JP 225 forecast: the index has formed resistance and may enter a correction

The JP 225 stock index continues to rise within the established uptrend. The JP 225 forecast for today is positive.

JP 225 forecast: key trading points

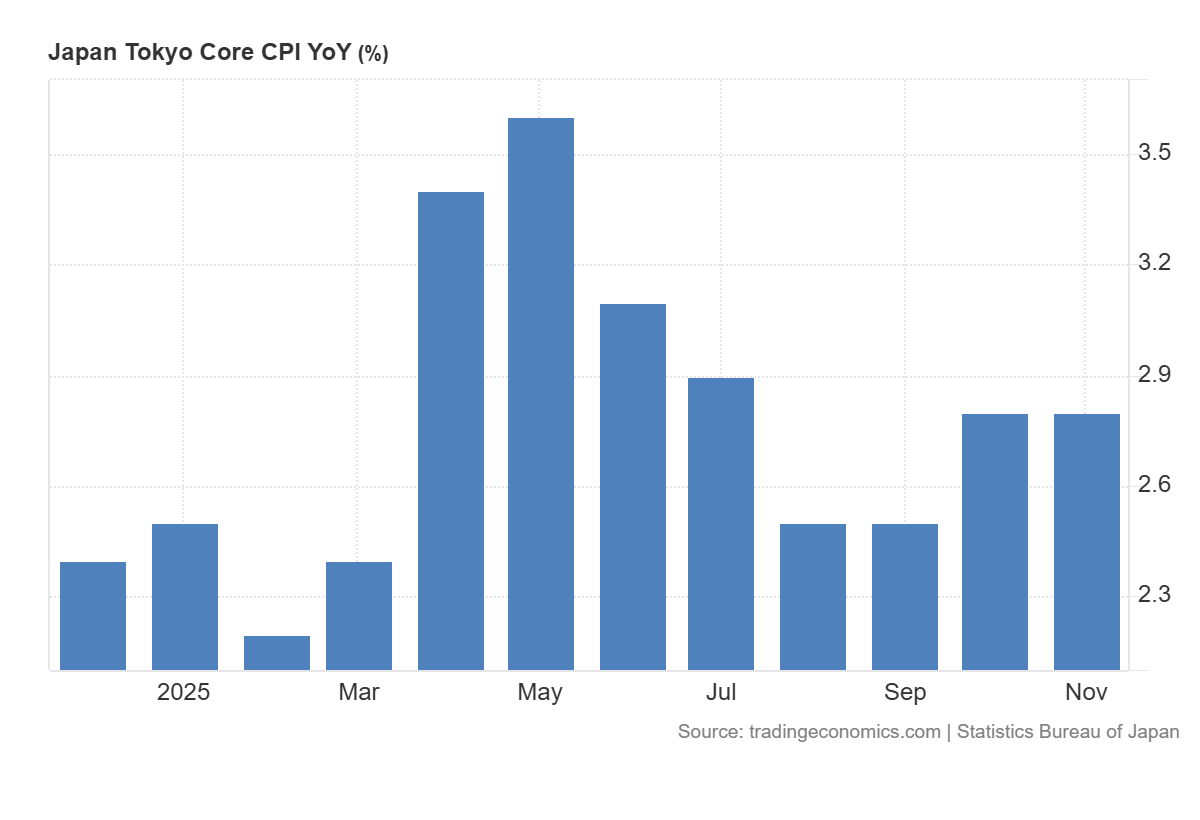

- Recent data: Japan Tokyo сore CPI increased by 2.8% year-on-year

- Market impact: moderately negative for the Japanese stock market

JP 225 fundamental analysis

The latest core inflation data from Tokyo showed an annual increase of 2.8%, matching the previous reading and slightly above the consensus forecast of 2.7%. This means inflation is not accelerating but also not slowing, remaining steadily above the Bank of Japan’s 2.0% target. For the stock market, this implies no deflationary risk: companies retain the ability to raise prices, domestic demand stays relatively firm, and consumer sector revenues remain supported. At the same time, stable but not excessively high inflation lowers the risk of a sharp economic contraction due to monetary policy tightening.

For the JP 225, the impact is somewhat restraining. Investors understand that a stable reading near 3.0% increases pressure on the Bank of Japan to gradually move away from its ultra-loose policy. The market may start pricing in higher future rates and the possibility of further steps to tighten control over bond yields. This creates the risk of yen appreciation, which is a negative factor for exporters and large industrial companies – sectors that constitute a significant share of the JP 225.

Japan Tokyo core CPI YoY: https://tradingeconomics.com/japan/tokyo-core-cpiJP 225 technical analysis

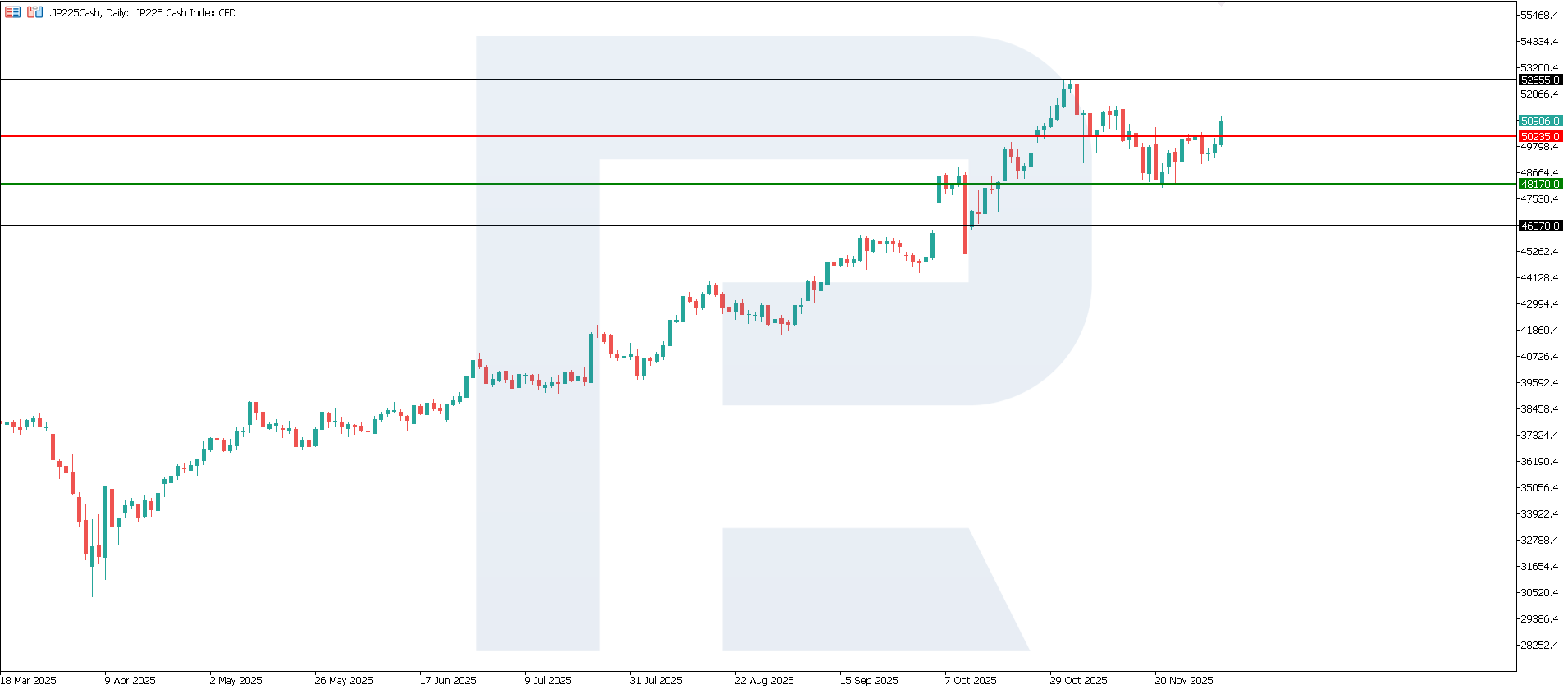

During the latest corrective move, the JP 225 rebounded from the 48,170.0 support level. Before resuming its rise, the index may trade sideways for some time, while the long-term uptrend remains intact. The nearest resistance level has formed at 50,235.0, and the next upside target stands at 52,655.0.

The JP 225 price forecast considers the following scenarios:

- Pessimistic JP 225 scenario: a breakout below the 48,170.0 support level could push the index down to 46,370.0

- Optimistic JP 225 scenario: a breakout above the 50,235.0 resistance level could boost the index up to 52,655.0

Summary

The index may face a phase of consolidation or minor correction: domestic demand and the banking sector benefit from more normal inflation, while export-driven sectors come under pressure due to the risk of a stronger yen and potentially higher borrowing costs in the future. Overall, the latest CPI report confirms the scenario of a soft but not risk-free transition of Japan’s economy towards a regime of higher prices and a more normal monetary policy, making the JP 225 more sensitive to future signals from the Bank of Japan. The next upside target for the index could be the 52,655.0 level.

Editors’ picks

EURUSD 2026-2027 forecast: key market trends and future predictions

EURUSD 2026-2027 forecast: key market trends and future predictionsThis article provides the EURUSD forecast for 2026 and 2027 and highlights the main factors determining the direction of the pair’s movements. We will apply technical analysis, take into account the opinions of leading experts, large banks, and financial institutions, and study AI-based forecasts. This comprehensive insight into EURUSD predictions should help investors and traders make informed decisions.

Gold (XAUUSD) forecast 2026 and beyond: expert insights, price predictions, and analysis

Gold (XAUUSD) forecast 2026 and beyond: expert insights, price predictions, and analysisThis article offers a Gold (XAUUSD) price forecast for 2026 and beyond, combining technical analysis, expert forecasts, and key macroeconomic factors. It explains the drivers behind gold’s recent surge, explores potential scenarios including a move toward 4,500 to 5,000 USD per ounce, and highlights why the metal remains a strong hedge during global uncertainty.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.