JP 225 forecast: the index entered a downward trend

The JP 225 stock index shifted into a downward trend after falling by 4.5%. The JP 225 forecast for today is negative.

JP 225 forecast: key takeaways

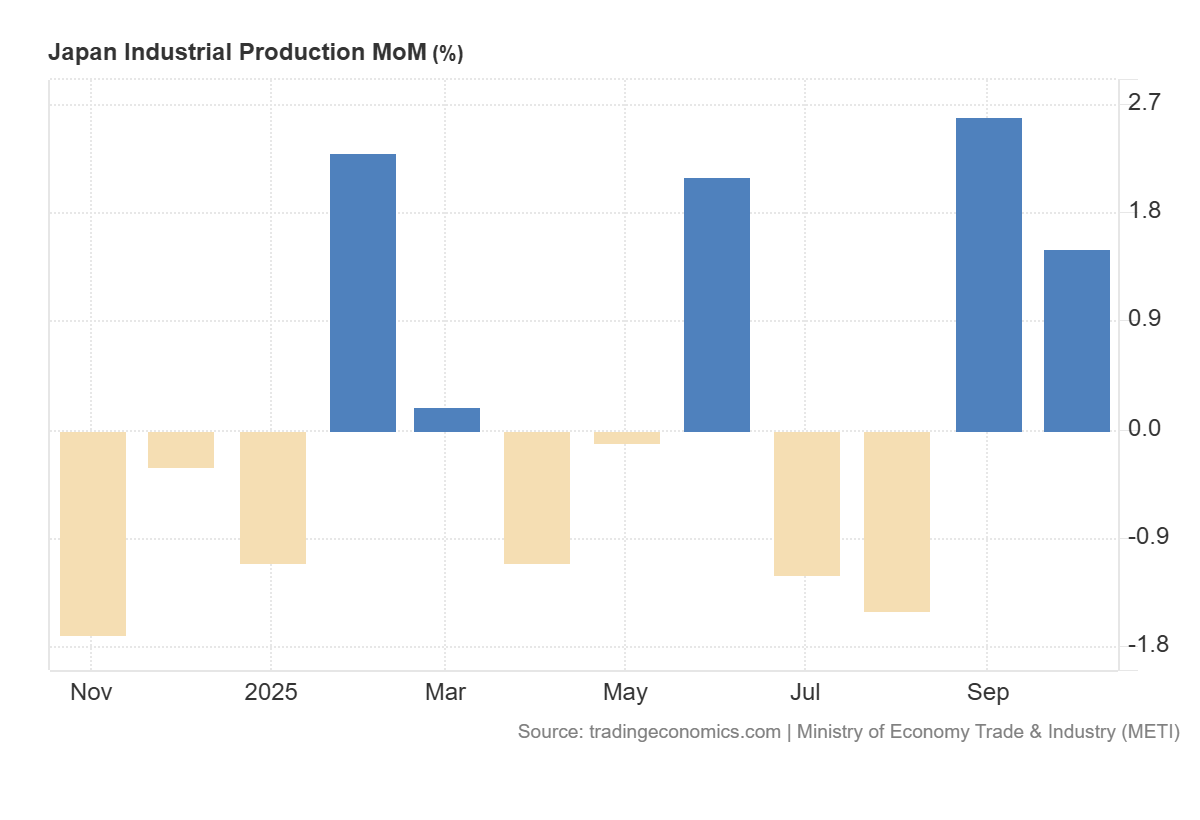

- Recent data: Japan Industrial Production MoM increased by 1.5%

- Market impact: the effect for the Japanese equity market is moderately positive

JP 225 fundamental analysis

Japan Industrial Production MoM printed at +1.5% for the month, compared with a forecast of +1.4%, following +2.6% in the previous month. This means industrial output grew slightly faster than expected, although the pace of growth slowed compared with the prior period. Rising production usually signals stronger order inflows, higher capacity utilisation, and an improved chance for companies to deliver solid revenue and profit growth in the coming quarters.

For the JP 225 index, the current data is generally positive. The index includes many large companies linked to industry, technology, supply chains, and exports. For these firms, higher production signals that demand and output remain intact, meaning the baseline profit outlook stays relatively healthy. This can support the index, especially if there is no simultaneous deterioration in orders or foreign trade data.

Japan Industrial Production MoM: https://tradingeconomics.com/japan/industrial-production-momJP 225 technical analysis

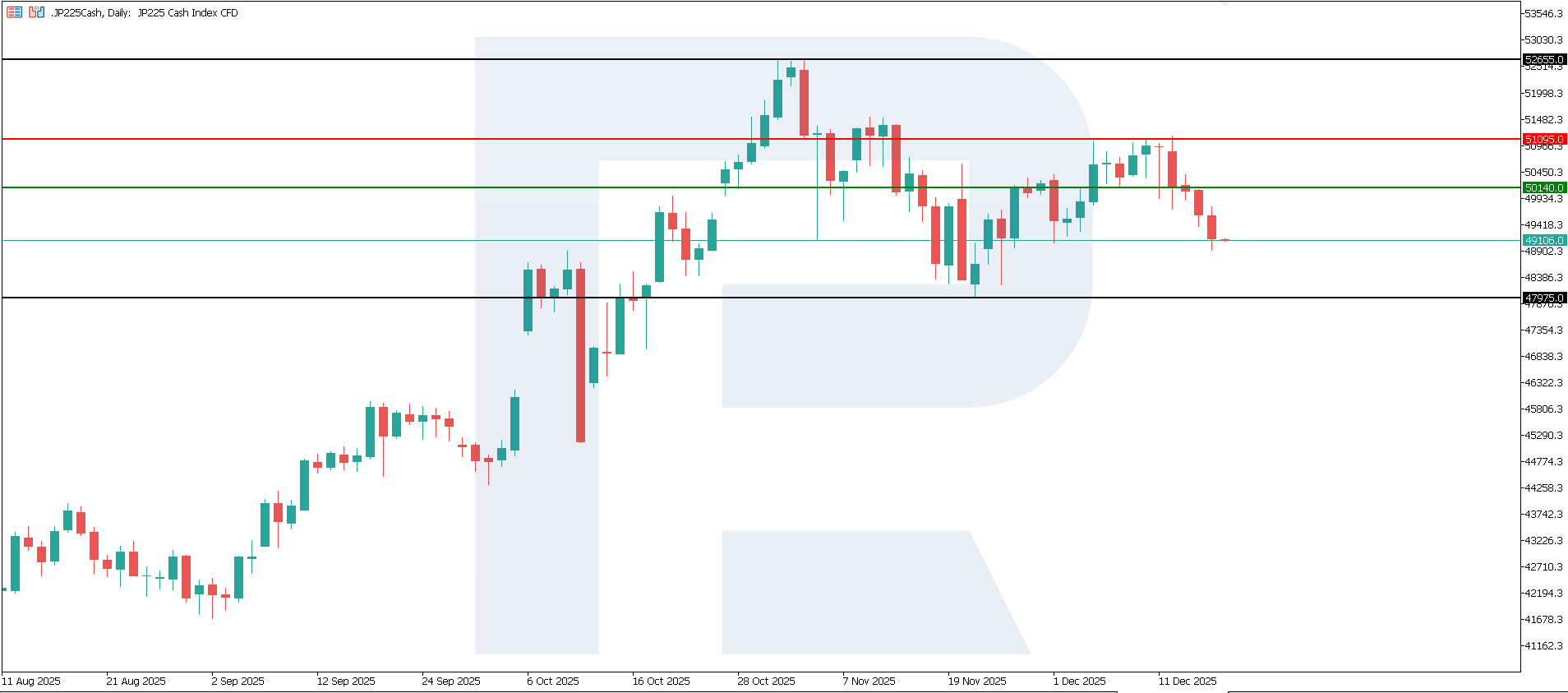

The JP 225 index trades in a downward trend. The support zone at 50,140.0 has been broken. The nearest resistance is located around 50,855.0. After the support break, the pace of the decline accelerated. The next potential downside target lies near 47,975.0.

Forecast scenarios for the JP 225 price:

- Bearish scenario: if prices remain below the previously broken support at 50,140.0, the index may fall to 47,975.0

- Bullish scenario: if resistance at 50,855.0 is broken, prices may rise to 52,655.0

Summary

The indicator is moderately positive for JP 225, as production is growing and slightly exceeds expectations. However, the slowdown compared with the previous month limits the potential for strong index growth. Confirmation of the trend in upcoming releases will matter more: if production growth stabilises at a sustainable level, it will support JP 225 through expectations of rising corporate profits. The next downside target for JP 225 stands at 52,655.0.

Editors’ picks

EURUSD 2026-2027 forecast: key market trends and future predictions

EURUSD 2026-2027 forecast: key market trends and future predictionsThis article provides the EURUSD forecast for 2026 and 2027 and highlights the main factors determining the direction of the pair’s movements. We will apply technical analysis, take into account the opinions of leading experts, large banks, and financial institutions, and study AI-based forecasts. This comprehensive insight into EURUSD predictions should help investors and traders make informed decisions.

Gold (XAUUSD) forecast 2026 and beyond: expert insights, price predictions, and analysis

Gold (XAUUSD) forecast 2026 and beyond: expert insights, price predictions, and analysisDive deep into the Gold (XAUUSD) price outlook for 2026 and beyond, combining technical analysis, expert forecasts, and key macroeconomic factors. It explains the drivers behind gold’s recent surge, explores potential scenarios including a move toward 4,500 to 5,000 USD per ounce, and highlights why the metal remains a strong hedge during global uncertainty.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.