JP 225 forecast: the index hit a new all-time high

The JP 225 stock index has completed its correction and fully recovered recent losses. The JP 225 forecast for today is positive.

JP 225 forecast: key takeaways

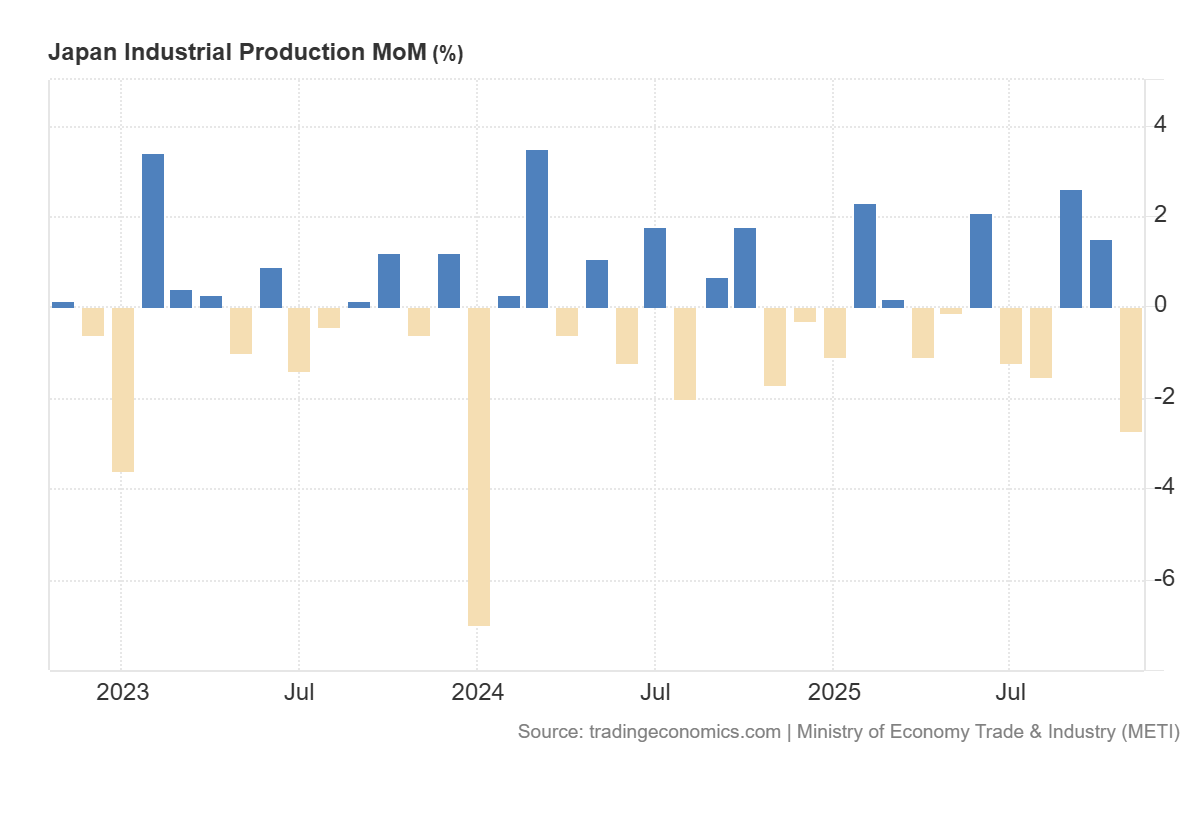

- Recent data: Japan’s industrial production fell by 2.7% month-on-month in November

- Market impact: the effect on the Japanese equity market is moderately negative

JP 225 fundamental analysis

Japan’s industrial production declined by −2.7% month-on-month, slightly worse than the forecast of −2.6%, following growth of 1.5% in the previous month. From an equity market perspective, this is an unfavourable signal, as it points to weakening output dynamics in the real sector and increases the risk of weaker earnings in cyclical industries. The reversal compared with the prior month is particularly important: the shift from solid growth to a sharp contraction strengthens the perception of cooling activity rather than mere volatility.

The JP 225 has a significant share of export-oriented corporations. As a result, if the yen weakens, the index may perform better than the macroeconomic data alone would suggest, or its decline may remain limited. However, if the yen does not weaken, or instead strengthens due to external factors, the negative impact of falling industrial production is more likely to be reflected directly in the index through downward revisions to sales and profit expectations in cyclical segments.

Japan’s industrial production m/m: https://tradingeconomics.com/japan/industrial-production-momJP 225 technical analysis

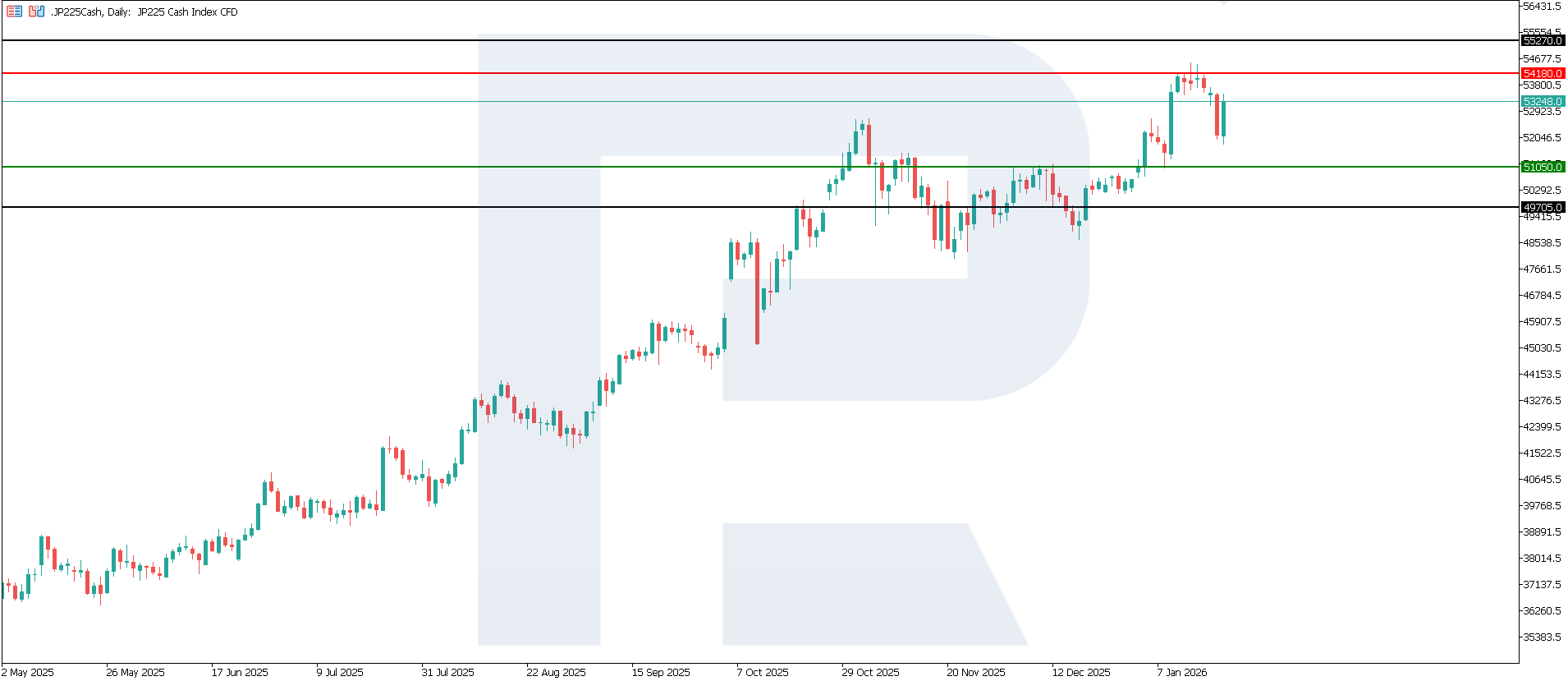

The JP 225 maintains its upward momentum, with the key support level at 51,150.0 and the nearest resistance level at 54,180.0. The current rise is highly likely to be medium-term, with the next potential target at the 55,270.0 area.

The JP 225 price forecast considers the following scenarios:

- Pessimistic JP 225 scenario: a breakout below the 51,180.0 support level could send the index down to 49,705.0

- Optimistic JP 225 scenario: a breakout above the 54,180.0 resistance level could propel the index to 55,270.0

Summary

The decline in Japan’s industrial production to −2.7% m/m is a negative factor for the Japanese equity market. However, for the JP 225, the impact may be partially offset if the release leads to a weaker yen and supports exporters. In the base case, the index reaction is expected to be moderately negative or mixed, with a strong dependence on currency movements. The next upside target for the JP 225 could be 55,270.0.

Editors’ picks

EURUSD 2026-2027 forecast: key market trends and future predictions

EURUSD 2026-2027 forecast: key market trends and future predictionsThis article provides the EURUSD forecast for 2026 and 2027 and highlights the main factors determining the direction of the pair’s movements. We will apply technical analysis, take into account the opinions of leading experts, large banks, and financial institutions, and study AI-based forecasts. This comprehensive insight into EURUSD predictions should help investors and traders make informed decisions.

Gold (XAUUSD) forecast 2026 and beyond: expert insights, price predictions, and analysis

Gold (XAUUSD) forecast 2026 and beyond: expert insights, price predictions, and analysisDive deep into the Gold (XAUUSD) price outlook for 2026 and beyond, combining technical analysis, expert forecasts, and key macroeconomic factors. It explains the drivers behind gold’s recent surge, explores potential scenarios including a move toward 4,500 to 5,000 USD per ounce, and highlights why the metal remains a strong hedge during global uncertainty.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.