JP 225 forecast: the index has updated its all-time high

The JP 225 stock index has continued its upward momentum. The JP 225 forecast for today is negative.

JP 225 forecast: key takeaways

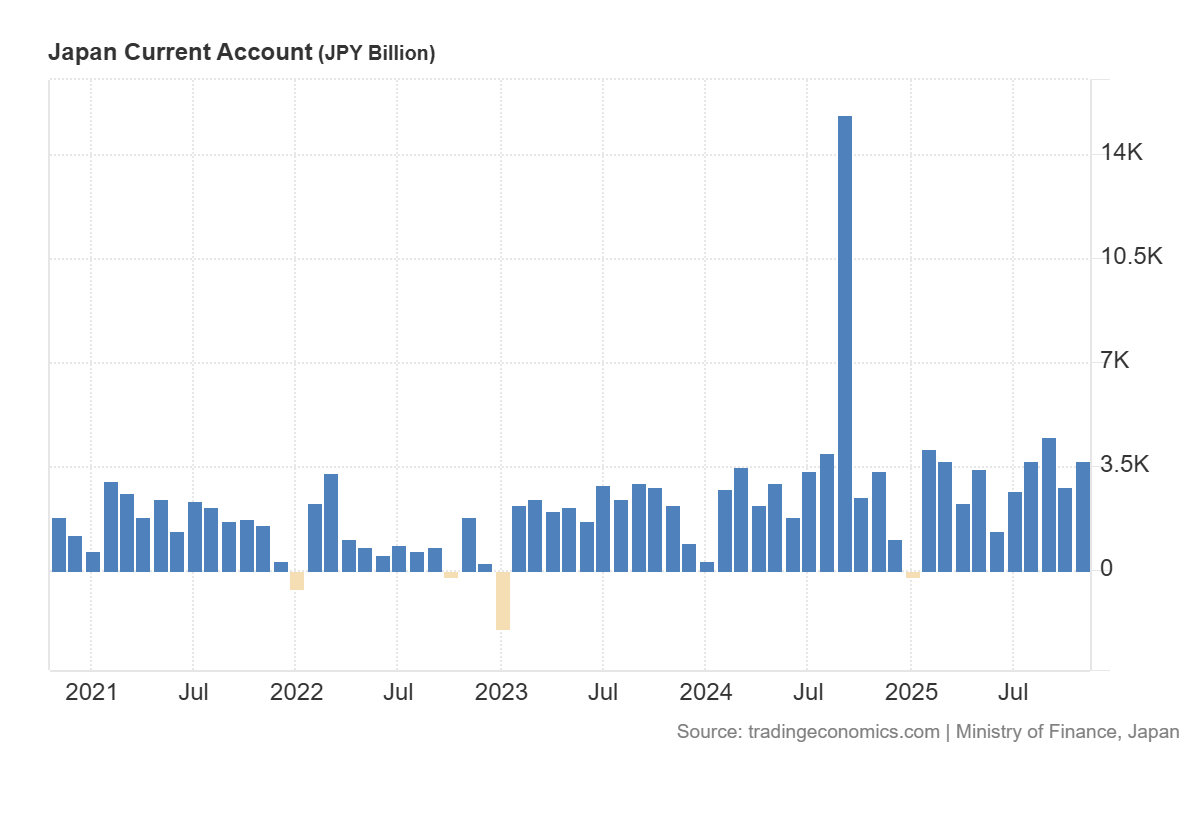

- Recent data: Japan’s current account reached 3.67 trillion JPY

- Market impact: the effect for the Japanese equity market is moderately positive

JP 225 fundamental analysis

Japan’s current account balance exceeded expectations, posting a surplus of 3.674 trillion JPY, above the forecast of 3.594 trillion JPY and the previous reading of 2.834 trillion JPY. For the equity market, this primarily signals a stronger external position and higher net income inflows from abroad, which fundamentally supports economic resilience and reduces sensitivity to external shocks. For Japanese equities, the impact of a potentially stronger yen is mixed. A stronger yen reduces the value of overseas revenues when converted into yen and may pressure the profits of export-oriented companies, while also weakening their price competitiveness in global markets. At the same time, yen appreciation lowers the cost of imported energy and raw materials.

For the JP 225 index, this release often has a moderately restraining effect in the short term, as the index structure is traditionally more sensitive to yen movements due to the significant weight of export-oriented corporations. If the market reacts to the data with yen strengthening, this would act as a direct headwind for the index. It is also worth noting that the current account figure is published without seasonal adjustment and can be volatile.

Japan’s current account: https://tradingeconomics.com/japan/current-accountJP 225 technical analysis

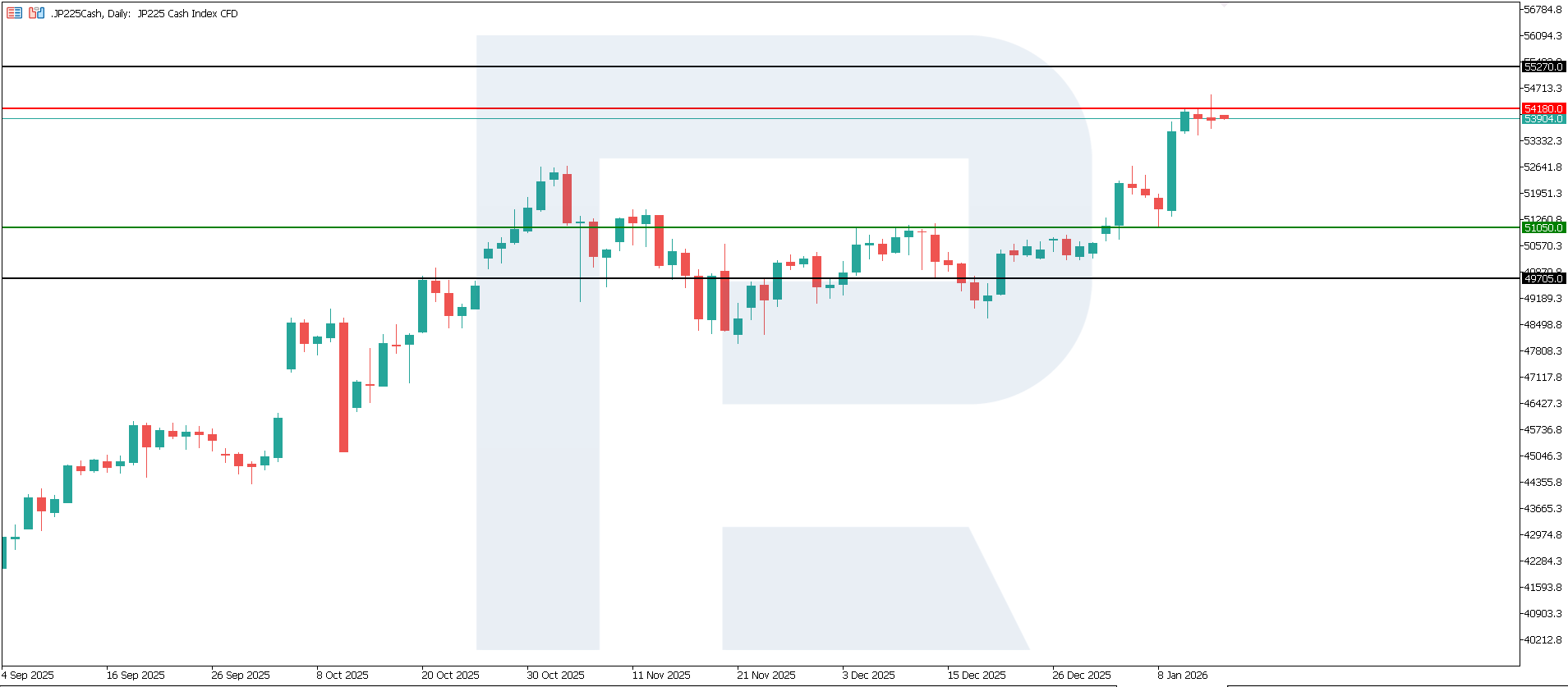

The JP 225 index is trading within an uptrend, with the support zone at 51,150.0 and the nearest resistance level around 54,180.0. The current trend is likely to be medium-term. The next potential upside target is the 55,270.0 area.

The JP 225 price forecast considers the following scenarios:

- Pessimistic JP 225 scenario: a breakout below the 51,180.0 support level could push the index down to 49,705.0

- Optimistic JP 225 scenario: a breakout above the 54,180.0 resistance level could boost the index up to 55,270.0

Summary

A higher-than-expected current account surplus in Japan is fundamentally a positive macroeconomic signal. However, for the JP 225, the key short-term driver will be the movement of the yen. If the yen strengthens, the effect on the index is likely to be neutral to moderately negative, with relatively better performance from companies focused on the domestic market. The next upside target for the JP 225 is 55,270.0.

Editors’ picks

EURUSD 2026-2027 forecast: key market trends and future predictions

EURUSD 2026-2027 forecast: key market trends and future predictionsThis article provides the EURUSD forecast for 2026 and 2027 and highlights the main factors determining the direction of the pair’s movements. We will apply technical analysis, take into account the opinions of leading experts, large banks, and financial institutions, and study AI-based forecasts. This comprehensive insight into EURUSD predictions should help investors and traders make informed decisions.

Gold (XAUUSD) forecast 2026 and beyond: expert insights, price predictions, and analysis

Gold (XAUUSD) forecast 2026 and beyond: expert insights, price predictions, and analysisDive deep into the Gold (XAUUSD) price outlook for 2026 and beyond, combining technical analysis, expert forecasts, and key macroeconomic factors. It explains the drivers behind gold’s recent surge, explores potential scenarios including a move toward 4,500 to 5,000 USD per ounce, and highlights why the metal remains a strong hedge during global uncertainty.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.