US 30 forecast: the index resumed growth after a correction

The upward trend continues in the US 30 index, and a new all-time high remains likely. The US 30 forecast for today is positive.

US 30 forecast: key trading points

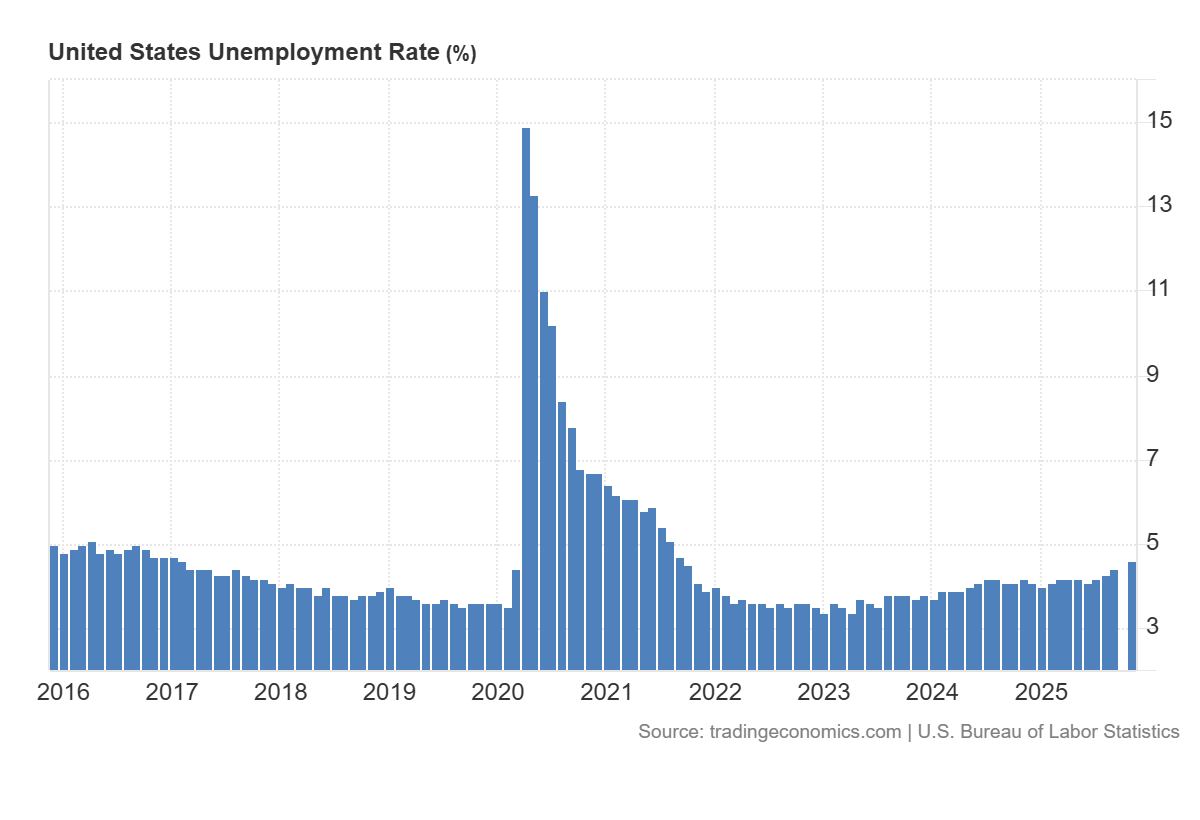

- Recent data: U.S. unemployment rate rose to 4.6% in November

- Market impact: the data has a moderately positive effect on the equity market

US 30 fundamental analysis

November U.S. labour market data turned out to be mixed. On the one hand, the economy created around 64K new jobs, which exceeded expectations, indicating that companies are still hiring overall. On the other hand, the unemployment rate rose to 4.6%, above both the previous reading and the forecast. This report paints a picture of an economy that is cooling, but not collapsing. Such a backdrop gives the Federal Reserve room to provide further cautious support to the economy if needed. Markets currently assess the probability of another rate cut at the January 2026 meeting as low (around 24%).

For the US 30 index, this type of report is usually interpreted as moderately positive. The index has a high weighting of large industrial, financial, and consumer companies that are more sensitive to economic conditions and demand. Lower Fed rates are generally positive for these sectors: financing becomes cheaper, debt servicing easier, and investment activity improves. However, rising unemployment poses risks to consumer spending and confidence, which in turn may pressure revenues for some index constituents. In addition, expectations of further rate cuts are not always favourable for the financial sector.

United States Unemployment Rate: https://tradingeconomics.com/united-states/unemployment-rateUS 30 technical analysis

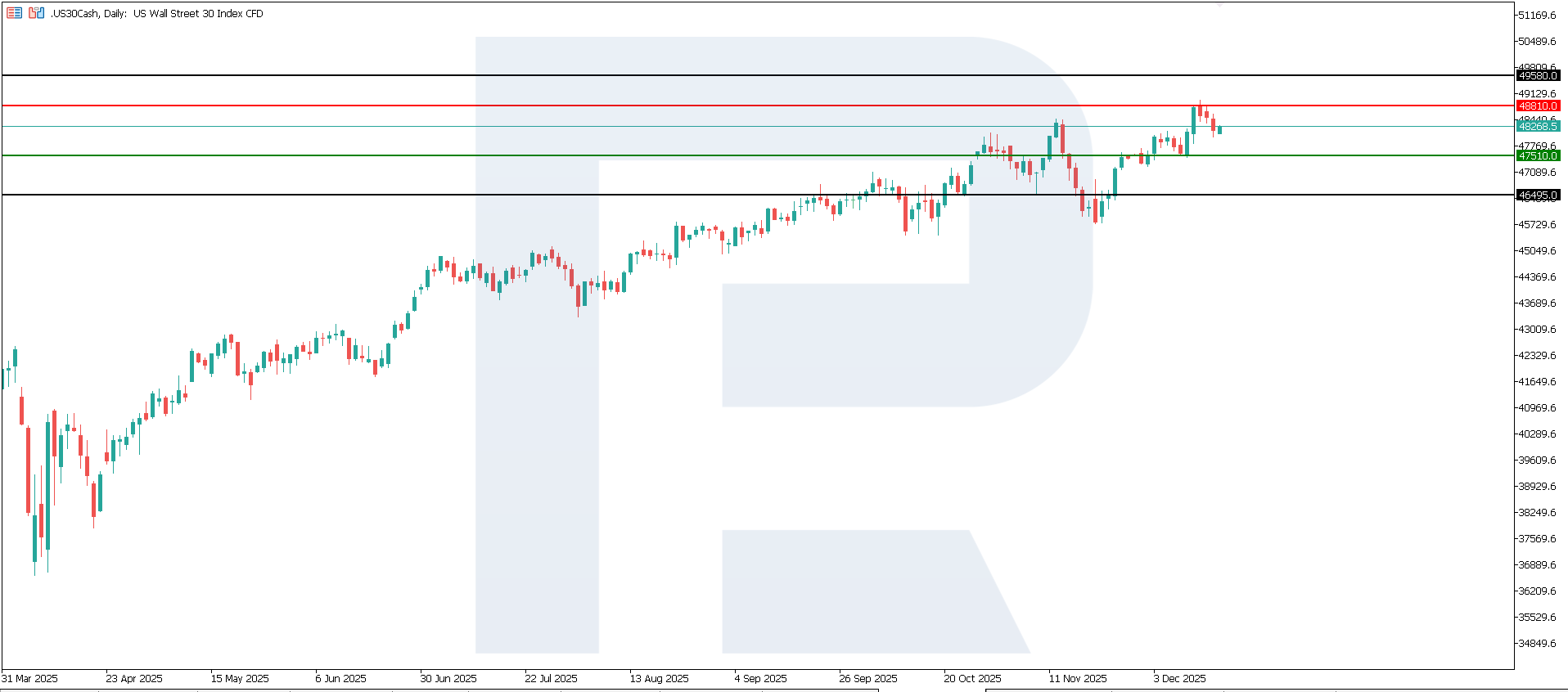

The US 30 index has entered an upward trend, with support formed at 47,510.0. New resistance has emerged at 48,810.0. Prices are undergoing a minor correction, but as long as support holds, the trend remains bullish. The nearest upside target is located at 49,580.0.

Forecast scenarios for the US 30:

- Bearish scenario: if support at 47,510.0 is broken, prices may fall to 46,495.0

- Bullish scenario: if resistance at 48,810.0 is broken, prices may rise to 49,580.0

Summary

The latest data is contradictory, but the overall trend is clear. On the one hand, November job creation exceeded analysts’ expectations, which can be seen as a positive surprise. On the other hand, the gain of 64K jobs is very modest compared with the 105K job losses recorded in October. The nearest upside target for the index remains 49,580.0.

Editors’ picks

EURUSD 2026-2027 forecast: key market trends and future predictions

EURUSD 2026-2027 forecast: key market trends and future predictionsThis article provides the EURUSD forecast for 2026 and 2027 and highlights the main factors determining the direction of the pair’s movements. We will apply technical analysis, take into account the opinions of leading experts, large banks, and financial institutions, and study AI-based forecasts. This comprehensive insight into EURUSD predictions should help investors and traders make informed decisions.

Gold (XAUUSD) forecast 2026 and beyond: expert insights, price predictions, and analysis

Gold (XAUUSD) forecast 2026 and beyond: expert insights, price predictions, and analysisDive deep into the Gold (XAUUSD) price outlook for 2026 and beyond, combining technical analysis, expert forecasts, and key macroeconomic factors. It explains the drivers behind gold’s recent surge, explores potential scenarios including a move toward 4,500 to 5,000 USD per ounce, and highlights why the metal remains a strong hedge during global uncertainty.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.