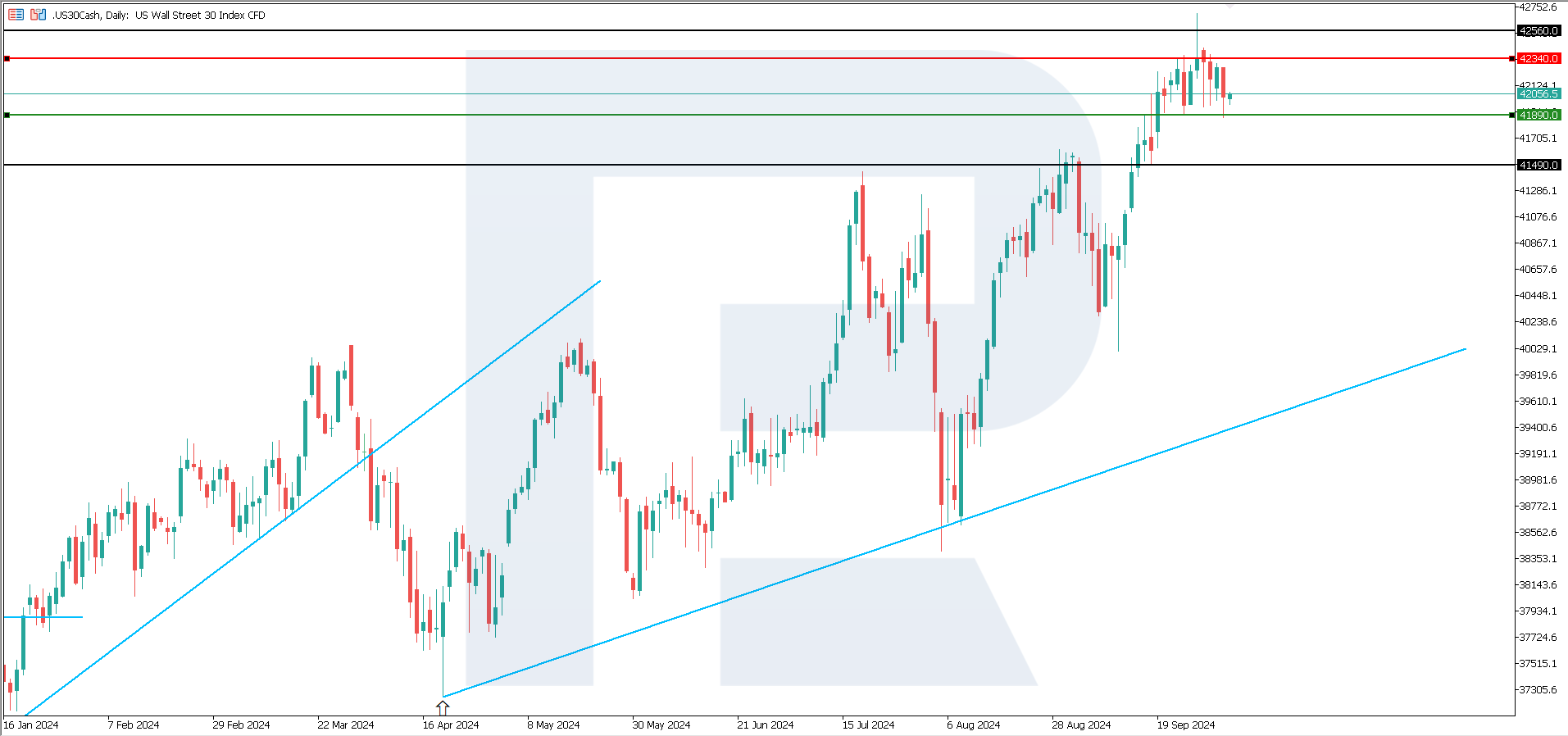

US 30 analysis: the index has failed to consolidate above the resistance level of 42,340.0 for over a week

The US 30 stock index is in an uptrend but has failed to overcome the resistance level at 42,340.0 for more than a week. The US 30 forecast for the next week is moderately positive.

US 30 forecast: key trading points

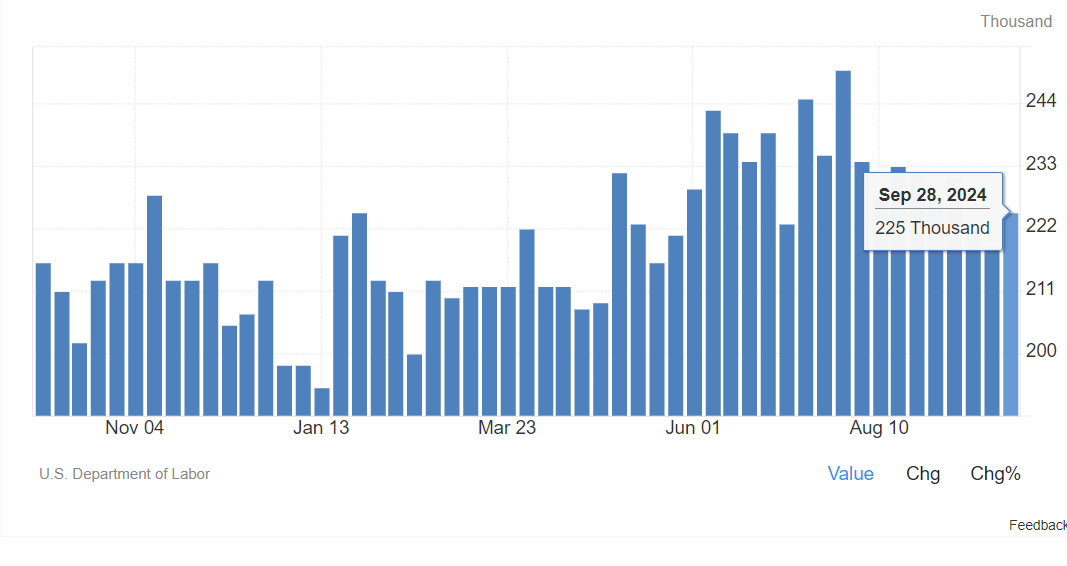

- Recent data: Initial Jobless Claims totalled 225,000 for the week

- Economic indicators: reflect the current state of the labour market and help estimate the prospects of unemployment growth

- Market impact: a rise in this indicator is interpreted as a sign of weakness in the labour market, which increases the probability of the US Federal Reserve cutting the key rate

- Resistance: 42,340.0, Support: 41,890.0

- US 30 price forecast: 42,560.0

Fundamental analysis

According to the US Department of Labour, Initial Jobless Claims (IJC) for the week were 225,000, although analysts expected the figure to be 222,000.

Source: https://tradingeconomics.com/united-states/jobless-claims

Current data shows a slight deterioration in the labour market. However, the difference is insignificant, so there may not be a direct adverse reaction. The situation will depend on general market sentiment and factors like macroeconomic statistics and Fed rate expectations.

The final data on the September unemployment rate will also greatly impact the market. If it is significantly worse than expected, the US Fed will likely be compelled to cut the key rate again by 0.50% at the next meeting. This will have a positive impact on the stock market. For this reason, the forecast for the US 30 is moderately positive.

US 30 technical analysis

The US 30 stock index is in an uptrend and has hit an all-time high but has failed to break through the resistance level at 42,340.0. From the perspective of technical analysis of the US 30, the scenario with further growth is more likely. A breakdown of the current support level and consolidation of prices below it will signal a trend change.

The following scenarios are identified for the US 30 price predictions:

- Pessimistic forecast for US 30: in case of a breakdown of the support level at 41,890.0, the price may fall to 41,490.0

- Optimistic forecast for US 30: if resistance at 42,340.0 is breached, the index may rise to 42,560.0.

Summary

According to the US Department of Labour, the number of Initial Jobless Claims (IJC) for the week was 225,000, more than analysts expected (222,000). This data may indicate a worsening situation in the labour market, which will prompt the Fed to reduce the key rate further.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.