JP 225 forecast: the index continues to rise

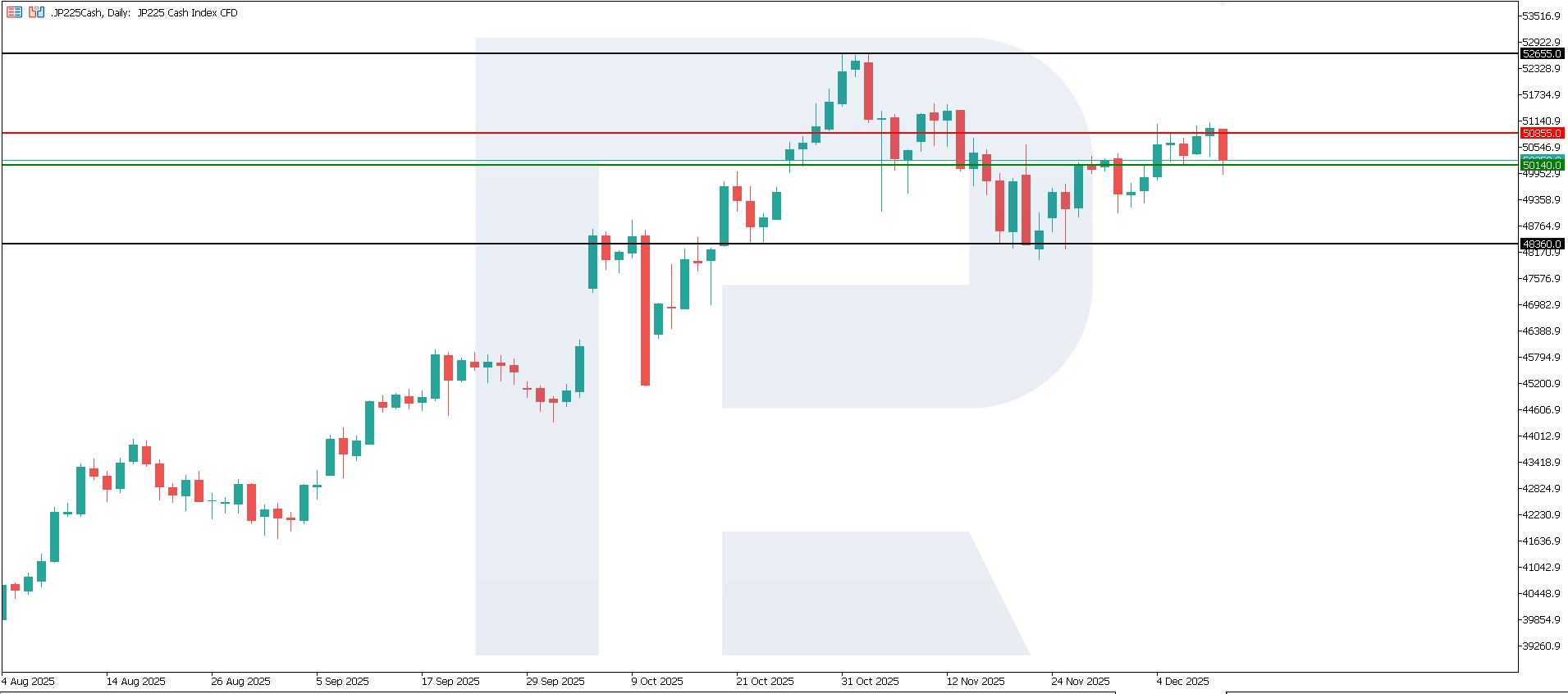

The JP 225 equity index trades within a narrow corridor between resistance and support. The forecast for JP 225 today is positive.

JP 225 forecast: key trading points

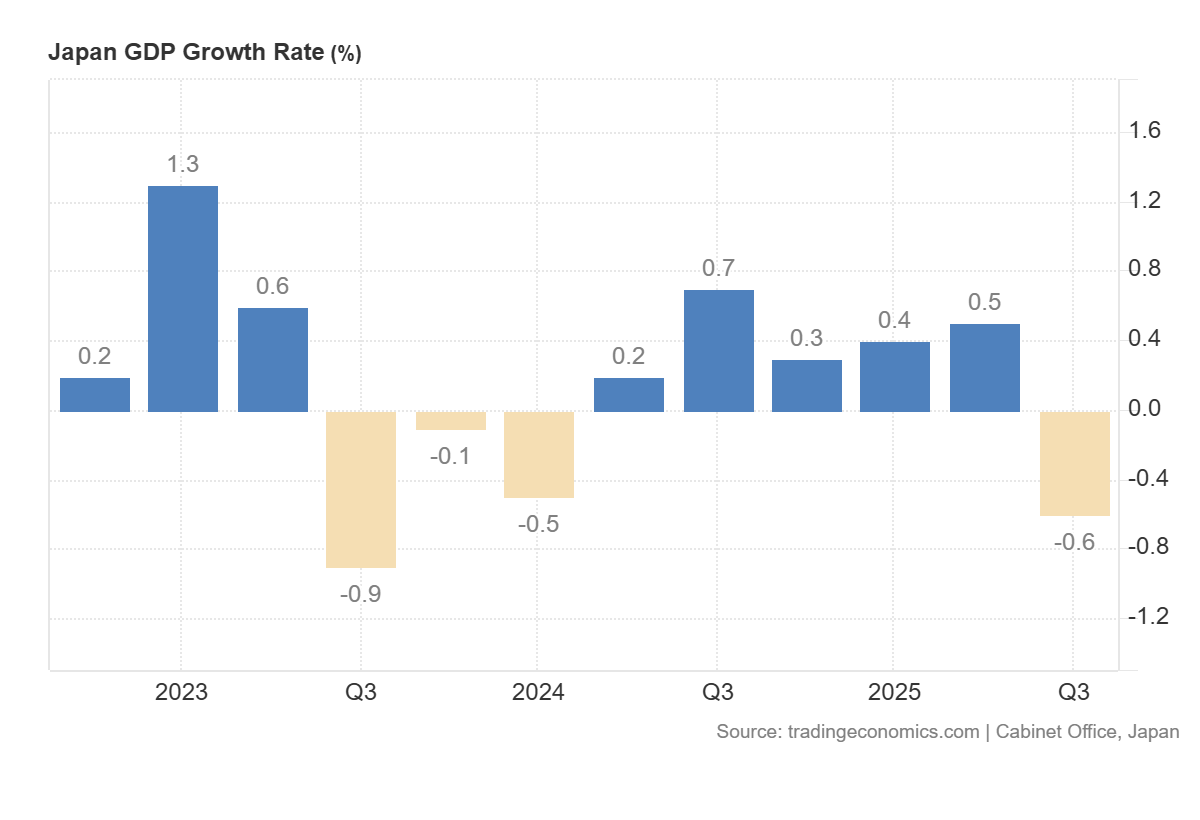

- Recent data: Japan’s GDP contracted by 0.60% quarter-on-quarter

- Market impact: the effect on the Japanese equity market is moderately negative

JP 225 fundamental analysis

Japan’s GDP decreased by -0.6% quarter-on-quarter, which came in weaker than forecasts and significantly below the previous expansion. The result shows a clear slowdown in economic activity: consumer spending, investment and exports all weakened. This increases investors’ concerns about the pace of economic recovery and the resilience of corporate profits. For Japan’s equity market, such numbers act as a restraining factor. Market participants usually treat a weak GDP print as a signal of elevated risks for companies.

JP 225 faces short-term pressure due to concerns about economic momentum. However, further dynamics depend on the stance of the Bank of Japan. If the regulator signals a readiness to support the economy, this could limit the index’s decline and soften the negative effect.

Japan GDP Growth Rate: https://tradingeconomics.com/japan/gdp-growthJP 225 technical analysis

JP 225 continues to trade in an upwards trend. The support zone lies at 50,140.0, while the nearest resistance sits around 50,855.0. The narrowing range between these levels suggests accumulation by major market participants. The next growth target stands in the area of 52,655.0.

Forecast scenarios for JP 225:

- Pessimistic scenario: if the price breaks support at 50,140.0, it may decline towards 48,360.0

- Optimistic scenario: if the price breaks resistance at 50,855.0, it may rise to 52,655.0

Summary

Japan’s GDP decline of -0.6% signals economic weakening and raises investors’ concerns. For the equity market this creates downward pressure, and JP 225 may show moderate declines. Expectations that the Bank of Japan will maintain a soft monetary stance continue to limit the depth of any correction. The trend remains upwards. The next growth target for JP 225 is 52,655.0.

Editors’ picks

EURUSD 2026-2027 forecast: key market trends and future predictions

EURUSD 2026-2027 forecast: key market trends and future predictionsThis article provides the EURUSD forecast for 2026 and 2027 and highlights the main factors determining the direction of the pair’s movements. We will apply technical analysis, take into account the opinions of leading experts, large banks, and financial institutions, and study AI-based forecasts. This comprehensive insight into EURUSD predictions should help investors and traders make informed decisions.

Gold (XAUUSD) forecast 2026 and beyond: expert insights, price predictions, and analysis

Gold (XAUUSD) forecast 2026 and beyond: expert insights, price predictions, and analysisDive deep into the Gold (XAUUSD) price outlook for 2026 and beyond, combining technical analysis, expert forecasts, and key macroeconomic factors. It explains the drivers behind gold’s recent surge, explores potential scenarios including a move toward 4,500 to 5,000 USD per ounce, and highlights why the metal remains a strong hedge during global uncertainty.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.