JP 225 analysis: easing inflation and rising interest rates adversely impact the stock market

The JP 225 stock index is reversing from an uptrend to a downtrend amid signs of declining economic growth in Japan. The JP 225 forecast for next week is negative.

JP 225 forecast: key trading points

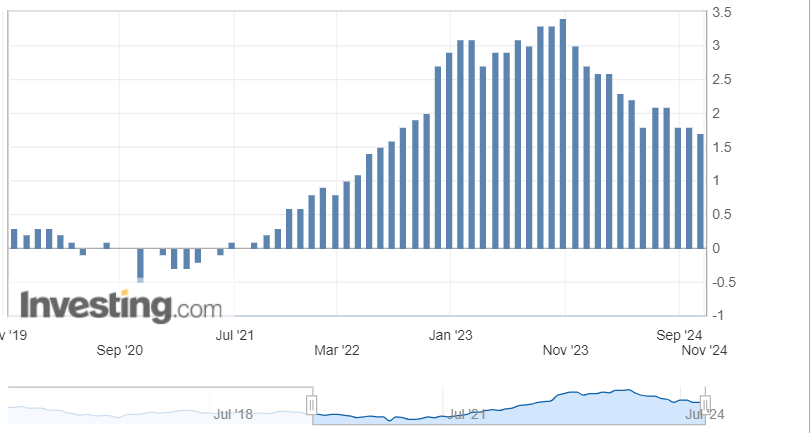

- Recent data: the Bank of Japan’s core Consumer Price Index (CPI) reached 1.7% year-on-year

- Economic indicators: this indicator shows the change in prices for consumer goods and services, excluding volatile categories (food and energy)

- Market impact: the key inflation gauge used by the Bank of Japan to assess the core inflation rate in the economy

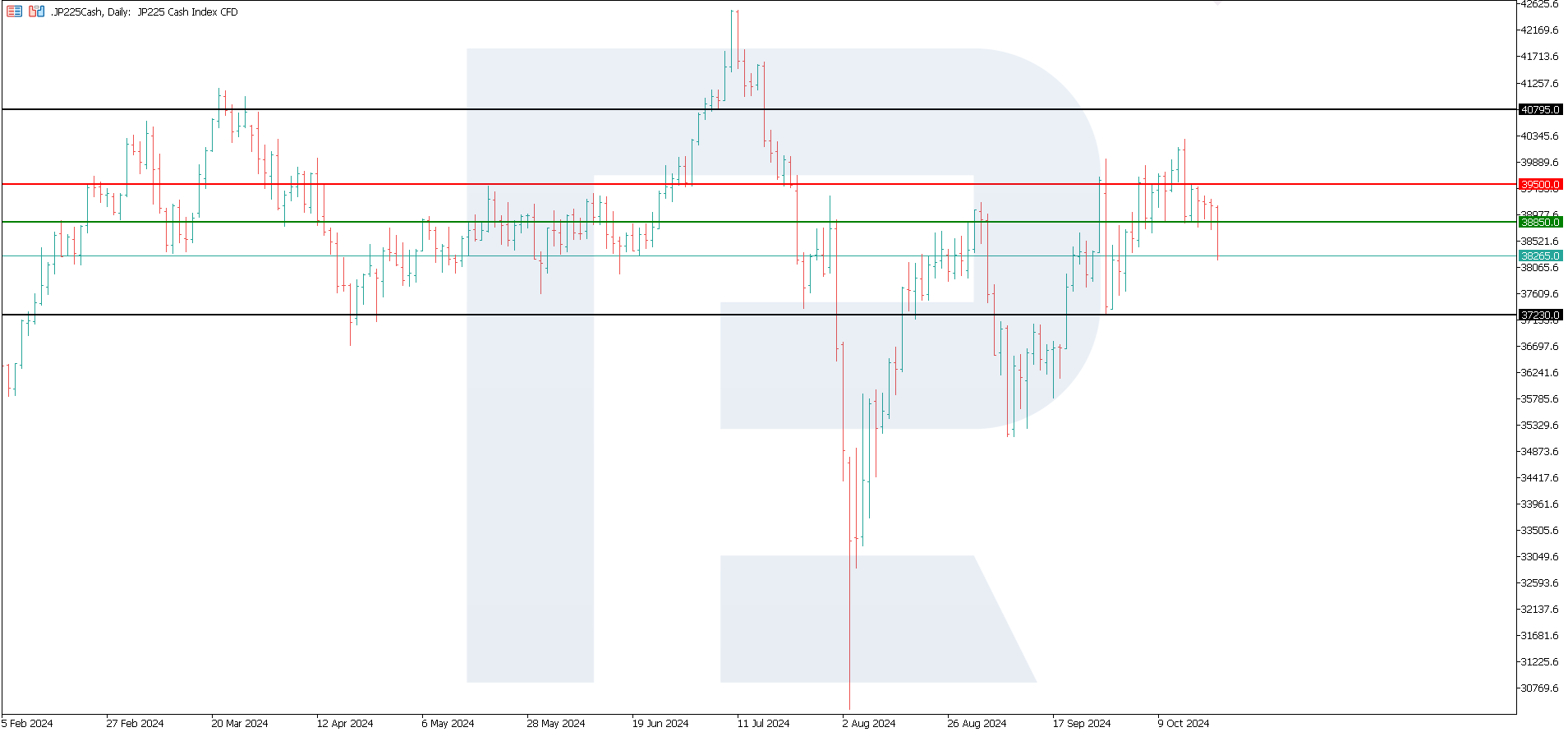

- Resistance: 39,500.0, Support: 38,850.0

- JP 225 price forecast: 37,230.0

Fundamental analysis

The decrease in the Bank of Japan’s core Consumer Price Index from 1.8% to 1.7% may indicate a reduction in inflationary pressures in the country. This may affect the Bank of Japan’s monetary policy decision. If inflation slows, the BoJ may refrain from further interest rate hikes to stimulate the economy.

Source: https://uk.investing.com/economic-calendar/boj-core-cpi-1667

According to economists in a Reuters poll, the Bank of Japan will refrain from raising interest rates further until the end of the year. Nevertheless, nearly 90% of respondents expect rate hikes by March next year. These results emphasise the difficulty of normalising monetary policy by the Bank of Japan, especially with most global central banks leaning towards rate cuts.

This may positively affect the Japanese stock market, particularly in the technology and export sectors sensitive to rate changes. Low interest rates typically support economic activity, reducing companies’ borrowing costs and possibly boosting their shares. However, if easing inflation is perceived as a sign of economic weakness, this could cause negative sentiment in the stock market. The JP 225 index forecast is negative.

JP 225 technical analysis

The JP 225 stock index was in a weak uptrend. It is currently attempting to break below the 38,850.0 support level. According to the JP 225 technical analysis, a downtrend will start if quotes secure below this level. The index’s next decline target will likely be the 37,230.0 level.

The following scenarios are considered for the JP 225 price forecast:

- Pessimistic JP 225 forecast: if the price secures below the 38,850.0 support level, the index may fall to 37,230.0

- Optimistic JP 225 forecast: a breakout above the 39,500.0 resistance level could propel the price to 40,475.0

Summary

The Bank of Japan’s core Consumer Price Index declined from 1.8% to 1.7% year-on-year. The decrease in this indicator may indicate easing inflationary pressures in the country. However, if an inflation slowdown is perceived as a sign of economic weakness, this could cause negative sentiment in the stock market. The JP 225 index is declining and attempts to gain a foothold below 38,850.0, with the next target for decline at 37,230.0.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.