JP 225 forecast: the index approaches resistance

The JP 225 stock index may break above the resistance level and reach a new all-time high. The JP 225 forecast for today is positive.

JP 225 forecast: key takeaways

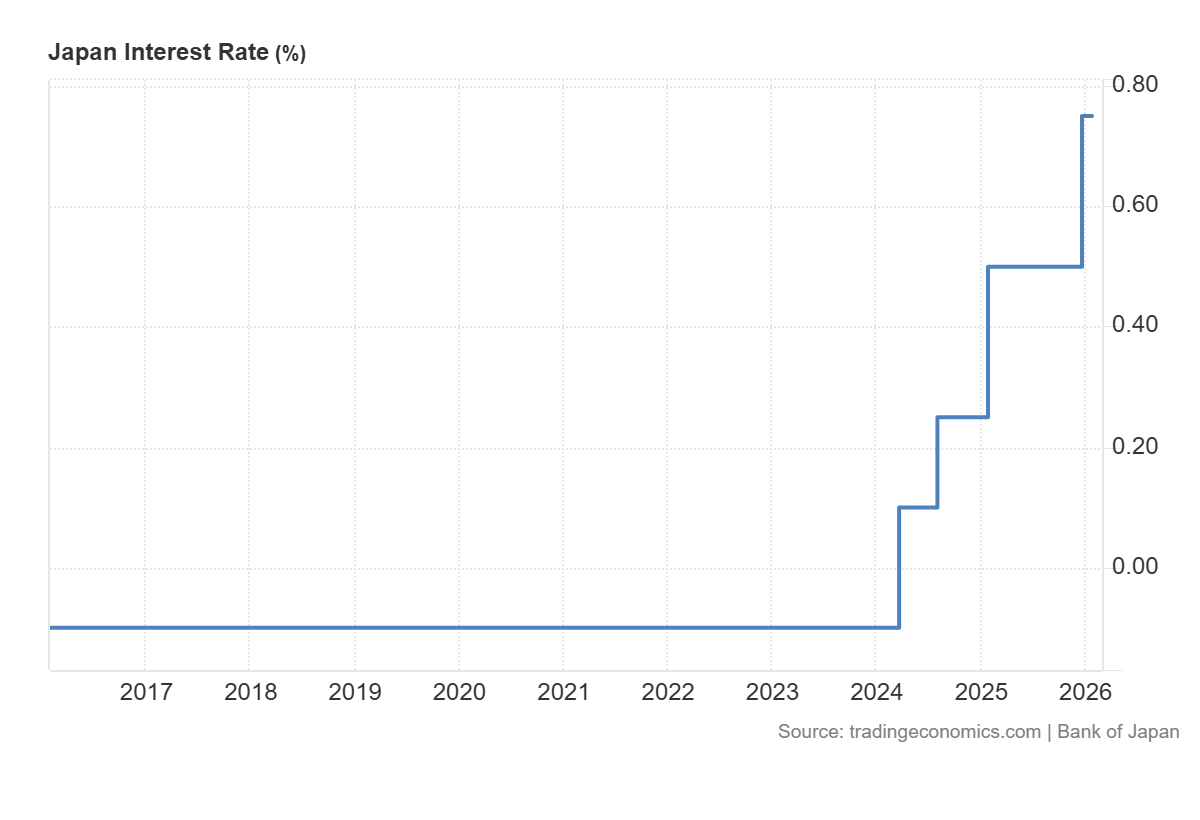

- Recent data: the Bank of Japan kept the policy rate at 0.75%

- Market impact: the effect on the Japanese stock market

is moderately negative

JP 225 fundamental analysis

The Bank of Japan’s decision to keep the rate at 0.75%, combined with an upward revision of economic growth and inflation forecasts, should be interpreted as a more hawkish signal than the rate level itself. Improved macroeconomic expectations from the regulator increase the likelihood of further rate hikes and, accordingly, strengthen the influence of rate expectations on the equity market in the current period. For the Japanese stock market, this implies a shift in the balance of factors towards a moderately negative bias in the short term.

Given the JP 225 index’s sensitivity to yen dynamics and its significant share of large exporters, the combination of higher growth and inflation forecasts with a clear hint of further rate hikes increases the likelihood of short-term pressure on the index. The most likely scenario is a strengthening of the yen and a more restrained assessment of future earnings amid expectations of policy tightening. However, the medium-term effect may become more mixed: higher growth and inflation forecasts improve underlying demand and corporate revenues, but the benefits of this factor will materialise if rate hikes remain gradual.

Japan’s interest rate: https://tradingeconomics.com/japan/interest-rateJP 225 technical analysis

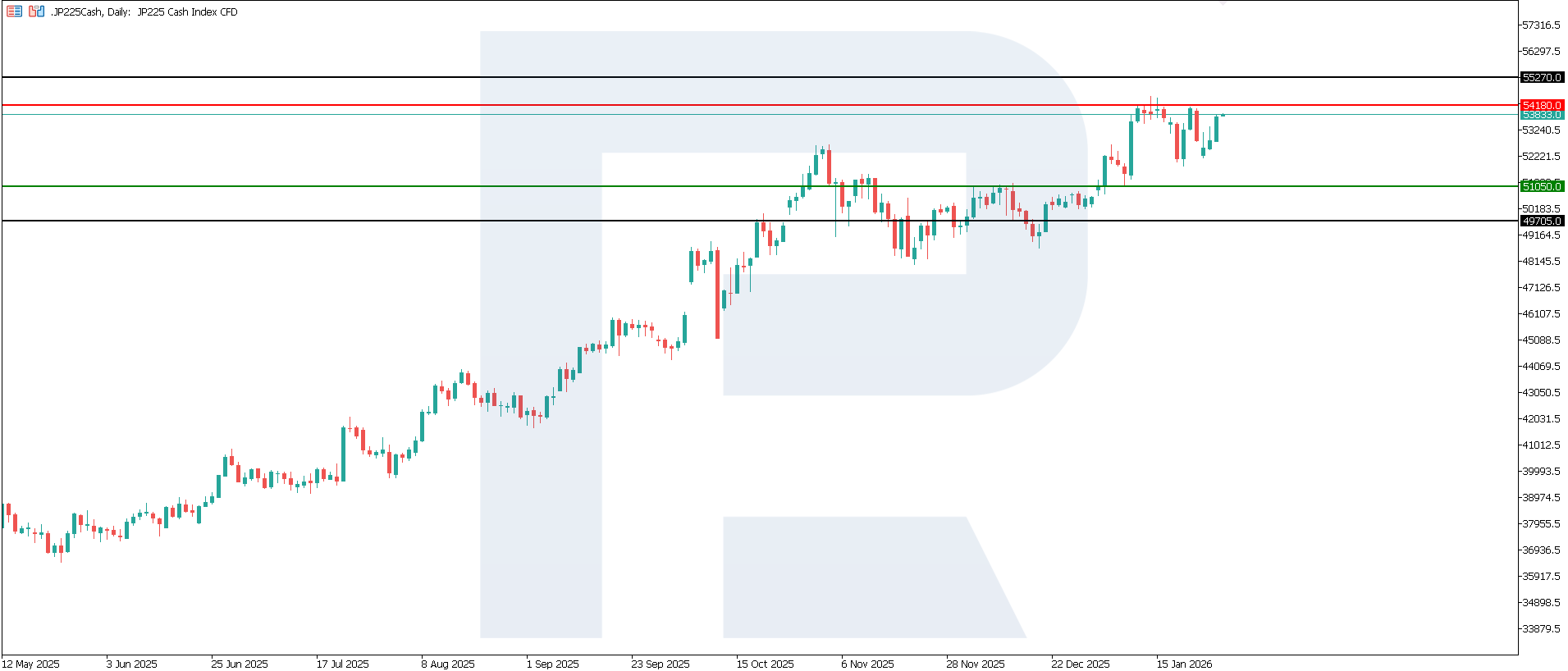

The JP 225 index continues its upward trajectory, with the key support level at 51,150.0 and the nearest resistance level at 54,180.0. The current rise is highly likely to be medium-term, with the next potential target at the 55,270.0 area.

The JP 225 price forecast considers the following scenarios:

- Pessimistic JP 225 scenario: a breakout below the 51,180.0 support level could push the index down to 49,705.0

- Optimistic JP 225 scenario: a breakout above the 54,180.0 resistance level could drive the index to 55,270.0

Summary

Given the upward revision of growth and inflation forecasts and the renewed signal of a likely future rate hike, the impact on the Japanese equity market and JP 225 shifts from neutral towards moderately restrictive in the short term, primarily through expectations of higher rates and the risk of yen appreciation. The resilience of the index will depend on the scale of the subsequent reaction in the currency market and the pace of any potential policy tightening. The next upside target for the JP 225 could be the 55,270.0 level.

Editors’ picks

EURUSD 2026-2027 forecast: key market trends and future predictions

EURUSD 2026-2027 forecast: key market trends and future predictionsThis article provides the EURUSD forecast for 2026 and 2027 and highlights the main factors determining the direction of the pair’s movements. We will apply technical analysis, take into account the opinions of leading experts, large banks, and financial institutions, and study AI-based forecasts. This comprehensive insight into EURUSD predictions should help investors and traders make informed decisions.

Gold (XAUUSD) forecast 2026 and beyond: expert insights, price predictions, and analysis

Gold (XAUUSD) forecast 2026 and beyond: expert insights, price predictions, and analysisDive deep into the Gold (XAUUSD) price outlook for 2026 and beyond, combining technical analysis, expert forecasts, and key macroeconomic factors. It explains the drivers behind gold’s recent surge, explores potential scenarios including a move toward 4,500 to 5,000 USD per ounce, and highlights why the metal remains a strong hedge during global uncertainty.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.