down to 15,705.0

- Optimistic US Tech forecast: a breakout above the 19,235.0 resistance level could propel the index to 19,810.0

Asian index forecast: JP 225

- Recent data: Japan’s core CPI reached 2.2% in March

- Market impact: a weaker-than-expected reading may keep Japanese government bond yields relatively low, with foreign assets remaining attractive to Japanese investors

Fundamental analysis

Core inflation remained at 2.2%, below the forecast of 2.4%, reducing the likelihood of aggressive rate hikes or faster tapering of stimulus. Market expectations of a softer Bank of Japan stance are keeping borrowing costs low and creating favourable conditions for most sectors.

Lower-than-expected core CPI data is a moderately positive factor for the Japanese stock market. Export-oriented companies capitalise on a likely weaker yen, with domestic retailers benefitting from easing price pressures. However, inflation above zero still prevents the regulator from pursuing an extremely loose policy, so stock growth will likely be subdued, with dynamics varying from sector to sector.

JP 225 technical analysis

The JP 225 stock index sees a medium-term sideways channel forming. Overall, the trend remains downward. However, a false breakout below the 31,915.0 support level is possible, followed by a reversal of the downtrend.

The following scenarios are considered for the JP 225 price forecast:

- Pessimistic JP 225 forecast: a breakout below the 31,915.0 support level could send the index down to 28,720.0

- Optimistic JP 225 forecast: a breakout above the 38,130.0 resistance level could propel the index to 39,635.0

European index forecast: DE 40

- Recent data: the ECB lowered the key rate to 2.40%

- Market impact: low returns on cash and debt instruments make stocks more attractive

Fundamental analysis

The ECB lowered the key rate by 0.25 percentage points in line with market expectations. The rate cut reduces the cost of borrowing for businesses and consumers, supporting corporate earnings and driving domestic demand.

If the rate weakens the EUR, large German exporters gain a competitive edge abroad. However, the currency factor may also increase volatility. Additionally, the US trade tariff issue has not been resolved yet, with an increase in tariffs able to negatively affect the stocks of German exporters.

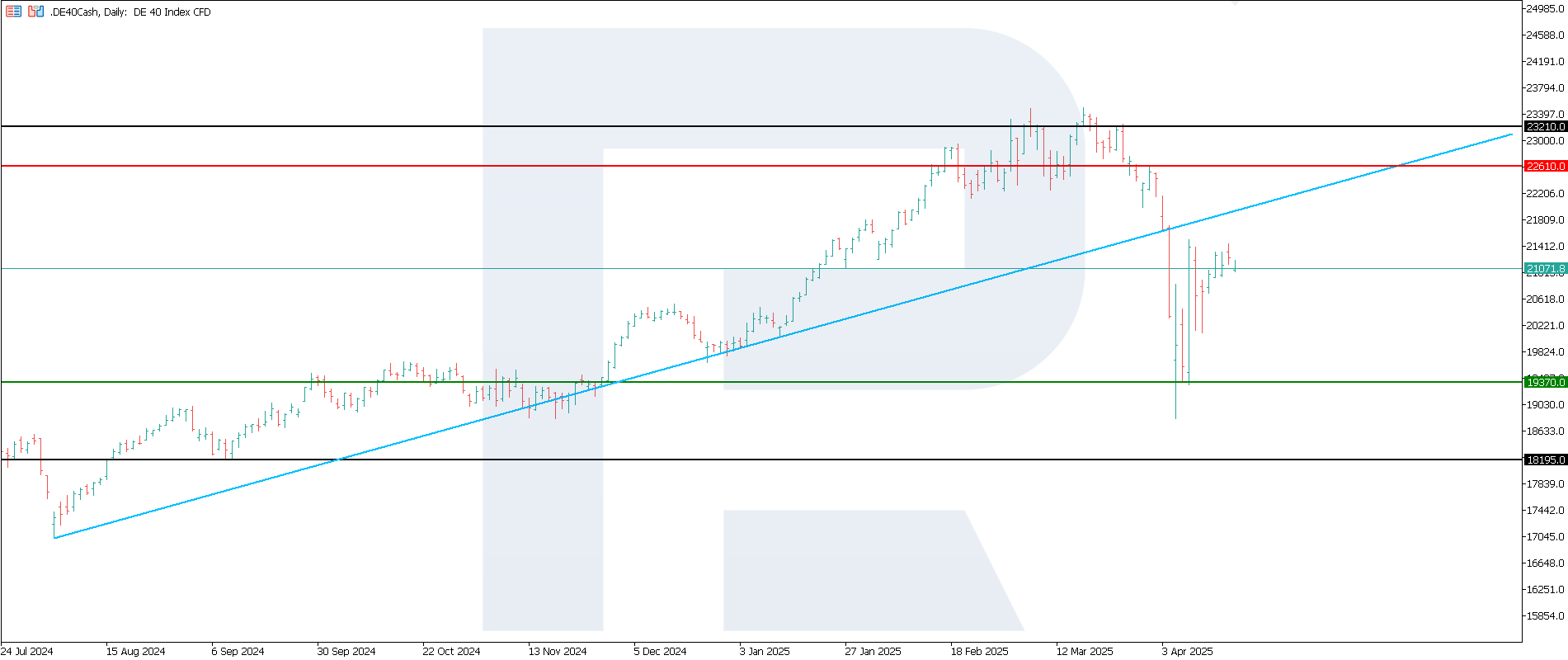

DE 40 technical analysis

Corrective growth in the DE 40 stock index is over, with the index moving to a horizontal range, which will unlikely be breached in the short term. The support level formed at 19,370.0, leaving minimal room for a directional movement.

The following scenarios are considered for the DE 40 price forecast:

- Pessimistic DE 40 forecast: a breakout below the 19,370.0 support level could push the index down to 18,195.0

- Optimistic DE 40 forecast: a breakout above the 22,610.0 resistance level could drive the index to 23,210.0

Summary

The ECB cut the interest rate to 2.40%, aligning with market expectations and sending a positive signal for the German stock market. However, uncertainty over US tariffs and the conflict between the executive and monetary authorities put pressure on global stock indices. The growth potential is over, with investors awaiting new drivers. The US 500 and US Tech indices are the only ones to see the uptrend.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.